Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a

leading innovator of transformative technologies targeting the

decarbonization of industrial process heat, today announced its

financial and operating results for the six months ended June 30,

2024 (all figures are in Canadian dollars unless otherwise noted).

Acceleware’s results reflect contributions from the Company’s two

business units, radio frequency (“RF”) heating for industrial

applications using the Company’s proprietary Clean Tech Inverter

(“CTI”) including enhanced oil recovery (“RF XL”), and

high-performance computing ("HPC”) scientific software. This news

release should be read in conjunction with the Company’s unaudited

interim condensed financial statements and the accompanying notes

for the six months ended June 30, 2024 and management’s discussion

and analysis (“MDA”) thereto, together with the audited financial

statements for the year ended December 31, 2023, notes and MDA

thereto, all of which are available on Acceleware’s website at

www.acceleware.com or on www.sedarplus.ca.

HIGHLIGHTS

Financial highlights for the three and six

months ended June 30, 2024:

|

|

|

Three Months Ended |

Six Months Ended |

|

|

|

Jun 30, 2024 |

Jun 30, 2023 |

|

Jun 30, 2024 |

Jun 30, 2023 |

|

|

Revenue |

|

2,012,047 |

69,407 |

|

2,055,641 |

172,954 |

|

| Comprehensive income/

(loss) |

|

1,263,914 |

(1,135,498) |

|

293,943 |

(1,391,115) |

|

|

Gross R&D expenditures |

|

717,968 |

637,633 |

|

1,219,083 |

1,390,001 |

|

|

Government assistance |

|

577,763 |

- |

|

577,763 |

434,023 |

|

|

|

Based on positive results to date, Acceleware

remains confident that RF XL will become viable as a critical

technology in the effort to decarbonize heavy oil and oil sands

production. In the six months ended June 30, 2024, the Company

continued to work closely with industry partners to progress next

steps in the RF XL Pilot. An output of this work is the

determination that the most practical path forward involves a

redeployment of all subsurface components incorporating the

multiple improvements and upgrades that Acceleware has made to the

RF XL downhole system. Acceleware is actively sourcing an

additional $5 million of funding to complete the redeployment. The

Company has been successful in securing partial non-dilutive

funding for the redeployment, contingent on receiving the remainder

of the $5 million. The Company has identified several potential

industry and government funders and is in the process of contacting

and discussing the project with them. The primary outreach message

is that the redeployment is expected to enable higher power to be

distributed in the reservoir for a sustained period in a second

phase of heating. Please refer to the MDA for a complete RF XL

Pilot update.

In the three months ended June 30, 2024 (“Q2

2024”) the Company completed all milestones under a Project Funding

Agreement with one oil-sands producer and as such recognized

$1,950,000 revenue related to that performance obligation (three

months ended June 30, 2023 - $nil). Subsequent to June 30, 2024, a

Test Data Purchase Agreement with a second oil-sands producer was

terminated and as such the Company will recognize $950,000 revenue

in the third quarter of 2024. The remaining revenue of $1,950,000

from the third oil-sands producer will be recognized when all

milestones have been met (which is expected in the second half of

2024), or the contract is terminated, whichever is earlier.

On April 11, 2024, Acceleware announced that it

had been awarded Phase 2 of a potash ore drying project by the

International Minerals Innovation Institute (“IMII”). This Phase

was structured to advance Phase 1 work and further validate the use

of radio frequency energy from Acceleware's CTI for drying potash

ore and other minerals. By the end of Q2 2024, Phase 2 was

successfully completed, including the construction and testing of a

lab-scale prototype potash dryer. The findings were presented to

IMII in July 2024. A proposal for Phase 3 has been presented to

IMII and is currently under review. Phase 3 of the project would

include the design, construction and testing of a larger shop-scale

demonstration dryer. IMII, a non-profit organization jointly funded

by industry and government, is committed to developing and

implementing innovative education, training, research and

development partnerships to support a world-class minerals

industry. IMII's minerals industry members include BHP, Cameco

Corporation, Fission Uranium Corp., The Mosaic Company and Nutrien

Ltd.

Acceleware continued to invest in developing and

protecting new intellectual property with the total number of

patents issued, allowed, applied for, or in development growing to

a total of 62.

QUARTER IN REVIEW

Revenue of $2.0 million was generated in Q2 2024

compared to $0.1 million in the three months ended June 30, 2023

(“Q2 2023”) and $0.04 million in the previous quarter ended March

31, 2024 (“Q1 2024”). Revenue in Q2 2024 included $1.95 million in

revenue related to the RF XL Pilot as all milestones were completed

under contract for one oil-sands producer triggering revenue

recognition of previously received milestone payments.

Total comprehensive income for Q2 2024 was $1.3

million compared to a comprehensive loss of $1.1 million for Q2

2023 and a comprehensive loss of $1.0 million for Q1 2024.

Comprehensive income in Q2 2024 was high due to revenue related to

the RF XL Pilot and receipt of government assistance from CRIN

relating to costs incurred from July 1, 2023 to December 31, 2023.

Finance expenses in Q2 2024 were higher as compared to Q2 2023 for

interest on notes payable funding the Company’s working capital.

Comprehensive income or loss in all periods was impacted by changes

in value of the derivative financial instruments embedded within

the convertible debenture. The changes in derivative value are

driven primarily by the fluctuation in the Company’s share

price.

Gross R&D expenses incurred in Q2 2024 were

$0.7 million compared to $0.6 million in Q2 2023 and $0.5 million

in Q1 2024. R&D spending was higher in Q2 2024 compared to Q2

2023 and Q1 2024 due to increased spending related to development

of the potash ore dryer. R&D activity in Q2 2024 was related to

lab engineering, designing and testing, data analysis, and partner

consultations. There was $0.6 million government assistance

received in Q2 2024 and $nil in Q2 2023 and $nil in Q1 2024. The

Company received the first CRIN payment in Q4 2023 of $2.1 million

and a second and third payment from CRIN totalling $0.6 million in

Q2 2024. The Government of Alberta’s Innovation Employment Grant

(“IEG”) to support research and development was effective January

1, 2021 and provides a grant of up to 20% of eligible R&D

expenses incurred in Alberta. This new grant effectively replaced

Alberta’s 10% scientific research and experimental development

refundable tax credit that was eliminated as at December 31, 2019.

The Company met the eligibility criteria, claimed eligible R&D

expenditures and received $0.4 million in the three months ended

March 31, 2023 related to 2021 eligible expenditures and received

$0.1 million in the three months ended September 30, 2023 related

to 2022 eligible expenditures. Subsequent to June 30, 2024, the

Company received $0.3 million related to 2023 eligible

expenditures. Government assistance offsets gross R&D

costs.

G&A expenses incurred in Q2 2024 were $0.4

million compared to $0.5 million in Q2 2023 and $0.5 million in Q1

2024. There were lower non-cash payroll related costs incurred in

Q2 2024 due to the timing of option grants and lower salaries as

the Company continues to prioritize cost control given uncertain

economic conditions.

At June 30, 2024, Acceleware had negative

working capital of $2,460,058 (December 31, 2023 – negative working

capital of $1,985,372) including $249,312 in cash and cash

equivalents (December 31, 2023 - $951,569) and $927,696 in

short-term notes payable (December 31, 2023 - $944,010). As of June

30, 2024, Acceleware also had $2,215,000 in long-term 10%,

semi-annual interest, convertible debentures outstanding, the

principal amount of which is owing four years from the date of

issue or approximately Q1 2026. Fluctuations in non-cash working

capital were attributable to the timing of receipt and recognition

of government and partner funding and related R&D spending.

Cash and cash equivalents decreased in Q1 2024 due to timing of

payments of trade payables. Increasing the deficit is deferred

revenue of $3,040,870 as at June 30, 2024 (December 31, 2022 –

$4,350,000). Despite receiving non-refundable cash payments for

these amounts, the milestone payments have not met all requirements

for revenue recognition under IFRS 15 Revenue from Contracts with

Customers. These amounts will be recognized as revenue and increase

shareholders’ equity when RF XL Pilot heating is complete or the

data revenue contracts are terminated, whichever is earlier. The

first data revenue related to these contracts was recognized in Q2

2024 for $1,950,000.

YEAR IN REVIEW

Revenue of $2.1 million was generated in the six

months ended June 30, 2024 compared to $0.2 million for the six

months ended June 30, 2023. Revenue for the six months ended June

30, 2024 included $1.95 million in revenue related to the RF XL

Pilot and amounts for software and maintenance revenue for HPC.

Revenue was higher as compared to 2023 due to revenue related to

the RF XL Pilot as all milestones were completed under contract for

one oil-sands producer triggering revenue recognition of previously

received milestone payments.

Total comprehensive income for the six months

ended June 30, 2024 was $0.3 million compared to comprehensive loss

of $1.4 million for the six months ended June 30, 2023 due to

higher revenue as noted above and higher government assistance.

There are fluctuations in both periods related to changes in fair

value of the derivative financial instruments embedded in the

convertible debentures.

Gross R&D expenses for the six months ended

June 30, 2024 were $1.2 million compared to $1.4 million incurred

during the six months ended June 30, 2023 due to higher R&D

activity in 2023 related to the final steps of the RF XL Pilot

workover during the six months ended June 30, 2023. Federal and

provincial government assistance of $0.6 million was recognized in

the six months ended June 30, 2024 compared to $0.4 million for the

six months ended June 30, 2023 as the RF XL Pilot nears

completion.

G&A expenses incurred during the six months

ended June 30, 2024 were $0.9 million compared to $0.9 million for

the six months ended June 30, 2023. The Company continues to

prioritize cost management.

ABOUT ACCELEWARE:

Acceleware is an innovator of clean-tech

decarbonization technologies comprised of two business units: Radio

Frequency Heating Technology and Seismic Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy production

that can quickly bend the emissions curve downward. With clean

electricity, Acceleware’s RF XL technology could eliminate

greenhouse gas (GHG) emissions associated with heavy oil and oil

sands production. RF XL uses no water, requires no solvent, has a

small physical footprint, can be redeployed from site to site, and

can be applied to a multitude of reservoir types. Acceleware is

also working on the decarbonization of other industrial process

heat applications through its EM Powered Heat technology, which

uses the Company’s proprietary CTI. These include a multi-phase EM

Powered Heat potash dryer project currently underway with the

International Minerals Innovations Institute in Saskatchewan,

Canada.

Acceleware and Saa Dene Group (co-founded by Jim

Boucher) have created Acceleware | Kisâstwêw to raise the profile,

adoption, and value of Acceleware technologies. The shared vision

of the partnership is to improve the environmental and economic

performance of the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

NOTE REGARDING FORWARD-LOOKING

INFORMATION AND OTHER ADVISORIES

This news release contains “forward-looking

information” within the meaning of Canadian securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that are prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by terms such as “believes”, “estimates”,

“plans”, “potential”, and “will”, and includes information about,

the expected commercialization of RF XL, the expected cost of

the RF XL Pilot, the timing of the execution of the

RF XL Pilot and the redeployment, expected financing required

for the RF XL Pilot redeployment, and the anticipated

economic and societal benefits of the RF XL technology. Acceleware

assumes that current cost estimates are accurate, current

timelines will not be delayed by either internal or external

causes, that research and development effort including the

commercial-scale test plans will result in commercial-ready

products, and that future capital raising efforts will be

successful.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release,

unless it is required to do so under Canadian securities

legislation.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this release in the United States. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information:Geoff ClarkTel: +1 (403)

249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3CanadaTel: +1 (403) 249-9099www.acceleware.com

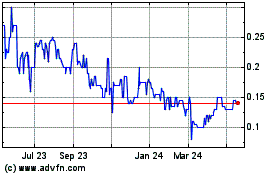

Acceleware (TSXV:AXE)

Historical Stock Chart

From Nov 2024 to Dec 2024

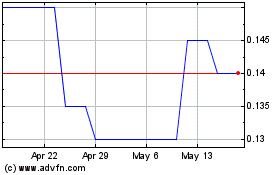

Acceleware (TSXV:AXE)

Historical Stock Chart

From Dec 2023 to Dec 2024