Sabre Gold Mines Corp. (TSX: SGLD; OTCQB: SGLDF)

(the “Company” or “Sabre Gold”) is pleased to announce the results

of a Preliminary Economic Assessment (“PEA”) for the Company’s 100%

owned, road-accessible Brewery Creek Gold Project located in Yukon

Territory, Canada.

All amounts shown are in United States dollars

and metric units of measurement unless otherwise Stated.

PEA Highlights:

-

After-tax NPV at 5% of $112 million at an Internal Rate of Return

(“IRR”) of 27.6% at $1,700 per ounce gold increasing to $157

million at an IRR of 35.7% at $1,900 per ounce gold;

-

After-tax average annual cash flow of $36 million at $1,700 per

ounce gold increasing to $44 million at $1,900 per ounce gold

-

Average Annual Production of 60,000 ounces per year for a total

473,000 ounces gold over an initial 8 year mine life;

-

Total cash cost of $850 per ounce and all-in sustaining cost

(“AISC”) US$966 per ounce gold;

-

Pre-production capital costs of $105 million with life of mine

sustaining costs of $18 million;

-

Payback period of 2.6 years at $1,700 per ounce gold;

-

Excellent expansion potential to extend mine life and annual

production with three open prospective resource areas and several

targets within a 182 square kilometers project boundary; and,

-

Lower technical and execution risk as a past brownfields producer

with existing infrastructure and road access from previous mining

operation.

Giulio T. Bonifacio, President and Chief

Executive Officer of Sabre Gold, stated: “The PEA and initial

results confirms our plans to resume production at Brewery Creek

with what will be low re-start capital with attractive economics

which we believe will be further enhanced in 2022. Sabre Gold

intends to continue the expansion of gold resources at Brewery

Creek and focus on several key opportunities to enhance value,

discussed in detail below. The PEA is advanced in several

categories as the predecessor company was initially targeting

completion of a feasibility study. Sabre Gold intends to move to a

feasibility level study upon completion of the advancement of key

opportunities, those of which will not impact our targeted

permitting timeline. Our permitting efforts will also now focus on

expanding the previously permitted area for purposes of allowing

for increases to our annual production profile.” The PEA was

prepared in accordance with National Instrument 43-101 (“NI

43-101”) and evaluated the economics of resuming mining at Brewery

Creek through open pit mining and heap leaching mined material for

gold recovery to doré. The PEA study was prepared by Kappes,

Cassiday & Associates of Reno, Nevada in cooperation with Tetra

Tech Inc. of Golden, CO, Gustavson and Associates of Lakewood, CO

and Wood Environment & Infrastructure Solutions, of Vancouver,

British Columbia.

|

PEA Summary - Assumptions and Results |

|

Description |

Units |

Pre-Tax |

Post-Tax |

|

Net Present Value (NPV 5%) |

US$ M |

$160 |

$112 |

|

Internal Rate of Return (IRR) |

% |

|

33.5 |

|

27.6 |

|

Payback Period (undiscounted) |

Years |

|

|

2.6 |

|

LOM Average Annual Cash Flow |

US$ M |

|

44 |

|

36 |

|

LOM Cumulative Cash Flow (undiscounted) |

US$ M |

|

237 |

|

170 |

|

LOM Average Cash Operating costs |

US$ per ounce |

$850 |

|

LOM Average AISC* |

US$ per ounce |

$966 |

|

Pre-Production Capital Costs |

US$ M |

$105 |

|

Sustaining Capital Costs (LOM) |

US$ M |

$18 |

|

Gold Price |

US$ per ounce |

$1,700 |

|

Mine Life |

Years |

|

8 |

|

Average Head Grade (diluted) |

g/t Au |

|

1.05 |

|

Average Recovery |

% |

|

75.4 |

|

Average Annual Mining Rate |

Tonnes per day |

|

9,000 |

|

Average Annual Gold Production |

Ounces per year |

|

60,000 |

|

Total LOM Recovered Gold |

Ounces |

|

473,180 |

* AISC - All-In-Sustaining-Cost

Mineral Resource Estimate

Measured, Indicated and Inferred Mineral

Resource estimates have been produced for the eleven named deposits

by Gustavson Associates. The results of the estimation result in

Brewery Creek Project containing Measured and Indicated Mineral

Resources totaling 34.5 million tonnes at 1.03 g/t, containing 1.14

million ounces of gold. Inferred resources total 35.9 million

tonnes at 0.88 g/t containing 1.02 million ounces of gold.

A Lerchs-Grossmann optimization pit shell

constrained the resource using a $2,000/oz gold price and the

cutoff grade used is based on a gold price of $1,500/oz and is an

internal cutoff grade. The process cost used for the pit shell and

cutoff grade includes project general and administrative expenses

as well as an average haulage cost to transport process material to

the leach pad. Only leachable Measured, Indicated and Inferred

Resources are being considered in the PEA.

During the work for the PEA, Gustavson reviewed

the classification utilized to classify material as Measured,

Indicated and Inferred and updated the classification to more

appropriately distribute the material into the classification

categories, based on an average drill spacing instead of a closest

point analysis. This technique utilizes a cell declustering

algorithm to quantify drill spacing taking into account geologic

anisotropy.

|

Total Mineral Resources |

|

Classification |

Tonnes (‘000) |

Grade(g/t) |

Contained (oz Au) |

|

Measured – LeachableIndicated - Leachable |

9,31013,670 |

1.181.11 |

353,000487,000 |

|

Total Leachable M & I |

22,980 |

1.14 |

840,000 |

|

Inferred - Leachable |

16,200 |

0.94 |

489,000 |

|

Measured – SulphideIndicated – Sulphide |

3,9507,540 |

0.770.85 |

98,000206,000 |

|

Total Sulphide M&I |

11,490 |

0.82 |

304,000 |

|

Inferred - Sulphide |

19,700 |

0.83 |

527,000 |

The Mineral Resource Estimate was divided into

two categories, leachable and non-leachable resources. Leachable

resources are materials that are amenable to cyanide leach

processing and can recover gold economically. Leachable material

was modeled by using CN soluble gold values to determine potential

recoverable gold.

The PEA is targeting only leachable resources

from the Measured, Indicated and Inferred categories to develop the

mine plan and resulting cash flow estimates. Leachable versus

non-leachable resources are determined by using the estimated total

gold grades and estimated recoveries in the resource model. While

the resource tables use cyanide soluble gold for categorization the

gold production, gold grades and cutoff grades are shown as in-situ

for easy comparison.

|

Leachable Mineral Resources by Pit being

evaluated |

|

Classification by Pit |

Tonnes (‘000) |

Grade (g/t) |

Contained (oz Au) |

|

Measured - LeachableKegLuckyBohemia-SchoonerEast

& West Big Rock |

3,2306272,5002,950 |

1.141.591.350.99 |

1193210894 |

|

Indicated - LeachableKegLuckyBohemia-SchoonerEast

& West Big Rock |

4,1601,0701,3101,630 |

1.131.761.310.94 |

151615549 |

|

Total Leachable M & I |

17,477 |

1.18 |

669 |

|

Inferred - LeachableKegLuckyBohemia-SchoonerEast

& West Big Rock |

3,0207676181,030 |

1.051.521.450.80 |

102382926 |

|

Total Leachable Inferred |

5,435 |

1.11 |

195 |

Note: The Keg area includes the previously mined pits of Golden,

Kokanee, portions of Canadian and UpperFosters and the unmined

Lower Fosters deposit. Resources estimates in Table 2 are prior to

final pit optimizationand design used to develop diluted

potentially minable material.

The Mineral Resource Estimate was prepared by

Gustavson Associates, LLC (Gustavson). The resource estimate was

conducted in accordance with Canadian National Instrument 43-101

Standards of Disclosure for Mineral Projects (NI 43-101), June

30,2011, and Canadian Institute of Mining, Metallurgy and Petroleum

(CIM) “Best Practices and Reporting Guidelines for Mineral

Resources and Mineral Reserves”, May 10, 2014.

Mineral Resources are not mineral reserves and

do not demonstrate economic viability. The quantity and grade of

inferred resources reported herein are uncertain in nature and

exploration completed to date is insufficient to define these

Mineral Resources as indicated or measured. There is no certainty

that all or any part of the Mineral Resource will be converted to

mineral reserves. Mineral Resources are not mineral reserves and

may be materially affected by environmental, permitting, legal,

socio-economic, marketing, political, or other factors. Quantity

and grade are estimates and are rounded to reflect the fact that

the resource estimate is an approximation. Gustavson knows of no

environmental, permitting, legal, title, taxation, socio-economic,

marketing, political, or other factors that could materially affect

the mineral resource. The effective date of this Mineral Resources

Report is May 31, 2020.

Mining

The Brewery Creek project was evaluated by Tetra

Tech for owner operated mining in the PEA as open pit truck and

shovel operation. Mining was considered on the leachable (oxide)

portions of nine deposits aligned in a more-or-less east-west trend

along 8 kilometers in what is known locally as the “reserve trend”.

The deposits are West Big Rock, East Big Rock, Upper & Lower

Fosters, Kokanee, Golden, Lucky, Bohemian and Schooner. The mine

schedule calls for mining and processing over 18.7 million tonnes

of heap leach feed and 79.6 million tonnes of waste for a strip

ratio of 4.03:1. The current life of mine is 7.9 years.

The base case assumes mining and crushing for

275 days per year at an average rate of 9,000 tonnes per day. All

heap leach feed material will be crushed to 80% passing 19 mm and

conveyor stacked onto existing leach pad which will be off loaded

with a 2-meter cushion of old material remaining on the pad to

protect the liner. The off-loaded material will be used as back

fill to reclaim old pits and or stacked on new storage facilities.

The last three original designed cells will be built in year 3.

|

Pit Area |

Sources of LOM Mill Feed (kt) |

Gold Grade (g/tonne) |

|

Keg |

7,173 |

1.00 |

|

Lucky |

2,250 |

1.38 |

|

Bohemia-Schooner |

4,300 |

1.23 |

|

East & West Big Rocks |

4,933 |

0.80 |

|

Total from Pits |

18,656 |

1.05 |

Infrastructure

Existing infrastructure includes the existing

main access road, two-man camps with a combined capacity for

approximately 100 personnel, existing 7 cell leach pad plus

foundations for 3 un-built cells, existing haul road network which

requires only minor refurbishment, three process solution ponds

which require cleaning and new liners, and the former truck shop, a

steel structure with the truck bays removed which is currently used

as offices and warehousing.

Summary of Economic Results

|

Gold Price Sensitivity |

|

Gold Price |

NPV 5% After Tax |

NPV 5% Pre-Tax |

Avg. Annual After tax CF |

|

US$/oz |

US$M |

IRR% |

US$M |

IRR% |

US$M |

|

$1450 |

53.4 |

16.2 |

73.0 |

19.1 |

27.2 |

|

$1500 |

65.4 |

18.6 |

90.4 |

22.1 |

29.1 |

|

$1600 |

88.7 |

23.2 |

125.2 |

28.0 |

32.7 |

|

$1700 |

111.6 |

27.6 |

160.0 |

33.5 |

36.3 |

|

$1800 |

134.3 |

31.7 |

194.7 |

38.9 |

39.9 |

|

$1900 |

156.8 |

35.7 |

229.5 |

44.2 |

43.5 |

|

$2000 |

179.3 |

39.6 |

264.2 |

49.2 |

47.1 |

|

PEA Capital Cost Summary |

|

Description |

Pre-Production |

Sustaining Capital |

Life of Mine |

|

|

US$000s |

US$000s |

US$000s |

|

Pre-strip, off load heap |

$18,105 |

|

$18,105 |

|

Mine equipment (net of lease) |

|

4,499 |

$4,601 |

|

9,100 |

|

Site Infrastructure |

|

29,207 |

|

11,182 |

|

40,389 |

|

Site Infrastructure Haul Roads |

|

1,810 |

|

|

1,810 |

|

Process Plant |

|

29,649 |

|

|

29,649 |

|

Indirects |

|

2,655 |

|

|

2,655 |

|

Owners, EPCM |

|

8,487 |

|

|

8,487 |

|

Contingency |

|

10,974 |

|

2,236 |

|

13,210 |

|

Subtotal |

$105,386 |

$18,019 |

$123,405 |

|

Working Capital |

|

11,181 |

|

(11,181) |

|

- |

|

GST (recovery) |

|

5,269 |

|

(5,269) |

|

- |

|

Reclamation |

|

- |

|

13,992 |

|

13,992 |

|

Total Capital |

$121,836 |

$15,561 |

$137,397 |

|

PEA Operating Costs Summary |

|

Mining per tonne moved |

|

1.96 |

|

Strip ratio |

4:1 |

|

Unit Operating Costs (per tonne leached) |

US$/tonne |

|

Mining |

$ |

11.31 |

|

Processing |

|

7.62 |

|

General & Administrative |

|

2.52 |

|

Total Operating Costs |

$ |

21.45 |

|

Total Cash Costs per ounce gold sold |

$850/oz |

|

All-in-Sustaining Costs per ounce gold sold |

$966/oz |

Metallurgy

The process plant flow sheet was developed by

Kappes, Cassidy Associates of Reno, Nevada and is designed to crush

and stack heap leach feed approximately 275 days per year and to

recover gold from the heap leach solutions 365 days per year. The

flow sheet used a daily feed rate of 9,000 tonnes per day or an

annual feed rate of approximately 2.48 million tonnes.

Historically, preg-robbing material had hampered

gold recoveries on the former heap leach pad. Since 2011, Sabre

Gold has routinely assayed for preg-robbing material and the data

reveals that the preg-robbing material is confined to sedimentary

rocks which were abundant host rocks in the Pacific and Blue pits

during the previous mining operation. The pits being targeted for

mining in the PEA have gold hosted in intrusive rocks which are

largely void of preg-robbing characteristics and contain only minor

amounts of sedimentary rocks. There is a strong visual difference

between the sedimentary and intrusive rocks at Brewery providing

easy visual ore control during mining if sediments are

encountered.

Material will be delivered to the crushing area

and reduced to a nominal 80% passing 19 mm after tertiary crushing

with modular crushing units. The crushed material will be stacked

on the leach pad by a conveyor stacking system and leached with a

low concentration cyanide solution. Gold recovery from the leach

solutions is accomplished through an ADR plant.

Estimates for gold recovery and consumption

rates of reagents is based on metallurgical testing conducted by

McClelland Laboratories and SGS. Testing was conducted on fresh

drill core samples in 2013, 2016 and 2020. In total 47 column leach

tests plus other testing was conducted on the nine deposits

included in the PEA and two deposits not included in the PEA.

Compacted permeability test work indicate that cement agglomeration

is not required for heap heights up to 60 meters.

|

Heap Leach Feed Source |

Au |

NaCN |

Lime |

|

Schooner |

76 |

0.40 |

2.5 |

|

Fosters |

82 |

0.21 |

2.0 |

|

Bohemian |

82 |

0.26 |

3.0 |

|

Golden |

75 |

0.21 |

1.7 |

|

Kokanee |

65 |

0.23 |

1.4 |

|

West Big Rock |

87 |

0.30 |

3.9 |

|

East Big Rock |

81 |

0.35 |

3.4 |

|

Lucky |

58 |

0.23 |

1.4 |

Note: The Keg Pit area consists of Fosters, Golden and Kokanee

deposits

Key Opportunities to Enhance

Value

The PEA outlined several opportunities to

enhance the economic potential of Brewery Creek including the

following:

-

Exploration drilling to expand the leachable mineral resource with

several prospective targets identified

-

In-fill drill the areas of inferred resource in the deposits

analyzed in this PEA to upgrade them to Measured and Indicated

levels of confidence for future conversion to reserves

-

Conduct trade off study for contract mining versus owner mining to

potentially reduce up front capital and enhance LOM economics.

-

New leach pad locations should be investigated to accommodate

material from additional deposits as they are brought into minable

status.

-

Further evaluation of the potential of the sulphide material at

depth in all the deposits. Preliminary metallurgical testing has

shown good recoveries of gold can be obtained by a flotation

process.

-

Continue expanding and upgrading resources at 3 oxide deposits not

included in the PEA, Classic, Lonestar and Sleeman.

-

The Classic deposit is located approximately 3 km south of the main

Brewery Creek deposit trend. The deposit was originally discovered

in 1991 (Hemlo Gold Mines Inc.-Loki Gold Corporation) through a

southern grid expansion, the Classic Zone was then being classified

as an isolated, arsenic gold anomaly. The deposit is currently

defined by 52 reverse-circulation drillholes and 17 core holes,

totaling 13,478 meters. The currently identified mineralization

lies on the southwest side of the Classic Fault. Predominant rock

units hosting mineralization contain variable percentages of

syenite (alkali) and biotite monzonite (increasing plagioclase).

Mineralization is found to exist within centimeter-scale sheeted

quartz veinlets. Structurally, the Classic Zone is open at depth

and in both directions along strike. Cutting across the eastern

portion is the northwest trending, steeply southwest dipping

Classic fault which is mapped to be post intrusion and post

mineralization.

-

The Lone Star mineralized area is the fault offset portion of the

Classic deposit and lies along the northeast side of the Classic

Fault, southeast of and adjacent to the Classic Zone. Surface

mineralization was first recognized by soil sampling in the 1990’s

but the area remained untested until 2012. Drilling in 2012

consists of 17 core holes and 12 RC holes, totaling 6,147 meters.

The same alkalic suite of intrusions that host Classic also host

Lone Star. The suite contains syenite, biotite monzonite,

monzodiorite, diorite, and gabbro; syenite is the most abundant.

The biotite monzonite intrusions commonly form very well developed,

course-grained skarn halos where adjacent to limestone and carry

copper-gold mineralization. Alteration includes development of a

propylitic mineral assemblage of chlorite, calcite and pyrite, and

local development of sheeted quartz-carbonate-pyrite-arsenopyrite

±chalcopyrite veins. Three styles of mineralization occur at Lone

Star; elevated Au associated with skarns, disseminations in

syenite, and auriferous sheeted quartz veins. The geometry of the

system is poorly understood; it remains open in both strike

directions and at depth.

- The Sleeman deposit is located to

the east of the Brewery Creek Reserve Trend (BCRT). It was

discovered by mapping, soil sampling and trenching, and was first

drilled in 1992. The zone is currently defined by 7

reverse-circulation drillholes and 58 core drillholes, totaling

11,374 meters. Mineralization at Sleeman is associated with an

altered tabular-shaped quartz monzonite intrusion that cuts

siltstone of the Steel formation and graphitic argillite of unknown

affinity. The intrusion strikes 120° azimuth and dips 65°

southwest. It has a known strike length of 500 meters and is open

in both strike directions and at depth. All mineralization is

associated with altered and veined areas. The style of veining and

alteration at Sleeman is similar to the other deposits found within

the BCRT with the exception of the presence of elevated base metal

concentrations, particularly lead and zinc.

First Nations, Community Engagement and

Environment

Community and First Nation engagement has been a

strong component of the Brewery Creek Project dating to the initial

mine operator, Viceroy Resources. In 2016 Golden Predator updated

and modernized the Socio-Economic Agreement with the Tr’ondek

Hwech’in (TH), which addresses environmental responsibilities,

permitting, education and employment as well as preferential

contracting opportunities and wealth sharing. The Brewery Creek

Project lies with the traditional territory of both the Tr’ondek

Hwech’in and the First Nation of Na Cho Nyak Dun (NND). Regardless

of the pre-existing relationship and agreement with TH and the

proximity to Dawson City, Yukon the Company has and will continue

to consult with both First Nations on all permitting and regulatory

matters.

The previous operator and the company have

conducted extensive environmental studies and monitoring programs

that document the property since the early 1990’s. Studies include

water quality, fisheries, wildlife, heritage and vegetation. The

company continues to conduct regular environmental sampling and

monitoring on the property.

Disclosure

The PEA results are summarized for purposes of

this press release. Further details on the PEA and technical report

will be filed on SEDAR and the Company’s website by January 31,

2022.

The PEA is preliminary in nature and it includes

inferred mineral resources that are considered too speculative to

be used in an economic analysis except as allowed for by Canadian

Securities Administrator’s NI 43-101 in PEA studies. There is no

guarantee that the inferred mineral resources can be converted to

Indicated or Measured mineral resources, and as such, there is no

guarantee the project economics described in this report will be

achieved.

Qualified Persons

The technical content of this news release has

been reviewed and validated by Michael Maslowski CPG, a Qualified

Person as defined by National Instrument 43-101 that the

information contained in the release is consistent with that

provided by the independent Qualified Persons responsible for the

PEA. Mr. Maslowski is employed by Sabre Gold Mine Corp as Vice

President of Technical Services and Exploration.

Non-IFRS Measures

The Company has included certain non-IFRS

measures in this press release. The Company believes that these

measures provide investors an improved ability to evaluate the

underlying performance of the project. The non-IFRS measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These measures do not

have any standardized meaning prescribed under IFRS, and therefore

may not be comparable to other issuers.

About Sabre Gold Mines

Corp.

Sabre Gold is a diversified, multi-asset

near-term gold producer in North America which holds 100-per-cent

ownership of both the fully permitted Copperstone gold mine located

in Arizona, United States, and the Brewery Creek gold mine located

in Yukon, Canada, both of which are former producers. Management

intends to restart production at Copperstone followed by Brewery

Creek in the near term. Sabre Gold also holds other investments and

projects at varying stages of development.

Sabre Gold’s two advanced projects have

approximately 1.5 million ounces gold in the Measured and Indicated

categories, and approximately 1.2 million ounces gold in the

Inferred category. Additionally, both Copperstone and Brewery Creek

have considerable exploration upside with a combined land package

of over 230 square kilometers that will be further drill tested

with high-priority targets currently identified. Sabre Gold is led

by an experienced team of mining professionals with backgrounds in

exploration, mine building and operations.

For further information please visit the Sabre

Gold Mines Corp. website (www.sabre.gold).

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

information under Canadian securities legislation including

statements regarding drill results, potential mineralization,

potential expansion and upgrade of mineral resources and current

expectations on future exploration and development plans. Forward

looking information includes, but is not limited to, the results of

the Brewery Creek PEA, including statements relating to net present

value, future production, estimates of cash cost, proposed mining

plans and methods, mine life estimates, cash flow forecasts, metal

recoveries, estimates of capital and operating costs, timing for

permitting and environmental assessments, realization of mineral

resource estimates, capital and operating cost estimates, project

and life of mine estimates, ability to obtain permitting by the

time targeted, size and ranking of project upon achieving

production, economic return estimates, the timing and amount of

estimated future production and capital, operating and exploration

expenditures and potential upside and alternatives.

These forward-looking statements also entail

various risks and uncertainties that could cause actual results to

differ materially from those reflected in these forward-looking

statements. Such statements are based on current expectations, are

subject to a number of uncertainties and risks, and actual results

may differ materially from those contained in such statements.

These uncertainties and risks include, but are not limited to: the

strength of the Canadian economy; the price of gold; operational,

funding, and liquidity risks; reliance on third parties,

exploration risk, failure to upgrade resources, the degree to which

mineral resource and reserve estimates are reflective of actual

mineral resources and reserves; the degree to which factors which

would make a mineral deposit commercially viable are present, and

the risks and hazards associated with underground operations and

other risks involved in the mineral exploration and development

industry.

Risks and uncertainties about Sabre Gold’s

business are more fully discussed in the Company’s disclosure

materials, including its annual information form and MD&A,

filed with the securities regulatory authorities in Canada and

available at www.sedar.com and readers are urged to read these

materials. Sabre Gold assumes no obligation to update any

forward-looking statement or to update the reasons why actual

results could differ from such statements unless required by

law.

For further information please contact:

Sabre Gold Mines Corp.Giulio BonifacioPresident & Chief

Executive Officergtbonifacio@sabre.gold

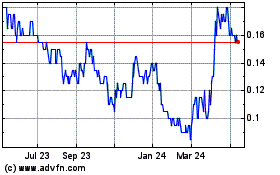

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Nov 2024 to Dec 2024

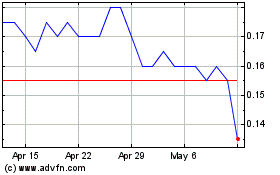

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Dec 2023 to Dec 2024