Osisko Mining Inc. (TSX:OSK) ("

Osisko") is pleased

to announce that it has entered into a binding letter agreement

with Bonterra Resources Inc. (TSXV:BTR)

("

Bonterra") for a 70% exploration earn-in and

joint venture on all of the Urban-Barry properties held by Bonterra

(hosting the Gladiator and Barry deposits), in addition to the

adjoining Duke and Lac Barry properties (collectively, the

"

Properties"), all located in Quebec's Eeyou

Istchee James Bay region. The Duke property is currently 70% owned

by Bonterra and 30% owned by Osisko, and the Lac Barry property is

currently 85% owned by Bonterra and 15% owned by Gold Royalties

Corp. The Properties total 496 claims over 22,508 hectares.

Under the binding letter agreement, Osisko has

agreed to pay Bonterra an initial upfront payment of $1 million in

cash (payable within one business day of the signing of the binding

letter agreement) and an additional $4 million in cash upon the

parties entering into the definitive agreement. Under the

Exploration Earn-In, Osisko has agreed to fund $30 million in work

expenditures over a three-year period to earn a 70% undivided

interest in the Properties, in accordance with annual work

expenditures $10 million in each year (which can be pre-paid at

Osisko's option).

After completion of the Exploration Earn-In,

Osisko and Bonterra have agreed to form a joint venture entity or

contractual joint venture in such form as the parties may agree,

each acting reasonably, taking into consideration any tax and other

factors relevant to the parties.

During the Exploration Earn-In and upon and

following the formation of the joint venture, Osisko will be the

operator of the Properties. Upon completion of the Exploration

Earn-In and the formation of the joint venture, Osisko and Bonterra

will form a management committee to provide direction to the

operator on exploration programs for the Urban-Barry

Properties.

Osisko and Bonterra have agreed to negotiate in

good faith, settle, and enter into definitive documentation

providing for the Exploration Earn-In as soon as practicable

following the date hereof, subject to the satisfaction of certain

customary conditions precedent.

Osisko may withdraw from the Exploration Earn-In

at any time upon written notice to Bonterra. In the event of an

election to withdraw from the Exploration Earn-In, Osisko will

forfeit all rights and interests in the Properties with no further

liability, and the definitive documentation shall be immediately

terminated upon such election.

About the Urban-Barry

Properties

Barry Deposit

The Barry deposit is a

shear-hosted gold deposit with multiple parallel, sub-vertical,

shear zones and a second set of veins dipping 25 to 60 degrees to

the southeast. The gold mineralization consists of disseminated

sulfides within the shear zones and the veins with local visible

gold. The Barry deposit has been delineated over 1.4 kilometres

along strike and 700 metres vertical and the deposit remains open

for expansion.

SLR Consulting (Canada) completed a mineral

resource estimate for Bonterra on the Barry deposit for both open

pit and underground scenarios. The combined open pit and

underground mineral resource estimate for the Barry deposit are (i)

measured mineral resources of 2,076,000 tons at 3.04 g/t Au for

203,000 oz Au, (ii) indicated mineral resources of 3,023,000 tons

at 5.01 g/t Au for 487,000 oz Au, and (iii) inferred mineral

resources of 4,379,000 tons at 4.89 g/t Au for 689,000 oz Au. The

Barry mineral resource estimate is supported by the Technical

Report (as defined herein).

Gladiator Deposit

Gold mineralization at the Gladiator

deposit is hosted within sheared veins of quartz-carbonate

composition, with sericite, chlorite, tourmaline with pyrite,

chalcopyrite, sphalerite, galena and visible gold. The veins are

divided into four groupings. The Gladiator deposit has been

outlined by diamond drilling to a strike length of 1,600 metres and

depth of 1,100 metres.

SLR Consulting (Canada) completed a mineral

resource estimate for Bonterra on the Gladiator deposit. The

mineral resource estimate for the Gladiator deposit are (i)

indicated mineral resources of 1,413,000 t at 8.61 g/t Au for

391,000 oz Au, and (ii) inferred mineral resources of 4,174,000 t

at 7.37 g/t Au for 989,000 oz Au. The Gladiator mineral resource

estimate is supported by the Technical Report.

Duke Property

The Duke property consists of

81 strategic mineral claims totaling 3,590 hectares adjacent to the

Gladiator Deposit. The Duke property mineralization is associated

with multiple sub-parallel, moderately dipping to subvertical,

shear hosted quartz-carbonate-chlorite veins and stockworks with

minor pyrite and gold trending northeast to east west hosted within

intermediate to mafic volcanics and tuffs with local felsic

intrusions. Bonterra and Osisko have a 70% and 30% interest,

respectively, in the Duke property.

Technical Report

The mineral resource estimates for the Barry and

Gladiator deposits are supported by the technical report (the

"Technical Report") entitled "Technical Report on

the Gladiator and Moroy Deposits and the Bachelor Mine and

Preliminary Economic Assessment on the Barry Deposit, Northwestern

Québec, Canada, Report for NI 43-101" dated July 25, 2022 (with an

effective date of June 1, 2022) prepared for Bonterra by SLR

Consulting (Canada). Reference should be made to the full text of

the Technical Report for the assumptions, qualifications and

limitations set forth therein, a copy of which is available on

SEDAR+ (www.sedarplus.com) under Bonterra's issuer profile.

Qualified Person

The scientific and technical content in this

news release has been reviewed and approved by Mr. Mathieu Savard,

P.Geo. (OGQ #510), President of Osisko, who is a "Qualified Person"

as defined by National Instrument 43-101 – Standards of Disclosure

for Mineral Projects.

About Osisko Mining Inc.

Osisko is a mineral exploration company focused

on the acquisition, exploration, and development of precious metal

resource properties in Canada. Osisko holds a 50% interest in the

high-grade Windfall gold deposit located between Val-d'Or and

Chibougamau in Québec and holds a 50% interest in a large area of

claims in the surrounding Urban Barry area and nearby Quévillon

area (over 2,300 square kilometers).

Cautionary Note Regarding

Forward-Looking Information

This news release contains "forward-looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

assumptions and projections as at the date of this news release.

The information in this news release about the timing and ability

of Osisko and Bonterra to complete the definitive documentation in

respect of the Exploration Earn-In and satisfy the conditions

precedent to executing the definitive documentation, if at all; the

work expenditures expected to be incurred by Osisko over a

three-year period, if at all; the formation of a joint venture on

the Urban-Barry Properties following the completion of the

Exploration Earn-In, if at all; the respective ownership interests

of Osisko and Bonterra in the joint venture entity; and any other

information herein that is not a historical fact may be "forward

looking information". Any statement that involves discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as "expects", or "does not expect",

"is expected", "anticipates" or "does not anticipate", "plans",

"budget", "scheduled", "forecasts", "estimates", "believes" or

"intends" or variations of such words and phrases or stating that

certain actions, events or results "may" or "could", "would",

"might" or "will" be taken to occur or be achieved) are not

statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

reasonable assumptions and estimates of management of Osisko, at

the time it was made, involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Osisko to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking information. Such factors include,

among others, risks relating to the timing and ability of Osisko

and Bonterra to complete the definitive documentation relating to

the Exploration Earn-In, satisfy the conditions precedent to

executing the definitive documentation, if at all, and close the

Exploration Earn-In, if at all; risks relating to changes in tax

laws; risks relating to property interests; the global economic

climate; metal prices; dilution; ability of Osisko to complete

further acquisitions; environmental risks; and community and

non-governmental actions. Although the forward-looking information

contained in this news release is based upon what management

believes, or believed at the time, to be reasonable assumptions,

Osisko cannot assure shareholders and prospective purchasers that

actual results will be consistent with such forward-looking

information, as there may be other factors that cause results not

to be as anticipated, estimated or intended, and neither Osisko nor

any other person assumes responsibility for the accuracy and

completeness of any such forward-looking information. Osisko does

not undertake, and assumes no obligation, to update or revise any

such forward-looking statements or forward-looking information

contained herein to reflect new events or circumstances, except as

may be required by law.

For further information, please contact:

John BurzynskiChief Executive OfficerTelephone:

(416) 363-8653

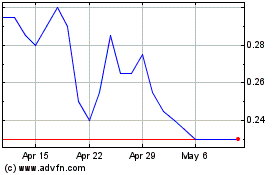

BonTerra Resources (TSXV:BTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

BonTerra Resources (TSXV:BTR)

Historical Stock Chart

From Dec 2023 to Dec 2024