LithiumBank Resources Corp. (

TSX-V:

LBNK) (

OTCQX: LBNKF)

(“

LithiumBank” or the “

Company”)

is pleased to announce that the hydrogeological study and well

network design at the 100% owned Boardwalk Lithium Brine Project,

located in west-central Alberta, has been completed. “The

exceptional flow rates at Boardwalk as determined from this study

are one of the most critical factors that contribute to the

economics of the NI 43-101 Preliminary Economic Assessment that is

nearing completion” stated Rob Shewchuk, CEO.

Highlights:

- The proposed well network within

the “Production Zone” of the PEA is found within and adjacent to

the Sturgeon Lake South Oil Pool.

- The producing area of the PEA

represents only 25% of the Leduc reservoir at Boardwalk.

- The hydrogeological study utilizes

past production data which includes data from over 28 wells with

drill stem test and 65 wells with lithium brine assays.

- Of the 65 wells with assay data, 4

are wells that LithiumBank re-entered and sampled in 2021.

- Results show that the key hydraulic

parameters within the Leduc allow for consistent, high volume brine

production over the assessment period of 20 years.

- A multi-well pad production network

has been designed for improved economics and reduced surface

disturbance.

- Suitable formations have been

identified for re-injection of processed lithium barren brines to

eliminate the possibility of dilution into the Leduc.

LithiumBank engaged GLJ Ltd. and Fluid Domains

Inc. to conduct a hydrogeological study and well network design as

part of the Boardwalk Preliminary Economic Assessment (the

“PEA”). The study area for the PEA shown as the

“Production Zone” in Figure 1 is where the majority of past oil and

gas production occurred within the Leduc Formation since the

1960’s. This area was selected because of its past production

history providing down hole data from over 400 wells (of the over

550 in the Leduc) and lithium and multi-element assay analysis from

40 of the overall 65 wells within the Leduc Formation.

The hydraulic characteristics indicate that the

Leduc Formation at Boardwalk is favourable for high volume,

long-term production of the lithium-rich brine. The hydrogeology

and well network design to be used in the PEA considers a 20-year

period of production and is capable of a daily production rate of

250,000 cubic metres of brine. The production zone consists of

approximately 25% of LithiumBank’s Mineral Permits in the Leduc

Formation at the Boardwalk project where LithiumBank has 100% of

the mineral rights.

The well network is designed to have multiple

wells from each well pad. Multi-well pads will minimize surface

disturbance and reduce unnecessary infrastructure between wells and

the Direct Lithium Extraction (DLE) facility. This strategy

benefits the environment and reduces upfront capital

expenditures.

The proposed multi-well brine production pads

will also be utilized to reinject brine that has been processed

through the DLE facility (barren brine) into disposal wells.

Disposal of the barren brine will be reinjected into multiple

formations, other than the Leduc, that lay stratigraphically above

the Leduc as well as below the Leduc. Reinjecting barren brine into

formations other than the Leduc will eliminate any possibility of

diluting future lithium resources and mitigating capital

expenditures when considering moving lithium depleted brine over

any distance. Figure 2 illustrates a simplified x-section of the

lithium brine extraction and disposal.

The information reported by GLJ and Fluid

Domains will be incorporated into the PEA that is being led by

Hatch Ltd. LithiumBank engaged Hatch Ltd. (see news release dated

July 19, 2022,

https://www.lithiumbank.ca/news/2022/ithiumankngagesatchtoestoardwalkithiumrinei20220719050301)

to complete the PEA and is working closely with the leading

engineering firm to continue to advance the report forward as it

nears completion.

Rob Shewchuk, CEO states, “We are very pleased

to see such strong technical support for Boardwalk indicating the

necessary reservoir parameters required to sustain a sizable

lithium-brine project over a long period of time. A project of this

magnitude has the potential to be a meaningful contributor to the

global supply of lithium that continues to be challenged by a

supply side imbalance. Growth in demand for lithium is expected to

continue to be very strong through the coming decades in an era of

rapid electrification. The comparatively small footprint and ESG

friendly development of Boardwalk, when compared to traditional

hard rock and salar lithium mining projects, could provide an

opportunity to produce battery grade lithium at scale and in a

sustainable manner that we believe has excellent alignment with the

broader environmental and sustainability initiatives that are

currently being emphasized and supported across resource

development industries globally.”

Figure 1: Proposed “Production Zone” from

LithiumBank’s Boardwalk Lithium Brine Project

Figure 2. Simplified schematic of brine production and disposal

from the Boardwalk lithium brine project

The Boardwalk (formally Sturgeon Lake) Leduc

Formation Li-brine inferred resource, with an effective date of May

18th, 2021, is globally estimated at 1,122,000 tonnes of elemental

Li at an average lithium concentration of 67.1 mg/L Li in 16.7 km3

of formation brine volume (Table 2). The global (total) lithium

carbonate equivalent (LCE) for the inferred mineral resource is

5,973,000 tonnes LCE at an average grade of 67.1 mg/L Li (as

reported in LithiumBank’s news release dated May 31, 2022).

Mineral resources are not mineral reserves and

do not have demonstrated economic viability. There is no guarantee

that all or any part of the mineral resource will be converted into

a mineral reserve. While bench-scale, and demonstration pilot

plants operated by companies other than LithiumBank are reportedly

having success in the recovery of high purity battery-grade lithium

from subsurface confined aquifers, DLE technology is in the

development stage and has not yet been proven at commercial

scale.

Table 2. Boardwalk (formally Sturgeon Lake) Leduc Formation

Li-brine NI 43-101 inferred resource estimate presented as a global

(total) resource.

|

Reporting parameter |

Leduc Formation Reef Domain |

|

Aquifer volume |

321.99 (km3) |

|

Brine volume |

16.72 (km3) |

|

Average lithium concentration |

67.1 (mg/L) |

|

Average porosity |

5.3 (%) |

|

Average brine in pore space |

98.0 (%) |

|

Total elemental lithium resource |

1,122,000 (tonnes) |

|

Total lithium carbonate equivalent |

5,973,000 tonnes (LCE) |

Note 1: Mineral resources are not mineral

reserves and do not have demonstrated economic viability. There is

no guarantee that all or any part of the mineral resource will be

converted into a mineral reserve. The estimate of mineral resources

may be materially affected by geology, environment, permitting,

legal, title, taxation, socio-political, marketing, or other

relevant issues.Note 2: The weights are reported in metric tonnes

(1,000 kg or 2,204.6 lbs).Note 3: Tonnage numbers are rounded to

the nearest 1,000 unit.Note 4: In a ‘confined’ aquifer (as reported

herein), porosity is a proxy for specific yield.Note 5: The

resource estimation was completed and reported using a cut-off of

50 mg/L Li.Note 6: In order to describe the resource in terms of

industry standard, a conversion factor of 5.323 is used to convert

elemental Li to Li2CO3, or Lithium Carbonate Equivalent (LCE).

The scientific and technical disclosure in this

news release has been reviewed and approved by Mr. Kevin Piepgrass

(Chief Operations Officer, LithiumBank Resources Corp.), who is a

Member of the Association of Professional Engineers and

Geoscientists of the province of BC (APEGBC) and is a Qualified

Person (QP) for the purposes of National Instrument 43-101. Mr.

Piepgrass consents to the inclusion of the data in the form and

context in which it appears.

About LithiumBank Resources

Corp.

LithiumBank Resources Corp. is an exploration

and development company focused on lithium-enriched brine projects

in Western Canada where low-carbon-impact, rapid DLE technology can

be deployed. LithiumBank currently holds over 3.77 million acres of

mineral titles, 3.44M acres in Alberta and 326K acres in

Saskatchewan. LithiumBank’s mineral titles are strategically

positioned over known reservoirs that provide a unique combination

of scale, grade and exceptional flow rates that are necessary for a

large-scale direct brine lithium production. LithiumBank is

advancing and de-risking several projects in parallel of the

Boardwalk Lithium Brine Project.

Contact:

Rob ShewchukCEO &

Directorrob@lithiumbank.ca(778) 987-9767

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this

release.

Cautionary Statement Regarding Forward Looking

Statements

This release includes certain statements and

information that may constitute forward-looking information within

the meaning of applicable Canadian securities laws, including

statements regarding the expected continued growth in demand for

lithium, plans and expectations regarding the Boardwalk project,

and expectations regarding the completion and timing of the PEA.

All statements in this news release, other than statements of

historical facts, including statements regarding future estimates,

plans, objectives, timing, assumptions or expectations of future

performance. Generally, forward-looking statements and information

can be identified by the use of forward-looking terminology such as

“believes”, “intends” or “anticipates”, or variations of such words

and phrases or statements that certain actions, events or results

“may”, “could”, “should”, “would” or “occur”. Forward-looking

statements are based on certain material assumptions and analysis

made by the Company and the opinions and estimates of management as

of the date of this press release, including there will be

continued growth in demand for lithium, that the hydrogeological

study will support a PEA that shows an economically viable

multi-decade DLE project and that the project will be scalable,

that the PEA will be completed on the timetable anticipated. These

forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking statements or forward-looking information.

Important factors that may cause actual results to vary, include,

without limitation the risk that the demand for lithium will fall

or not grow as anticipated, the risk that the PEA will not be

completed on the timetable anticipated or at all, and the risk that

the PEA will not shows an economically viable multi-decade DLE

project or that the project will not be scalable. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements or forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements and forward-looking

information. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. The Company

does not undertake to update any forward-looking statement,

forward-looking information or financial out-look that are

incorporated by reference herein, except in accordance with

applicable securities laws.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0b83520f-eff9-456e-a099-8ebfb475e7f6

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb896fea-9640-4e10-ac4a-03d6f5f484ed

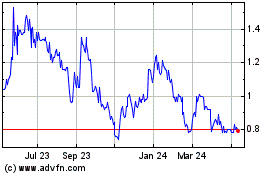

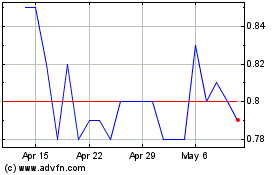

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Dec 2023 to Dec 2024