LithiumBank Resources Corp. (

TSX-V:

LBNK) (

OTCQX: LBNKF)

(“

LithiumBank” or the “

Company”)

is pleased to announce the highlights from the initial Preliminary

Economic Assessment (“PEA”) for the Boardwalk lithium brine project

located in west-central Alberta, Canada. The completed NI 43-101

PEA Technical Report will be filed on SEDAR within 45 days of this

announcement.

Boardwalk

Highlights1

- 31,350 metric tonnes per year of

battery grade lithium hydroxide monohydrate (“LHM”)2 over a 20-year

period, the largest proposed LHM production in North America

- USD $2.7 Billion NPV8 and 21.6% IRR

on a pre tax basis

- USD $1.7 Billion NPV8 and 17.8% IRR

on an after tax basis

- OPEX of USD $6,807/tonne LHM

- Direct Lithium Extraction (“DLE”)

used to process Boardwalk brine will require less fresh water and

have a surface footprint that is a fraction of hard rock or

evaporation lithium production.

- Located in Tier 1 jurisdiction,

west-central Alberta, that has a long history of resource

extraction, well established infrastructure, and an actively

supportive government.

- Power to be generated on site using

high-efficiency gas turbines with steam cogeneration that will

lower the project’s overall carbon footprint. The proposed gas

turbine units may be run on 80% hydrogen when a reliable supply is

available.

- Multiple opportunities to

significantly enhance project economics through optimization,

further engineering, and pending incentive tax credit.

- Project economics used USD

$26,000/t LHM and provides strong leverage to higher lithium

prices.

__________________1 Readers are cautioned that

reliance on information in this announcement without reference to

the Technical Report may not be appropriate. The forthcoming

Technical Report is meant to be read as a whole, and sections

should not be read or relied upon out of context.2 31,350 metric

tonnes lithium hydroxide monohydrate (“LHM”) is equivalent to

28,000 metric tonnes lithium carbonate equivalent (“LCE”)

“We are very pleased to provide one of a handful

of economic studies of DLE based lithium projects in the world.

Over the last 15 months, our PEA has rigorously tested or assessed

over a dozen DLE technologies, completed multiple trade off studies

and has established Boardwalk as an economically viable project in

the new post-pandemic financial environment,” commented Paul

Matysek, Executive Chairman LithiumBank. “Boardwalk is unique with

an uncomplicated mineral title containing a 6.2M tonne LCE brine

resource that has the potential to produce battery grade LHM for 20

years, right here in North America. Furthermore, there is potential

for substantial upside on these economics from the recently

announced Canadian Investment Tax Credit and other numerous

optimization opportunities.”

Near Term PEA Enhancements

- The Government of Canada announced

an Investment Tax Credit (ITC) for Clean Technology Manufacturing

in its Budget 2023. Refundable tax credit will be applied on

capital expenditures for the extraction and processing of critical

minerals (ITC link).

- Use of smaller electrical

submersible pumps (ESPs) that could fit in reduced diameter well

casing throughout the network that would significantly reduce

capital expenditures.

- Leveraging of existing wells and

surface infrastructure including roads, well pads, pipelines, and

utilities.

- Reduction of well and power

requirements through enhanced 3-D reservoir modelling and new

drilling information.

- Next generation sorbent being

developed by Conductive, the provider of the lithium brine DLE

technology chosen for the PEA, is expected to reduce costs,

increase efficiency and reduce reagent consumption.

- Alternative DLE technology

trade-off studies.

- Utilise ZS2 Technologies Inc. to

capture and sequester CO2 emissions to produce carbon credits,

extract magnesium from barren brine to produce low carbon cement

products that will lower brine reinjection amounts by at least

10%.

- Additional trade-off studies aimed

at streamlining pipeline infrastructure.

“The Boardwalk PEA marks a significant milestone

for LithiumBank” commented Rob Shewchuk CEO & Director of

LithiumBank. “It sets the stage for our team to now pursue lithium

resource development in Western Canada with a significantly

enhanced ESG profile compared to other forms of lithium mining. We

will leverage this PEA to expedite an additional PEA on Park Place

lithium brine project only 50 km to the south. By the end of 2023,

we expect to commence pilot plant studies on both Boardwalk and

Park Place in tandem. In parallel, we will be working to capture

the near-term enhancement opportunities we have already identified

in this study that we expect to drive significant incremental NPV

and IRR performance. We believe this has the potential to position

both the Boardwalk and Park Place districts among the most

attractive direct brine projects in North America.”

Boardwalk PEA

Introduction

The Boardwalk PEA was compiled by Hatch Ltd.

(“Hatch”) integrating the work of Hatch and other consultants each

having the qualifications necessary to author their respective

sections of the PEA. Since their founding in 1955, Hatch has

successfully designed numerous large scale industrial projects

throughout North America and the world.

LithiumBank Resources Corp. is a lithium brine

exploration and development company that is focused on developing

their flagship projects in western Canada. The Boardwalk project is

based on a lithium hydroxide monohydrate (“LHM”) plant that will

use Direct Lithium Extraction (“DLE”) technology. The in-situ

lithium-rich brine will be pumped to a processing facility from the

Leduc well-field shown in Figure 6. The PEA contemplates the brine

will be treated using Conductive Energy Inc.'s Ion Exchange (“IX”)

sorbent that will selectively extract lithium from the brine. After

passing through the extraction process, the concentrated lithium

brine stream undergoes further processing steps including

purification, concentration and conversion to produce commercial

battery grade lithium hydroxide monohydrate shown in Figure 7.

Economic Analysis

The base case assumes a long term LHM price of

US$26,000/t. At this price the project achieves a positive NPV of

$2.7 billion on a pre-tax basis at an 8% real discount rate. A

summary of key indicators is shown in Table 1.

|

|

|

|

Table 1 - Boardwalk Economic Summary |

|

|

|

|

|

Description |

Unit |

Value |

|

|

|

|

LHM Sales |

t/year |

31,350 |

|

|

LHM Price |

US$/t |

26,000 |

|

|

Site Operating Unit Cost |

US$/t sold |

6,941 |

|

|

Site Operating Cost |

US$M/year |

214 |

|

|

EBITDA |

US$M/year |

586 |

|

|

Project Life |

years |

20 |

|

|

Initial Capital Cost |

US$M |

2,092 |

|

|

Sustaining Capital Cost |

US$M |

129 |

|

|

USD/CAD Exchange Rate |

US$/C$ |

0.74 |

|

|

Pre-tax NPV @ 8% |

US$M |

2,722 |

|

|

After-tax NPV @ 8% |

US$M |

1,657 |

|

|

Pre-tax IRR |

% |

21.6 |

|

|

After-tax IRR |

% |

17.8 |

|

|

Pre-tax Payback |

operating years |

4.1 |

|

|

After-tax Payback |

operating years |

4.5 |

|

The preliminary economic assessment is

inherently preliminary in nature. It includes inferred mineral

resources that are too speculative geologically to have economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

results indicated in this preliminary economic assessment will be

realized.

Capital and Operating Cost

Estimates

The Capital Expenditure (CAPEX) Estimate was

prepared in accordance with the Association for the Advancement of

Cost Engineering (AACE) Class 5 Study standards, and has an

approximate accuracy of +50%, -30%.

The total estimated CAPEX for the project is

presented in table 2 below, inclusive of contingency.

|

|

|

|

Table 2 - Capital Cost Estimate Summary |

|

|

|

|

|

Description |

Estimated Cost (M USD) |

|

|

|

|

Plant Wide - General |

$22.90 |

|

|

Onsite Infrastructure |

$264.90 |

|

|

Offsite Infrastructure |

$18.90 |

|

|

Brine Wellfield Services |

$276.30 |

|

|

Surface Brine Infrastructure |

$208.70 |

|

|

Lithium Processing Plant |

$574.80 |

|

|

Direct Cost - Subtotal |

$1,366.60 |

|

|

Indirect Cost |

$311.40 |

|

|

Contingency |

$359.50 |

|

|

Owner’s Cost |

$54.70 |

|

|

Total Project Capital Cost |

$2,092.10 |

|

The Operating Expenditure (OPEX) Estimate for

the project was also prepared in accordance with the AACE Class 5

Study standard. The total OPEX is presented below in table 3.

|

|

|

|

Table 3 - Operating Cost Summary |

|

|

|

|

|

Cost Component |

Lithium Plant Annual Operating Cost (M USD) |

Lithium Plant Unit Operating Cost (USD/t LHM) |

% of total OPEX |

|

|

|

|

Reagents |

117.5 |

3,689 |

54% |

|

|

Utilities |

47.2 |

1,480 |

22% |

|

|

Consumables |

4.9 |

154 |

2% |

|

|

Labour |

16.3 |

513 |

8% |

|

|

Maintenance Materials and Services |

20.6 |

646 |

9% |

|

|

Transport and Logistics |

3.6 |

114 |

2% |

|

|

General and Administrative (G&A) |

6.7 |

210 |

3% |

|

|

Total Operating Cost |

216.9 |

6,807 |

100% |

|

Returns are highly sensitive to input

assumptions and should be viewed in the context of the sensitivity

analysis provided in figures 1 through 4 as well as the stated

accuracies for items such as capital costs.

Figure 1: NPV @ 8% Pre-Tax

Sensitivity

Figure 2 - NPV @ 8% Discount Rate

After-Tax Sensitivity

Figure 3: IRR Pre-Tax

Sensitivity

Figure 4 - IRR After-Tax

Sensitivity

Lithium Demand

Lithium-ion battery demand has grown

substantially in recent years as electric vehicle (EV) adoption has

strengthened and energy storage systems (ESS) have grown in

popularity. EV batteries are forecast to become the primary driver

for lithium chemical demand, with Wood Mackenzie3 projecting demand

in 2032 to be over twelve times higher than 2020 levels, as shown

in Figure 5. EV demand growth is expected from passenger vehicles,

with global sales forecast to increase 22% per year from 2020 to

20304. EV manufacturers are increasingly making direct investments

in Lithium projects especially in politically stable resource

friendly jurisdictions.

__________________3 The data and information

provided by Wood Mackenzie should not be interpreted as advice and

you should not rely on it for any purpose. You may not copy or use

this data and information except as expressly permitted by Wood

Mackenzie in writing. To the fullest extent permitted by law, Wood

Mackenzie accepts no responsibility for your use of this data and

information except as specified in a written agreement you have

entered into with Wood Mackenzie for the provision of such data and

information. The foregoing chart was obtained from Battery &

raw materials – Investment horizon outlook to 2032 (Q4 2022)™, a

product of Wood Mackenzie.4 The foregoing information was obtained

from Lithium market 2021 outlook to 2050™, a product of Wood

Mackenzie.

Figure 5: Total Battery Demand by End-Use

(TWh) (Wood Mackenzie, 2022)3

Mineral Resource and Reserve

Estimates

The Boardwalk Leduc Formation Li-brine resource

estimate is classified as indicated and inferred mineral resources

in accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum definition standards and best practice guidelines (2014,

2019) and the Canadian Securities Administration’s Standards for

Disclosure of Mineral Projects, National Instrument 43-101.

The indicated and inferred Boardwalk Leduc

Formation lithium-brine resource estimations are presented as a

total (or global value), and were estimated using the following

relation in consideration of the Leduc Formation aquifer brine:

Lithium Resource =

Total Brine Aquifer Volume X Average Porosity X Percentage of Brine

in the Pore Space X Average Concentration of Lithium in the

Brine.

The indicated mineral resource area is defined

by the outline of the Sturgeon Lake South Oilfield. The resource

classification within the Sturgeon Lake South Oilfield is elevated

to an indicated mineral resource due to 1) the correlation of

historical Li-brine data in conjunction with 2021-2022 brine

analytical work conducted by LithiumBank; 2) reinterpretation of

2-D seismic data and understanding of the dimensions of the Leduc

Formation reef buildups; and 3) mineral processing test work – all

of which have advanced the confidence level of the Li-brine

concentration, geological model and potential for recovery of

lithium from the brine. The inferred mineral resource area is

defined by the remaining area of the Sturgeon Lake Reef Complex

that is situated outside of the indicated mineral resource

area.

Three-dimensional wireframes of the Leduc

Formation aquifer were created using the grid surfaces of the top

and base of the Leduc Formation within the 3-D geological model.

The 2-D strings were connected to create a solid 3-D wireframe of

the Leduc Formation aquifer within the resource areas. Only those

parts of the Sturgeon Lake Reef Complex that occur within the

permitted LithiumBank Boardwalk Property were used in the resource

estimate process. The 3-D closed solid polygon wireframe of the

Leduc Formation aquifer domain was used to calculate the volumes of

rock, or the aquifer volumes. The aquifer volumes underlying the

Boardwalk Property, summarized as the total Leduc Formation domain

aquifer volumes, are 19.83 km3 and 308.93 km3 in the indicated and

inferred resource areas, respectively.

The brine volumes are calculated for the Leduc

Formation aquifer domain, or resource areas, by multiplying the

aquifer volume (in km3) times the average porosity times the

percentage of brine assumed within the pore space. Using an average

effective porosity value of 5.3% and an average modal abundance of

brine in the Leduc Formation pore space percentage of 98%, the

indicated and inferred resource brine volumes are 1.03 km3 and

16.05 km3, respectively.

Average Leduc Formation aquifer brine lithium

concentrations of 71.6 milligrams per liter (mg/L) Li and 68.0 mg/L

Li were selected for the calculation of the indicated and inferred

resource estimations. These values were determined from a lithium

assay database of 25 ICP-OES analyses conducted by LithiumBank’s

primary lab (indicated resource area) and 89 LithiumBank and

historical ICP-OES analyses (inferred resource area). The quality

of the average lithium concentrations was assessed and is

considered to represent high levels of analytical precision.

The Li-brine resources were estimated using a

cut-off grade of 50 mg/L lithium. With respect to units of

measurement, 1 mg/L = 1 g/m3. If concentration is in mg/L and

volume in m3, then the calculated resource has units of grams. (1

g/m3 x 1 m3 = 1 gram or 0.001 kg).

The Updated Boardwalk Leduc Formation Li-brine

indicated resource estimate is globally estimated at 74,000 tonnes

of elemental Li (Table 4). The global (total) lithium carbonate

equivalent for the main resource is 393,000 tonnes.

The Updated Boardwalk Leduc Formation Li-brine

inferred resource estimate is globally estimated at 1,091,000

tonnes of elemental Li (Table 5). The global (total) lithium

carbonate equivalent for the main resource is 5,808,000 tonnes.

The mineral resources reported here and used in

the PEA are unchanged from the updated resource estimate titled

“Updated Indicated and Inferred Resource Estimates for LithiumBank

Resources Corp.’s Boardwalk Lithium-Brine Project in West- Central

Alberta, Canada” effectively dated December 20, 2022.Mineral

resources are not mineral reserves and do not have demonstrated

economic viability. There is no guarantee that all or any part of

the mineral resource will be converted into a mineral reserve. The

estimate of mineral resources may be materially affected by

geology, environment, permitting, legal, title, taxation,

socio-political, marketing, or other relevant issues.

Table 4 - Boardwalk Indicated Li—brine

resource estimation presented as a global (total) resource

contained within the Leduc Formation of the Sturgeon Lake South

Oilfield.

Note 1: Mineral resources are not mineral

reserves and do not have demonstrated economic viability.Note 2:

The weights are reported in metric tonnes (1,000 kg or 2,204.6

lbs).Note 3: Tonnage numbers are rounded to the nearest 1,000 unit.

Note 4: In a ‘confined’ aquifer (as reported herein), porosity is a

proxy for specific yield.Note 5: The resource estimation was

completed and reported using a cutoff of 50 mg/L Li.Note 6: To

describe the resource in terms of industry standard, a conversion

factor of 5.323 is used to convert elemental Li to Li2CO3, or

Lithium Carbonate Equivalent (LCE).

Table 5 - Boardwalk Inferred Li—brine

resource estimation presented as a global (total) resource that is

contained within the Leduc Formation that encompasses the Sturgeon

Lake Reef Complex outside of the Sturgeon Lake South Oilfield (or

area of the Indicated mineral resource).

Note 1: Mineral resources are not mineral

reserves and do not have demonstrated economic viabilityNote 2: The

weights are reported in metric tonnes (1,000 kg or 2,204.6

lbs).Note 3: Tonnage numbers are rounded to the nearest 1,000 unit.

Note 4: In a ‘confined’ aquifer (as reported herein), porosity is a

proxy for specific yield.Note 5: The resource estimation was

completed and reported using a cutoff of 50 mg/L Li.Note 6: To

describe the resource in terms of industry standard, a conversion

factor of 5.323 is used to convert elemental Li to Li2CO3, or

Lithium Carbonate Equivalent (LCE).

Property Description

The Boardwalk Property is located in

west-central Alberta, Canada, directly south and west of the Town

of Valleyview, approximately 85 km east of the City of Grande

Prairie and 270 km northwest of the City of Edmonton (Figure 6).

The Boardwalk Project, within the Boardwalk property, and shown on

Figure 6 & 7 as the “Boardwalk Production Zone” encompasses

approximately 30,000 ha of the south and eastern portion of the

Sturgeon Lake Leduc reef.

Figure 6: Location map the Boardwalk

lithium brine project.

The Boardwalk Property consists of 30 Alberta

Metallic and Industrial Mineral Permits that collectively form a

contiguous 231,028 hectares land package that overlies the Sturgeon

Lake Reef Complex and Late Devonian Leduc Formation reservoir. The

permits were acquired directly from the Government of Alberta

through the Provinces on-line mineral tenure system. LithiumBank

has 100% ownership of the mineral rights at the Boardwalk

Property.

70 years of oil and gas activities from numerous

energy companies have developed a strong foundation of social and

physical infrastructure in the area. This history of hydrocarbon

extraction established a well-trained labour force, networks of

all-weather gravel roads, drill sites that can be easily accessed

from Provincial highways, and electrical transmission lines that

run through and adjacent to the project (see Figure 6 & 7).

Wells in the Sturgeon Lake South oilfield are currently inactive

and are not producing hydrocarbons. LithiumBank has shown that

these legacy wells can be re-entered to obtain Leduc Formation

brine thereby providing significant savings versus drilling new

wells.

Mining Methods

The lithium resource at Boardwalk is dissolved

in the brine water contained within the Leduc Formation. The

lithium will be produced by pumping the brine to the surface

through vertical or deviated wells and then by pipeline to the

Central Processing Facility (“CPF”). The project is targeting a

total lithium brine production rate of 250,000 m3/d over a period

of 20 years from 50 production wells (Figure 7).

After processing, the depleted lithium brine is

returned to the Leduc Formation through 50 injection wells. The

reinjection well network is designed to optimize reservoir pressure

and mitigate early breakthrough of depleted lithium brine. The well

network utilizes multi-well pads to minimize the surface footprint.

Up to 23 multi-well pads are planned for this project. The wells

are drilled from these pads, starting vertically at surface, and

deviating in the subsurface to achieve the desired bottomhole

target for each well. Completing all the required wells will take

approximately 2 years of drilling utilizing 3 rigs. The production

wells require artificial lift to produce the large brine volumes to

surface, which will be achieved with Electrical Submersible Pumps

(ESPs).

Figure 7: Production Zone Infrastructure

of the Boardwalk Lithium Brine Project.

Figure 8:

Conceptual Schematic of LithiumBank's Production

Process

Recovery Methods

LithiumBank commissioned a comprehensive testing

campaign to establish the selective lithium extraction performance

of Conductive Energy’s DLE technology. The test work also assessed

optimal process conditions that produce lithium concentrates that

can be upgraded to battery grade products (Figure 8). The first

stage of the work was completed at Conductive Energy’s lab

facility. It included the bench scale of tests of the thermodynamic

and kinetic properties of the DLE media during loading and elution.

The testing successfully demonstrated that the DLE media can

selectively extract lithium from LithiumBank’s feed brine and

produce a lithium concentrate suitable for downstream production of

lithium chemicals.

The lithium processing facility is designed to a

nameplate production capacity of approximately 31,800 metric tonnes

per annum of battery grade lithium hydroxide monohydrate (28,000

metric tonnes per annum LCE) at a feed brine throughput of 250,000

m3/d at an average concentration of 70.1 mg/L. This assumes a 90%

operating factor and a 91% overall lithium recovery. Once the

dissolved H2S, residual suspended solids and hydrocarbons are

removed from the brine, lithium is preferentially extracted through

the DLE ion exchange technology. Then the lithium concentrate is

polished for lithium chloride electrolysis to produce lithium

hydroxide. Battery grade lithium hydroxide monohydrates are

produced through two stages of crystallization, followed by drying

and packaging. The processing stages that follow the DLE extraction

are similar to what is used in the processing of other lithium-rich

bines around the world and are well understood and commonly

used.

Environmental and

Permitting

The Company considers the environmental and

social impacts of the Boardwalk project an integral part in the

development process. The Company has made efforts to reduce the

surface impact by utilizing multi-well pad designs. The entire

project lies within a brownfields area with existing surface

disturbance from either agriculture, utilities, and/or the oil and

gas industry. The Company has chosen to build a power facility

within the fence of the project which allows for power to be used

more efficiently by way of steam that is used in the lithium

processing and to co-generate additional electricity. The Company

has also taken steps toward carbon capture from the power facility.

Although not included in the PEA, LithiumBank and ZS2 Technologies

signed a memorandum of understanding where, using ZS2’s proprietary

technology, CO2 emissions can be captured directly from the power

facility and sequestered, using magnesium extracted from barren

brine, into a magnesium cement product (news release April 13,

2023).

Following closure operations at the Boardwalk

facility, monitoring and reclamation requirements will need to be

conducted, including decommissioning of onsite facilities

associated with the project, remediating environmental media

contaminated as a result of project operations and restoring land

that was utilized for project activities.

The Alberta Energy Regulator (AER) will be the

primary life cycle regulator of the project. To this end, the AER

will assess the project under their new directive, Directive 090 –

Brine Hosted Mineral Resource Development. In addition to Directive

090, there are several well-established supplementary directives

provided by the AER that would apply to the Boardwalk project.

Future advancement of the Boardwalk project is

recommended to include the ongoing development, refinement and

implementation of a community engagement plan.

The scientific and technical disclosure in this

news release has been reviewed and approved by Mr. Kevin Piepgrass

(Chief Operations Officer, LithiumBank Resources Corp.), who is a

Member of the Association of Professional Engineers and

Geoscientists of Alberta (APEGA) and the Association of

Professional Engineers and Geoscientists of the Province of British

Columbia (APEGBC) and is a Qualified Person (QP) for the purposes

of National Instrument 43-101. Mr. Piepgrass consents to the

inclusion of the data in the form and context in which it

appears.

Clarification of Compensation Paid to

Underwriters

As previously disclosed in the Company’s news

release dated May 15, 2023, LithiumBank closed a bought deal

private placement financing for gross proceeds of $6.9 million (the

“Financing”). As compensation pursuant to the

Financing, the Company paid to Echelon Capital Markets, Beacon

Securities Limited and Red Cloud Securities Inc. (the

“Underwriters”) a cash commission equal to 6.0% of

the gross proceeds raised under the Financing (subject to reduction

to 3.0% in respect of sales to certain president’s list purchasers)

and issued to the Underwriters an aggregate of 192,372

non-transferable compensation warrants. In addition, the Company

paid to the Underwriters a corporate finance fee in the amount of

$75,000. For additional details regarding the Financing, please

refer to the Company’s news release dated May 15, 2023.

Contact:

Rob ShewchukCEO &

Directorrob@lithiumbank.ca(778) 987-9767

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward

Looking Statements

This release includes certain statements and

information that may constitute forward-looking information within

the meaning of applicable Canadian securities laws. All statements

in this news release, other than statements of historical facts,

including statements regarding future estimates, plans, objectives,

timing, assumptions or expectations of future performance,

including without limitation, the initial results of the

Preliminary Economic Assessment, including the expected NPV of the

Boardwalk project; expectations that commercial production will be

achievable within 3 years under new permitting directives;

expectations that governmental regulators will be supportive of the

Boardwalk project; expectations that the carbon footprint of the

Boardwalk project will be reduced through DLE extraction technology

and through the use of high-efficiency gas turbines with steam

cogeneration; expectations that that the 30% Investment Tax Credit

(ITC) for Clean Technology Manufacturing will be passed by the

Government of Canada; expectations that significantly reduced

capital expenditures can be achieved on the Boardwalk projects;

expectations that the Boardwalk project will see reduced costs,

increased efficiency and reduced reagent consumption through the

use of new sorbent; expectations that the Company will pursue and

obtain a mineral resource estimate and/or Preliminary Economic

Analysis on the Park Place project on the timing anticipated or at

all; and expectations that the Company will complete drilling and

commence pilot plant studies on both the Board and Park Place

projects by the end of 2023 are forward-looking statements and

contain forward-looking information. Generally, forward-looking

statements and information can be identified by the use of

forward-looking terminology such as “intends” or “anticipates”, or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “should” or “would” or

occur.

Forward-looking statements are based on certain

material assumptions and analysis made by the Company and the

opinions and estimates of management as of the date of this press

release, including that the initial results of the Preliminary

Economic Assessment, including the expected NPV of the Boardwalk

project, will prove to be accurate; that commercial production will

be achievable within 3 years under new permitting directives; that

governmental regulators will be supportive of the Boardwalk

project; that the carbon footprint of the Boardwalk project can and

will be reduced through DLE extraction technology and through the

use of high-efficiency gas turbines with steam cogeneration; that

the 30% Investment Tax Credit (ITC) for Clean Technology

Manufacturing will be passed by the Government of Canada; that

significantly reduced capital expenditures can be achieved on the

Boardwalk projects through the use of smaller electrical

submersible pumps that could fit in reduced diameter well casing;

that the use of new sorbent will result in reduced costs, increased

efficiency and reduced reagent consumption; that the Company will

be able to obtain a mineral resource estimate and/or Preliminary

Economic Analysis on the Park Place project on the timing

anticipated or at all; and that the Company will be able to

complete drilling and commence pilot plant studies on both the

Boardwalk and Park Place projects by the end of 2023.

These forward-looking statements are subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward-looking statements or

forward-looking information. Important risks that may cause actual

results to vary, include, without limitation, the risks that

circumstances may arise which require that the Preliminary Economic

Assessment be revised; the risk that permitting directives will not

accommodate commercial production within 3 years; the risk that

governmental regulators will not be supportive of the Boardwalk

project; the risk that DLE extraction technology and the use of

high-efficiency gas turbines will not reduce the carbon footprint

of the Boardwalk project as anticipated; the risk that the 30%

Investment Tax Credit (ITC) for Clean Technology Manufacturing will

not be passed by the Government of Canada; the risk that smaller

electrical submersible pumps will not result in significantly

reduced capital expenditures on the Boardwalk project; the risk

that the use of new sorbent will not result in reduced costs,

increased efficiency and reduced reagent consumption; the risk that

the Company is not able to obtain a mineral resource estimate

and/or Preliminary Economic Analysis on the Park Place project on

the timing anticipated or at all; and the risk that the Company

will be unable to complete drilling and commence pilot plant

studies on both the Boardwalk and Park Place projects by the end of

2023 or at all.

Although management of the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements and forward-looking information. Readers are cautioned

that reliance on such information may not be appropriate for other

purposes. The Company does not undertake to update any

forward-looking statement, forward-looking information or financial

out-look that are incorporated by reference herein, except in

accordance with applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/178db869-dd89-47a8-820f-e93594bfa579

https://www.globenewswire.com/NewsRoom/AttachmentNg/92a3bc2a-f55d-4b71-b960-015afb184479

https://www.globenewswire.com/NewsRoom/AttachmentNg/8f0d480f-12cf-4dcd-a928-06463b1adf1a

https://www.globenewswire.com/NewsRoom/AttachmentNg/a99e928d-5cbd-4a0c-939d-52cb48e6fa31

https://www.globenewswire.com/NewsRoom/AttachmentNg/d080333e-2c0e-4429-b74a-f6ec4e1671c6

https://www.globenewswire.com/NewsRoom/AttachmentNg/a995636f-8e90-4a13-963d-3e6e31662994

https://www.globenewswire.com/NewsRoom/AttachmentNg/444b541c-4752-42c8-8e25-b162d3193468

https://www.globenewswire.com/NewsRoom/AttachmentNg/7c4fb55e-9db6-4a32-9820-cccfadd1e8bc

https://www.globenewswire.com/NewsRoom/AttachmentNg/11b0d851-f69a-44e3-ac26-70456d88f6b9

https://www.globenewswire.com/NewsRoom/AttachmentNg/65b47393-fa8c-49db-9dd0-26e6244d4840

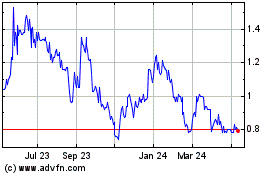

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

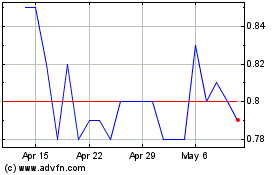

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Dec 2023 to Dec 2024