TRX Gold Corporation (TSX: TNX) (NYSE American: TRX) (the “Company”

or “TRX Gold”) today reported its results for the third quarter of

2023 (“Q3 2023”) for the three months ended May 31, 2023. Financial

results are available on the Company’s website.

Key highlights for Q3 2023

include:

- 1,000

tonne per day (“tpd”) mill running efficiently: In Q3

2023, Buckreef Gold poured 4,764 ounces of gold and sold 4,810

ounces of gold, resulting in positive operating cash flow for the

Company of $3.2 million. Year to date, Buckreef Gold poured and

sold 15,794 and 16,068 ounces of gold respectively; both nine-month

production records for the Company, resulting in positive operating

cash flow of $14.6 million.

-

Maintaining strong profit margins: In Q3 2023,

Buckreef Gold recognized revenue of $9.3 million and cost of sales

of $5.4 million, generating gross profit of $3.9 million, gross

profit margin of 42% and Adjusted EBITDA1 of $3.3 million. Year to

date, Buckreef Gold recognized revenue of $29.1 million and cost of

sales of $15.0 million, generating gross profit of $14.1 million,

gross profit margin of 48% and Adjusted EBITDA1 of $11.6

million.

- Sulphide

bulk sample test proves future potential: During the

quarter, the Company pivoted its mining plan to include a test bulk

sample of sulphide ore which was subsequently processed through

Buckreef Gold’s existing processing plant. Over 6,500 tonnes of

sulphide ore were successfully processed, achieving an indicative

gold recovery of 88.7%. This was a significant achievement as

approximately 90% of Buckreef Gold’s gold mineral resource is held

in sulphide material, thus unlocking the significant economic

potential of the project. The bulk sample test indicates that the

Company can likely process sulphide ore through its existing

processing plant, thus potentially minimizing capex for future

plant expansions.

-

Reinvesting cash flow to grow operations: The

Company used cash flow from operations to invest in the further

growth of Buckreef Gold, including procurement of an additional

1,000 tpd ball mill to increase annual throughput by 75-100%

through the addition of this new mill, and advanced construction of

a significantly expanded tailings storage facility to accommodate

higher production volumes.

-

Exploration results from high-priority gold zones:

During the quarter, the Company drilled 839 meters at Buckreef Gold

and announced near surface drill results at the Anfield and Eastern

Porphyry Zones, with highlights of 14 meters @ 3.5 g/t including

3.0 meters @ 10.9 g/t from a downhole depth of 47 meters from the

Eastern Porphyry zone, and 2.94 meters grading 13.74 g/t, from a

downhole depth of 43 meters in the Anfield Zone. Year to date, the

Company drilled 11,171 meters of exploration, infill and

sterilization drilling.

TRX Gold’s CEO, Stephen Mullowney comments:

“These positive results continue to demonstrate the immense

opportunity at Buckreef Gold and reflect successful execution of

the Company’s sustainable business plan where cash flow from

operations funds value creating activities.”

Figure 1. The Buckreef Gold Mine oxide starter

pit during Q3 2023

Figure 2. The Buckreef Gold Tailings Storage

Facility expansion; liner installation at TSF 2.2 during Q3

2023

Outlook for the Remainder of Fiscal

2023

-

Maintaining market guidance: The Company continues

to expect gold production from the 1,000+ tpd processing plant for

fiscal 2023 to be between 20,000 - 25,000 ounces and expects total

average cash cost2 to be at the upper end of the originally

estimated range of between $750 - $850 per ounce.

-

Near-term production growth on target: The Company

continues to advance a project aimed at increasing the average

annual throughput by 75-100% with an expansion of the existing

carbon-in-leach plant. Construction will seamlessly integrate into

the existing operating plant, with the addition of a new 1,000 tpd

ball mill and construction of an extended foundation and bund wall

to support the additional leach tanks, as well as all ancillary

work. The capital cost of the expanded plant is expected to be

approximately US$6 million and will be funded using operating cash

flow from Buckreef Gold. Construction of the expanded milling

circuit is expected to start in Q4 2023 and potentially benefit

production in early calendar 2024.

- Larger

development project advancement: The Company continues to

work with our principal consultants on advancing the larger

development project that will target a large-scale gold mine

operation, including advanced metallurgical testing across the

deposit and geotechnical studies for a deeper pit. Concurrent with

this work, the Company has started assessing a significantly larger

processing facility.

Webcast Details

When: Wednesday, July 19 at 11:00 AM ESTWebcast

URL: Click here or copy paste into web browserA replay will be made

available for 30 days following the call on the Company’s

website.

Qualified Person

Mr. Andrew Mark Cheatle, P.Geo., MBA, ARSM, is

the Company’s Qualified Person under National Instrument 43-101

“Standards of Disclosure for Mineral Projects” (“NI 43-101”) and

has reviewed and assumes responsibility for the scientific and

technical content in this press release.

Non-IFRS Performance

Measures

The company has included certain non-IFRS

measures in this news release. The following non-IFRS measures

should be read in conjunction with the Company’s unaudited interim

consolidated financial statements for the three and nine months

ended May 31, 2023 filed on Sedar and Form 6-K with the Securities

and Exchange Commission (“SEC”), as well as the Company’s audited

consolidated financial statements included in the Company's Annual

Report on Form 40-F and Annual Information Form for the year ended

August 31, 2022. The financial statements and related notes of TRX

Gold have been prepared in accordance with International Financial

Reporting Standards (“IFRS”). Additional information has been filed

electronically on SEDAR and with the SEC and is available online

under the Company’s profile at www.sedar.com and the Company’s

filings with the SEC at www.sec.gov and on our website at

www.TRXGold.com.

Cash cost per ounce of gold

sold

Cash cost per ounce of gold sold is a non-IFRS

performance measure and does not constitute a measure recognized by

IFRS and does not have a standardized meaning defined by IFRS. Cash

cost per ounce may not be comparable to information in other gold

producers’ reports and filings. As the Company uses this measure to

monitor the performance of our gold mining operations and its

ability to generate positive cash flow, beginning in Q1 2023, total

cash cost per ounce of gold sold starts with cost of sales related

to gold production and removes depreciation.

Adjusted EBITDA

Adjusted EBITDA is a non-IFRS performance

measure and does not constitute a measure recognized by IFRS and

does not have a standardized meaning defined by IFRS. Adjusted

EBITDA may not be comparable to information in other gold

producers’ reports and filings. Adjusted EBITDA is presented as a

supplemental measure of the Company’s performance and ability to

service its obligations. Adjusted EBITDA is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in the industry, many of which present

Adjusted EBITDA when reporting their results. Issuers present

Adjusted EBITDA because investors, analysts and rating agencies

consider it useful in measuring the ability of those issuers to

meet their obligations. Adjusted EBITDA represents net income

(loss) before interest, income taxes, and depreciation and also

eliminates the impact of a number of items that are not considered

indicative of ongoing operating performance.

Certain items of expense are added, and certain

items of income are deducted from net income that are not likely to

recur or are not indicative of the Company’s underlying operating

results for the reporting periods presented or for future operating

performance and consist of:

• Change in fair value of derivative financial

instruments; • Accretion related to the provision for reclamation;

and • Share-based compensation expense; and• Tax adjustments

related to a prior period tax assessment (2012-2020).

The following table provides a reconciliation of

net income (loss) and comprehensive income (loss) to Adjusted

EBITDA per the financial statements for the three and nine months

ended May 31, 2023.

|

|

Three Months Ended |

Three Months Ended |

Nine Months Ended |

Nine Months Ended |

|

|

May 31, 2023 |

May 31, 2022 |

May 31, 2023 |

May 31, 2022 |

|

Net (loss) income and comprehensive (loss) income per financial

statements |

(374) |

|

3,188 |

|

4,736 |

|

28 |

|

| Add: |

|

|

|

|

|

Depreciation |

376 |

|

47 |

|

863 |

|

172 |

|

| Interest

and other expenses |

327 |

|

54 |

|

1,368 |

|

434 |

|

| Income

tax expense |

1,719 |

|

108 |

|

4,383 |

|

259 |

|

| Change in

fair value of derivative financial instruments |

730 |

|

(1,345) |

|

(1,670) |

|

(1,408) |

|

|

Share-based payment expense |

541 |

|

612 |

|

1,939 |

|

2,125 |

|

|

Adjusted EBITDA |

3,319 |

|

2,664 |

|

11,619 |

|

1,610 |

|

The Company has included “cash costs per ounce

of gold sold” and “Adjusted EBITDA” as non-IFRS performance

measures throughout this news release as TRX Gold believes that

these generally accepted industry performance measures provide a

useful indication of the Company’s operational performance. The

Company believes that certain investors use this information to

evaluate the Company’s performance and ability to generate cash

flow. Accordingly, they are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

About TRX Gold Corporation

TRX Gold is rapidly advancing the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 2020, the

project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource of 35.88 MT at 1.77 g/t gold containing 2,036,280 ounces

of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t

gold for 635,540 ounces of gold. The leadership team is focused on

creating both near-term and long-term shareholder value by

increasing gold production to generate positive cash flow. The

positive cash flow will be utilized for exploratory drilling with

the goal of increasing the current gold Resource base and advancing

the Sulphide Ore Project which represents 90% of current gold

Resources. TRX Gold’s actions are led by the highest ESG standards,

evidenced by the relationships and programs that the Company has

developed during its nearly two decades of presence in Geita

Region, Tanzania.

For investor or shareholder inquiries,

please contact:Investors

RelationsChristina Lalli Vice President, Investor

RelationsTRX Gold Corporation+1-438-399-8665

c.lalli@TRXgold.comwww.TRXgold.com

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC and the various Canadian

securities authorities. You can review and obtain copies of these

filings from the SEC's website at http://www.sec.gov/edgar.shtml

and the Company’s profile on the System for Electronic Document

Analysis and Retrieval (“SEDAR”) at www.sedar.com.

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

The TSX and NYSE America have not reviewed and

do not accept responsibility for the adequacy or accuracy of the

contents of this press release, which has been prepared by the

management of TRX Gold.

1 Refer to “Non-IFRS Performance Measures” section.2 Refer to

“Non-IFRS Performance Measures” section.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0cea5cd6-8933-4b97-a787-0da4bf2bc720

https://www.globenewswire.com/NewsRoom/AttachmentNg/2cf72546-bc0c-4624-aed7-eb0036d572fd

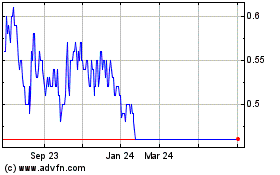

TRX Gold (TSX:TNX)

Historical Stock Chart

From Nov 2024 to Dec 2024

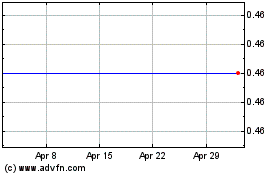

TRX Gold (TSX:TNX)

Historical Stock Chart

From Dec 2023 to Dec 2024