Stelmine Canada (“Stelmine” or “The Company”) (TSXV:

STH) is pleased to provide a geological update on its 100%

owned Mercator property located in northeastern Quebec. Stelmine

completed a maiden diamond drilling campaign in 2022 totaling 1950

m in 13 holes collared on the gold-bearing Meridian Zone located at

the core of the property.

Project Highlights:

- Meridian Zone mineralization traced

on surface over 2500 m x 500 m

- Drilling returned

multiple lenses of gold mineralization

- Early-stage

exploration in newly identified Caniapiscau gold

district

- Multiple zones of

gold mineralization hosted in Iron Formations

- Large gold deposits

are associated with iron formation such as Musselwhite, Meadowbank,

Lake Amaruq and Back River

-

Bulk tonnage and high-grade mineralization potential

- Large land package

in the positive mining and exploration jurisdiction of

Quebec

Mercator is a rare occurrence of an Archean

orogenic type mineralization associated with granulite-facies and

silicate iron formations. Iron Formations (IF) are

highly sought-after targets for gold exploration because of their

potential to host high-grade, large-tonnage deposits.

From the initial INAA results obtained from

drilling campaign, a subset of samples (<10%) was re-submitted

by the Fire Assay analysis method. Variations in the gold results

were deemed small and the highlights of the updated drill

intersections are presented below and in table 1.

Drilling Highlights:

|

Mercator DDH - Best Gold Value |

|

|

|

DDH # |

From (m) |

To (m) |

Interval* (m) |

Au (g/t) |

|

MCT22-01 |

9.30 |

15.67 |

6.37 |

1.22 |

| Incl. |

9.30 |

9.85 |

0.55 |

3.01 |

|

MCT22-03 |

26.85 |

35.5 |

8.65 |

1.22 |

| Incl. |

33.80 |

35.50 |

1.70 |

3.21 |

| And

Incl. |

34.80 |

35.50 |

0.70 |

5.71 |

|

MCT22-03 |

40.75 |

42.20 |

1.45 |

1.43 |

|

MCT22-06 |

3.20 |

5.85 |

2.65 |

0.59 |

|

MCT22-08 |

47.15 |

64.95 |

17.80 |

2.62 |

| Incl. |

59.35 |

64.95 |

5.60 |

4.87 |

|

And Incl. |

59.35 |

59.90 |

0.55 |

27.7 |

| |

|

|

|

|

|

DDH # |

From (m) |

To (m) |

Interval* (m) |

Au (g/t) |

|

MCT22-11 |

99.00 |

108.00 |

9.00 |

1.02 |

| Incl. |

105.60 |

108.00 |

2.40 |

2.68 |

| And

Incl. |

105.60 |

106.20 |

0.60 |

7.07 |

|

MCT22-11 |

151.25 |

155.50 |

4.25 |

1.24 |

|

MCT22-11 |

184.20 |

193.50 |

9.30 |

1.19 |

| Incl. |

184.20 |

186.00 |

1.80 |

1.11 |

| Incl. |

190.05 |

191.50 |

1.45 |

4.51 |

| And

Incl. |

191.00 |

191.50 |

0.50 |

9.94 |

|

MCT22-12 |

85.45 |

88.15 |

2.70 |

1.20 |

Table 1. Significant gold intercepts from

the 2022 drilling campaign

Drilling results corelate well with surface channel, grab and

soil samples obtained on the project since 2018. Channel sampling

returned gold intersections > 1.0 g/t for 11 of the 22 channel

sites, with the highlights summarized below and in Figure 1.

Channel Samples Highlights:

2.07 g/t Au over 27.50 (R21025)2.27 g/t Au over 7.60 m, incl.

4.25 g/t Au over 3.00 m (R21033)2.16 g/t Au over

7.60 m, incl. 3.64 g/t Au over 4.00 m (R21027)2.13

g/t Au over 12.50 m, incl. 3.54 g/t Au over 6.00 m

(R21034)2.66 g/t Au over 11.50 m, incl. 5.10 g/t

Au over 4.10 m (R21010)

Grab Samples

Highlights:

18.20 g/t Au, 9.27 g/t Au, 7.60 g/t Au, and 6.93 g/t Au

See the figure in the

presentation.Figure 1. IP survey contour

chargeability map of the gold-rich Meridian zone. Significant gold

intercepts from drilling and channel sampling are

reported.

Isabelle Proulx President and CEO says:

“Stelmine believes the Mercator project, particularly the 2.5 km x

500 m gold-rich Meridian Zone, has the potential to develop

into a major high tonnage body.”

The property lies near the gold-prospective

structural contact of the La Grande and Opinaca subprovinces

extending 500 km in an EW direction km from the Eeyou Itschee James

Bay Territory to the Caniapiscau district. There are several

gold-bearing IF prospects situated along this highly prospective

shear contact such as the Orfée, Pontois, Lac Guyer and Bourdon

(Figure 3). These large-scale structural features provide fluid

pathways for gold migration and deposition. Gold occurrences on the

property are associated with pyrrhotite, pyrite,

arsenopyrite-löllingite ± chalcopyrite sulphide mineralization. In

Quebec, other gold-bearing granulitic IF interstratified with

metasediments are currently found in the Lilois sector within the

Ashuanipi subprovince.

A northern view of the Meridian Zone shows three

roughly parallel 1.4 km long, NE/SW oriented gold-mineral zones,

exposed on a hill crest and valley floor, dipping shallowly to the

NW and open in both directions (Figure 2a). The IP survey section

indicates most of the gold mineralization is spatially associated

with high chargeability envelopes (Figure 2b). A preliminary 3D

model built in the IP section area also reveals two mineralized

layers dipping NNW crossing high chargeability zones (Figure

2c).

See the figure in the

presentation.Figure 2. a) A

Northeastern oblique view of a portion of the Meridian Zone showing

3 sub-parallel gold-mineralized zones on a hill crest and in a

valley floor with their possible extensions, b) IP

Inverted section indicating most of the gold mineralization is

spatially associated with high chargeability envelopes,

c) A portion of the 3D model cut along the IP

section.

There are several examples of world class

deposits in Archean IF within the Superior Province of Canada such

as the 4 M oz. Au Meadowbank deposit, the Lake Amaruq mine (2.7 M

oz. Au) both in the Medialine district of Nunavut and the northern

Ontario Musselwhite deposit, with measured and indicated resources

of 3.7Mt at 3.55 g/t Au.

Stelmine continues to apply a combination of

geophysics, geochemistry and drill targeting techniques to

effectively explore the Meridian Zone and other orogenic gold

occurrences on the Mercator property. Mineralizing structures have

been identified and will be targeted with the planned 2023 diamond

drilling program. Further, structural analyses from detailed

mapping will assist in understanding structural controls and guide

exploration efforts on the property. The highly experienced

team at Stelmine realizes that successful exploration requires a

thorough understanding of the target areas, as well as careful

planning and execution of exploration work programs.

Continue following Stelmine for more exciting

news from their newly identified Archean aged orogenic gold system

of the Meridian Zone and beyond.

See the figure in the presentation.

Qualified Person

The technical information in this news release

has been reviewed and approved by Michel Boily, P. Geo, PhD. Mr.

Boily is the qualified person responsible for the scientific and

technical information contained herein under National Instrument

43-101 standards.

QA/QC Protocol

Stelmine implemented a strict QA/QC protocol in

processing all rock samples collected from the Mercator property.

The protocol included the insertion and monitoring of appropriate

reference materials, in this case high concentration and low

concentration certified gold standards, blanks and duplicates, to

validate the accuracy and precision of the assay results. All

collected rock samples were put in sturdy plastic bags, tagged, and

sealed in the field under the supervision of geologists in

training. Sample bags were then put in rice pouches and kept

securely in a field tent before being sent by floatplane to the

city of Fermont. Transport to Actlabs laboratories in Ancaster,

Ontario was made by truck from dependable transport companies. Gold

was analyzed by fire assay (1A2_ICP_50 g) or the INAA+ICP_OES (1H)

methods. Note however the gold intersections presented above were

calculated with Au concentrations obtained by the Fire Assay

method. Other trace element concentrations were obtained via the 1H

method.

About Stelmine Canada

Stelmine is a junior mining exploration company

pioneering a new gold district (Caniapiscau) east of James Bay in

the under-explored eastern part of the Opinaca metasedimentary

basin where the geological context has similarities to the Eleonore

mine. Stelmine has 100% ownership of metasedimentary basin where

the geological context has similarities to the Eleonore mine.

Stelmine has 100% ownership of 1 782 claims or 938 km² in this part

of northern Quebec, highlighted by the Courcy and Mercator

Projects.

Forward-looking statements

Certain information in this press release may

contain forward-looking statements, such as statements regarding

the expected closing of and the anticipated use of the proceeds

from the Offering, acquisition and expansion plans, availability of

quality acquisition opportunities, and growth of the Company. This

information is based on current expectations and assumptions

(including assumptions in connection with obtaining all necessary

approvals for the Offering and general economic and market

conditions) that are subject to significant risks and uncertainties

that are difficult to predict. Actual results might differ

materially from results suggested in any forward-looking

statements. Risks that could cause results to differ from those

stated in the forward-looking statements in this release include

those relating to the ability to complete the Offering on the terms

described above. The Company assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those reflected in the forward-looking

statements unless and until required by securities laws applicable

to the Company. Additional information identifying risks and

uncertainties is contained in the Company’s filings with the

Canadian securities regulators, which filings are available at

www.sedar.com.

Cautionary statement

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information, contact:

| Isabelle Proulx,

President and CEO |

Investor

Relations: |

| Stelmine |

|

| Tel: 418-626-6333 |

MarketSmart

Communications Inc |

| info@stelmine.com |

Adrian Sydenham |

| |

Toll-free: 1-877-261-4466 |

| |

info@marketsmart.ca |

Follow us on: Website : Twitter : LinkedIn :

Facebook:

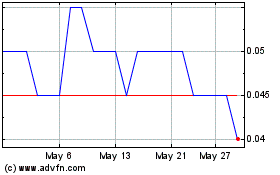

Stelmine Canada (TSXV:STH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Stelmine Canada (TSXV:STH)

Historical Stock Chart

From Feb 2024 to Feb 2025