Gowest Acquires White Star Leases to Support Bradshaw Mining Infrastructure

March 03 2014 - 6:00AM

Marketwired Canada

Gowest Gold Ltd. ("Gowest" or the "Company") (TSX VENTURE:GWA)(OTCBB:GWSAF) is

pleased to report that it has finalized an agreement to acquire two mining

leases (12 claim units) covering 193 hectares (1.93 sq km) adjacent to the

eastern portion of the Company's wholly-owned Bradshaw Gold Deposit (Bradshaw)

on the Frankfield Property, part of the Company's North Timmins Gold Project

(NTGP). Formerly known as the White Star property, the surface rights (81

hectares) accompanying these newly acquired leases provide additional land

needed for the infrastructure to be built around Gowest's planned mine at

Bradshaw, including room for the planned waste rock dump and settling ponds.

Importantly, Gowest also believes that this new property has strong geological

potential and could enable the Company to extend Bradshaw's current 1.3

kilometre gold mineralization strike length still further to the east. White

Star contains a 1.2-km strike length of the same volcanic stratigraphy that

hosts this mineralization. Gowest's easternmost drill intersection on Bradshaw

returned of 2.98 grams per tonne (g/t) gold over 0.8 metres just 75 m west of

the White Star boundary.

In 2006, Gowest conducted shallow diamond drilling (three holes totaling 1,180

m) on the White Star leases under a previous option and prior to the current

resource expansion of the Bradshaw deposit to NI 43-101 standards. Gowest has

since developed a clearer understanding of the gold mineralization at Bradshaw,

which will better allow the Company to focus on the recognized potential to

extend eastward across the White Star leases.

The leases are to be acquired pursuant to the terms and conditions of a purchase

agreement entered into between J. Patrick Sheridan (the "Vendor"), New Texmont

Explorations Ltd. ("New Texmont") and the Company. The purchase price payable by

the Company for the leases will be the grant to the Vendor of a sliding scale

net smelter return royalty in respect of gold production from the relevant

properties equal to 1.0% at gold prices less than US$950 per ounce and 1.5% at

gold prices equal to or greater than US$950 per ounce (the "NSRR"). Pursuant to

the purchase agreement, the Vendor will immediately following closing assign and

transfer all of his right, title and interest in and to the NSRR to New Texmont.

The NSRR will be subject to the same terms and conditions (and form part of the

same royalty interest) as previously granted by the Company to New Texmont as

set out in an Acquisition Agreement dated December 19, 2008 between the

Purchaser and New Texmont.

The Company also announces that a total of 3,275,000 options to purchase common

shares of the Company were granted on February 28, 2014 to directors, officers

and consultants at an exercise price of $0.08 per share, expiring on February

28, 2019. The grant is subject is subject to regulatory approval.

The Company also announces that it intends to issue, subject to TSX Venture

Exchange approval, an aggregate of 250,000 common shares to non-management

directors of the Corporation (50,000 common shares per director), as partial

payment of fees owed to such directors in respect of the quarter ended October

31, 2013. The aggregate deemed value of the common shares to be issued is

$12,500.00. The shares are being issued in lieu of cash in order to conserve the

cash resources of the Corporation.

Qualified Person: This press release has been reviewed by Mr. Kevin Montgomery,

P.Geo., Gowest's Manager of Exploration and a Qualified Person under National

Instrument 43-101.

About Gowest

Gowest is a Canadian gold exploration and development company focused on the

delineation and development of its 100% owned Bradshaw Gold Deposit (Bradshaw),

on the Frankfield Property, part of the Company's North Timmins Gold Project

(NTGP). Gowest is exploring additional gold targets on its 109-square-kilometre

NTGP land package and continues to evaluate the area, which is part of the

prolific Timmins, Ontario gold camp. The latest updated resource estimate for

Bradshaw included approximately 945,600 ounces of gold ("Au") in the Indicated

category (6.0 million tonnes at a grade of 4.9 grams per tonne ("g/t") Au) and

536,800 ounces of gold in the Inferred category (3.7 million tonnes at a grade

of 4.2 g/t Au). As was used in the Company's Preliminary Economic Assessment,

the current estimate is based on a 3.0 g/t Au cut-off and a conservative gold

price of US$1,200/oz. This resource estimate has been completed by Neil N. Gow,

P. Geo., an independent Qualified Person, and reported in accordance with

Canadian Securities Administration National Instrument 43-101 ("NI 43-101")

requirements and CIM Standards on Mineral Resources and Reserves.

Forward-looking statements

This news release contains certain "forward looking statements". Such

forward-looking statements involve risks and uncertainties. The results or

events depicted in these forward-looking statements may differ materially from

actual results or events. Any forward-looking statement speaks only as of the

date of this news release and, except as may be required by applicable

securities laws, the Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information, future events

or results or otherwise.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS

DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OF THIS RELEASE.

FOR FURTHER INFORMATION PLEASE CONTACT:

Greg Romain

President & CEO

(416) 363-1210

info@gowestgold.com

Greg Taylor

Investor Relations

905 337-7673 / Mob: 416 605-5120

gregt@gowestgold.com

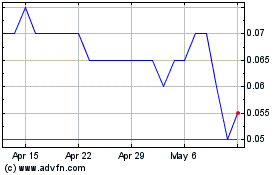

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From May 2024 to Jun 2024

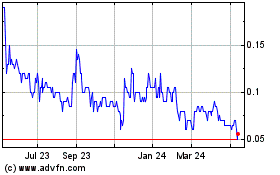

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Jun 2023 to Jun 2024