Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG) is

pleased to announce results from resource expansion and exploratory

drilling completed in the broader Media Luna area (“Cluster”),

which extended mineralization to the south and west of the EPO

deposit and identified a potential new zone of mineralization (EPO

South Extension), located between the Media Luna deposit and the

Media Luna West target.

Jody Kuzenko, President & CEO stated:

“A key pillar of the Torex strategy is a renewed

focus on drilling and exploration, and our latest drilling results

at the Media Luna Cluster reinforce our positive outlook on our

ability to complement future production at Media Luna. With the

construction of the project well underway, we are stepping out

beyond the existing mine resource footprint on the south side of

the Balsas River, testing extensions of the Media Luna and EPO

deposits, conducting initial drilling at previously identified

targets, and identifying new exploration targets – all with the aim

of demonstrating the underlying resource potential of the Morelos

Property.

“Drilling within the EPO South target has

extended the mineralized footprint of the EPO deposit by

approximately 250 metres (“m”) to the south and approximately 150 m

to the west, which bodes well for future resource growth at EPO. As

detailed in Table 1, notable intersects include 9.7 m grading 11.44

grams per tonne gold equivalent (“g/t AuEq”) at 8.51 g/t gold

(“Au”), 33.44 g/t silver (“Ag”) and 1.57% copper (“Cu”); 17.3 m

grading 7.29 g/t AuEq at 4.18 g/t Au, 25.15 g/t Ag and 1.74% Cu;

and 35.6 m grading 4.10 g/t AuEq at 2.05 g/t Au, 30.33 g/t Ag and

1.05% Cu.

“In 2021, the Company completed a

high-resolution magnetic geophysical survey over a portion of the

property covering the Media Luna Cluster. The survey was reduced

and merged with the existing broader-scale low-resolution airborne

magnetic survey and known geology to yield anomalies of interest.

One anomaly, the EPO South Extension, was the focus of a small

follow-up drill program that validated the utility of the survey,

with four of the six holes drilled within the newly identified

target intersecting mineralization, including an impressive 16.5 m

grading 9.63 g/t AuEq at 8.70 g/t Au, 4.27 g/t Ag and 0.54% Cu as

well as 6.3 m grading 5.48 g/t AuEq at 4.00 g/t Au, 19.44 g/t Ag

and 0.78% Cu.

“Overall, this drilling, in conjunction with

additional drilling both north and south of the Balsas River,

enhances our confidence in bolstering the economics of the Morelos

Complex beyond the levels outlined in the recent Technical

Report."

Table 1: Highlights from 2022 drilling at EPO

South and EPO South Extension targets

|

Drill Hole1 |

Target |

From(m) |

To(m) |

True Width(m) |

Au(g/t) |

Ag(g/t) |

Cu(%) |

AuEq(g/t) |

|

ML22-765 |

EPO South |

670.26 |

680.00 |

9.73 |

8.51 |

33.44 |

1.57 |

11.44 |

|

ML22-769A |

EPO South |

650.68 |

668.00 |

17.25 |

4.18 |

25.15 |

1.74 |

7.29 |

|

Including |

3.02 |

10.85 |

28.37 |

2.09 |

14.56 |

|

including |

3.48 |

4.40 |

42.82 |

3.37 |

10.34 |

|

ML22-763A |

EPO South |

637.80 |

673.57 |

35.63 |

2.05 |

30.33 |

1.05 |

4.10 |

|

including |

8.97 |

5.78 |

11.53 |

0.41 |

6.57 |

|

including |

4.02 |

0.77 |

154.05 |

4.65 |

10.07 |

|

ML21-756 |

EPO South Ext. |

537.37 |

556.03 |

16.48 |

8.70 |

4.27 |

0.54 |

9.63 |

|

including |

2.38 |

56.50 |

8.18 |

0.75 |

57.81 |

|

ML21-753 |

EPO South Ext. |

836.00 |

847.00 |

6.31 |

4.00 |

19.44 |

0.78 |

5.48 |

|

including |

2.29 |

10.13 |

35.40 |

1.20 |

12.48 |

|

ML21-759 |

EPO South Ext. |

733.89 |

741.35 |

5.10 |

2.79 |

8.60 |

0.27 |

3.34 |

|

including |

3.41 |

3.82 |

11.37 |

0.38 |

4.57 |

Notes to Drill Results Highlights Table:1)

Intersections are reported as true thickness, based on current

geological understanding of the mineralization.2) The gold

equivalent grade calculation used is as follows: AuEq (g/t) = Au

(g/t) + Ag (g/t) * 0.011385 + Cu (%) * 1.621237 and use the same

metal prices ($1,550/oz gold, $20/oz silver, and $3.50/lb copper)

and metallurgical recoveries (85% gold, 75% silver and 89% copper)

used in the Mineral Resource estimate for the EPO deposit.

Details of the assay results from expansion

drilling at EPO South and scout drilling at EPO South Extension can

be found in Table 2 of this release.

The gold equivalent grade calculation accounts

for the same metal prices ($1,550/oz gold, $20/oz silver, and

$3.50/lb copper) and metallurgical recoveries (85% gold, 75% silver

and 89% copper) used in the current Mineral Resource estimate for

the EPO deposit, set out in the Technical Report.

EPO – INFILL AND EXPANSION DRILL

PROGRAMS

In 2022, the Company is targeting 64,000 m of

drilling within the Media Luna Cluster, of which 28,000 m is

focused in and around the EPO deposit. Approximately half the

metres to be drilled at EPO are targeting to upgrade Inferred

Mineral Resources to the Indicated category (infill program) with

the remainder focused on growing the overall size of the resource

envelope (expansion program).

Results from the first seven holes

(approximately 4,800 m including one hole completed in 2021) of the

expansion program have been positive, with drilling within the EPO

South target extending the mineralized footprint of the EPO deposit

250 m to the south (ML22-778A) and 150 m to the west

(ML22-773).

Figure 1: Media Luna Cluster – Key drill results

from EPO expansion program and results of scout drilling testing

the recently identified EPO South Extension

target: https://www.globenewswire.com/NewsRoom/AttachmentNg/fc5d0cad-db96-4791-a7aa-cdd7dee68c15

EXPANDING THE MEDIA LUNA CLUSTER – 2021

SCOUT DRILL PROGRAM

Over the last several years, Torex has carried

out early-stage exploration activities across the broader Morelos

Property. As part of these efforts, the Company completed a

high-resolution geophysical survey (drone magnetic and

electromagnetic survey within 50 meters line spacing) across the

Morelos Property, which provided greater scale and coverage as well

as improved resolution. The survey was reduced and merged with the

existing broader-scale low-resolution airborne magnetic survey and

known geology to yield anomalies of interest.

One anomaly identified by the high-resolution

magnetic survey, EPO South Extension, was the focus of a small

follow-up drill program. This program validated the utility of the

survey with four of the six holes drilled intersecting

mineralization. The discovery of EPO South Extension is

particularly encouraging given the target zone is in an area that

was thought to be unmineralized, opening the possibility for

similar discoveries across the broader Morelos Property.

Given the improved visibility and information

provided by the high-resolution magnetic survey, the Company has

decided to expand the survey across other areas of the Morelos

Property to identify new potential targets and prioritize future

drilling.

MORELOS PROPERTY – 2022 EXPLORATION AND

DRILLING PROGRAM

Torex expects to invest approximately $39M in

drilling and exploration across the broader Morelos Property

(Figure 2) in 2022, including $5M of definition and grade control

drilling within the current operations.

Figure 2: Broader Morelos Property – 2022 drill

program primarily focused on Media Luna Cluster, ELG Underground,

as well as near-mine and regional

targets: https://www.globenewswire.com/NewsRoom/AttachmentNg/4f032e9b-af81-4556-b973-92816e57560b

The Company’s exploration and drill program is

primarily focused around upgrading and expanding Mineral Resources

at Media Luna and EPO as well as continued expansion of the ELG

Underground.

- Media Luna:

Approximately $19M is budgeted for infill and step-out drilling at

Media Luna as well as an initial infill drill program at the

adjacent EPO deposit. A total of 64,000 m of drilling is budgeted

at Media Luna. Costs of the program are being classified as

non-sustaining capital expenditures.

- ELG Underground:

Approximately $6M is budgeted for infill and step-out drilling

within the ELG Underground. Drilling targeting deeper extensions of

the Sub-Sill and ELD deposits is expected to commence in H2, with

the completion of Portal #3. A total of 28,000 m of drilling is

budgeted for the ELG Underground in 2022. Program costs are being

classified as capital expenditures and are included in the

sustaining capital expenditure and all-in sustaining cost guidance

for ELG.

- Near Mine and

Regional: Approximately $9M is budgeted to conduct

exploration across the broader land package, including drilling of

near mine targets (28,500 m of drilling) as well as regional

exploration north and south of the Balsas River (6,000 m of

drilling). The program expenditures are being classified as

exploration expenses.

- Definition and Grade

Control: Approximately $5M is budgeted for ore control and

definition drilling in the ELG Open Pit and Underground. The costs

associated with these programs are included in mining operating

expenses and, therefore, reflected in total cash cost and all-in

sustaining cost guidance.

MEDIA LUNA REGIONAL GEOLOGY

The Media Luna deposit is hosted within the

Mesozoic carbonate-rich Morelos Platform, which has been intruded

by Paleocene stocks, sills, and dykes of granodioritic to tonalitic

composition. Skarn-hosted gold-silver-copper mineralization is

developed within the sedimentary rocks along the contacts of

intrusive rocks as well as within altered dykes of the skarn

envelope. The main portion of this mineralized package dips to the

southwest at approximately 30°; in the lowest part of the known

mineralization, the dip steepens to approximately 60°, while the

northernmost portion of the deposit dips to the north, resulting in

a broad antiformal geometry of the deposit.

Mineralization at Media Luna is hosted in skarn

that developed at the contact of the intrusive granodiorite and

overlying sedimentary rocks. The skarn is characterized by a

mineral assemblage of pyroxene, garnet, and magnetite. Metal

deposition and sulfidation occurred during retrograde alteration

and is associated with a mineral assemblage comprising amphibole,

phlogopite, chlorite, and calcite ± quartz ± epidote as well as

variable amounts of magnetite and sulfides, primarily pyrrhotite.

Additional mineralization is associated with skarn developed within

and along dykes and sills above the main granodiorite intrusion

Additional information on the Media Luna

deposit, the Media Luna Feasibility Study and the analytical and

sampling process is available in the Company’s technical report

entitled the “Morelos Property, NI 43-101 Technical Report, ELG

Mine Complex Life of Mine Plan and Media Luna Feasibility Study,

Guerrero State, Mexico”, dated effective March 16, 2022 filed on

March 31, 2022 (the “Technical Report”) on SEDAR at

www.sedar.com and the Company’s website at

www.torexgold.com.

QUALITY ASSURANCE / QUALITY CONTROL

At the Company’s Morelos Property (see

description above), all the Media Luna project drill core is logged

and sampled at the core facility within the project camp under the

supervision of Nicolas Landon, Chief Exploration Geologist for the

Media Luna Project. A geologist marks the individual samples for

analysis and sample intervals, sample numbers, standards and blanks

are entered into the database. The core is cut in half lengthwise

using an electric core saw equipped with a diamond tipped blade.

One half of the core is placed into a plastic sample bag and sealed

with zip ties in preparation for shipment. The other half of the

core is returned to the core box and retained for future reference

in the Company core shack with the assay pulps and coarse rejects.

The core samples are picked up at the project camp and delivered to

Bureau Veritas (“BV”) to conduct all the analytical work.

Sample preparation is carried out by BV at its

facilities in Durango, Mexico and consists of crushing a 1 kg

sample to >70% passing 2 mm followed by pulverisation of 500 g

to >85% passing 75 μm. Gold is analyzed at the BV facilities in

Hermosillo, Mexico following internal analytical protocols (FA430)

and comprises a 30g fire assay with an atomic absorption finish.

Samples yielding results >10 g/t Au are re-assayed by fire assay

with gravimetric finish (FA530-Au). Copper and silver analyses are

completed at the BV facilities in Vancouver, Canada as part of a

multi-element geochemical analysis by an aqua regia digestion with

detection by ICP-ES/MS using BV internal analytical protocol AQ270.

Overlimits for the multi-element package are analyzed by internal

protocol AQ374. BV is independent of the Company and its Vancouver

and Hermosillo facilities are ISO-17025 accredited.

Torex has a sampling and analytical Quality

Assurance/Quality Control (“QA/QC”) program in place that has been

approved by BV and is overseen by Nicolas Landon, Chief Exploration

Geologist for the Media Luna Project. The program includes 5% each

of Certified Reference Materials and Blanks; blind duplicates are

not included, but Torex evaluates the results of internal BV

laboratory duplicates. Torex uses an independent laboratory to

check selected assay samples and reference materials and has

retained a consultant to audit the QAQC data for every drill

campaign at Media Luna. The QA/QC procedure is described in more

detail in the Technical Report filed on SEDAR.

QUALIFIED PERSONS

The scientific and technical data contained in

this news release pertaining to the Media Luna exploration program

have been reviewed and approved by John Makin, MAIG. Mr. Makin is a

member of the Australian Institute of Geoscientists (#7313), has

experience relevant to the style of mineralization under

consideration, and is a Consultant Geologist employed by SLR

(Canada) Consulting Ltd. Mr. Makin has verified the data disclosed,

including sampling, analytical, and test data underlying the drill

results. Verification included visually reviewing the drillholes in

three dimensions, comparing the composited grades against the assay

results, comparing the assay results to the original assay

certificates, and reviewing core photography for each intercept.

Mr. Makin consents to the inclusion in this release of said data in

the form and context in which they appear.

ABOUT TOREX GOLD RESOURCES

INC.

Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mining

Complex, Media Luna Project, processing plant and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to extend and optimize production from the ELG

Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan

Rollins |

| President and CEO |

Senior Vice President,

Corporate Development & Investor Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

|

jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTSThis press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements about:

the potential new zone of mineralization (EPO South Extension);

overall, the drilling reported in the news release, in conjunction

with additional drilling both north and south of the Balsas River,

enhancing the Company’s confidence in bolstering the economics of

the Morelos Complex beyond the levels outlined in the recent

Technical Report; the Company’s 2022 target of 64,000 m of drilling

within the Media Luna Cluster, of which 28,000 m is focused in and

around the EPO deposit; approximately half the metres to be drilled

at EPO are targeting to upgrade Inferred Mineral Resources to the

Indicated category (infill program) with the remainder focused on

growing the overall size of the resource envelope (expansion

program); the primary focus of exploration and drill program around

upgrading and expanding Mineral Resources at Media Luna and EPO as

well as continued expansion of the ELG Underground; the discovery

of EPO South Extension opening up the possibility for similar

discoveries across the broader Morelos Property; budgets and

planned metres for drilling programs; and the Company’s key

strategic objectives to extend and optimize production from the ELG

Mining Complex, de-risk and advance Media Luna to commercial

production, build on ESG excellence, and to grow through ongoing

exploration across the entire Morelos Property. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “strategy”, “focus”, “budget”,

“continue”, “potential” or variations of such words and phrases or

statements that certain actions, events or results “will”, or “is

expected to" occur. Forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of the Company to be materially different from those expressed or

implied by such forward-looking information, including, without

limitation, risks and uncertainties associated with: the ability to

upgrade mineral resources categories of mineral resources with

greater confidence levels or to mineral reserves; risks associated

with mineral reserve and mineral resource estimation; uncertainty

involving skarns deposits; the ability of the Company to obtain

additional permits for the Media Luna Project; the ability of the

Company to successfully construct and operate in an economically

viable manner as projected in the Media Luna Feasibility Study; the

ability of the Company to fully fund the Media Luna Project to

production; the ability of the Company’s mining and exploration

operations to operate as intended due to shortage of skilled

employees or shortages in supply chains; and those risk factors

identified in the Technical Report and the Company’s annual

information form and management’s discussion and analysis or other

unknown but potentially significant impacts. Forward-looking

information is based on the assumptions discussed in the Technical

Report and such other reasonable assumptions, estimates, analysis

and opinions of management made in light of its experience and

perception of trends, current conditions and expected developments,

and other factors that management believes are relevant and

reasonable in the circumstances at the date such statements are

made. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in the forward-looking information, there may be

other factors that cause results not to be as anticipated. There

can be no assurance that such information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company does not undertake to update any

forward-looking information, whether as a result of new information

or future events or otherwise, except as may be required by

applicable securities laws.

Table 2: Drill results from 2021 scout drill

program at EPO South Extension and 2022 expansion drill program at

EPO South

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Intersection |

|

|

|

|

|

Drill-Hole |

Area |

UTM-E |

UTM-N |

Elevation |

Hole |

Mother |

Azimuth |

Dip |

Depth |

From |

To |

True Length1 |

Au |

Ag |

Cu |

AuEq2 |

Lithology |

|

|

|

(m) |

(m) |

(m) |

Type |

Hole |

|

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

(g/t) |

|

|

ML21-753 |

EPO South Ext. |

421867.8 |

1984351.1 |

1113.5 |

CD |

|

234.83 |

-74.89 |

938.00 |

836.00 |

847.00 |

6.31 |

4.00 |

19.44 |

0.78 |

5.48 |

Breccia/Skarn |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

2.29 |

10.13 |

35.40 |

1.20 |

12.48 |

Breccia/Skarn |

|

|

|

|

|

|

|

|

|

|

|

858.34 |

859.34 |

0.57 |

0.14 |

80.40 |

1.96 |

4.23 |

Breccia |

|

ML21-754 |

EPO South Ext. |

421877.5 |

1984344.5 |

1113.4 |

CD |

|

63.18 |

-63.42 |

548.35 |

|

|

|

|

|

|

|

No significant values |

|

ML21-755 |

EPO South Ext. |

421501.8 |

1984837.1 |

1155.6 |

CD |

|

104.87 |

-59.88 |

498.25 |

|

|

|

|

|

|

|

No significant values |

|

ML21-756 |

EPO South Ext. |

421869.5 |

1984348.7 |

1113.6 |

CD |

|

351.26 |

-75.77 |

577.1 |

537.37 |

556.03 |

16.48 |

8.70 |

4.27 |

0.54 |

9.63 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

2.38 |

56.50 |

8.18 |

0.75 |

57.81 |

Skarn |

|

ML21-757 |

EPO South |

421989.6 |

1985602.6 |

1440.5 |

CD |

|

142.58 |

-68.7 |

677.4 |

252.65 |

256.15 |

3.17 |

0.70 |

81.04 |

0.31 |

2.13 |

Massive sulfide |

|

|

|

|

|

|

|

|

|

|

|

553.72 |

554.25 |

0.48 |

0.74 |

63.00 |

0.90 |

2.91 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

615.03 |

625.86 |

9.82 |

0.82 |

9.66 |

0.65 |

1.99 |

Skarn Composite 2 |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

2.69 |

1.62 |

8.18 |

0.88 |

3.14 |

Skarn |

|

ML21-758 |

EPO South Ext. |

421503.1 |

1984835.7 |

1155.7 |

CD |

|

44.89 |

-50.12 |

497.9 |

140.09 |

144.63 |

4.15 |

1.54 |

3.44 |

0.00 |

1.58 |

Dike |

|

|

|

|

|

|

|

|

|

|

|

147.16 |

147.79 |

0.58 |

1.89 |

13.20 |

0.08 |

2.16 |

Massive sulfide |

|

ML21-759 |

EPO South Ext. |

421872.0 |

1984348.2 |

1113.5 |

CD |

|

117.89 |

-67.78 |

773.8 |

718.99 |

719.68 |

0.53 |

0.77 |

50.90 |

0.70 |

2.49 |

Breccia/Skarn |

|

|

|

|

|

|

|

|

|

|

|

723.39 |

726.90 |

2.69 |

1.09 |

22.51 |

0.47 |

2.11 |

Breccia/Skarn |

|

|

|

|

|

|

|

|

|

|

|

733.89 |

741.35 |

5.10 |

2.79 |

8.60 |

0.27 |

3.34 |

Breccia/Skarn |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

3.41 |

3.82 |

11.37 |

0.38 |

4.57 |

Breccia/Skarn |

|

ML22-763 |

EPO South |

421991.2 |

1985601.3 |

1440.2 |

CD |

|

128.27 |

-76.11 |

177.60 |

|

|

|

|

|

|

|

Mother hole |

|

ML22-763A |

EPO South |

421991.2 |

1985601.3 |

1440.2 |

DD |

ML22-763 |

|

|

715.05 |

550.41 |

558.07 |

7.63 |

0.76 |

12.19 |

0.60 |

1.87 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

598.00 |

602.00 |

3.98 |

1.71 |

14.68 |

0.37 |

2.47 |

Skarn Composite 2 |

|

|

|

|

|

|

|

|

|

|

|

618.05 |

619.58 |

1.52 |

1.21 |

11.69 |

0.43 |

2.04 |

Skarn Composite 3 |

|

|

|

|

|

|

|

|

|

|

|

637.80 |

673.57 |

35.63 |

2.05 |

30.33 |

1.05 |

4.10 |

Skarn Composite 4 |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

8.97 |

5.78 |

11.53 |

0.41 |

6.57 |

Skarn |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

4.02 |

0.77 |

154.05 |

4.65 |

10.07 |

Skarn |

|

ML22-765 |

EPO South |

421934.1 |

1985580.0 |

1432.2 |

CD |

|

283.74 |

-86.59 |

714.7 |

670.26 |

680.00 |

9.73 |

8.51 |

33.44 |

1.57 |

11.44 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

689.58 |

694.80 |

5.14 |

2.31 |

24.66 |

0.89 |

4.04 |

Skarn Composite 2 |

|

ML22-769 |

EPO South |

421986.6 |

1985604.0 |

1440.2 |

DD |

|

162.47 |

-72.93 |

137.10 |

|

|

|

|

|

|

|

Mother hole |

|

ML22-769A |

EPO South |

421986.6 |

1985604.0 |

1440.2 |

DD |

ML22-769 |

|

|

773.45 |

213.75 |

217.10 |

2.93 |

0.57 |

69.25 |

0.23 |

1.73 |

Breccia |

|

|

|

|

|

|

|

|

|

|

|

650.68 |

668.00 |

17.25 |

4.18 |

25.15 |

1.74 |

7.29 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

3.02 |

10.85 |

28.37 |

2.09 |

14.56 |

Skarn |

|

|

|

|

|

|

|

|

|

|

|

Including |

|

3.48 |

4.40 |

42.82 |

3.37 |

10.34 |

Skarn |

|

|

|

|

|

|

|

|

|

|

|

720.94 |

721.94 |

1.00 |

0.20 |

37.80 |

1.22 |

2.61 |

Skarn Composite 2 |

|

|

|

|

|

|

|

|

|

|

|

737.81 |

738.53 |

0.72 |

2.98 |

6.10 |

0.16 |

3.32 |

Skarn Composite 3 |

|

ML22-773 |

EPO South |

421931.9 |

1985578.8 |

1432.2 |

CD |

|

267.84 |

-80.23 |

718.50 |

141.35 |

143.00 |

1.61 |

0.53 |

78.44 |

0.29 |

1.88 |

Massive sulfide |

|

|

|

|

|

|

|

|

|

|

|

665.10 |

667.00 |

1.86 |

1.41 |

18.23 |

0.53 |

2.48 |

Skarn Composite 1 |

|

|

|

|

|

|

|

|

|

|

|

676.45 |

676.98 |

0.52 |

3.77 |

22.90 |

0.02 |

4.07 |

Granodiorite |

|

ML22-778 |

EPO South |

421933.8 |

1985578.1 |

1432.2 |

CD |

|

155.48 |

-66.69 |

134.65 |

|

|

|

|

|

|

|

Mother hole |

|

ML22-778A |

EPO South |

421933.8 |

1985578.1 |

1432.2 |

CD |

ML22-778 |

|

|

763.9 |

438.01 |

440.00 |

1.99 |

0.90 |

19.87 |

0.22 |

1.49 |

Marble |

|

|

|

|

|

|

|

|

|

|

|

703.30 |

704.30 |

1.00 |

2.49 |

4.30 |

0.00 |

2.54 |

Granodiorite |

Notes to Table

- Intersections are reported as true

thickness, based on current geological understanding of the

mineralization.

- The gold equivalent grade

calculation used is as follows: AuEq (g/t). = Au (g/t) + Ag (g/t) *

0.011385 + Cu (%) * 1.621237 account for the same metal prices

($1,550/oz gold, $20/oz silver, and $3.50/lb copper) and

metallurgical recoveries (85% gold, 75% silver and 89% copper) used

in the Mineral Resource estimate for the EPO deposit.

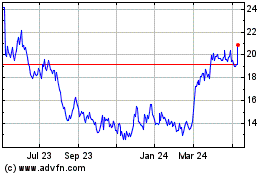

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

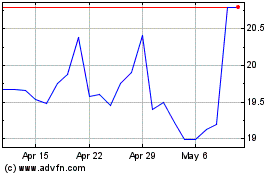

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024