Copper Fox Metals Inc.

(“Copper Fox” or the “Company”)

(TSX-V: CUU – OTC-Pink: CPFXF) is pleased to announce that

its unaudited interim consolidated July 31, 2018 financial

statements have been filed on SEDAR.

All of the Company’s material subsidiaries are

wholly owned, except for District Copper Corp. (formerly named

Carmax Mining Corp.) (“District”) (TSX-V:

DCOP), of which the Company owns 39.51% of the outstanding

common shares. These unaudited interim consolidated financial

statements include 100% of the assets and liabilities related to

District and include a non-controlling interest portion,

representing 60.49% of District’s assets and liabilities that are

not owned by the Company.

For the nine months ended July 31, 2018, Copper

Fox had a net loss of $1,320,825 (July 31, 2017 – $1,041,591) which

equated to $0.00 loss per share (July 31, 2017 - $0.00 loss per

share).

During the nine months ended July 31, 2018, the

Company incurred $162,831 in expenditures toward furthering the

development of its Schaft Creek, Van Dyke, Sombrero Butte and

Mineral Mountain copper projects. Copies of the financial

statements, notes, and related management discussion and analysis

may be obtained on SEDAR at www.sedar.com, the Company’s web site

at www.copperfoxmetals.com or by contacting the Company

directly. All references to planned activities and technical

information contained in this news release have been previously

announced by way of news releases. All amounts are expressed

in Canadian dollars unless otherwise stated.

Elmer B. Stewart, President and CEO of Copper

Fox, stated, “Copper Fox is pleased with the progress on the Schaft

Creek project. The multi-disciplinary approach adopted in

2018 is being used to enhance the value of the project by

investigating various sizing and investment scenarios (milling and

open pit) targeting potential cost reductions, a higher-grade

initial starter pit and other opportunities to improve project

economics. The expanded porphyry “footprint” at Mineral

Mountain is encouraging and warrants additional exploration to

advance the project to the drilling stage by better delineating the

structural controls and extent of the porphyry copper

mineralization/alteration.”

2018 Q3 Highlights:

a) At Schaft Creek, the desktop studies are progressing,

focusing in part on describing a phased development approach that

targets potential capital, operating and sustaining cost

reductions, a higher-grade initial starter pit and identifying

other opportunities to improve project economics;

b) The Multi-Year Area Based Permit (“MYAB”) for the Schaft

Creek project has been received from the Ministry of Mines for

British Columbia. The main activities covered pursuant to the

MYAB include approval for up to 50 diamond drill holes, 5 kms of

new drill road, and 20 kms of line cutting; none of which are

planned at this stage;

c) At Mineral Mountain a sampling program on Target #2 and an

airborne (magnetic and radiometric) geophysical survey are planned;

and

d) District has completed a program on their Eaglehead porphyry

copper project consisting primarily of re-logging and where

necessary, sampling or re-sampling historical drill core.

Analytical results from the program will be released once

received from District.

Elmer B. Stewart, MSc. P. Geol., President of

Copper Fox, is the Company’s non-independent, nominated Qualified

Person pursuant to National Instrument 43-101, Standards for

Disclosure for Mineral Projects, and has reviewed and approves the

scientific and technical information disclosed in this news

release.

Selected Financial Results

|

|

July 31, 2018 |

April 30, 2018 |

January 31, 2018 |

October 31, 2017 |

|

|

|

3 months ended |

3 months ended |

3 months ended |

3 months ended |

|

| Loss before taxes |

$ |

620,441 |

$ |

541,914 |

|

$ |

213,774 |

$ |

400,188 |

|

|

| Net loss |

|

620,441 |

|

541,914 |

|

|

213,774 |

|

144,910 |

|

|

| Comprehensive

loss/(gain) |

|

456,739 |

|

(47,768 |

) |

|

787,900 |

|

(322,819 |

) |

|

| Comprehensive

loss/(gain) per share, basic and diluted |

|

0.00 |

|

(0.00 |

) |

|

0.00 |

|

(0.00 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

July 31, 2017 |

April 30, 2017 |

January 31, 2017 |

October 31, 2016 |

|

|

|

3 months ended |

3 months ended |

3 months ended |

3 months ended |

|

| Loss before

non-operating items and taxes |

$ |

395,888 |

$ |

453,045 |

|

$ |

207,014 |

$ |

633,383 |

|

|

| Net loss |

|

395,888 |

|

453,045 |

|

|

207,014 |

|

37,171 |

|

|

| Comprehensive

loss/(gain) |

|

1,637,337 |

|

(220,645 |

) |

|

549,757 |

|

(724,814 |

) |

|

|

Comprehensive loss/(gain) per share, basic and diluted |

|

0.00 |

|

(0.00 |

) |

|

0.00 |

|

(0.00 |

) |

|

Liquidity

As at July 31, 2018, the Company had $1,714,530

in cash (October 31, 2017 - $286,195).

About Copper Fox

Copper Fox is a Tier 1 Canadian resource company

listed on the TSX Venture Exchange (TSX-V: CUU) focused on copper

exploration and development in Canada and the United States.

The principal assets of Copper Fox and its wholly owned

Canadian and United States subsidiaries, being Northern Fox Copper

Inc. and Desert Fox Copper Inc., are the 25% interest in the Schaft

Creek Joint Venture with Teck Resources Limited on the Schaft Creek

copper-gold-molybdenum-silver project located in northwestern

British Columbia and a 100% ownership of the Van Dyke oxide copper

project located in Miami, Arizona. For more information on

Copper Fox’s other mineral properties and investments visit the

Company’s website at http://www.copperfoxmetals.com.

On behalf of the Board of Directors,

Elmer B. StewartPresident and Chief Executive

Officer

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

| For

additional information contact: |

|

|

|

|

Copper Fox Metals Inc. |

|

|

Renmark Financial Communications Inc. |

| Lynn Ball:

investor@copperfoxmetals.com |

|

|

Robert Thaemlitz:

rthaemlitz@renmarkfinancial.com |

| (844)

484-2820 or (403) 264-2820 |

|

|

Tel:

(416) 644-2020 or (514) 939-3989 |

|

www.copperfoxmetals.com |

|

|

www.renmarkfinancial.com |

Cautionary Note Regarding

Forward-Looking Information

This news release contains forward-looking

statements within the meaning of the Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

and forward-looking information within the meaning of the Canadian

securities laws (collectively, “forward-looking information”).

Forward-looking information in this news release include

statements regarding: enhancing the value of the Schaft Creek

project by investigating various sizing and investment scenarios

(milling and open pit) targeting potential cost reductions, a

higher-grade initial starter pit and other opportunities to improve

project economics; additional exploration of the expanded porphyry

“footprint” at Mineral Mountain, and the potential value thereof; a

potential sampling program and an airborne survey at Mineral

Mountain; and releasing results from District’s Eaglehead

project.

In connection with the forward-looking

information contained in this news release, Copper Fox and its

subsidiaries have made numerous assumptions regarding, among other

things: the geological, financial and economic advice that Copper

Fox has received is reliable and is based upon practices and

methodologies which are consistent with industry standards; the

reliability of historical reports; and the stability of economic

and market conditions. While Copper Fox considers these assumptions

to be reasonable, these assumptions are inherently subject to

significant uncertainties and contingencies.

Additionally, there are known and unknown risk

factors which could cause Copper Fox’s actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. Known risk factors

include, among others: the Company may decide to change its

strategic focus; the Company may not be able to enhance the value

of the Schaft Creek project to the extent expected, if at all; the

Mineral Mountain project may not warrant additional exploration;

the sampling program and airborne survey at Mineral Mountain may

not be completed; the overall economy may deteriorate; uncertainty

as to the availability and terms of future financing; copper prices

and demand may fluctuate; currency exchange rates may fluctuate;

conditions in the financial markets may deteriorate; and

uncertainty as to timely availability of permits and other

governmental approvals.

A more complete discussion of the risks and

uncertainties facing Copper Fox is disclosed in Copper Fox's

continuous disclosure filings with Canadian securities regulatory

authorities at www.sedar.com. All forward-looking information

herein is qualified in its entirety by this cautionary statement,

and Copper Fox disclaims any obligation to revise or update any

such forward-looking information or to publicly announce the result

of any revisions to any of the forward-looking information

contained herein to reflect future results, events or developments,

except as required by law.

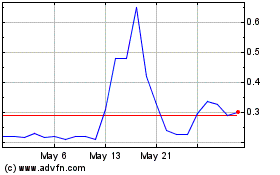

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Nov 2024 to Dec 2024

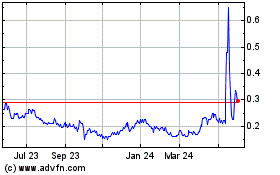

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Dec 2023 to Dec 2024