Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX:

TXG) announces the Company has finalized a credit agreement

with a syndicate of Banks which increases the amount of credit

available to $250 million from $150 million and extends the

maturity of the facilities into 2025 from 2023.

Andrew Snowden, CFO of Torex, stated:

“We are pleased to increase the capacity and

extend the maturity of our credit facilities with a syndicate of

supportive lenders. The amended credit agreement represents another

key de-risking milestone in the development of the Media Luna

Project. The amended facilities provided by Bank of Montreal, as

Joint Bookrunner, Joint Lead Arranger and Administrative Agent, The

Bank of Nova Scotia, as Joint Bookrunner, Joint Lead Arranger and

Syndication Agent, the Canadian Imperial Bank of Canada, ING

Capital LLC., National Bank of Canada and Societe Generale, further

enhances the Company’s financial flexibility. The facilities

include similar covenants and security to the prior credit

agreement and maintain the optionality for the Company to pursue a

potential future high yield debt offering, assuming the interest

rate and maturity are advantageous to Torex shareholders.

“With $311 million of cash on hand at the end of

June, no debt, and strong forecast cash flow from El Limón Guajes,

the $250 million available under the latest credit facilities place

Torex on solid footing to fund the development of Media Luna,

continue to invest in value-generating exploration, and maintain a

minimum of $100 million of liquidity on the balance sheet.”

The credit agreement consists of a $150 million

revolving credit facility and a $100 million term loan credit

facility. The $150 million revolving credit facility matures on

December 31, 2025 and is subject to quarterly commitment reductions

of $12.5 million commencing on March 31, 2024. The $100 million

term loan facility can be drawn until December 31, 2023, matures on

June 30, 2025 and is subject to four equal quarterly repayment

instalments commencing on September 30, 2024. Both the revolving

credit facility and term loan facility can be repaid in full

anytime without penalty.

These facilities bear an interest rate of Term

SOFR plus a Credit Spread Adjustment and an Applicable Margin based

on the Company’s leverage ratio. The Applicable Margin applied is

2.50% based on a leverage ratio less than 1.0 times, 2.75% at a

ratio less than 2.0 times, 3.00% at a ratio less than 2.5 times,

and 3.50% at a ratio equal to or greater than 2.5 times. Any unused

portion of the facilities will be subject to a customary commitment

fee. The Credit Spread Adjustment will range from 0.10% to

0.25%.

The revolving credit facility and term loan

facility include standard and customary financing terms and

conditions, including those related to security, fees,

representations, warranties, covenants, and conditions.

The amended and restated Credit Agreement will

be posted to SEDAR (www.sedar.com) in due course.

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mining

Complex, the Media Luna Project, the processing plant and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to extend and optimize production from the ELG

Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property.

For further information, please contact:

|

TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan Rollins |

| President and CEO |

Senior Vice President, Corporate

Development & Investor Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

CAUTIONARY NOTE

Forward Looking Information

This press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements that:

the facility continues to maintain optionality for the Company to

pursue a potential future high yield debt offering, assuming the

interest rate and maturity are advantageous to Torex shareholders;

with $311 million of cash on hand at the end of June, no debt, and

strong forecast cash flow from El Limón Guajes, the $250 million

available under the latest credit facility places Torex on solid

footing to fund the development of Media Luna, continue to invest

in value-generating exploration, and maintain a minimum of $100

million of liquidity on the balance sheet; and Torex’s key

strategic objectives are to extend and optimize production from the

ELG Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property. Generally,

forward-looking information and statements can be identified by the

use of forward-looking terminology such as “forecast,” “continues”,

“potential”, “future”, “strategic” or variations of such words and

phrases or statements that certain actions, events or results

“will”, “may,” “could,” “would,” “might,” or “on track,”, “well

positioned to” or “on strong footing to” occur. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

and uncertainties identified in the technical report (the

“Technical Report”) released on March 31, 2022, entitled “NI 43-101

Technical Report ELG Mine Complex Life of Mine Plan and Media Luna

Feasibility Study”, which has an effective date of March 16, 2022,

and the Company’s annual information form (“AIF”) and management’s

discussion and analysis (the “MD&A”) or other unknown but

potentially significant impacts. Forward-looking information and

statements are based on the assumptions discussed in the Technical

Report, the AIF, the MD&A and such other reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and perception of trends, current

conditions and expected developments, and other factors that

management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

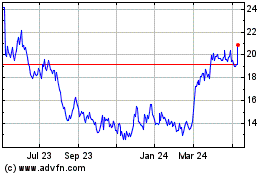

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

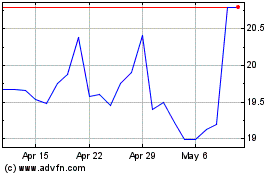

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024