Jura Energy Corporation (TSXV: JEC) (“

Jura” or the

“

Company”) announced today that it has been

advised by its controlling shareholder, Phoenix Exploration

(“

Phoenix”), that Phoenix has completed the sale

of all of its common shares in the Company, representing

approximately 73.3% of the outstanding common shares of the Company

(“

Common Shares”), to IDL Investments Limited

(“

IDL”), a British Virgin Islands investment

company (the “

Transaction”).

In conjunction with the change of control, Mr.

Nadeem Farooq has stepped down as Chief Executive Officer (CEO) and

a director of Jura. Mr. Farooq shall however continue to serve as

an advisor to Jura’s board of directors, in particular in relation

to the ongoing legal proceedings involving Jura’s subsidiaries. Dr.

Grant Pogosyan has also resigned as a director of the Company.

Mr. Kashif Afzal, Director of IDL, has been

appointed as a director of the Company. Mr. Afzal is a British

businessman based in the United Arab Emirates. He is the founder of

Juniper Group, a private investment and advisory firm, and is an

investor in renewable energy, natural resources and carbon credits

projects. Mr. Afzal holds an MSc from Oxford University and has

completed the Mining Development professional program from the

Camborne School of Mines.

The board is now comprised of Mr. Afzal and

incumbent directors Stephen Smith and Mehran Inayat Mirza. Mr. Arif

Siddiq continues in his role as Chief Financial Officer. The

Company is currently in advanced discussions with a CEO candidate

and expects to announce the appointment of a replacement CEO

soon.

Early Warning Disclosures

IDL acquired 50,659,076 Common Shares (the

“Acquired Shares”) from Phoenix, representing

approximately 73.3% of the outstanding Common Shares of Jura, at a

price of C$0.025 per share for total consideration of

C$1,266,476.90. The Transaction was completed by a private

agreement between IDL and Phoenix and did not occur on any stock

exchange or other securities market. None of the parties to the

purchase agreement are, and none of the Acquired Shares were

acquired from or were offered to be acquired from, parties located

in any province or territory of Canada. The value of the

consideration paid for the Acquired Shares, including brokerage

fees or commissions, was not greater than 115% of the market price

of the Acquired Shares as determined in accordance with Section

1.11 of National Instrument 62-104 – Take-Over Bids and Issuer

Bids.

Immediately prior to the Transaction, IDL

indirectly beneficially owned 5,035,714 Common Shares representing

approximately 7.29% of the outstanding Common Shares. Upon

completion of the Transaction, IDL directly beneficially owns

55,694,790 common shares, representing approximately 80.62% of the

outstanding Common Shares of Jura on a non-diluted basis. IDL has

advised the Company that IDL has acquired the Acquired Shares for

investment purposes. IDL will evaluate its investment in Jura on an

ongoing basis and may increase or decrease its holdings in Jura,

subject to market conditions and other relevant factors. IDL was

formed under the laws of British Virgin Islands, its principal

business is to make investments and its head office is located at

Vistra Corporate Services Centre, Wickhams Cay Il, Road Town,

Tortola, VG1110, British Virgin Islands.

Immediately prior to the Transaction, Phoenix

directly beneficially owned 50,659,076 Common Shares, representing

approximately 73.3% of the outstanding common shares of Jura on a

non-diluted basis. Upon completion of the Transaction, Phoenix does

not beneficially own or exercise control over any shares of the

Company. Phoenix has advised the Company that it has disposed of

its Common Shares for investment purposes and it may acquire shares

of Jura in the future, subject to market conditions and other

relevant factors, although it has no present intention to do so.

The address of Phoenix is 33 Edith Cavell St., Port Louis,

Mauritius.

The early warning disclosures above are issued

pursuant to National Instrument 62-103 – The Early Warning Systems

and Related Take-Over Bids and Insider Reporting Issues, which also

requires a report to be filed with regulatory authorities in each

of the jurisdictions in which the Company is a reporting issuer

containing information with respect to the foregoing matters

("Early Warning Reports"). IDL and Phoenix have

confirmed that the Early Warning Reports containing additional

information with respect to the foregoing matters will be filed and

made available under the SEDAR+ profile of Jura at

www.sedarplus.ca.

The head office of the Company is Suite 2100,

144 – 4th Avenue SW, Calgary, Alberta T2P 3N4.

For additional information or, in the

case of IDL or Phoenix, to obtain a copy of their applicable Early

Warning Report, please contact:

|

Jura |

|

|

Stephen Smith, Chairman, Jura Energy Corporation |

|

|

T: +44 7834 834 976 |

|

|

E: info@juraenergy.com |

|

|

|

|

|

IDL |

Phoenix |

|

Kashif Afzal |

Muhammad Munzir Latif |

|

T: +971 55 257 7687 |

T: +971 55 691 0087 |

|

E: ka+jura@ekigai.com |

E: munzirlatif@yahoo.com |

|

|

|

About Jura Energy Corporation

Jura is an international energy company engaged

in the exploration, development and production of petroleum and

natural gas properties in Pakistan. Jura is based in Calgary,

Alberta, and listed on the TSX-V trading under the symbol JEC. Jura

conducts its business in Pakistan through its subsidiaries,

Frontier Holdings Limited and Spud Energy Pty Limited.

Forward Looking Advisory

This press release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of Canadian securities laws. Specific

forward-looking statements in this press release include

information regarding plans for the near-term appointment of a new

CEO. The forward-looking statements contained in this press release

are based on management's beliefs, estimates and opinions on the

date the statements are made in light of management's experience,

current conditions and expected future development in the areas in

which Jura is currently active and other factors management

believes are appropriate in the circumstances. Jura undertakes no

obligation to update publicly or revise any forward-looking

statement or information, whether as a result of new information,

future events or otherwise, unless required by applicable law.

Readers are cautioned not to place undue reliance on

forward-looking information. By their nature, forward-looking

statements are subject to numerous assumptions, risks and

uncertainties that contribute to the possibility that the predicted

outcome will not occur, including some of which are beyond Jura's

control. These assumptions and risks include, but are not limited

to: the availability of a suitable CEO candidate on acceptable

terms. There can be no assurance that forward-looking statements

will prove to be accurate as actual results and future events could

vary or differ materially from those anticipated in such

statements. See Jura's Management’s Discussion and Analysis for the

year ended December 31, 2023, available on SEDAR+ at

www.sedarplus.ca, for further description of the risks and

uncertainties associated with Jura's business.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

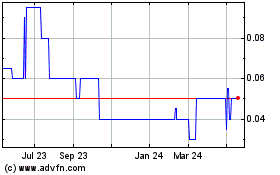

Jura Energy (TSXV:JEC)

Historical Stock Chart

From Feb 2025 to Mar 2025

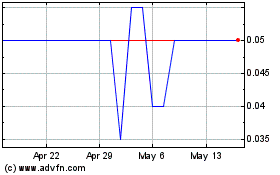

Jura Energy (TSXV:JEC)

Historical Stock Chart

From Mar 2024 to Mar 2025