Petro-Reef Resources Ltd. - Acquisition of New Undeveloped Alexander Acreage and Appointment of Chief Financial Officer

March 03 2011 - 7:18AM

Marketwired Canada

Petro-Reef Resources Ltd. (TSX VENTURE:PER),("Petro-Reef" or the "Company")

announces that it has acquired additional lands directly offsetting its

development lands in the Alexanderarea of Alberta. The new section (94% working

interest) is adjacent to Section sevenand management believes that the oil trend

extends into the new land acquisitionproviding Petro-Reef with additional

development locations.

Based on the Company's drilling success in the fall of 2010 and strong

production from the Detritaloil zone, Petro-Reef is preparing to license and

intends to drill 4 development wellsin Q1 and Q2 of 2011targeting the same,

highly prolific crude oil zone. Petro-Reef holds a 79% working interest in three

of the locations and a 94% working interest in the fourth.

The Company's two development wells drilled in the fall of 2010 on the Alexander

landshave stabilized and are currently producing a combined total of 405 BOE/day

(319 BOE/day net):

06-07 11-07

Gross Net Gross Net

----------------------------

Bbl Oil/day 179 141 90 71

Mcf Gas/day 320 253 495 391

BOE/day 232 183 173 136

The 11-07 well came on stream in early October, 2010 and the 06-07 well came on

stream in late December, 2010.

Petro-Reef Resources Ltd. also announces that Mr. Alisdair Leeson, C.A., has

been appointed Vice President Finance and Chief Financial Officer of the

Company. Mr. Leeson brings twenty five(25) years of experience as a Chartered

Accountant in various industries. The appointment of Mr. Leeson is in addition

to the previously announced appointment of Mr. Hugh Thomson as Chief Accountant.

The TSX Venture Exchange has not reviewed and does not accept responsibility for

the adequacy or accuracy of this news release.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forthin this news release, including without limitation, assumptions

and statements regardingreservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-lookingstatements that

involve substantial known and unknown risks and uncertainties. Some ofthese

risks and uncertainties are beyond management's control, including but not

limited to, theimpact of general economic conditions, industry conditions,

fluctuation of commodity prices,fluctuation of foreign exchange rates,

environmental risks, industry competition, availability ofqualified personnel

and management, availability of materials, equipment and third partyservices,

stock market volatility, timely and cost effective access to sufficient capital

frominternal and external sources. The reader is cautioned that assumptions used

in the preparation ofsuch information, although considered reasonable by the

Corporation at the time of preparation,may prove to be incorrect. There can be

no assurance that such statements will prove to beaccurate and actual results

and future events could differ materially from those anticipated insuch

statements.Reference is made to barrels of oil equivalent (BOE). Barrels of oil

equivalent may be misleading,particularly if used in isolation. In accordance

with National Instrument 51-101, a BOEconversion ratio for natural gas of 6 Mcf

: 1 bbl has been used, which is based on an energyequivalency conversion method

primarily applicable at the burner tip and does not represent avalue equivalency

at the wellhead.

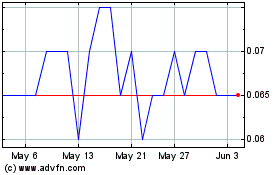

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Dec 2024 to Jan 2025

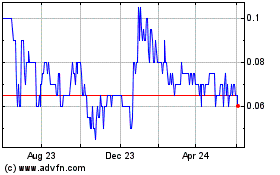

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Jan 2024 to Jan 2025