Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the

"Company") is pleased to announce a production increase of 181

BOE/day and a 12% increase in proved plus probable reserves.

Petro-Reef has tied in its Alexander 09-12-56-27W4 step-out well

producing from the Detrital oil zone. The well came on stream on

October 26, 2011, and during the first 19 days on production the

well has flowed at an average rate of 193 BOE/day (181 BOE/day net)

- 151 bbl/day (142 bbl/day net) of oil and 247 mcf/day (232 mcf/day

net) of natural gas. Petro-Reef has a 94% working interest in the

9-12 well.

The Company believes that this step-out well in Section 12

confirms that the Detrital oil trend extends west from Section 7

where Petro-Reef has three wells producing from the same zone. The

Company has completed the reprocessing of 35 sections of 3-D

seismic data on its Alexander lands which has been incorporated

into the October 1, 2011 independent reserves evaluation, prepared

by McDaniel & Associates Consultants Ltd. ("McDaniel") (the

"McDaniel Update Report"). Four additional Detrital development

locations have been included in the McDaniel Update Report.

Petro-Reef's gross proved plus probable reserves at October 1,

2011 indicated an increase of 12% to 1,771,150 BOE from 1,580,000

BOE at December 31, 2010, after extensions, technical revisions,

discoveries, acquisitions, economic factors, and production. After

considering the production for the period January 1 to September

30, 2011 of 180,300 BOE, the 2011 reserve additions totalled

371,450 BOE which represents an increase of 24% over the 2010 year

end reserves.

Using a 10% net present value ("NPV"), the value of proved plus

probable reserves at forecast prices and costs (before income

taxes) was unchanged at $34,735,200 as compared with proved plus

probable reserves of $34,741,400 as at December 31, 2010.

Petro-Reef's gross proved, probable plus possible reserves at

October 1, 2011 totaled 2,623,050 BOE. Using a 10% NPV, the value

of proved, probable plus possible reserves at forecast prices and

costs (before income taxes) totaled $56,281,100. The possible

reserves include four potential development locations targeting the

Detrital zone offsetting the Company's recent 09-12-56-27W4

well.

Only extensions to the existing producing zones were included in

the possible reserves. The resource plays in the Nordegg at Goose

River and the Wabamum and other plays identified by the seismic

reprocessing at Alexander were not included in the evaluation.

Proved plus probable reserves were comprised of 47% natural gas

and 53% crude oil and natural gas liquids (December 31, 2010 - 54%

natural gas and 46% crude oil and natural gas liquids).

Of the total proved plus probable reserves reported (using

forecast prices) Petro-Reef's reserves are 54% proved and 46%

probable.

Based on proved plus probable reserves and production volumes,

Petro-Reef's reserve life index was 7.0 years (41.1 years remaining

life) on a proved plus probable basis at October 1, 2011 compared

with 4.2 years (39.8 years remaining life) at the end of 2010.

Summary of Oil and Gas Reserves - Forecast Prices and Costs

The table below provides a summary of the oil and natural gas

reserves attributable to Petro-Reef as at October 1, 2011. As the

tables below summarize the data contained in the McDaniel Update

Report, they may contain slightly different numbers than those

contained in the original report due to rounding. Also due to

rounding, certain columns may not add exactly.

Light / Medium Oil Natural Gas BOE

Gross Net Gross Net Gross Net

(Mbbl) (Mbbl) (MMcf) (MMcf) (MBOE) (MBOE)

---------------------------------------------------------

Reserves Category

Proved

Developed Producing 125.4 112.1 2,397.7 2,056.5 525.0 454.8

Developed Non-

Producing 256.4 212.3 607.8 528.0 357.7 300.3

Undeveloped 74.2 65.5 157.2 140.7 100.4 89.0

---------------------------------------------------------

Total Proved 456.0 389.9 3,162.7 2,725.2 983.1 844.1

Probable 483.3 397.1 1,828.4 1,593.1 788.0 662.6

---------------------------------------------------------

Total Proved &

Probable 939.3 787.0 4,991.1 4,318.3 1,771.1 1,506.7

Possible 595.7 511.2 1,537.2 1,341.6 851.9 734.8

---------------------------------------------------------

Total Proved,

Probable &

Possible 1,535.0 1,298.2 6,528.3 5,659.9 2,623.0 2,241.5

----------------------------------------------------------------------------

Notes:

1. "Mbbl" means thousands of barrels

2. "MMcf" means million cubic feet

3. "MBOE" means thousands of barrels of oil equivalent

Summary of Net Present Values of Future Net Revenue as of

October 1, 2011 Forecast Prices and Costs

Before Income Taxes

Discounted at (% / Year)

0 5 10 15 20

(M$) (M$) (M$) (M$) (M$)

------------------------------------------------

Reserves Category

Proved

Developed Producing 6,691 6,281 5,920 5,600 5,316

Developed non-producing 14,146 12,741 11,666 10,812 10,112

Undeveloped 2,485 2,243 2,035 1,855 1,698

------------------------------------------------

Total Proved 23,322 21,265 19,621 18,267 17,126

Probable 26,501 19,274 15,114 12,470 10,646

------------------------------------------------

Total Proved & Probable 49,823 40,539 34,735 30,737 27,772

Possible 32,858 25,995 21,546 18,415 16,080

------------------------------------------------

Total Proved, Probable &

Possible 82,681 66,534 56,281 49,152 43,852

----------------------------------------------------------------------------

After Income Taxes Before tax

Discounted at (% / Year) Net Value

0 5 10 15 20 10%/yr

(M$) (M$) (M$) (M$) (M$) ($/boe)

------------------------------------------------

Reserves Category

Proved

Developed Producing 6,691 6,281 5,920 5,600 5,316 11.24

Developed non-producing 14,146 12,741 11,666 10,812 10,112 32.62

Undeveloped 2,485 2,243 2,035 1,855 1,698 20.27

--------------------------------------

Total Proved 23,322 21,265 19,621 18,267 17,126 19.93

Probable 22,238 16,054 12,502 10,257 8,719 19.17

--------------------------------------

Total Proved & Probable 45,560 37,319 32,123 28,524 25,845 19.59

Possible 24,702 19,465 16,070 13,679 11,895 25.27

--------------------------------------

Total Proved, Probable &

Possible 70,262 56,784 48,193 42,203 37,740 21.43

----------------------------------------------------------------------------

Notes:

1. NPV of future net revenue includes all resource income including, sale

of oil, gas, by-product reserves, processing third party reserves, and

other income.

2. Income taxes include all resource income and prior tax pools.

3. Unit values are based on net reserves volumes.

4. All of the Company's reserves are located in Canada.

5. The estimated values disclosed in the McDaniel Update Report do not

necessarily represent fair market value.

Reconciliation of Changes in Reserves - Proved plus Probable

Reserves

The reserves reconciliation reflects current proved, probable,

and proved plus probable reserves.

Light / Medium Oil

----------------------------------------------------------------------------

Gross Proved

Gross Probable Plus Probable

Factors Gross Proved (Mbbl) (Mbbl) (Mbbl)

----------------------------------------------------------------------------

December 31, 2010 372.8 330.1 702.9

Extensions 108.4 272.6 381.0

Technical

Revisions 32.0 (119.5) (87.5)

Production (57.1) - (57.1)

----------------------------------------------------------

October 1, 2011 456.1 483.2 939.3

----------------------------------------------------------------------------

Natural Gas BOE

----------------------------------------------------------------------------

Gross Gross

Proved Proved

Gross Gross Plus Gross Gross Plus

Proved Probable Probable Proved Probable Probable

Factors (MMcf) (MMcf) (MMcf) (MBOE) (MBOE) (MBOE)

----------------------------------------------------------------------------

December 31, 2010 3,467.2 1,794.6 5,261.8 950.7 629.2 1,579.9

Extensions 180.1 619.3 799.4 138.4 375.9 514.3

Technical

Revisions 254.3 (585.1) (330.8) 74.2 (217.0) (142.8)

Production (738.9) (0.4) (739.3) (180.2) (0.1) (180.3)

----------------------------------------------------------

October 1, 2011 3,162.7 1,828.4 4,991.1 983.1 788.0 1,771.1

----------------------------------------------------------------------------

Notes:

1. Gross reserves means the Company's working interest reserves before

calculation of royalties, and before consideration of the Company's

royalty interests.

2. All of the Company's reserves are located in Canada.

3. There were no changes to discoveries, acquisitions, dispositions and

economic factors in the McDaniel Update Report

Forecast Prices Used in Estimates

McDaniel employed the following pricing, exchange rate and

inflation rate assumptions in estimating Petro-Reef reserve data as

of October 1, 2011:

Edmonton Par Cromer Medium Natural Gas

Price 40 29.3 degrees AECO Gas

WTI Crude Oil degrees API API Prices

Year ($US /bbl) ($Cdn/bbl) ($Cdn/bbl) ($Cdn/MMBtu)

----------------------------------------------------------------------------

Historical

2005 56.56 68.72 57.47 8.58

2006 66.23 72.80 61.25 7.16

2007 72.30 76.35 65.40 6.65

2008 99.60 102.20 93.20 8.15

2009 61.80 65.90 62.80 4.20

2010 79.50 77.50 73.80 4.15

2011(9 mths) 95.45 94.35 87.90 3.80

Forecast

2011(3 mths) 85.00 86.20 79.20 3.80

2012 91.80 93.10 85.60 4.30

2013 93.60 95.00 87.30 4.75

2014 95.50 96.90 89.10 5.25

2015 97.40 98.80 90.80 5.75

Edmonton Edmonton Inflation

Condensate Butane Rate Exchange Rate

Year ($Cdn/bbl) ($Cdn/bbl) (%/Yr) ($US /$Cdn)

----------------------------------------------------------------------------

Historical

2005 69.63 52.58 2.1 0.83

2006 75.06 60.10 2.2 0.88

2007 77.36 63.75 2.0 0.94

2008 104.75 75.25 2.4 0.94

2009 68.15 49.25 2.0 0.88

2010 84.25 66.05 2.0 0.97

2011(9 mths) 101.90 73.05 2.0 1.02

Forecast

2011(3 mths) 90.20 69.50 2.0 0.98

2012 95.10 75.00 2.0 0.98

2013 97.10 76.60 2.0 0.98

2014 99.00 78.10 2.0 0.98

2015 101.00 79.60 2.0 0.98

Thereafter 2.0% Escalation Rates

----------------------------------------------------------------------------

Notes:

1. Inflation rates for forecasting prices and costs.

2. Exchange rates used to generate the benchmark reference prices in this

table.

3. Product sale prices will reflect these reference prices with further

adjustments for quality and transportation to point of sale.

4. Forecast prices and costs as supplied by our independent and qualified

reserves evaluator, McDaniel.

The McDaniel Update Report, effective October 1, 2011, was

prepared in accordance with National Instrument 51-101 - Standards

of Disclosure for Oil and Gas Activities and the COGE handbook, and

is dated November 21, 2011.

Estimates are prepared such that there is a 90% probability that

at least the estimated proved reserves will be recovered and a 50%

probability that at least the sum of the estimated proved reserves

plus probable reserves will be recovered. Possible reserves are

those additional reserves that are less certain to be recovered

than probable reserves. There is a 10% probability that the

quantities actually recovered will equal or exceed the sum of the

estimated proved plus probable plus possible reserves.

About Petro-Reef Resources Ltd.

Petro-Reef Resources Ltd. is a Calgary-based crude oil and

natural gas exploration and production company with producing

properties in Alberta, Canada.

Additional information about the Company is available under

Petro-Reef's profile on SEDAR at www.sedar.com.

BOE Reference

Reference is made to barrels of oil equivalent ("BOE"). BOE may

be misleading, particularly if used in isolation. In accordance

with National Instrument 51-101, a BOE conversion ratio of six mcf

of natural gas to one bbl of oil has been used, which is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead.

Forward-Looking Statements

This press release contains certain forward-looking information

and statements within the meaning of applicable securities laws

(collectively, "forward-looking information"). The use of the words

"potential", "estimate" and similar expressions are intended to

identify forward-looking information. In particular, but without

limiting the foregoing, this press release contains forward-looking

information pertaining to potential Detrital development locations

and reserve life index. Various assumptions were used in drawing

the conclusions or making the projections contained in the

forward-looking information throughout this press release.

Forward-looking information is based upon the opinions and

expectations of management of Petro-Reef as at the effective date

of such information. The forward-looking information contained in

press release reflects several material factors and expectations

and assumptions of Petro-Reef including, without limitation: the

accuracy of current production data; historical well production;

reservoir conditions on the Company's Alexander lands; the accuracy

of the estimates of Petro-Reef's reserves volumes; and certain

commodity pricing and other cost assumptions.

Petro-Reef believes the material factors, expectations and

assumptions reflected in the forward-looking information are

reasonable at this time but no assurance can be given that these

factors, expectations and assumptions will prove to be correct. The

forward-looking information included in this press release is not a

guarantee of future performance and should not be unduly relied

upon. Such information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information including, without limitation: the

impact of general economic and industry conditions; fluctuation of

commodity prices; fluctuation of foreign exchange rates;

environmental risks; industry competition; availability of

qualified personnel and management; availability of materials,

equipment and third party services; stock market volatility; timely

and cost effective access to sufficient capital from internal and

external sources; unanticipated operating results or production

declines; changes in tax or environmental laws or royalty rates;

inaccurate estimation of Petro-Reef's oil and gas reserves volumes;

for reasons currently unforeseen, the current development locations

identified by the Company may prove to be unsuitable or

unavailable; and certain other risks detailed from time to time in

Petro-Reef's public disclosure documents including, without

limitation, those risks identified in this press release, which are

available under Petro-Reef's SEDAR profile at www.sedar.com.

The forward-looking information contained in this press release

speaks only as of the date of this press release, and Petro-Reef

does not assume any obligation to publicly update or revise its

forward-looking information to reflect new events or circumstances,

except as may be required pursuant to applicable laws. The

forward-looking information contained herein is expressly qualified

by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Petro-Reef Resources Ltd. Hugh M. Thomson

Vice-President Finance & CFO (403) 523-2505 (403) 264-1348

(FAX)info@petro-reef.cawww.petro-reef.ca Petro-Reef Resources Ltd.

970, 10655 Southport Road S.W. Calgary, Alberta T2W 4Y1

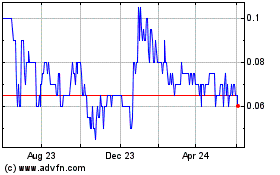

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Dec 2024 to Jan 2025

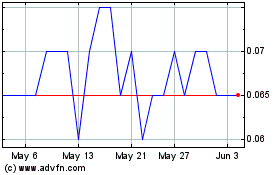

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Jan 2024 to Jan 2025