NOT FOR DISTRIBUTION TO U.S. NEWS SERVICES OR

DISSEMINATION IN THE UNITED STATES. ANY FAILURE TO COMPLY WITH THIS

RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW.

Prairie Provident Resources Inc. ("Prairie Provident" or the

"Company") (TSX: PPR) is pleased to announce the closing of its

previously announced bought deal financing ("Bought Deal

Financing") and strategic private placement, each led by Mackie

Research Capital Corporation ("MRCC") for total gross proceeds of

$5.5 million, including exercise of the over-allotment option under

the Bought Deal Financing.

Pursuant to the Bought Deal Financing, the

Company issued 6,810,200 subscription receipts ("Subscription

Receipts") at a price of $0.39 per Subscription Receipt and

3,750,150 common shares on a "flow-through" basis pursuant to the

Income Tax Act (Canada) ("Flow Through Shares") at a price of $0.46

per Flow-Through Share, for total gross proceeds of approximately

$4.4 million.

In addition, the Company closed its previously

announced private placement with a strategic investor of an

additional 2,780,000 Subscription Receipts at a price of $0.39 per

Subscription Receipt for gross proceeds of approximately $1.1

million (the "Private Placement" and, together with the

Subscription Receipt portion of the Bought Deal Financing, the

"Subscription Receipt Offering").

As previously announced on September 13, 2018,

the Company has entered into an agreement to effect the acquisition

of Marquee Energy Ltd. by way of a plan of arrangement (the

"Arrangement") whereby Marquee Energy Ltd. ("Marquee") shareholders

will receive 0.0886 of a Prairie Provident common share for each

Marquee share. Upon completion of the Arrangement, Prairie

Provident production is anticipated to be approximately 7,700 boe/d

(69% oil and liquids), and estimated proved plus probable

reserves more than double to 43,321 Mboe as of December 31, 2017,

yielding a pro forma net asset value per share (based on

estimated NPV10 of such reserves at December 31, 2017) of $2.71 (or

$561 million).

The gross proceeds from the Subscription Receipt

Offering were placed in escrow and will be released to the Company

(together with interest thereon), and each holder of Subscription

Receipts shall receive one unit of the Company (a "Unit") for no

additional consideration, upon MRCC receiving a certificate from

the Company to the effect that: (i) all conditions precedent to the

completion of the Arrangement have been satisfied or waived in

accordance with the terms of the definitive agreement in respect of

the Arrangement (the "Arrangement Agreement") (any such waiver to

be consented to by MRCC, acting reasonably); and (ii) receipt by

the Company of all necessary regulatory and other approvals

regarding the Subscription Receipt Offering and the

Arrangement.

Each Unit shall consist of one common share of

the Company (a "Unit Share") and one-half of one share purchase

warrant (each whole share purchase warrant, a "Warrant"). Each

Warrant will entitle the holder to acquire one common share (a

"Warrant Share") at the exercise price of $0.50 until October 11,

2020.

If: (i) the Arrangement has not been completed

by 5:00 p.m. (Calgary time) on December 6, 2018 (or such later date

as MRCC may consent in writing); (ii) the Arrangement Agreement is

terminated in accordance with its terms; or (iii) the Company

advises MRCC or the public that it does not intend to proceed with

the Arrangement, the gross proceeds from the Subscription Receipt

Offering will be reimbursed pro rata to the holders of Subscription

Receipts together with each such holder's pro rata portion of

interest earned thereon, if any. To ensure that each holder of the

Subscription Receipt receives an amount equal to the aggregate

purchase price of such Subscription Receipts, the Company shall

contribute such amounts as are necessary to satisfy any

shortfall.

For each Flow-Through Share, the Company has

covenanted to incur and renounce to the subscriber, effective for

the fiscal year ended December 31, 2018, qualifying "Canadian

exploration expenses", within the meaning of the Income Tax Act

(Canada), in an amount equal to the purchase price of the

Flow-Through Share.

The Toronto Stock Exchange ("TSX") has

conditionally approved the listing of the Flow-Through Shares, the

Unit Shares issuable pursuant to the Subscription Receipts, and the

Warrant Shares issuable upon exercise of the Warrants. Listing is

subject to the issuer fulfilling all of the requirements of the TSX

on or before December 18, 2018. The Subscription Receipts and

Warrants will not be listed on the TSX.

Light Oil Drilling Program Commencing in

October

Prairie Provident is also pleased to announce it

has expanded its planned light-oil Granite Wash drilling program at

Evi, as part of its flow through share commitment, to four

exploration wells (3.5 net). The Company’s Evi exploration program

will commence in October 2018, at an estimated cost of

approximately $1.5 million per well to drill and complete. In

addition to its exploration program, Prairie Provident also plans

to drill two lower-risk Slave Point light-oil development wells in

the area following the completion of its exploration program. These

wells are expected to come on stream in February and contribute to

first quarter 2019 production.

This news release does not constitute an offer

to sell or the solicitation of an offer to buy any securities of

the Company in the United States or in any other jurisdiction in

which any such offer, solicitation or sale would be unlawful. The

securities to be offered under the Offering have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the "1933 Act") or any state securities laws, and may

not be offered or sold in the United States or to U.S. Persons (as

that term is defined in Regulation S under the 1933 Act) except in

transactions exempt from the registration requirements of the 1933

Act and applicable state securities laws.

About Prairie Provident

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at Wheatland

and Princess in Southern Alberta targeting the Ellerslie and the

Lithic Glauc formations, along with an early stage waterflood

project at Evi in the Peace River Arch. Prairie Provident protects

its balance sheet through an active hedging program and manages

risk by allocating capital to opportunities offering maximum

shareholder returns.

For further information, please

contact:

Prairie Provident Resources

Inc.

Tim Granger President and Chief Executive

Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca Website:

www.ppr.ca

Forward Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, and are based upon internal assumptions,

plans, intentions, expectations and beliefs. All statements other

than statements of current or historical fact constitute

forward-looking statements. Forward-looking statements are

typically, but not always, identified by words such as

"anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "continue", "may", "will", "should" or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to:

completion of the Arrangement; anticipated use of proceeds;

forecast production on completion of the Arrangement; listing on

the TSX of the Flow-Through Shares, Unit Shares and Warrant Shares;

and Evi drilling plans (including timing for commencement,

estimated drilling and completion costs per well, number of wells,

target formations and projected on-stream timing).

Combined reserves data disclosed in this news

release (i.e., reserves data assuming completion of the

Acquisition) is based on year-end evaluation reports prepared by

Sproule Associates Limited for Prairie Provident in a report dated

January 23, 2018 and for Marquee in a report dated March 7, 2018,

respectively – in each case effective December 31, 2017, prepared

in accordance with National Instrument 51-101 and, pursuant

thereto, the Canadian Oil and Gas Evaluation Handbook, and applying

forecast prices and costs (using Sproule's pricing, exchange rate

and inflation rate assumptions as of December 31, 2017) but without

giving effect to any year-to-date production in 2018 or any other

intervening event since January 1, 2018.

The proved plus probable (2P) reserves figure

cited in this news release (43,321 Mboe) is the sum of the

Company's estimated 2P reserves as of December 31, 2017 plus

Marquee's estimated 2P reserves as of December 31, 2017, based on

the evaluations referred to above. Similarly the estimated

net present value of future net revenues from 2P reserves (before

taxes and discounted at 10% per year) (NPV10) cited in this news

release (approximately $561 million) is the sum of the Company's

estimated NPV10 as of December 31, 2017 plus Marquee's estimated

NPV10 as of December 31, 2017, based on the same year-end

evaluations.

The forward-looking statements contained in this

news release reflect material factors and expectations and

assumptions of Prairie Provident including, without limitation: the

timely receipt of TSX and other regulatory approvals relating to

the Private Placement, the Bought Deal Financing and the

Arrangement; that Marquee shareholders approve the Arrangement at a

special meeting scheduled to be held in November; that the Court of

Queen's Bench of Alberta approves the Arrangement pursuant to the

arrangement provisions of the Business Corporations Act (Alberta);

that the Company's lenders enter into definitive agreements to

increase Prairie Provident's existing debt facilities by the

amounts (and otherwise on the terms) contemplated by their

respective commitment letters; and that all other conditions

precedent to completion of the Arrangement are satisfied or waived

on terms satisfactory to the Company.

Although Prairie Provident believes that the

expectations and assumptions upon which the forward-looking

statements in this news release is based are reasonable based on

currently available information, undue reliance should not be

placed on such information, which is inherently uncertain, relies

on assumptions and expectations, and is subject to known and

unknown risks, uncertainties and other factors, both general and

specific, many of which are beyond the Company's control, that may

cause actual results or events to differ materially from those

indicated or suggested in the forward-looking statements. Prairie

Provident can give no assurance that the forward-looking statements

contained herein will prove to be correct or that the expectations

and assumptions upon which they are based will occur or be

realized. These include, but are not limited to: risks inherent to

oil and gas exploration, development, exploitation and production

operations and the oil and gas industry in general,; adverse

changes in commodity prices, foreign exchange rates or interest

rates; the ability to access capital when required and on

acceptable terms; the ability to secure required services on a

timely basis and on acceptable terms; increases in operating costs;

environmental risks; changes in laws and governmental regulation

(including with respect to royalties, taxes and environmental

matters); adverse weather or break-up conditions; competition for

labour, services, equipment and materials necessary to further the

Company's oil and gas activities; and changes in plans with respect

to exploration or development projects or capital expenditures in

respect thereof. These and other risks are discussed in more detail

in the Company's current annual information form and other

documents filed by it from time to time with securities regulatory

authorities in Canada, copies of which are available electronically

under Prairie Provident's issuer profile on the SEDAR website at

www.sedar.com and on the Company's website at www.ppr.ca. This list

is not exhaustive.

The forward-looking statements contained in this

news release are made only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Barrel of Oil Equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

(boe) basis whereby natural gas volumes are converted at the ratio

of six thousand cubic feet to one barrel of oil. The intention is

to sum oil and natural gas measurement units into one basis for

improved analysis of results and comparisons with other industry

participants. A boe conversion ratio of six thousand cubic feet to

one barrel of oil is based on an energy equivalency conversion

method primarily applicable at the burner tip. It does not

represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

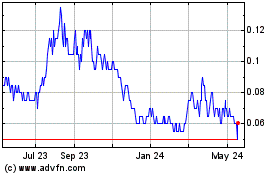

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

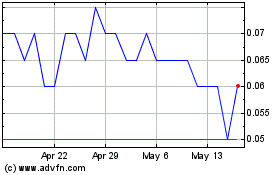

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025