Reunion Gold Corporation (TSXV: RGD; OTCQX: RGDFF) (the “Company”

or “Reunion Gold”) is pleased to continue reporting positive drill

results from its ongoing infill and deep drilling programs. The

infill program is designed to upgrade the classification of the

Inferred mineral resources within the maiden Mineral Resource

Estimate (MRE) to an Indicated category. The deep drilling program

is aimed at testing and defining the potential for an underground

resource at depths greater than 500 meters below surface.

For a detailed list of results associated with

this press release, please see Reunion Gold’s website: Results

“We are very encouraged with the results of the

deep drilling program to date, which indicate the potential for a

high-grade zone at depth,” said Rick Howes, President and CEO of

Reunion Gold. “With these results, we see the potential to add

significant value as a combined open pit and underground project

and therefore we intend to continue the depth extension drilling

program and delay the release of the PEA to allow for inclusion of

an underground resource and evaluation of combined open pit and

underground option to the PEA study, which we would expect to

release in Q2 of 2024.”

Deep Drilling Program

Highlights of results from the deep drilling

program below Block 4 can be seen in Table 1 and on Figure 1 which

reports the broader intervals using a 0.3 g/t cutoff and includes

the higher-grade intercepts using a 1.5 g/t cutoff. In addition to

hole D-243-W1, results of note include holes D-316 and D-320, both

of which reported high grade gold intercepts, representing a

significant expansion of known mineralization at depth. These

intercepts are being interpreted as the depth extension of the

high-grade zone that was identified in the maiden MRE reported on

June 13, 2023 (see associated press release on that date).

Hole D-316 intercepted 88.8 m @ 4.13 g/t Au,

including 10.8 m @ 14.96 g/t Au from 772.4 m to

783.2 m downhole and 21.8 m @ 6.45 g/t Au from

787.9 m to 809.7 m downhole (reported using a 1.5 g/t cutoff

grade). Hole D-320 reported 83.0 m @ 1.92

g/t including 3.0 m @ 4.79 g/t Au from

777m to 780 m downhole and 20.0 m @ 4.41 g/t Au

from 800 m to 820 m downhole. Hole D-243-W1

reported significant high-grade intercepts including 71.0 m

@ 5.77 g/t Au from 504.0 m to 575.0 m downhole.

“On-going structural work is continuing to

demonstrate a steep northerly plunge to our high grade zone, which

sits within the larger volume of mineralization apparent along the

2 km trend from Block 1 through Block 4 to Blocks 5 and 6. The

high-grade zone appears to have a relatively sharp boundary along

its southern margin, an orientation confirmed through structural

analysis of our oriented drill core, although we are confident that

drilling to date is demonstrating a 150 m to 300 m wide high-grade

zone of mineralization that plunges well below the drill holes

reported in this release,” Justin van der Toorn, VP Exploration for

Reunion Gold explained.

Table 1 – Selected Significant Intersects

below 500m depth within Blocks 1 & 4

|

Hole ID |

From(m) |

To(m) |

DownholeInterval(m) |

Au Grade(g/t) |

Grade xDownholeInterval(gm/t) |

ETT *(m) |

Cutoff(Au g/t)** |

|

OKWD23-243-W1 |

439.0 |

577.0 |

138.0 |

3.12 |

430 |

133.67 |

0.3 |

|

inc. |

504.0 |

575.0 |

71.0 |

5.77 |

410 |

42.64 |

1.5 |

|

OKWD23-243-W3 |

432.0 |

578.0 |

146.0 |

2.10 |

306 |

135.24 |

0.3 |

|

inc. |

435.3 |

438.5 |

3.2 |

3.57 |

11 |

2.24 |

1.5 |

|

inc. |

442.5 |

447.0 |

4.5 |

8.18 |

37 |

3.16 |

1.5 |

|

inc. |

457.5 |

462.0 |

4.5 |

2.39 |

11 |

3.17 |

1.5 |

|

inc. |

494.9 |

501.6 |

6.8 |

4.62 |

31 |

4.79 |

1.5 |

|

inc. |

503.8 |

531.5 |

27.8 |

4.90 |

136 |

19.77 |

1.5 |

|

inc. |

535.1 |

549.0 |

13.9 |

2.77 |

39 |

9.99 |

1.5 |

|

OKWD23-316 |

696.1 |

719.6 |

23.4 |

0.34 |

8 |

21.15 |

0.3 |

|

OKWD23-316 |

730.2 |

819.0 |

88.8 |

4.13 |

367 |

79.58 |

0.3 |

|

inc. |

743.6 |

750.8 |

7.2 |

5.85 |

42 |

5.56 |

1.5 |

|

inc. |

772.4 |

783.2 |

10.8 |

14.96 |

161 |

8.32 |

1.5 |

|

inc. |

787.9 |

809.7 |

21.8 |

6.45 |

140 |

16.89 |

1.5 |

|

OKWD23-320 |

768.0 |

851.0 |

83.0 |

1.92 |

160 |

72.77 |

0.3 |

|

inc. |

777.0 |

780.0 |

3.0 |

4.79 |

14 |

2.40 |

1.5 |

|

inc. |

800.0 |

820.0 |

20.0 |

4.41 |

88 |

16.12 |

1.5 |

* Estimated True Thickness ("ETT") based on an

average dip / dip direction of -65° / 095° to represent the

orientation of the mineralized zone in Block 4.** Significant

intervals calculated using a 0.3 g/t Au cutoff, 10m minimum length

and 10m maximum consecutive internal waste. Included intervals

calculated using a 1.5 g/t Au cutoff, 3m minimum length and a 2m

maximum consecutive internal waste.

Infill Drill Results

The infill drilling program is designed to

upgrade the inferred resources within the MRE pit shell to an

Indicated mineral resource category. The drill results shown in

Table 2 and Figure 1 continue to illustrate the strong continuity

of the mineralization within the MRE pit constraints. Highlights

include D-328, which intersected 75 m@ 4.07 g/t Au, hole

D-288A which intersected 100 m @ 2.24 g/t Au, hole D-243W2

intersecting 98.8 m @ 2.13 g/t Au and hole D-325A intersecting 67.2

m grading 3.06 g/t all reported using a 0.3 cutoff. The

infill drill program will be completed by the end of this year.

Table 2 – Selected Significant Intersects

above 500m depth within Blocks 1 & 4

|

Hole ID |

From(m) |

To(m) |

DownholeInterval(m) |

Au Grade(g/t) |

Grade

xDownholeInterval(gm/t) |

ETT*(m) |

Cutoff(Au g/t) |

|

OKWD23-243-W2 |

419.0 |

517.8 |

98.8 |

2.13 |

211 |

81.16 |

0.3 |

|

inc. |

425.0 |

436.0 |

11.0 |

2.44 |

27 |

9.37 |

1.5 |

|

inc. |

482.0 |

497.0 |

15.0 |

6.51 |

98 |

12.93 |

1.5 |

|

inc. |

500.0 |

507.0 |

7.0 |

2.63 |

18 |

6.04 |

1.5 |

|

inc. |

512.2 |

515.7 |

3.5 |

10.98 |

38 |

3.03 |

1.5 |

|

OKWD23-287 |

256.0 |

279.0 |

23.0 |

0.96 |

22 |

18.03 |

0.3 |

|

OKWD23-287 |

302.8 |

369.0 |

66.3 |

3.64 |

241 |

49.04 |

0.3 |

|

inc. |

302.8 |

306.0 |

3.3 |

5.01 |

16 |

2.93 |

1.5 |

|

inc. |

316.0 |

354.0 |

38.0 |

5.75 |

218 |

34.54 |

1.5 |

|

OKWD23-288A |

241.0 |

341.0 |

100.0 |

2.24 |

224 |

80.90 |

0.3 |

|

inc. |

261.0 |

266.0 |

5.0 |

3.90 |

20 |

4.32 |

1.5 |

|

inc. |

269.0 |

275.0 |

6.0 |

2.47 |

15 |

5.18 |

1.5 |

|

inc. |

298.0 |

302.0 |

4.0 |

30.59 |

122 |

3.46 |

1.5 |

|

inc. |

320.0 |

324.0 |

4.0 |

1.71 |

7 |

3.48 |

1.5 |

|

OKWD23-325A |

361.0 |

389.0 |

28.0 |

0.78 |

22 |

23.12 |

0.3 |

|

OKWD23-325A |

403.0 |

470.2 |

67.2 |

3.06 |

206 |

54.76 |

0.3 |

|

inc. |

404.0 |

408.2 |

4.2 |

2.31 |

10 |

3.60 |

1.5 |

|

inc. |

434.0 |

461.0 |

27.0 |

6.04 |

163 |

23.53 |

1.5 |

|

OKWD23-328 |

364.0 |

374.0 |

10.0 |

0.75 |

8 |

7.40 |

0.3 |

|

OKWD23-328 |

396.0 |

471.0 |

75.0 |

4.07 |

305 |

53.40 |

0.3 |

|

inc. |

423.0 |

455.0 |

32.0 |

7.00 |

224 |

29.99 |

1.5 |

|

OKWD23-332A |

374.0 |

459.0 |

85.0 |

1.94 |

164 |

67.96 |

0.3 |

|

inc. |

390.9 |

399.0 |

8.2 |

1.57 |

13 |

7.09 |

1.5 |

|

inc. |

416.0 |

421.0 |

5.0 |

3.05 |

15 |

4.36 |

1.5 |

|

inc. |

428.0 |

443.0 |

15.0 |

5.72 |

86 |

13.08 |

1.5 |

|

inc. |

447.0 |

459.0 |

12.0 |

2.18 |

26 |

10.49 |

1.5 |

* Estimated True Thickness ("ETT") based on an

average dip / dip direction of -65° / 095° to represent the

orientation of the mineralized zone in Block 4.** Significant

intervals calculated using a 0.3 g/t Au cutoff, 10m minimum length

and 10m maximum consecutive internal waste. Included intervals

calculated using a 1.5 g/t Au cutoff, 3m minimum length and a 2m

maximum consecutive internal waste.

Update on release of PEA

With the strong results that have been reported

from the deep drilling program, which confirm the potential for the

higher-grade zone to continue at depth, the Company has decided to

delay the release of the PEA until the end of Q2/2024. This will

allow the Company to continue to drill the high-grade zone down to

a depth of approximately 1000 meters with the goal of including an

underground mineral resource for use in the PEA. In addition, it

will give the Company time to investigate the potential to develop

a combined open pit and underground mining operation as part of the

PEA. The PEA will also look at, amongst other things, the optimal

transition point between open pit and underground mining as well as

the sequencing of the potential underground mine.

Exploration

In addition to the ongoing drilling at the

Kairuni zone the Company also continues to advance its exploration

programs on the remainder of the Oko West Prospecting License with

the implementation of ground magnetics and IP geophysical surveys,

RC drill programs and follow up diamond drill programs.

Drilling to the south of Block 4, on Blocks 5,

6, and 7, focuses on the southern continuation of the main Kairuni

mineralized trend and contact zone. Follow up diamond drilling in

this area has intersected additional zones of mineralization as

shown on Figure 2 and as detailed in the associated tables of

significant intervals available on the Company’s website.

Follow up of the geochem anomalies generated

from shallow Scout RC drilling (sampling below the duricrust) on

the High Road target commenced with 23 conventional RC holes

completed, for a total of 2,444 m of drilling. The location of

these RC drill collars on the High Road target area, located

approximately 2 km northwest of the Kairuni MRE, is shown on Figure

3. Assays were received for five of these holes, with R-1414

reporting 3.0 m @ 8.75 g/t Au from 58.0 m

downhole. Further assays are pending for this High Road target area

and other new target areas.

Sample Collection, Assaying and Data

management

Significant intervals in this press release have

been calculated using a grade cut-off of 0.3 g/t Au, a minimum

length of ten meters, and up to ten meters maximum length of

consecutive internal waste. Included significant intervals have

been calculated using a grade cut-off of 1.5 g/t Au, a minimum

length of three meters, and up to two meters maximum length of

consecutive internal waste. Gold grades are uncapped. Mineralized

intersection lengths are not necessarily true widths and estimated

true thickness (“ETT”) has been calculated using an assumed plane

of mineralization dipping 65° towards 095°, representative of the

mineralization identified in Block 4. Complete drilling results and

drill hole data are posted on the Company's Website. Diamond drill

(DD) samples consist of half of either HQ or NQ core taken

continuously at regular intervals averaging 1.4 m, bagged, and

labelled at the site core shed. Reverse circulation (RC) drill

samples are obtained from a rotary splitter attached to a Metzke

cyclone, weighed, bagged, and tagged at the drill site. All

resource drilling samples are shipped to the Actlabs certified

laboratory in Georgetown, Guyana, respecting best-practice chain of

custody procedures. Samples from the Scout RC program and recent

conventional RC samples are shipped to MS Analytical in Georgetown

using the same chain-of-custody procedures. At each laboratory,

samples are dried, crushed to 80% passing 2 mm, riffle split (250

g), and pulverized to 95% passing 105 μm. Coarse blanks are

inserted by the Company, and are used between and following

suspected high-grade intervals. Barren sand flushes are inserted by

the analytical laboratory after each sample is pulverized to clean

the bowl. Gold analysis is carried out through a 50 g fire assay

with an atomic absorption finish. Initial assays with results above

3.0 g/t Au are re-assayed with a gravimetric finish. Samples with

visible gold are additionally assayed with a metallic screen method

using 1 kg of pulp. Certified reference materials and blanks are

inserted at a rate of 5% of samples shipped to the laboratories. RC

field duplicates and DD umpire pulp duplicates are also generated

at a rate of 5% of samples. Pulp umpire duplicates are analyzed at

the MSALabs certified laboratory in Georgetown. Assay data is

subject to QA/QC prior to accepting into the Company database

managed by an independent consultant.

Qualified Person

The technical information in this press release

has been reviewed and approved by Justin van der Toorn, the

Company's VP, Exploration. Mr. van der Toorn (CGeol FGS, EurGeol)

is a qualified person under Canadian National Instrument

43-101.

About Reunion Gold

Corporation

Reunion Gold Corporation is a leading gold

explorer and developer in the Guiana Shield, South America. In

early 2021, the Company announced an exciting new greenfield gold

discovery at the Kairuni zone on its Oko West project in Guyana,

where in June 2023, after 22 months of resource definition

drilling, the Company announced an initial Mineral Resource

Estimate containing 2.475 Moz of gold in Indicated resources

grading 1.84 g/t Au and 1.762 Moz of gold in Inferred resources

grading at 2.02 g/t (see NI 43-101 Technical Report Oko West Gold

Project, Cuyuni-Mazaruni Mining Districts, dated effective June 1,

2023 available under the Company’s profile on SEDAR+). In addition

to advancing development of the Kairuni zone resource, the Company

is actively exploring several additional priority exploration

targets at Oko West with the objective of outlining additional

satellite deposits.

The Company's common shares are listed on the

TSX Venture Exchange under the symbol 'RGD' and trade on the OTCQX

under the symbol 'RGDFF'. Additional information about the Company

is available on SEDAR+ (www.sedarplus.ca) and the Company's website

(www.reuniongold.com).

For further information, please contact:

REUNION GOLD CORPORATION Rick Howes, President

and CEO, or Doug Flegg, Business Development AdvisorE:

doug_flegg@reuniongold.comE: info@reuniongold.comTelephone: +1

450.677.2585

Cautionary Disclaimer Regarding

Forward-Looking Statements

This press release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities laws (collectively, "forward-looking

statements"). Statements and information that are not historical

facts are forward-looking statements. Forward-looking statements

are frequently, but not always, identified by words such as

"expects", "anticipates", "believes", "intends", "estimates",

"potential", "possible" and similar expressions, or statements that

events, conditions, or results "will", "may", "could" or "should"

occur or be achieved. Forward-looking statements and the

assumptions made in respect thereof involve known and unknown

risks, uncertainties and other factors beyond the Company's

control. Forward-looking statements in this press release include

statements regarding plans to complete drilling and other

exploration programs and studies, exploration and drill results,

interpretation of such exploration and drill results, potential

mineralization, expectations regarding completion of a preliminary

economic assessment, forward looking assumptions used relating to

the mineral resources estimates, expectations to expand the

resources at depth and elsewhere within the Oko West Project, as

well as statements regarding beliefs, plans, expectations or

intentions of the Company. Mineral exploration is highly

speculative, characterized by several significant risks, which even

a combination of careful evaluation, experience and knowledge may

not eliminate. Refer to the Company's most recent annual

information form dated May 9, 2023 for a description of such

risks.

Forward-looking statements in this press release

are made as of the date herein. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

statements in this press release are reasonable, undue reliance

should not be placed on such statements. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information

or future events or otherwise, except as may be required by

law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this press release.

Figure 1 - Inclined long section across Block 4,

showing selected results and drill hole locations reported in this

press release. ETT = Estimated True Thickness; Significant

intersects are calculated using a 0.3 g/t Au cutoff, 10 m minimum

down hole length and 10 m maximum consecutive internal dilution;

Included intersects are calculated using a 1.5 g/t Au cutoff, 3 m

minimum down hole length and 2 m maximum consecutive internal

dilution.LINK TO FIGURE 1:

https://www.reuniongold.com/231019-pr?lightbox=dataItem-kn7b0389

Figure 2 - Inclined long section across Block 4,

showing selected results and drill hole locations reported in this

press release. Significant intersects are calculated using a 0.3

g/t Au cutoff, 10 m minimum length and 10 m maximum consecutive

internal dilution; Included intersects are calculated using a 1.5

g/t Au cutoff, 3 m minimum length and 2 m maximum consecutive

internal dilution.LINK TO FIGURE 2:

https://www.reuniongold.com/231019-pr?lightbox=dataItem-kn7b03892

Figure 3 - MaxCAT RC drilling of geochem anomalies

located on the High Road target area, shown in relation to the Oko

West resource.LINK TO FIGURE 3:

https://www.reuniongold.com/231019-pr?lightbox=dataItem-kn7ca6051

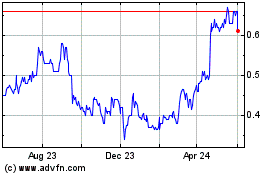

Reunion Gold (TSXV:RGD)

Historical Stock Chart

From Dec 2024 to Jan 2025

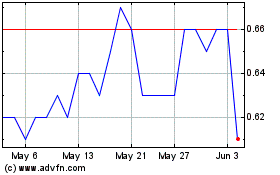

Reunion Gold (TSXV:RGD)

Historical Stock Chart

From Jan 2024 to Jan 2025