Mkango Resources Ltd. (Formerly Alloy Capital Corp.) Completes Acquisition of Lancaster Exploration Limited as Its Qualifying Tr

January 05 2011 - 7:31PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. WIRE SERVICES

Mkango Resources Ltd. (formerly Alloy Capital Corp.) (TSX VENTURE:MKA) (the

"Corporation" or "Mkango") is pleased to announce that on December 20, 2010, it

completed the acquisition ("Acquisition") of Lancaster Exploration Limited

("Lancaster") as its Qualifying Transaction as set forth in Policy 2.4 of the

TSX Venture Exchange ("TSXV").

Prior to the Acquisition, Lancaster was a wholly-owned subsidiary of Leo Mining

and Exploration Limited ("Leominex"). The Acquisition constitutes a reverse

take-over by Leominex of the Corporation whereby Leominex shall become a

controlling shareholder of the Corporation. Both Lancaster and Leominex are

private companies incorporated in the British Virgin Islands. Lancaster is

engaged in exploration for rare earth elements in Africa.

The Qualifying Transaction

Pursuant to the terms of the transaction, prior to completion of the Acquisition

and the concurrent private placement, the Corporation consolidated its common

shares on a 2.5 for 1 basis (each post-consolidated common share referred to

hereafter as a "Common Share"). The Corporation then issued 19,852,899 Common

Shares (the "Acquisition Shares") at a deemed value of $0.50 per Acquisition

Share to Leominex for all of the issued and outstanding shares of Lancaster, for

a purchase price of $9,926,449.50.

The Corporation's acquisition of Lancaster was an arm's length transaction and

the principal shareholders of Leominex, the parent company to Lancaster, are

William Dawes and Alexander Lemon, each of whom are resident in London, England.

Private Placement

In conjunction with the Acquisition, the Corporation issued 4,825,000 units (the

"Units"), at a price of $0.50 per Unit, pursuant to a brokered private placement

(the "Brokered Offering"), co-lead by Haywood Securities Inc. and Byron

Securities Limited (collectively, the "Agents") for gross proceeds of

$2,412,500. In addition, the Corporation concurrently completed a non-brokered

private placement (the "Non-Brokered Offering") of 10,696,499 Units at a price

of $0.50 per Unit for total gross proceeds of $5,348,249.50. Each Unit consists

of one Common Share and one-half of one Common Share purchase warrant (the

"Warrant"). Each whole Warrant entitles the holder to acquire one Common Share

at the exercise price of $0.75 on or before December 20, 2012. All of the

securities issued under the Brokered and Non-Brokered Offerings are subject to a

four month restriction from resale, as stipulated under applicable securities

legislation and the TSXV, expiring on April 21, 2011. The combined Brokered and

Non-Brokered Offerings were oversubscribed and resulted in gross proceeds of

$7,760,749.50.

As compensation for completion of the Brokered Offering, the Agents received a

commission equal to 7% of the gross proceeds of the Brokered Offering, Agents'

warrants (the "Agents' Warrants") equal to 7% of the number of Units sold under

the Brokered Offering and a corporate finance fee of $25,000. Each Agents'

Warrant entitles the holder to purchase one Unit ("Agents' Unit") at an exercise

price of $0.50 on or before December 20, 2012. Each Agents' Unit consists of one

Common Share ("Agents' Unit Share") and one-half of one warrant ("Agents' Unit

Warrant"). Each whole Agents' Unit Warrant entitles the holder to acquire one

Common Share at an exercise price of $0.75 on or before December 20, 2012. In

addition, the Corporation paid $180,235 in finder's fees and 272,970 warrants

(the "Finder's Warrants") as compensation to finders under the Non-Brokered

Offering. The terms of the Finder's Warrants are identical to the Agents'

Warrants.

The proceeds of the Brokered and Non-Brokered Offerings will be used to complete

the proposed exploration program for Mkango, working capital and general

corporate purposes.

Directors and Officers

The directors and officers of the Corporation are as follows:

William Dawes, Chief Executive Officer and Director

Mr. Dawes is a graduate of Bristol University (BSc Geology) and Imperial

College, London (MSc Mineral Exploration). He previously worked as a mining

analyst based in London and from 1995 to 1998, for Rio Tinto's exploration

division. From 1998 to 2005, Mr. Dawes gained significant global mining

transaction experience in the metals and mining team of Robert Fleming & Co.,

Chase Manhattan Bank and JPMorgan, where he held the position of Vice-President.

From 2006 to 2007, he worked as a consultant and co-founded Leominex in

September of 2007. He is a Member of the Institute of Materials, Minerals and

Mining and holds the Chartered Financial Analyst designation.

Alexander Lemon, President and Director

Mr. Lemon is a graduate of Oxford Brookes University (BSc Geological Sciences)

and Imperial College, London (MSc Mineral Exploration). From 1994 to 2001, he

was the Managing Director of Gold and Mineral Excavation Inc., which owned and

operated a producing gold mine in Central Asia, where he gained extensive

operating experience in emerging markets including government negotiations and

project management. From 2001 to 2005, he worked for Allied Commercial Exporters

as an investment advisor. Mr. Lemon worked as a consultant from 2006 to 2007 and

co-founded Leominex in September of 2007. He is a Member of the Canadian

Institute of Mining, Metallurgy and Petroleum and is an Associate Member of the

Institute of Materials, Minerals and Mining.

David Berg, Corporate Secretary, Chief Financial Officer and Director

Mr. Berg is currently an independent businessman.

He spent 28 years of consecutive service with one of Canada's largest publicly

traded companies, serving in the capacity of Vice President of Operations. He

managed a business unit with over $1.5 billion in annual revenue and a total of

8,500 employees. His corporate experience has encompassed financial, retail

services and petroleum business.

As the former Chairman and a director of Potash One (TSX:KCL) Mr. Berg

participates in a number of its Executive Committees. He has actively

contributed to its successful development from an early stage exploration

company to its recent pending acquisition by a multinational fertilizer company

for $434 million dollars. He is also an advisor, founder and director of

numerous other publicly traded companies.

Presently Mr. Berg operates a private consulting business based in Calgary,

Alberta specializing in the provision of management services and business models

for the natural resource sector with a focus on restructuring and financing

public and private entities.

Eugene Chen, Director

Mr. Chen is currently a Partner in the securities, corporate finance and mergers

and acquisitions group with Gowling Lafleur Henderson LLP. He was an associate

and then Partner practicing corporate finance and securities law with Fraser

Milner Casgrain LLP from July 2005 to March 2010. Mr. Chen has been a director

and/or officer of numerous public and private companies.

Mr. Chen holds a Bachelor of Science from the University of Alberta, a Bachelor

of Laws from the University of British Columbia and is a member of the Law

Society of Alberta.

Arthur Wong, Director

Mr. Wong is an independent businessman and Managing Director and Chief Executive

Officer of Optimus U.S. Real Estate Partners Ltd. He was a founder,

Vice-President, Chief Operating Officer and Director of Genesis Land Development

Corp. ("Genesis") from December 1997 to April 2008. Genesis is a publicly traded

real estate development company listed on the TSX.

Mr. Wong is a Professional Engineer and holds a Bachelor of Science degree

(Mechanical Engineering - Cooperative Program) from the University of Alberta.

Mkango Resources Ltd.

Mkango's primary business is the exploration for rare earth elements and

associated minerals in the Republic of Malawi. It holds, through its wholly

owned subsidiary Lancaster, a 100% interest in two exclusive prospecting

licenses covering a combined area of 1,751 km2 in southern Malawi. The main

exploration target is the Songwe Hill deposit, which features carbonatite hosted

rare earth mineralization and was subject to previous exploration programs in

the late 1980s and in 2010, the latter funded and managed by Lancaster.

The Corporation's corporate strategy is to further delineate the rare earth

mineralization at Songwe Hill and secure additional rare earth element and other

mineral opportunities in Malawi and elsewhere in Africa.

Effective at the opening on Thursday January 6, 2011, the Common Shares of

Mkango will be reinstated for trading under the symbol "MKA".

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements relating to the

Corporation. Readers are cautioned not to place undue reliance on

forward-looking statements, as there can be no assurance that the plans,

intentions or expectations upon which they are based will occur. By their

nature, forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and other

forward-looking statements will not occur, which may cause actual performance

and results in future periods to differ materially from any estimates or

projections of future performance or results expressed or implied by such

forward-looking statements.

The forward-looking statements contained in this press release are made as of

the date of this press release. Except as required by law, the Corporation

disclaims any intention and assume no obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by applicable securities law.

Additionally, the Corporation undertakes no obligation to comment on the

expectations of, or statements made, by third parties in respect of the matters

discussed above.

The TSX Venture Exchange has neither approved nor disapproved the contents of

this press release.

Not for distribution to U.S. Newswire Services or for dissemination in the

United States of America. Any failure to comply with this restriction may

constitute a violation of U.S. Securities Laws.

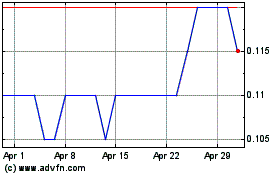

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Jun 2024 to Jul 2024

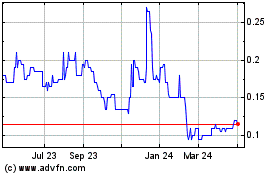

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Jul 2023 to Jul 2024