Prairie Provident Announces Confirmation of Revolving Facility Borrowing Base and Amendments to Financial Covenants

April 10 2019 - 7:00AM

Prairie Provident Resources Inc. ("Prairie Provident", "PPR" or the

"Company") is pleased to announce the confirmation of its US$60

million borrowing base under the Company’s senior secured revolving

facility (the “Revolving Facility”). PPR has also finalized terms

of amending agreements with Prudential Capital Group (“Prudential”)

respecting its Revolving Facility and senior subordinated notes

(the “Senior Notes”), which relax certain financial covenant

thresholds effective for the quarter ending March 31, 2019 through

the quarter ending December 31, 2019. Prairie Provident expects

that the amended thresholds will provide it with additional

financial flexibility and runway to execute its 2019 capital

program and deliver long-term growth in reserves, production and

cash flow for shareholders.

In light of the impact from widened Canadian

crude oil price differentials during the fourth quarter of 2018 on

the computation of PPR’s financial covenants for 2019, Prudential

agreed to relax certain financial covenant ratios to the levels

outlined below.

| Financial

Covenant |

Revolving

Facility Requirement |

Senior

Note Requirement |

| Total Leverage – adjusted

indebtedness to EBITDAX1 for the fiscal quarters ending March 31,

June 30, and September 30, 2019. |

Cannot Exceed 4.75 to 1.00 |

Cannot Exceed 5.00 to 1.00 |

| For the fiscal quarter ending December 31,

2019. |

Cannot Exceed 3.75 to 1.00 |

Cannot Exceed 4.00 to 1.00 |

| Senior Leverage – senior

adjusted indebtedness to EBITDAX1 for the fiscal quarters ending

March 31, June 30, September 30, and December 31, 2019. |

Cannot Exceed 3.25 to 1.00 |

Cannot Exceed 3.50 to 1.00 |

| Current

ratio – consolidated current assets2, plus any undrawn

capacity under the Revolving Facility, to consolidated current

liabilities2 for the fiscal quarters ending March 31, June 30,

September 30, and December 31, 2019. |

Cannot

be less than 0.85 to 1.00 |

Cannot

be less than 0.85 to 1.003 |

1 Under the note purchase agreements governing the Revolving

Facility and Senior Notes (the "NPAs"), EBITDAX is defined as net

earnings before financing charges, foreign exchange gain (loss),

E&E expense, income taxes, depreciation, depletion,

amortization, other non-cash items of expense and non-recurring

items, adjusted for major acquisitions and material dispositions

assuming that such transactions had occurred on the first day of

the applicable calculation period.2 Under the NPAs, current assets

excludes derivative assets while current liabilities excludes the

current portion of long-term debt, decommissioning obligations,

derivative liabilities and non-cash liabilities.3 The current ratio

covenant under the NPA for the Senior Notes is unchanged.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Michichi and Princess areas in Southern Alberta targeting the

Banff, the Ellerslie and the Lithic Glauconite formations, along

with an established and proven waterflood project at our Evi area

in the Peace River Arch. Prairie Provident protects its balance

sheet through an active hedging program and manages risk by

allocating capital to opportunities offering maximum shareholder

returns.

For further information, please contact:

Prairie Provident Resources Inc. Tim Granger President and Chief

Executive Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca

Forward Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein.

All statements other than statements of current or historical fact

constitute forward-looking statements.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: the

Company’s ability to execute its 2019 capital program; and its

ability to deliver future growth in reserves, production and cash

flow.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements but which

may prove to be incorrect. Although the Company believes that the

expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and

assumptions. Prairie Provident can give no assurance that the

forward-looking information contained herein will prove to be

correct or that the expectations and assumptions upon which they

are based will occur or be realized. Actual results or events

will differ, and the differences may be material and adverse to the

Company. In addition to other factors and assumptions which

may be identified herein, assumptions have been made regarding,

among other things: results from future drilling and development

activities, the continued and timely development of infrastructure

in areas of new production; the accuracy of the estimates of

Prairie Provident's reserves volumes; certain commodity price and

other cost assumptions; availability of debt and equity financing

and cash flow to fund Prairie Provident's current and future plans

and expenditures; the impact of increasing competition, with

external financing on acceptable terms; the general continuance of

current industry conditions; the timely receipt of any required

regulatory approvals; the ability of Prairie Provident to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; and field production rates and decline rates.

The forward-looking statements included in this

news release are not guarantees of future performance and should

not be unduly relied upon. Such statements, including the

assumptions made in respect thereof, involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements including, without limitation:

changes in realized commodity prices; the early stage of

development of some of the evaluated areas and zones; unanticipated

operating results or production declines; regulatory changes;

changes in development plans; inaccurate estimation of Prairie

Provident's oil and gas reserve volumes; limited, unfavourable or a

lack of access to capital markets; increased costs; and such other

risks as may be detailed from time-to-time in Prairie Provident's

public disclosure documents, (including, without limitation, those

risks identified in this news release and Prairie Provident's

current Annual Information Form).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

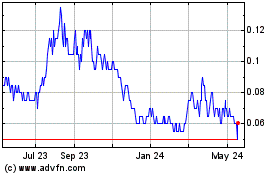

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

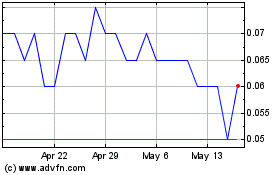

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025