TSX VENTURE COMPANIES:

ALASKA HYDRO CORPORATION ("AKH")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 10, 2010:

Convertible Debenture $90,000

Conversion Price: Convertible into 562,500 common shares for

a three year period.

Maturity date: three years from the date of issuance

Interest rate: 12% per annum

Number of Placees: three

Insider / Pro

Group Participation: n/a

Finder's Fee: $1,000 is payable to Haywood Securities

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

BANDERA GOLD LTD. ("BGL")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date

of the following warrants:

Private Placement:

# of Warrants: 2,750,000

Original Expiry Date

of Warrants: February 12, 2011

New Expiry Date

of Warrants: February 12, 2012

Exercise Price

of Warrants: 0.25

These warrants were issued pursuant to a private placement of 5,500,000

shares with 2,750,000 share purchase warrants attached, which was

accepted for filing by the Exchange effective February 24, 2010.

------------------------------------------------------------------------

BROWNSTONE ENERGY INC. ("BWN")

BULLETIN TYPE: Halt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 6:19 a.m. PST, February 15, 2011, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules. Members are prohibited from trading in the shares of

the Company during the period of the Halt.

------------------------------------------------------------------------

BROWNSTONE ENERGY INC. ("BWN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 8:00 a.m., PST, February 15, 2011, shares of the Company

resumed trading, an announcement having been made over Stockwatch.

------------------------------------------------------------------------

CASTILLIAN RESOURCES CORP. ("CT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 11, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 24, 2010:

Number of Shares: 29,825,000 flow through shares

31,131,823 non flow through shares

Purchase Price: $0.10 per flow through share

$0.075 per non flow through share

Warrants: 15,565,911 share purchase warrants to

purchase 15,565,911 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 60 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Stan Bharti Y 3,500,000

William Pearson Y 1,333,333

2051580 Ontario Inc.

(Stan Bharti) Y 8,999,999

Pearson Geoligical Ltd.

(William Pearson) Y 400,000

D & S Gower Holdings Ltd.

(David Gower) Y 333,333

David Argyle Y 333,333

M. Hoffman Consulting Ltd.

(Michael Hoffman) Y 200,000

Finder's Fee: an aggregate of $208,650, plus 2,343,000

finder's warrants (each exercisable into

one common share at a price of $0.10 for a

period of one year) payable to Sector

Holdings Inc.; Jones, Gable Mineral Funds;

Norstar Securities L.P.; GMP Securities

L.P.; Two Jat Holdings Inc. and Delano

Capital Corp.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). Note

that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

------------------------------------------------------------------------

DIANOR RESOURCES INC. ("DOR")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 876,851 shares at a deemed price of $0.075 per share to settle an

outstanding debt of $65,763.80.

Number of Creditors: 1 creditor

The Company issued a news release on July 30, 2009 in connection with

that Shares for Debt.

RESSOURCES DIANOR INC. ("DOR")

TYPE DE BULLETIN : Emission d'actions en reglement d'une dette

DATE DU BULLETIN : Le 15 fevrier 2011

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation de la

societe en vertu de l'emission proposee de 876 851 actions au prix

repute de 0,075 $ l'action en vertu du reglement d'une dette de 65

763,80 $.

Nombre de creanciers : 1 creancier

La societe a emis un communique de presse le 30 juillet 2009

relativement a ce reglement de dette.

------------------------------------------------------------------------

ECL ENVIROCLEAN VENTURES LTD. ("ECL")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 380,000 shares and 190,000 share purchase warrants to settle

outstanding debt for $19,000.

Number of Creditors: 6 Creditors

Warrants: 190,000 share purchase warrants to purchase

190,000 shares

Warrant Exercise Price: $0.10 for a two year period

The Company shall issue a news release when the shares are issued and

the debt extinguished.

------------------------------------------------------------------------

ENWAVE CORPORATION ("ENW")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced January 18, 2011:

Number of Shares: 6,706,000 shares

Purchase Price: $1.80 per share

Warrants: 3,353,000 share purchase warrants to

purchase 3,353,000 shares

Warrant Exercise Price: $2.25 for an eighteen month period

Number of Placees: 133 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Kim Gartland P 30,000

Agents' Fees: $631,769.80, 451,976 Agents' Warrants and

30,175 shares payable to Canaccord Genuity

Corp.

$159,437.00 and 163,968 Agents' Warrants

payable to Laurentian Bank Securities Inc.

$53,145.67 and 54,656 Agents' Warrants

payable to Clarus Securities Inc.

- Each Agent Warrant is exercisable into

one common share at $1.80 for an eighteen

month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

FINAVERA WIND ENERGY INC. ("FVR")

BULLETIN TYPE: Halt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 5:59 a.m. PST, February 15, 2011, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules. Members are prohibited from trading in the shares of

the Company during the period of the Halt.

------------------------------------------------------------------------

FINAVERA WIND ENERGY INC. ("FVR")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 10:45 a.m., PST, February 15, 2011, shares of the Company

resumed trading, an announcement having been made over Canada News Wire.

------------------------------------------------------------------------

GOGOLD RESOURCES INC. ("GGD")

BULLETIN TYPE: Halt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 6:12 a.m. PST, February 15, 2011, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules. Members are prohibited from trading in the shares of

the Company during the period of the Halt.

------------------------------------------------------------------------

GOGOLD RESOURCES INC. ("GGD")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated February 15, 2011,

effective at 11:22 a.m., PST, February 15, 2011, trading in the shares

of the Company will remain halted pending receipt and review of

acceptable documentation regarding the Qualifying Transaction pursuant

to Listings Policy 2.4. Members are prohibited from trading in the

shares of the Company during the period of the Halt.

------------------------------------------------------------------------

ILI TECHNOLOGIES (2002) CORP. ("ILI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 26, 2010:

Number of Shares: 6,200,000 shares

Purchase Price: $0.10 per share

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Universal Abundance Holdings

Ltd. ( Rene Spielmann) Y 2,599,640

Phil D'Angelo Y 1,400,360

Finder's Fee: Raymond James Ltd. - $8,400 cash and 84,000

broker warrants

Ardent Capital Leasing Inc. - $14,400 cash

AVW Contracting - $144,000 broker warrants

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

J5 ACQUISITION CORP. ("JV.P")

BULLETIN TYPE: Halt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 5:59 a.m. PST, February 15, 2011, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules. Members are prohibited from trading in the shares of

the Company during the period of the Halt.

------------------------------------------------------------------------

J5 ACQUISITION CORP. ("JV.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated February 15, 2011,

effective at 8:52 a.m., PST, February 15, 2011, trading in the shares of

the Company will remain halted receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

------------------------------------------------------------------------

KWG RESOURCES INC. ("KWG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced on November 15 and 19,

2010:

Number of Shares: 23,076,923 flow-through common shares

Purchase Price: $0.13 per flow-through common share

Insider / Pro Group Participation:

Insider = Y /

Name Pro Group = P Number of shares

Rene Galipeau Y 128,423

Thomas E. Masters Y 120,000

Finders' Fees: An amount of $51,659 cash has been paid to

Finders, which also received 480,480 common

shares.

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release dated February 1, 2011.

RESSOURCES KWG INC. ("KWG")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 15 fevrier 2011

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce les

15 et 19 novembre 2010 :

Nombre d'actions : 23 076 923 actions ordinaires accreditives

Prix : 0,13 $ par action ordinaire accreditive

Participation Initie / Groupe Pro :

Initie = Y /

Nom Groupe Pro = P / Nombre d'actions

Rene Galipeau Y 128 423

Thomas E. Masters Y 120 000

Honoraires d'intermediaire : Un montant de 51 659 $ en especes a ete

paye a des intermediaires qui ont egalement

recu 480 480 actions ordinaires

La societe a confirme la cloture du placement prive par voie de

communique de presse le 1er fevrier 2011.

------------------------------------------------------------------------

_

LATEEGRA GOLD CORP. ("LRG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option to purchase and

royalty agreement dated January 31, 2011 between Lateegra Gold Corp.

(the 'Company') and Janice Bonhomme, Jean Claude Bonhomme, Peter

Colbert, and Sea Green Capital Corp. ('Sea Green') (a TSX Venture listed

company), whereby the Company will acquire a 100% interest in 33 mineral

claims encompassing approximately 5.3 square kilometers and located in

the Beschefer Township, in northwestern Quebec.

Total consideration consists of $50,000 in cash payments and 6,000,000

shares of the Company as follows:

CASH SHARES

Upon Exchange approval $50,000 2,000,000

Within six months of Exchange approval $0 2,000,000

Within twelve months of Exchange approval $0 2,000,000

In addition, there are the following net smelter returns relating to the

acquisition:

- A 2% net smelter return relating to the acquisition in favour of Ms.

Bonhomme, Mr. Bonhomme, and Mr. Colbert. The Company may at any time

purchase 1% of the net smelter return for $1,000,000 in order to reduce

the total net smelter return to 1%.

- A 1% net smelter return relating to the acquisition in favour of Sea

Green. The Company may at any time purchase 0.75% of the net smelter

return for $500,000 in order to reduce the total net smelter return to

0.25%.

------------------------------------------------------------------------

MANITOK ENERGY INC. ("MEI")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced November 29, 2010 and December

16, 2010:

Number of Shares: 10,356,900 shares

6,728,689 flow-through

Purchase Price: $1.00 per share

$1.15 per flow-through

Number of Placees: 83 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

John Gibson P 65,000

30,434 FT

Trapeze Asset Management Y 7,972,500

Y 1,227,900 FT

Spoletini Holdings Y 75,400

Robert Dales Y 52,100 FT

Bruno Geremia Y 100,000 FT

Rob Dion Y 30,000 FT

Greg Peterson Y 17,400 FT

Tom Spoletini Y 65,000 FT

Wilfred Gobert Y 100,000 FT

Massimo Germia Y 22,000 FT

Agent's Fee: Integral Wealth Securities Limited -

$1,085,693.54 cash.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

METALEX VENTURES LTD. ("MTX")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposed

issuance of 12,097 shares at a deemed price of $0.62 per share, in

consideration of certain services provided to the Company for the

quarter ending January 31, 2011, pursuant to an Amended Deferred Share

Unit Plan for Deferred Share Unit Plan for Lorie Waisberg dated March

13, 2009 and effective May 1, 2004.

The Company shall issue a news release when the shares are issued.

------------------------------------------------------------------------

METALEX VENTURES LTD. ("MTX")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposed

issuance of 12,097 shares at a deemed price of $0.62 per share, in

consideration of certain services provided to the Company for the

quarter ending January 31, 2011, pursuant to an Amended Deferred Share

Unit Plan for Glenn Nolan dated March 13, 2009 and effective November

14, 2008.

The Company shall issue a news release when the shares are issued.

------------------------------------------------------------------------

MOSQUITO CONSOLIDATED GOLD ("MSQ")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Effective at 6:30 a.m., PST, February 15, 2011, shares of the Company

resumed trading, an announcement having been made over Stockwatch.

------------------------------------------------------------------------

NEW SHOSHONI VENTURES LTD. ("NSV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced January 26, 2011 and

February 9, 2011:

Number of Shares: 26,410,000 shares

Purchase Price: $0.05 per share

Warrants: 26,410,000 share purchase warrants to

purchase 26,410,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 75 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

David L. Hamilton-Smith P 150,000

Donald Wong P 100,000

Nancy Wong P 100,000

Kerry Chow P 400,000

Jacqueline Chow P 600,000

Roberto Chu P 300,000

Jones, Gable & Co. in

trust for John R. Griffith P 200,000

Finders' Fees $81,500 and 1,630,000 Finders' Warrants

payable to Canaccord Genuity Corp.

$27,000 and 540,000 Finders' Warrants

payable to Haywood Securities Inc.

$23,500 and 471,000 Finders' Warrants

payable to Jones, Gable & Company

- Each Finder Warrant is exercisable into

one common share at a price of $0.10 for a

one year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

NORDIC OIL AND GAS LTD. ("NOG")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 136,358 shares at a price of $0.17 per share to settle outstanding

debt for $23,180.86.

Number of Creditors: 4 Creditors

No Insider / Pro Group Participation

The Company shall issue a news release when the shares are issued and

the debt extinguished.

------------------------------------------------------------------------

NORTHERN RAND RESOURCE CORP. ("NRR")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated February 7, 2011,

effective at 9:15 a.m., PST, February 15, 2011, trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Change of Business and/or Reverse Takeover

pursuant to Listings Policy 5.2.

Members are prohibited from trading in the shares of the Company during

the period of the Halt.

------------------------------------------------------------------------

QUATERRA RESOURCES INC. ("QTA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced February 7, 2010:

Number of Shares: 3,293,407 shares

Purchase Price: $1.82 per share

Warrants: 1,646,703 share purchase warrants to

purchase 1,646,703 shares

Warrant Exercise Price: $2.27 for a two year period

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

REDWATER ENERGY CORP. ("RED")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to

an Asset Exchange and Conveyance Agreement (the "Agreement") between the

Company and Harvest Operations (the "Vendor"). As per the terms of the

Agreement the Company sold its Red Earth and Loon properties to the

Vendor. In consideration the Company will receive $2,100,000 cash and

once section of mineral rights.

------------------------------------------------------------------------

RESOURCE HUNTER CAPITAL CORP ("RHC")

BULLETIN TYPE: Private Placement-Non-Brokered, Remain Halted

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced January 27, 2011:

Number of Shares: 3,000,000 shares

Purchase Price: $0.10 per share

Warrants: 1,500,000 share purchase warrants to

purchase 1,500,000 shares

Warrant Exercise Price: $0.20 for a one year period

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Steve Isenburg P 100,000

Ron Kimel P 250,000

Finders' Fees: $8,000 cash payable to M Partners Inc

$9,600 cash payable to MC Promotion

Consulting Ltd (Matt Christopherson)

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

REVOLVER RESOURCES INC. ("RZ")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated December

17, 2010, has been filed with and accepted by TSX Venture Exchange, and

filed with and receipted by the B.C. Securities Commission on December

20, 2010, pursuant to the provisions of the B.C. Securities Act.

The prospectus was filed under Multilateral Instrument 11-102 Passport

System in Alberta. A receipt for the prospectus is deemed to be issued

by the regulator in this jurisdiction, if the conditions of the

Instrument have been satisfied.

The gross proceeds received by the Company for the Offering were

$675,000 (4,500,000 common shares at $0.15 per share). The Company is

classified as a 'Mineral Exploration' company.

Commence Date: At the opening February 16, 2011, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value

of which 8,850,000 common shares are issued

and outstanding

Escrowed Shares: 2,500,000 common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: RZ

CUSIP Number: 76155T 10 9

Agent: PI Financial Corp.

Agent's Warrants: 360,000 non-transferable share purchase

warrants. One warrant to purchase one share

at $0.20 per share up to February 14, 2013.

For further information, please refer to the Company's Prospectus dated

December 17, 2010.

Company Contact: Jerry A. Minni

Company Address: 200-551 Howe Street, Vancouver, B.C., V6C

2C2

Company Phone Number: 604-683-8610

Company Fax Number: 604-683-4499

Company Email Address: info@revolverresources.com

------------------------------------------------------------------------

SEAWAY ENERGY SERVICES INC. ("SEW")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: February 15, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated February

10, 2011, it may repurchase for cancellation, up to 3,098,847 shares in

its own capital stock. The purchases are to be made through the

facilities of TSX Venture Exchange during the period February 17, 2011

to February 17, 2012. Purchases pursuant to the bid will be made by

Canaccord Capital Corporation on behalf of the Company.

------------------------------------------------------------------------

SEDEX MINING CORP. ("SDN")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second tranche of a Brokered Private Placement announced October

27, 2010:

Number of Shares: 3,950,000 non-flow through shares

Purchase Price: $0.10 per share

Warrants: 1,975,000 share purchase warrants to

purchase 1,975,000 shares

Warrant Exercise Price: $0.15 for a three year period

Number of Placees: 19 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

David Hamilton-Smith P 100,000 NFT

Nancy Wong P 50,000 NFT

Li Zhu P 105,000 NFT

Dimitrious Nasirpour P 75,000 NFT

Agents' Fees: M Partners Inc. receives $20,850 and

208,500 compensation options exercisable at

$0.10 for a two year period into units

(each unit comprised of one share and one

half of one warrant, with each full warrant

exercisable at a price of $0.15 per share

for a two year period).

Union Securities Ltd. receives $3,000 and

30,000 compensation options (same terms as

above).

Redplug Capital (Otis Brandon Munday)

receives $1,200 and 12,000 compensation

options (same terms as above).

Canaccord Genuity Corp. receives $6,600 and

66,000 compensation options (same terms as

above).

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

------------------------------------------------------------------------

STANDARD EXPLORATION LTD. ("SDE")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to

the Offer to Purchase (the "Agreement") between the Company and an arm's

length party (the "Vendor") whereby the Company will acquire a 25%

working interest in over 6 sections of land in the Crossfield area of

Alberta. In consideration, the Company will pay $100,000 cash and issue

726,392 shares at a price of $0.413 to the Vendor.

No Insider / Pro Group Participation.

For further details on this transaction please refer to the Company's

press release dated January 18, 2011

------------------------------------------------------------------------

TEMPLE REAL ESTATE TRUST UNIT ("TR.UN")

BULLETIN TYPE: Prospectus-Trust Unit Offering

BULLETIN DATE: February 15, 2011

TSX Venture Tier 1 Company

Effective February 4, 2011, the Company's Prospectus dated February 4,

2011 was filed with and accepted by TSX Venture Exchange, and filed with

and receipted by the Manitoba and Ontario Securities Commissions on

February 4, 2011. The prospectus has also been filed under Multilateral

Instrument 11-102 Passport System in the British Columbia, Alberta,

Saskatchewan, Nova Scotia, New Brunswick, Prince Edward Island,

Newfoundland and Labrador, Yukon, Nunavut and Northwest Territories

Securities Commissions. A receipt for the prospectus is deemed to be

issued by the regulator in each of those jurisdictions, if the

conditions of the Instrument have been satisfied.

TSX Venture Exchange has been advised that closing occurred on February

11, 2011, for gross proceeds of $20,000,000.

Agents: Wellington West Capital Inc.

HSBC Securities (Canada) Inc.

Macquarie Capital Markets Canada Ltd.

Raymond James Ltd.

Desjardins Securities Inc.

Mackie Research Capital Corporation

Stonecap Securities Inc.

Offering: 5,000,000 Trust Units

Trust Unit Price: $4.00 per Trust Unit

Agents' Commission: Cash commission equal to 5.5% of the gross

proceeds of the Offering to be paid to the

Agents

For further information, please refer to the Company's prospectus dated

February 4, 2011.

------------------------------------------------------------------------

WHITE TIGER MINING CORP. ("WTC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 1, 2010:

Number of Shares: 4,541,165 shares

Purchase Price: $0.30 per share

Warrants: 2,270,585 share purchase Series A warrants

to purchase 2,270,585 shares

2,270,585 share purchase Series B warrants

to purchase 2,270,585 shares

Warrant Exercise Price: $0.40 for a one year period

(Series A)

Warrant Exercise Price: $0.50 for a two year period

(Series B)

If the closing price of the Company's shares is $0.60 or greater for a

period of 20 consecutive trading days, the Company may give notice of an

earlier expiry of the Series A Warrants, in which case they would expire

30 calendar days from the giving of such notice. If the closing price of

the Company's shares is $0.75 or greater for a period of 20 consecutive

trading days, the Company may give notice of an earlier expiry of the

Series B Warrants, in which case they would expire 30 calendar days from

the giving of such notice.

Number of Placees: 66 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Bruce Morley Y 33,333

Hazmagic Holdings Inc.

(Sead Hamzagic) Y 75,000

Coombes & Sons

Administration Inc.

(Ronald Coombes) Y 165,000

Criterion Capital Corporation

(Douglas Mason) Y 250,000

Thomas Seltzer P 100,000

Bill Godson P 100,000

Thomas Sears P 50,000

Robert Rose Investments Ltd. P 333,333

Finders' Fees: $480 and 1,600 warrants payable to NBCN

Inc.

$18,600 and 62,000 warrants payable to

Union Securities Ltd.

$3,120 and 10,400 warrants payable to

Haywood Securities Inc.

$31,348 and 104,493 warrants payable to

Loeb Aron & Company Ltd.

$9,600 and 32,000 warrants payable to

Raymond James Ltd.

$9,200 and 30,666 warrants payable to D & D

Securities Inc.

800 warrants payable to Terry Trip

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

NEX COMPANIES:

AXEA CAPITAL CORP. ("XEA.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: February 15, 2011

NEX Company

Further to TSX Venture Exchange Bulletin dated February 11, 2011,

effective at 8:51 a.m., PST, February 15, 2011, trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4. Members are prohibited from trading in the shares of the

Company during the period of the Halt.

------------------------------------------------------------------------

CHELSEA MINERALS CORP. ("CCC.H")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: February 15, 2011

NEX Company

TSX Venture Exchange has accepted for filing, a Property Option

Agreement dated January 28, 2011 between the Company and North Arrow

Minerals Inc. ("North Arrow") providing for the right of the Company to

acquire a 60% interest in North Arrow's Hope Bay Oro Project located at

Hope Bay on the Arctic coast in Western Nunavut. In order to earn the

60% interest, the Company is to pay North Arrow $50,000 cash at closing

and to occur $5,000,000 of expenditures on the property over 5 years

with a minimum of $500,000 in Year 1, $750,000 in Year 2, $1,000,000 in

Year 3, $1,250,000 in Year 4, and $1,500,000 in Year 5.

Insider / Pro Group Participation: N/A

------------------------------------------------------------------------

MANOR GLOBAL INC. ("GGV.H")

BULLETIN TYPE: Halt

BULLETIN DATE: February 15, 2011

NEX Company

Effective at 7:13 a.m. PST, February 15, 2011, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules. Members are prohibited from trading in the shares of

the Company during the period of the Halt.

------------------------------------------------------------------------

MANOR GLOBAL INC. ("GGV.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: February 15, 2011

NEX Company

Further to TSX Venture Exchange Bulletin dated February 15, 2011,

effective at 10:47 a.m., PST, February 15, 2011, trading in the shares

of the Company will remain halted pending receipt and review of

acceptable documentation regarding the Qualifying Transaction pursuant

to Listings Policy 2.4. Members are prohibited from trading in the

shares of the Company during the period of the Halt.

------------------------------------------------------------------------

ROYCE RESOURCES CORP. (ROY.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: February 15, 2011

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced on January 26, 2011:

Number of Shares: 7,350,000 shares

Purchase Price: $0.075 per share

Warrants: 7,350,000 share purchase warrants to

purchase 7,350,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 4 placees

Insider / Pro Group Participation: N/A

Finder's Fee: 500,000 shares at a deemed price of $0.10

per share payable to Endeavour Financial

Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s).

------------------------------------------------------------------------

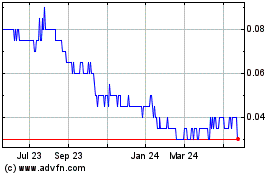

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Nov 2024 to Dec 2024

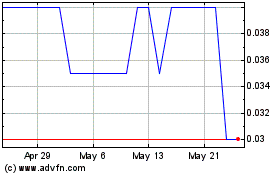

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Dec 2023 to Dec 2024