Stella-Jones Announces Intention to Acquire McFarland Cascade Holdings, Inc.

November 02 2012 - 7:00AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. WIRE SERVICES OR FOR DISTRIBUTION INTO THE UNITED

STATES.

Stella-Jones Inc. (TSX:SJ) today announced that it has signed a non-binding

letter of intent to acquire the shares of McFarland Cascade Holdings, Inc.

("McFarland"), a provider of treated wood products based in the state of

Washington.

The letter of intent contemplates a purchase price of approximately US$230.0

million, which includes approximately US$113.0 million of net working capital

and the assumption of certain liabilities. The transaction, if finalized, is

expected to close in November 2012 and is subject to customary closing

conditions, including entry into a definitive purchase agreement, customary

approvals and satisfactory due diligence. Stella-Jones has already received U.S.

antitrust clearance with regard to the proposed acquisition. Stella-Jones plans

to finance the transaction through a combination of term financing and equity.

Founded in 1916, McFarland is one of North America's long-standing suppliers of

utility poles, as well as crossarms, piling and crane mats. It is also a

provider of treated lumber for outdoor home projects, including composite

decking, railings and related accessories. It serves its customer base through

four wood treating facilities located in Tacoma, Washington; Eugene, Oregon;

Electric Mills, Mississippi; and Galloway, British Columbia; as well as through

an extensive distribution network. McFarland's sales for its fiscal year ended

December 31, 2011 were approximately US$255.0 million. Sales for its fiscal year

ended December 31, 2012 are expected to reach approximately US$280.0 million and

earnings before interest, taxes, depreciation and amortization ("EBITDA") for

2012 are expected to be approximately US$29.0 million.

"The potential acquisition of McFarland would further enhance the range of

Stella-Jones' offerings in the North American wood treating industry. A strong

commitment to product quality and customer service has been a hallmark of

McFarland's business operations, which Stella-Jones is committed to continue and

build on," said Brian McManus, President and Chief Executive Officer of

Stella-Jones.

This press release is not an offer to sell, or a solicitation of an offer to

buy, any securities. The securities referred to in this press release have not

been and will not be registered under the U.S. Securities Act of 1933, as

amended and may not be offered or sold in the United States except pursuant to

an exemption from, or in a transaction not subject to, the registration

requirements of the U.S. Securities Act of 1933.

NON-GAAP MEASURE

Earnings before interest, taxes, depreciation and amortization ("EBITDA") is a

financial measure not prescribed by Canadian generally accepted accounting

principles ("GAAP") and is not likely to be comparable to similar measures

presented by other issuers. Management considers it to be useful information to

assist knowledgeable investors in evaluating the cash generating capabilities of

the Company.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX:SJ) is a leading producer and marketer of pressure

treated wood products. The Company supplies North America's railroad operators

with railway ties, timbers and recycling services; and the continent's

electrical utilities and telecommunications companies with utility poles.

Stella-Jones also provides industrial products and services for construction and

marine applications, as well as residential lumber to retailers and wholesalers

for outdoor applications. The Company's common shares are listed on the Toronto

Stock Exchange.

Except for historical information provided herein, this press release contains

information and statements of a forward-looking nature concerning the proposed

acquisition of McFarland. Forward looking information also includes information

relating to McFarland's sales and EBITDA for its fiscal year ended December 31,

2012. These statements are based on suppositions, uncertainties and other

factors as well as on management's best possible evaluation of future events.

Such factors may include, without excluding other considerations, satisfactory

completion of due diligence, satisfaction of the other closing conditions,

failure to complete the proposed acquisition for any other reason, fluctuations

in quarterly results, evolution in customer demand, the impact of price

pressures exerted by competitors, and general market trends or economic changes.

As a result, readers are advised that actual results may differ from expected

results and should not place undue reliance on forward-looking information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Stella-Jones Inc.

Eric Vachon, CPA, CA

Senior Vice-President and Chief Financial Officer

(514) 940-3903

evachon@stella-jones.com

Martin Goulet, CFA

MaisonBrison Communications

(514) 731-0000

martin@maisonbrison.com

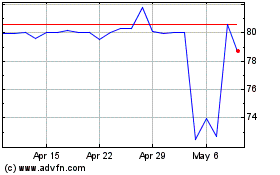

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jul 2023 to Jul 2024