Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

provides 2022 operational guidance for its El Limón Guajes (“ELG”)

Mining Complex, which forms part of the Company’s Morelos Property

in Guerrero, Mexico. Full year non-sustaining capital expenditure

guidance for the Company’s Media Luna project will be announced

when the updated Technical Report for the entire Morelos Property

is released at the end of March.

2022 OPERATIONAL OUTLOOK FOR

ELG

|

|

2022 Guidance |

2021 Guidance1 |

|

Gold Production |

oz |

430,000 to 470,000 |

430,000 to 470,000 |

|

Total Cash Costs2a |

$/oz sold |

$695 to $735 |

$680 to $720 |

|

All-in Sustaining Costs2b |

$/oz sold |

$980 to $1,030 |

$920 to $970 |

|

Sustaining Capital Expenditures2c |

|

|

|

|

Capitalized Waste |

M$ |

$50 to $60 |

$45 to $50 |

|

ELG Sustaining |

M$ |

$35 to $45 |

$30 to $40 |

|

Total Sustaining |

M$ |

$85 to $105 |

$75 to $90 |

|

Non-Sustaining Capital Expenditures2d |

|

|

|

|

ELG Non-Sustaining |

M$ |

$15 to $20 |

$25 to $40 |

|

Media Luna Non-Sustaining |

M$ |

Pending |

$100 to $110 |

|

Total Non-Sustaining |

M$ |

Pending |

$125 to $150 |

| 1) |

2021 guidance was updated mid-year to reflect

increased level of capital waste related to approval of El

Limón pushback. |

| 2) |

Refer to “Non-IFRS Financial Performance Measures”

in the Company’s September 30, 2021 MD&A for further

information and a detailed reconciliation. See also the Cautionary

Notes to this press release. |

| |

a) |

Total cash costs in 2021 have averaged $646 per ounce gold

sold through Q3. |

| |

b) |

All-in sustaining costs in 2021 have averaged $883 per ounce gold

sold through Q3. |

| |

c) |

Sustaining capital expenditures in 2021 have totaled $59.2 million

(including $33.9 million of capitalized waste) through Q3. |

| |

d) |

Non-sustaining capital expenditures in 2021 have totaled $111.5

million (including $80.4 million of capital expenditures for Media

Luna) through Q3. |

Jody Kuzenko, President and CEO of Torex,

stated:

“We expect 2022 to be another solid year for

Torex as we continue to build on our reputation as a profitable,

safe, reliable, and consistent operator. Our guided gold production

for 2022 is consistent with the range set out within our inaugural

3-year outlook issued in September 2021. With another strong year

of cash flow anticipated from ELG and a robust cash position with

zero debt, we are well positioned to advance the development of

Media Luna and fund our exploration efforts.

“The forecast increase in all-in sustaining

costs at ELG is due to a higher level of waste mined and select

additional fleet rebuilds. Both elements directly relate to the

previously announced expansion of the El Limón pit, which will

extend open pit mining from late-2023 to mid-2024 and provide

additional confidence in a smooth transition from ELG to Media

Luna. Exploration will also remain a key focus, with a total of $39

million in exploration and drilling planned in 2022 with the intent

to grow the overall resource and reserve base.

“Non-sustaining capital expenditures specific to

Media Luna will be announced with the release of the upcoming

Technical Report scheduled for the end of March. With the increased

activity associated with the project, we expect expenditures to

materially increase in 2022 and peak in 2023, with a tail in

2024.

“2022 is a pivotal year for Torex and will set

the foundation for our future. The strength of our underlying

business will enable us to continue to execute on our plan –

optimize and extend operations at ELG, de-risk and advance Media

Luna, grow reserves and resources and invest in other value

accretive opportunities.”

2022 PRODUCTION OUTLOOKGold

production in 2022 is expected to be between 430,000 ounces and

470,000 ounces. The guided range is consistent with the range of

430,000 to 470,000 ounces outlined within the Company’s inaugural

3-year production outlook released in September 2021.

Quarterly production is expected to be the

lowest in Q1 and the highest in Q4, with relative similar levels of

production anticipated in Q2 and Q3. The quarterly variability is

attributed to sequencing of the open pits, which is expected to

result in processed grades increasing slightly through the

year.

2022 COST OUTLOOKTotal cash

costs in 2022 are expected to be moderately higher than the result

delivered in 2021, driven by higher labour rates for our employees

and contractors, higher reagent costs, higher electricity

consumption and unit rates, and other consumables. These factors

will be partially offset by a higher level of mined waste

capitalized versus expensed. All-in sustaining costs in 2022 are

expected to be above the levels achieved in 2021, primarily as a

result of a greater level of capitalized waste and modestly higher

sustaining capital expenditures in the open pit driven by the

decision to extend the life of the El Limón deposit. The gold price

used within operational guidance is consistent with the $1,700 per

ounce assumption used when setting 2021 guidance.

The strip ratio for 2022 is expected to average

8:1, slightly higher than the 7.3:1 result in 2021. The forecast

strip ratio for 2022 is consistent with the optimized mine plan

that spreads out the pushback strip ratio over 2022 and 2023.

2022 CAPITAL EXPENDITURE

OUTLOOKSustaining capital expenditures in 2022 are guided

at $85 million to $105 million, of which $50 million to $60 million

is related to capitalized waste stripping. The year-over-year

increase in both capitalized waste and sustaining capital

expenditures is directly attributable to the pushback of the El

Limón open pit. The pushback will result in a greater level of

waste mined in 2022 as well as additional equipment rebuilds, which

are required to extend the life of the open pit fleet into mid-2024

when open pit reserves are expected to be depleted.

Non-sustaining capital expenditures specific to

ELG are guided at $15 million to $20 million. The lower level of

expenditure relative to 2021 reflects the anticipated completion of

Portal #3 by mid-year and no further investment in the Company’s

monorail-based mining technology.

Full-year non-sustaining capital expenditure

guidance for Media Luna will be announced when the Company releases

an updated Technical Report for the broader Morelos Property at the

end of March. Anticipated project-specific investment in Q1 2022 is

estimated at $50 million, with the quarterly level of project

expenditures anticipated to increase through the year as

development activities ramp-up.

EXPLORATION OUTLOOKThe Company

plans to invest approximately $39 million in exploration and

drilling in 2022, with the purpose of increasing the overall

resource and reserve base of the Morelos Property. Details of the

planned exploration programs are as follows:

- Media Luna:

Approximately $19 million is budgeted for infill and step-out

drilling at Media Luna as well as an initial infill drill program

at the adjacent EPO deposit. A total of 64,000 metres of drilling

is budgeted at Media Luna. Costs of the program will be classified

as non-sustaining capital expenditures.

- ELG Underground:

Approximately $6 million is budgeted for infill and step-out

drilling within the ELG Underground. Drilling targeting deeper

extensions of the Sub-Sill and ELD deposits is expected to commence

in H2 with the completion of Portal #3. A total of 28,000 metres of

drilling is budgeted for the ELG Underground in 2022. Program costs

will be classified as capital expenditures and are included in the

sustaining capital expenditure guidance for ELG.

- Near Mine and

Regional: Approximately $9 million is budgeted to conduct

exploration across the broader land package, including drilling of

near mine targets (28,500 metres of drilling) as well as regional

exploration north and south of the Balsas River (6,000 metres of

drilling). The program expenditures will be classified as

exploration expenses.

- Definition and Grade

Control: Approximately $5 million is budgeted for ore

control and definition drilling in the ELG Open Pit and

Underground. The costs associated with these programs are included

in mining operating expenses and, therefore, reflected in total

cash cost guidance.

2022 CASH FLOW SEASONALITYCash

flow from operations in Q1 will be impacted by the payment of the

Mexican-based Mining Tax (accrued throughout the year and paid out

the following March) as well as Corporate Income Tax owing at

year-end, after accounting for monthly installments made during

2021. Taxes paid will be reflected in cash flow from operations

prior to changes in non-cash working capital. In Q2, cash flow from

operations after changes in non-cash working capital is expected to

be impacted by payment of the employee profit sharing (“PTU”),

which is accrued through the year and paid out in full by May the

following year.

Cash flow seasonality in 2022 will be further

impacted by the expectation that quarterly gold production will be

more heavily weighted to the back half of the year compared to

2021, when production was weighted towards the first half.

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the mining, developing, and exploring of its

100% owned Morelos Gold Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal assets are the El

Limón Guajes mining complex (“ELG” or the “ELG Mine Complex”),

comprising the El Limón, Guajes and El Limón Sur open pits, the El

Limón Guajes underground mine including zones referred to as

Sub-Sill and ELD, and the processing plant and related

infrastructure, which commenced commercial production as of April

1, 2016, and the Media Luna deposit, which is an advanced stage

development project, and for which the Company issued an updated

preliminary economic assessment in September 2018 (the “2018

Technical Report”). The property remains 75% unexplored.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES INC. |

| Jody

Kuzenko |

Dan

Rollins |

| President and CEO |

Vice President, Corporate Development & Investor

Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

QUALIFIED PERSONThe technical and scientific

information in this news release, with respect to the Company’s

2022 production outlook and strip ratio, has been reviewed and

approved by Dave Stefanuto, P. Eng, Executive Vice President,

Technical Services and Capital Projects of the Company, and a

qualified person under National Instrument 43-101.

CAUTIONARY NOTESNON-IFRS FINANCIAL PERFORMANCE

MEASURESTotal cash costs per oz of gold sold (“TCC”), and all-in

sustaining costs per ounce of gold sold (“AISC”), sustaining

capital expenditures and non-sustaining capital expenditures are

financial performance measures with no standard meaning under

International Financial Reporting Standards (“IFRS”) and might not

be comparable to similar financial measures disclosed by other

issuers. Please refer to the “Non-IFRS Financial Performance

Measures” section (the “MD&A Information”) in the Company’s

management’s discussion and analysis (the “MD&A”) for the

quarter ended September 30, 2021, dated November 2, 2021, available

on the Company’s SEDAR profile at www.sedar.com for further

information with respect to TCC, AISC, sustaining capital

expenditures and non-sustaining capital expenditures and a detailed

reconciliation of these non-IFRS financial performance measures the

most directly comparable measure under IFRS. The MD&A

Information is incorporated by reference into this press

release.

FORWARD LOOKING INFORMATIONThis press release

contains "forward-looking statements" and "forward-looking

information" within the meaning of applicable Canadian securities

legislation. While pending the results of the Feasibility Study on

the Media Luna project, the Company is advancing the project and

continues the early works program to maintain the schedule to first

production. However, the Company has not taken a production

decision in advance of completing the Feasibility Study.

Forward-looking information includes, but is not limited to, the

operational outlook for 2022 including gold production, TCC, AISC,

sustaining capital expenditures and non-sustaining capital

expenditures (collectively the 2022 Guidance; another solid year

expected for the Corporation, including another strong year of cash

flow anticipated from ELG, a robust cash position with zero debt,

positioning the Corporation to advance the development of Media

Luna and fund exploration efforts; the expansion of the El Limón

pit, extending the open pit mining from late-2023 to mid-2024 and

for additional confidence in a smooth transition from operations at

ELG to Media Luna; plans to spend a total of $39 million in

exploration and drilling in 2022 with the intent to grow the

overall resource and reserve base on the Morelos Property,

allocated to the various purposes as set out in the press release;

the release date of the upcoming Technical Report scheduled for the

end of March 2022; expenditures to materially increase in 2022 and

peak in 2023, with a tail in 2024; continued to execution on the

Corporation’s plan – optimize and extend operations at ELG, de-risk

and advance Media Luna, grow reserves and resources and invest in

other value accretive opportunities; quarterly production is

expected to be the lowest in Q1 and the highest in Q4, with

relative similar levels of production anticipated in Q2 and Q3;

quarterly variability is attributed to sequencing of the open pits

which is expected to result in processed grades improving through

the year; the strip ratio for 2022, as set out in the press

release; open pit reserves are expected to be depleted by mid-2024;

anticipated Media Luna expenditures specific to Q1 2022 are

currently estimated at $50 million, with the quarterly level of

project expenditure anticipated to increase through the year as

development activities ramp-up; and cash flow seasonality in 2022

will be impacted by the expectation that quarterly gold production

will be more heavily weighted to the back half of the year compared

to 2021 when production was higher during the first half.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as "expects", “planned” or

variations of such words and phrases or statements that certain

actions, events or results “will”, or “is expected to" occur.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, the

inability of the Company’s mining and exploration operations to

operate as intended due to shortage of skilled employees, shortages

in supply chains, inability of employees to access sufficient

healthcare, significant social upheavals, government or regulatory

actions or inactions, and those risk factors identified in the 2018

Technical Report and the Company’s annual information form (“AIF”)

and MD&A or other unknown but potentially significant impacts.

Notwithstanding the Company's efforts, there can be no guarantee

that the Company’s measures to protect employees and surrounding

communities from COVID-19 during this period will be effective.

Forward-looking information is based on the assumptions discussed

in the 2018 Technical Report, AIF and MD&A and such other

reasonable assumptions, estimates, analysis, and opinions of

management made in light of its experience and perception of

trends, current conditions and expected developments, and other

factors that management believes are relevant and reasonable in the

circumstances at the date such information is made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

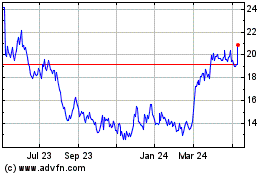

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

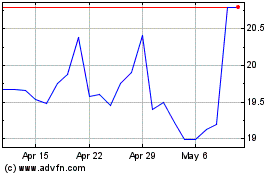

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024