Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the "Company") is

pleased to announce a production increase of 181 BOE/day and a 12% increase in

proved plus probable reserves.

Petro-Reef has tied in its Alexander 09-12-56-27W4 step-out well producing from

the Detrital oil zone. The well came on stream on October 26, 2011, and during

the first 19 days on production the well has flowed at an average rate of 193

BOE/day (181 BOE/day net) - 151 bbl/day (142 bbl/day net) of oil and 247 mcf/day

(232 mcf/day net) of natural gas. Petro-Reef has a 94% working interest in the

9-12 well.

The Company believes that this step-out well in Section 12 confirms that the

Detrital oil trend extends west from Section 7 where Petro-Reef has three wells

producing from the same zone. The Company has completed the reprocessing of 35

sections of 3-D seismic data on its Alexander lands which has been incorporated

into the October 1, 2011 independent reserves evaluation, prepared by McDaniel &

Associates Consultants Ltd. ("McDaniel") (the "McDaniel Update Report"). Four

additional Detrital development locations have been included in the McDaniel

Update Report.

Petro-Reef's gross proved plus probable reserves at October 1, 2011 indicated an

increase of 12% to 1,771,150 BOE from 1,580,000 BOE at December 31, 2010, after

extensions, technical revisions, discoveries, acquisitions, economic factors,

and production. After considering the production for the period January 1 to

September 30, 2011 of 180,300 BOE, the 2011 reserve additions totalled 371,450

BOE which represents an increase of 24% over the 2010 year end reserves.

Using a 10% net present value ("NPV"), the value of proved plus probable

reserves at forecast prices and costs (before income taxes) was unchanged at

$34,735,200 as compared with proved plus probable reserves of $34,741,400 as at

December 31, 2010.

Petro-Reef's gross proved, probable plus possible reserves at October 1, 2011

totaled 2,623,050 BOE. Using a 10% NPV, the value of proved, probable plus

possible reserves at forecast prices and costs (before income taxes) totaled

$56,281,100. The possible reserves include four potential development locations

targeting the Detrital zone offsetting the Company's recent 09-12-56-27W4 well.

Only extensions to the existing producing zones were included in the possible

reserves. The resource plays in the Nordegg at Goose River and the Wabamum and

other plays identified by the seismic reprocessing at Alexander were not

included in the evaluation.

Proved plus probable reserves were comprised of 47% natural gas and 53% crude

oil and natural gas liquids (December 31, 2010 - 54% natural gas and 46% crude

oil and natural gas liquids).

Of the total proved plus probable reserves reported (using forecast prices)

Petro-Reef's reserves are 54% proved and 46% probable.

Based on proved plus probable reserves and production volumes, Petro-Reef's

reserve life index was 7.0 years (41.1 years remaining life) on a proved plus

probable basis at October 1, 2011 compared with 4.2 years (39.8 years remaining

life) at the end of 2010.

Summary of Oil and Gas Reserves - Forecast Prices and Costs

The table below provides a summary of the oil and natural gas reserves

attributable to Petro-Reef as at October 1, 2011. As the tables below summarize

the data contained in the McDaniel Update Report, they may contain slightly

different numbers than those contained in the original report due to rounding.

Also due to rounding, certain columns may not add exactly.

Light / Medium Oil Natural Gas BOE

Gross Net Gross Net Gross Net

(Mbbl) (Mbbl) (MMcf) (MMcf) (MBOE) (MBOE)

---------------------------------------------------------

Reserves Category

Proved

Developed Producing 125.4 112.1 2,397.7 2,056.5 525.0 454.8

Developed Non-

Producing 256.4 212.3 607.8 528.0 357.7 300.3

Undeveloped 74.2 65.5 157.2 140.7 100.4 89.0

---------------------------------------------------------

Total Proved 456.0 389.9 3,162.7 2,725.2 983.1 844.1

Probable 483.3 397.1 1,828.4 1,593.1 788.0 662.6

---------------------------------------------------------

Total Proved &

Probable 939.3 787.0 4,991.1 4,318.3 1,771.1 1,506.7

Possible 595.7 511.2 1,537.2 1,341.6 851.9 734.8

---------------------------------------------------------

Total Proved,

Probable &

Possible 1,535.0 1,298.2 6,528.3 5,659.9 2,623.0 2,241.5

----------------------------------------------------------------------------

Notes:

1. "Mbbl" means thousands of barrels

2. "MMcf" means million cubic feet

3. "MBOE" means thousands of barrels of oil equivalent

Summary of Net Present Values of Future Net Revenue as of October 1, 2011

Forecast Prices and Costs

Before Income Taxes

Discounted at (% / Year)

0 5 10 15 20

(M$) (M$) (M$) (M$) (M$)

------------------------------------------------

Reserves Category

Proved

Developed Producing 6,691 6,281 5,920 5,600 5,316

Developed non-producing 14,146 12,741 11,666 10,812 10,112

Undeveloped 2,485 2,243 2,035 1,855 1,698

------------------------------------------------

Total Proved 23,322 21,265 19,621 18,267 17,126

Probable 26,501 19,274 15,114 12,470 10,646

------------------------------------------------

Total Proved & Probable 49,823 40,539 34,735 30,737 27,772

Possible 32,858 25,995 21,546 18,415 16,080

------------------------------------------------

Total Proved, Probable &

Possible 82,681 66,534 56,281 49,152 43,852

----------------------------------------------------------------------------

After Income Taxes Before tax

Discounted at (% / Year) Net Value

0 5 10 15 20 10%/yr

(M$) (M$) (M$) (M$) (M$) ($/boe)

------------------------------------------------

Reserves Category

Proved

Developed Producing 6,691 6,281 5,920 5,600 5,316 11.24

Developed non-producing 14,146 12,741 11,666 10,812 10,112 32.62

Undeveloped 2,485 2,243 2,035 1,855 1,698 20.27

--------------------------------------

Total Proved 23,322 21,265 19,621 18,267 17,126 19.93

Probable 22,238 16,054 12,502 10,257 8,719 19.17

--------------------------------------

Total Proved & Probable 45,560 37,319 32,123 28,524 25,845 19.59

Possible 24,702 19,465 16,070 13,679 11,895 25.27

--------------------------------------

Total Proved, Probable &

Possible 70,262 56,784 48,193 42,203 37,740 21.43

----------------------------------------------------------------------------

Notes:

1. NPV of future net revenue includes all resource income including, sale

of oil, gas, by-product reserves, processing third party reserves, and

other income.

2. Income taxes include all resource income and prior tax pools.

3. Unit values are based on net reserves volumes.

4. All of the Company's reserves are located in Canada.

5. The estimated values disclosed in the McDaniel Update Report do not

necessarily represent fair market value.

Reconciliation of Changes in Reserves - Proved plus Probable Reserves

The reserves reconciliation reflects current proved, probable, and proved plus

probable reserves.

Light / Medium Oil

----------------------------------------------------------------------------

Gross Proved

Gross Probable Plus Probable

Factors Gross Proved (Mbbl) (Mbbl) (Mbbl)

----------------------------------------------------------------------------

December 31, 2010 372.8 330.1 702.9

Extensions 108.4 272.6 381.0

Technical

Revisions 32.0 (119.5) (87.5)

Production (57.1) - (57.1)

----------------------------------------------------------

October 1, 2011 456.1 483.2 939.3

----------------------------------------------------------------------------

Natural Gas BOE

----------------------------------------------------------------------------

Gross Gross

Proved Proved

Gross Gross Plus Gross Gross Plus

Proved Probable Probable Proved Probable Probable

Factors (MMcf) (MMcf) (MMcf) (MBOE) (MBOE) (MBOE)

----------------------------------------------------------------------------

December 31, 2010 3,467.2 1,794.6 5,261.8 950.7 629.2 1,579.9

Extensions 180.1 619.3 799.4 138.4 375.9 514.3

Technical

Revisions 254.3 (585.1) (330.8) 74.2 (217.0) (142.8)

Production (738.9) (0.4) (739.3) (180.2) (0.1) (180.3)

----------------------------------------------------------

October 1, 2011 3,162.7 1,828.4 4,991.1 983.1 788.0 1,771.1

----------------------------------------------------------------------------

Notes:

1. Gross reserves means the Company's working interest reserves before

calculation of royalties, and before consideration of the Company's

royalty interests.

2. All of the Company's reserves are located in Canada.

3. There were no changes to discoveries, acquisitions, dispositions and

economic factors in the McDaniel Update Report

Forecast Prices Used in Estimates

McDaniel employed the following pricing, exchange rate and inflation rate

assumptions in estimating Petro-Reef reserve data as of October 1, 2011:

Edmonton Par Cromer Medium Natural Gas

Price 40 29.3 degrees AECO Gas

WTI Crude Oil degrees API API Prices

Year ($US /bbl) ($Cdn/bbl) ($Cdn/bbl) ($Cdn/MMBtu)

----------------------------------------------------------------------------

Historical

2005 56.56 68.72 57.47 8.58

2006 66.23 72.80 61.25 7.16

2007 72.30 76.35 65.40 6.65

2008 99.60 102.20 93.20 8.15

2009 61.80 65.90 62.80 4.20

2010 79.50 77.50 73.80 4.15

2011(9 mths) 95.45 94.35 87.90 3.80

Forecast

2011(3 mths) 85.00 86.20 79.20 3.80

2012 91.80 93.10 85.60 4.30

2013 93.60 95.00 87.30 4.75

2014 95.50 96.90 89.10 5.25

2015 97.40 98.80 90.80 5.75

Edmonton Edmonton Inflation

Condensate Butane Rate Exchange Rate

Year ($Cdn/bbl) ($Cdn/bbl) (%/Yr) ($US /$Cdn)

----------------------------------------------------------------------------

Historical

2005 69.63 52.58 2.1 0.83

2006 75.06 60.10 2.2 0.88

2007 77.36 63.75 2.0 0.94

2008 104.75 75.25 2.4 0.94

2009 68.15 49.25 2.0 0.88

2010 84.25 66.05 2.0 0.97

2011(9 mths) 101.90 73.05 2.0 1.02

Forecast

2011(3 mths) 90.20 69.50 2.0 0.98

2012 95.10 75.00 2.0 0.98

2013 97.10 76.60 2.0 0.98

2014 99.00 78.10 2.0 0.98

2015 101.00 79.60 2.0 0.98

Thereafter 2.0% Escalation Rates

----------------------------------------------------------------------------

Notes:

1. Inflation rates for forecasting prices and costs.

2. Exchange rates used to generate the benchmark reference prices in this

table.

3. Product sale prices will reflect these reference prices with further

adjustments for quality and transportation to point of sale.

4. Forecast prices and costs as supplied by our independent and qualified

reserves evaluator, McDaniel.

The McDaniel Update Report, effective October 1, 2011, was prepared in

accordance with National Instrument 51-101 - Standards of Disclosure for Oil and

Gas Activities and the COGE handbook, and is dated November 21, 2011.

Estimates are prepared such that there is a 90% probability that at least the

estimated proved reserves will be recovered and a 50% probability that at least

the sum of the estimated proved reserves plus probable reserves will be

recovered. Possible reserves are those additional reserves that are less certain

to be recovered than probable reserves. There is a 10% probability that the

quantities actually recovered will equal or exceed the sum of the estimated

proved plus probable plus possible reserves.

About Petro-Reef Resources Ltd.

Petro-Reef Resources Ltd. is a Calgary-based crude oil and natural gas

exploration and production company with producing properties in Alberta, Canada.

Additional information about the Company is available under Petro-Reef's profile

on SEDAR at www.sedar.com.

BOE Reference

Reference is made to barrels of oil equivalent ("BOE"). BOE may be misleading,

particularly if used in isolation. In accordance with National Instrument

51-101, a BOE conversion ratio of six mcf of natural gas to one bbl of oil has

been used, which is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead.

Forward-Looking Statements

This press release contains certain forward-looking information and statements

within the meaning of applicable securities laws (collectively, "forward-looking

information"). The use of the words "potential", "estimate" and similar

expressions are intended to identify forward-looking information. In particular,

but without limiting the foregoing, this press release contains forward-looking

information pertaining to potential Detrital development locations and reserve

life index. Various assumptions were used in drawing the conclusions or making

the projections contained in the forward-looking information throughout this

press release.

Forward-looking information is based upon the opinions and expectations of

management of Petro-Reef as at the effective date of such information. The

forward-looking information contained in press release reflects several material

factors and expectations and assumptions of Petro-Reef including, without

limitation: the accuracy of current production data; historical well production;

reservoir conditions on the Company's Alexander lands; the accuracy of the

estimates of Petro-Reef's reserves volumes; and certain commodity pricing and

other cost assumptions.

Petro-Reef believes the material factors, expectations and assumptions reflected

in the forward-looking information are reasonable at this time but no assurance

can be given that these factors, expectations and assumptions will prove to be

correct. The forward-looking information included in this press release is not a

guarantee of future performance and should not be unduly relied upon. Such

information involves known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from those

anticipated in such forward-looking information including, without limitation:

the impact of general economic and industry conditions; fluctuation of commodity

prices; fluctuation of foreign exchange rates; environmental risks; industry

competition; availability of qualified personnel and management; availability of

materials, equipment and third party services; stock market volatility; timely

and cost effective access to sufficient capital from internal and external

sources; unanticipated operating results or production declines; changes in tax

or environmental laws or royalty rates; inaccurate estimation of Petro-Reef's

oil and gas reserves volumes; for reasons currently unforeseen, the current

development locations identified by the Company may prove to be unsuitable or

unavailable; and certain other risks detailed from time to time in Petro-Reef's

public disclosure documents including, without limitation, those risks

identified in this press release, which are available under Petro-Reef's SEDAR

profile at www.sedar.com.

The forward-looking information contained in this press release speaks only as

of the date of this press release, and Petro-Reef does not assume any obligation

to publicly update or revise its forward-looking information to reflect new

events or circumstances, except as may be required pursuant to applicable laws.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

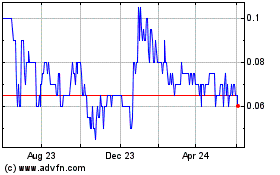

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Dec 2024 to Jan 2025

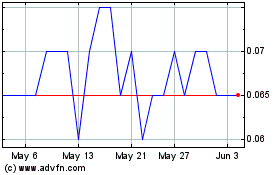

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Jan 2024 to Jan 2025