Bullion Gold Resources Corp. (TSX-V: BGD)

(“

Bullion Gold” or the

“

Corporation”) announces the start of a drilling

campaign of at least 1,000 meters on the Bousquet project. The

drilling program will focus on the Paquin East showing. The targets

determined using 3D modeling and geophysical inversion performed by

GoldSpot Discoveries will aim to test the potential lateral and

depth extensions of the Paquin East zone.

“We are very happy to relaunch drilling on

Bousquet. The project is located in the heart of one of the best

mining camps in the world and could reveal interesting potential

given the first results published at the beginning of the year

(16.96 g/t Au over 9 meters - see press release of January 31,

2022). said Mr. Jonathan Hamel, President and Chief Executive

Officer of the Company.

Historical works

Five gold showings, Decoeur, Paquin Est and

Paquin Ouest, CB 1 and Joannes, were discovered during the first

exploration work (1932 to 1945) on the property. They are located

within a 2.5-kilometer hydrothermal gold system in a shear zone

parallel to the Cadillac-Larder Lake Fault approximately one km

south of it. These showings probably formed in the same episode of

mineralization within regional east-west trending faults.

On the Paquin showings, grades of 7.13 grams per

ton of gold over 12.10 meters, 4.51 g/t Au over 9.40 m and 2.44 g/t

Au over 13 m were intersected in the historic drillings (GM

07013-A). On the Decoeur showing, 1.26 g/t Au over 18.60 m and 1.16

g/t Au over 16.80 m were intersected in historical drilling (GM

07013-A). On the newly acquired west block, 26.46 g/t Au and 19.55

g/t Au over widths of 1.5 m were discovered on the Joannes gold

showing (GM 00735-B).

At the end of 2021, in the Paquin East zone,

drill hole BO-21-08 intersected a 9-meter gold section grading

16.96 g/t Au including a 4.5-meter zone grading 33.21 g/t Au also

including 1 meter at a grade of 129.25 g/t Au while BO-21-09

revealed a gold zone of 4.5 meters at a grade of 3.21 g/t Au

including 2 meters at a grade of 4.11 g/t Au. In the Decoeur zone,

holes BO-21-01 and BO-21-02 returned grades ranging from 1.03 g/t

Au over 9.3 meters and 1.09 g/t Au over 17.84 meters respectively.

meters while BO-21-03 revealed a grade of 2.02 g/t Au over 3 meters

in an anomalous zone of more than 12 meters along the hole.

Located in the Paquin East zone, hole BO-21-08

intersected a 9-meter gold section grading 16.96 g/t Au including a

4.5-meter zone grading 33.21 g/t Au also including 1 meter at a

grade of 129.25 g/t Au while BO-21-09 revealed a gold zone of 4.5

meters at a grade of 3.21 g/t Au including 2 meters at a grade of

4.11 g/t Au.

In the Decoeur zone, holes BO-21-01 and BO-21-02

returned grades ranging from 1.03 g/t Au over 9.3 meters and 1.09

g/t Au over 17.84 meters respectively while BO-21-03 revealed a

grade of 2.02 g/t Au over 3 meters in an anomalous zone of more

than 12 meters along the hole.

The deepest gold intersection on the property

was on the Paquin showing at a vertical depth of 325 m where 23.52

g/t Au over 1.2 m was intersected (GM 61411). High-grade gold

mineralization at depth is known from nearby mining operations. For

example, grades of 38.1 g/t Au over four m were found at a vertical

depth of 1,600 m at the Westwood mine (IAMGOLD), 14.8 g/t Au over

4.9 m at the 1,335 m level at the Lapa mine (Agnico Eagle). Recent

drilling at the former O'Brien mine by Radisson intersected 24.22

g/t Au over three meters at 900 meters depth. Longitudinal sections

of historical drilling show that all the showings of this powerful

gold system are open at depth and future drilling will verify their

continuity at depth.

Other drill targets will include anomalous

gold-bearing felsic intrusions in the Cadillac-Larder Lake Fault

which bear significant geological parameters with felsic intrusions

in the Malartic mining district. The CB 1 gold showing will also

verify the continuity at depth of a shallow intersection of 8.09

g/t Au over two meters.

Bousquet Project

Located 30 km east of Rouyn-Noranda, the

Bousquet project is composed of 97 cells for an area of

approximately 2,675 hectares. The property extends over nearly 7

km along the Cadillac Fault. An ENE gold corridor of more than 3.5

km long including the main gold showings confirmed by drilling is

located south of this fault. The world-renowned Cadillac-Larder

Lake fault is one of the most prolific gold-bearing faults in

Canada. More than 100M ounces of gold have been produced

historically in its immediate environment. Still today, several

gold deposits in production are associated with it such as Lapa,

Canadian Malartic, La Ronde, Goldex, Sigma and Lamaque.

The Bousquet property is underlain by

metasedimentary rocks of the Cadillac, Timiskaming and Pontiac

groups and volcanic and intrusive flows of the Piché group. The

Cadillac mining camp is mainly characterized by three types of

mineralization related to distinct auriferous geological contexts:

auriferous massive sulphide lenses (Bousquet 2 and La Ronde mines),

gold-rich polymetallic veins (Doyon and Mouska mines) and

auriferous veins associated with EW oriented regional faults (Lapa

deposit). The property is 100% owned by the Corporation.

This press release was read and approved by

Gilles Laverdière, P.Geo., director, and Qualified Person under

National Instrument 43-101.

About Bullion Gold Resources

Bullion Gold is involved in the identification, exploration, and

development of viable mineral properties in the Province Quebec and

British Columbia. For more information on the Corporation, visit

www.bulliongold.ca

For further information, please contact:

Jonathan HamelPresident and

CEOjhamel@bulliongold.ca 514-317-7956

Other Information

The TSX Venture Exchange and its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts no responsibility for the veracity or

accuracy of its content.

Forward-Looking

Statements: This press release contains

forward-looking statements. Forward-looking statements are

frequently characterized by words such as "plan", "expect",

"project", "intend", "believe", “anticipate", "estimate", "may",

"will", "would", "potential", "proposed" and other similar words,

or statements that certain events or conditions "may" or "will"

occur. The forward-looking statements are based on certain key

expectations and assumptions made by the Corporation. Although

Bullion Gold believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Bullion Gold can give no assurance that they

will prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. In addition to other risks that may affect the

forward-looking statements in this press release are those set out

in the Corporation’s management discussion and analysis of the

financial condition and results of operations for the year ended

December 31, 2019 and the third quarter ended September 30, 2020,

which are available on the Corporation’s profile

at www.sedar.com. The forward-looking statements contained in

this press release are made as of the date hereof and Warrior Gold

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

NOT FOR DISSEMINATION IN THE UNITED STATES OR

FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES AND DOES NOT CONSTITUTE

AN OFFER OF THE SECURITIES DESCRIBED HEREIN.

Two maps accompanying this announcement are available

at: https://www.globenewswire.com/NewsRoom/AttachmentNg/fb25efce-f839-4a08-bfdf-11ddc7c80ac3https://www.globenewswire.com/NewsRoom/AttachmentNg/7574734d-4bef-4315-9959-e302677f0f67

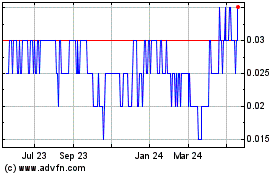

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Dec 2024 to Jan 2025

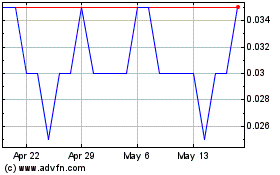

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Jan 2024 to Jan 2025