Prairie Provident Resources Inc. ("Prairie

Provident" or the "Company") (TSX: PPR) and Marquee Energy Ltd.

("Marquee") (TSX-V: MQX) are pleased to announce that they have

entered into an agreement to effect the acquisition of Marquee (the

“Acquisition”) by way of a plan of arrangement (the "Arrangement").

Under the terms of the Arrangement, Marquee shareholders will

receive 0.0886 of a Prairie Provident common share ("Prairie

Provident Share") for each Marquee share ("Marquee Share"). Based

on Prairie Provident's closing price of $0.42

on September 12, 2018, the exchange ratio translates

to $0.037 per Marquee common share, representing a 24% premium

to Marquee's closing price on September 12, 2018. The total

consideration, including Marquee’s net debt of $39 million([1]), is

approximately $55 million. The Arrangement includes a reciprocal

break fee of $2.5 million.

Upon completion of the Arrangement, Prairie

Provident production is anticipated to be approximately 7,700 boe/d

(69% oil and liquids)(2) and proved plus probable reserves more

than double to 43,321 Mboe as of December 31, 2017, yielding a pro

forma net asset value per share4[2] of $2.71 (or $561 million). The

proved plus probable reserve life index (“RLI”) goes to 23 years

(from 10 years).

Marquee is a publicly traded, western Canadian

focused, oil and gas producer with current production of

approximately 2,700 boe/d (>50% oil and liquids). Marquee’s core

assets are located in the Michichi area where it owns a high

working interest position in a large, proven and delineated, Banff

light oil accumulation with >60 Proved Undeveloped drilling

locations that deliver robust new well economics at current strip

prices and significant waterflood upside potential. At Michichi,

Marquee owns and operates a pipeline-connected 2,000 bbl/d central

oil battery, as well as two gas plants and associated gas gathering

infrastructure with 15 mmcf/d of combined processing capacity, all

of which are expected to provide considerable operating synergies

to Prairie Provident. In addition, the Acquisition also provides

G&A synergies as Prairie Provident benefits from economies of

scale.

The Board of Directors of Prairie Provident and

Marquee have both unanimously approved the Acquisition and have

received verbal fairness opinions from their respective financial

advisors, Cormark Securities Inc. and GMP FirstEnergy. The

Arrangement remains subject to customary closing conditions

including receipt of applicable court, Marquee shareholder, TSX,

and other regulatory approvals, and is expected to close on or

about November 15, 2018.

Concurrent with the Arrangement, Prairie

Provident has also entered into a $3.5 million bought-deal

short-form prospectus equity financing (the “Financing”) led by

Mackie Research Capital Corporation as sole lead and bookrunner for

the offering.

|

(1) |

|

Estimated

net debt at closing as per the Arrangement agreement, exclusive of

transaction costs. |

| (2) |

|

Based on

forecast November 2018 production. |

| (3) |

|

Based on

the respective reserves evaluation reports of Prairie Provident and

Marquee, prepared by Sproule Associates Ltd., evaluating the

reserves data of each company as of December 31, 2017 in accordance

with the requirements of National Instrument 51-101 Standards of

Disclosure for Oil and Gas Activities. |

| (4) |

|

Assumes

outstanding common shares of 167 million pro forma the Transaction,

Financing and debt redemption costs. |

| |

|

|

Strategic Highlights

The Board of Directors and executive management

teams of both Prairie Provident and Marquee believe that the

Arrangement will provide significant benefits to the shareholders

of both companies. Shareholders are expected to now benefit from an

improved light oil-weighted growth profile that can be executed on,

while supported by a stronger financial position better suited to

fund the long-term development of the deep inventory of highly

attractive drilling prospects at Michichi.

The Acquisition is accretive to Prairie

Provident shareholders on a fully-diluted per share basis on all

pertinent fundamental metrics(5)[3].

|

Cash flow per share (2019 estimate) |

5 |

% |

|

Production per share (2019 estimate) |

18 |

% |

|

Total proved reserves per share (Dec. 31,

2017) |

48 |

% |

|

Total proved net asset value per share (Dec. 31,

2017) |

35 |

% |

| |

|

|

The combined company will have three high

quality core areas (Michichi/Wayne, Princess and Evi) with exposure

to Canadian light oil and will manage the combined portfolio to

choose the best projects and optimize capital allocation. The

diverse oil-weighted asset portfolio with a strong inventory of

opportunities and associated capital allocation optimization are

expected to provide more profitable growth than either company

could achieve on a stand-alone basis.

Pro forma the Acquisition, the combined Company

will have a total enterprise value of approximately $177 million,

and the shareholders will benefit from larger cash flows,

operational and G&A synergies, better economies of scale and

significantly improved trading liquidity.

Summary of the Acquisition

|

Total purchase price1 |

$55 million |

|

Current production |

2,700 boe/d (53% oil and liquids) |

|

Proved plus probable RLI2 |

23 years |

|

Total net undeveloped land (at Michichi)3 |

187 sections (140 sections) |

|

Total proved undeveloped locations4 |

62 |

|

Operating netback (2019 estimate)5 |

$17.76/boe |

|

Reserves (Mboe)4: |

|

|

Proved developed producing (“PDP”) |

5,270 (50% oil and NGLs) |

|

Proved (“1P”) |

13,915 (62% oil and NGLs) |

|

Proved plus probable (“P+P”) |

22,643 (64% oil and NGLs) |

|

Reserves value (BT NPV10)4: |

|

|

PDP |

$67 million |

|

1P |

$154 million |

|

P+P |

$262 million |

|

|

|

___________5) These metrics exclude the impacts

from Financing, New Credit Facilities and potential non-core asset

disposition.

The associated Acquisition metrics are as

follows:

|

Current production |

$20,451 per boe/d |

|

Net operating income multiple (2019

estimate)6 |

3.2x |

|

Finding, development and acquisition cost

(“FD&A”)4,8: |

|

|

PDP |

$10.48 per boe |

|

1P |

$3.97 per boe |

|

P+P |

$2.44 per boe |

|

P+P Recycle Ratio7 |

7.28x |

|

Reserves value (BT NPV10)4: |

|

|

PDP |

0.82x |

|

1P |

0.36x |

|

P+P |

0.21x |

|

|

|

Notes to the tables above:

- The purchase price will be subject to normal adjustments for a

transaction of this nature.

- Defined as proved plus probable reserves relative to years of

current production.

- Land totals estimated as at June 30, 2018.

- As per independent qualified engineering evaluation of the oil

and natural gas reserves attributable to the properties of Marquee

prepared by Sproule dated March 7, 2018 and effective December 31,

2017, prepared in accordance with National Instrument 51-101

Standards of Disclosure for Oil and Gas Activities. 'Mboe' means

thousands of barrels of oil equivalent.

- Forecast 2019 operating netback based on US$67/bbl WTI,

$1.60/mcf AECO and 0.78 CAD/USD, realized revenue net of royalties,

operating and transportation costs and prior to realized hedging

gains/losses.

- Forecast 2019 field cash flows multiple is calculated by

dividing the purchase price by the current production and forecast

2019 operating netback from the acquired assets.

- The recycle ratio is calculated by dividing the forecast 2019

operating netback by the P+P FD&A cost.

- The reserve acquisition metrics are calculated off the stated

Arrangement enterprise value, and are exclusive of 1P and P+P

future development capital of $129 million and $215 million,

respectively.

Pro Forma Key Operating and Financial

Information

|

Production1 |

7,700 boe/d (69% oil and liquids) |

|

P+P reserves (Mboe)2 |

43,321 |

|

Net debt3 |

$104 million |

|

Enterprise value4 |

$170 million |

|

Outstanding shares |

167 million |

| |

|

Notes to the tables above:

- Based on forecast November 2018 production.

- Based on the respective reserves evaluation reports of Prairie

Provident and Marquee, prepared by Sproule Associates Ltd.,

evaluating the reserves data of each company as of December 31,

2017 in accordance with the requirements of National Instrument

51-101 Standards of Disclosure for Oil and Gas Activities, prior to

adjusting for anticipated non-core asset dispositions.

- Estimated net debt at closing of the Arrangement, after the net

proceeds from the Financing and proceeds from anticipated non-core

asset dispositions.

- Estimated enterprise value at closing of the Arrangement, after

the net proceeds from the Financing and proceeds from anticipated

non-core asset dispositions.

Upon completion of the Arrangement, Prairie Provident

anticipates a forward 12-month Adjusted Debt to EBITDAX ratio

of approximately 2.2x, a 27% improvement over the second quarter of

2018. Pro forma Prairie Provident is expected to have the following

key attributes:

- A light and medium oil-weighted asset base focused on three

core areas in Alberta (Michichi/Wayne, Princess and Evi), which

offer meaningful growth potential through lower risk development

drilling opportunities, a proven water flood program and future

consolidation prospects;

- A combined land base of approximately 715,000 net undeveloped

acres (pro forma, as at June 30, 2018), with over 114 proved

drilling locations that are expected to generate compelling returns

at current strip commodity prices;

- Operatorship of over 90% of its production and an average

working interest greater than 98% in its core areas;

- PDP and P+P reserves(4) of 13,738 Mboe and 43,321 Mboe,

respectively, which had NPV10 value of $217 million(6) and $561(6)

million as at December 31, 2017 yielding a pro forma net asset

value per share(6)(5) of $0.65 and $2.71, respectively;

- Forecast Q4 2018 Adjusted EBITDAX of approximately $11 million

based on forward strip pricing that is expected to position Prairie

Provident to efficiently develop its inventory of capital projects,

as well as pursue accretive new opportunities;

- Enhanced operational and G&A efficiencies from economies of

scale with annualized cost synergies of approximately $5

million;

- A senior secured credit facility of US$65 million (or C$84

million equivalent) backed by the Prudential Capital Group, with

approximately US$44 million (or C$57 million equivalent)

anticipated to be drawn at closing, depending on the outcome of

certain non-core asset disposition previously announced by Marquee

on August 29, 2018, which will support ongoing development and

continued growth; and

- A robust three-year hedge book that Prairie Provident believes

will provide meaningful protection against commodity price

volatility and underpins funds from operations(4), further details

of which will be outlined in the information circular.

|

(4) |

|

These

metrics exclude the impacts from Financing, New Credit Facilities

and potential non-core asset disposition.tes Ltd., evaluating the

reserves data of each company as of December 31, 2017 in accordance

with the requirements of National Instrument 51-101 Standards of

Disclosure for Oil and Gas Activities. |

| (5) |

|

Net asset

value calculated using estimated net debt at closing, after

consideration for the net Financing proceeds but prior to

contemplated non-core asset sales. |

| |

|

|

Bought Deal Prospectus Financing

Concurrent with the Arrangement, Prairie

Provident has entered into an agreement for a $3.5 million bought

deal financing by way of a short-form prospectus (the "Bought Deal

Financing") with Mackie Research Capital Corporation ("MRCC") as

lead underwriter and bookrunner, on its own behalf and on behalf of

a syndicate of underwriters (collectively, the "Underwriters").

Under the terms of the Bought Deal Financing, the Underwriters have

agreed to purchase for resale to the public, on a bought deal

basis, 5,129,000 subscription receipts of the Company

("Subscription Receipts") at a price of $0.39 per Subscription

Receipt for total gross proceeds of approximately $2.0 million (the

“Subscription Receipt Offering”). The Underwriters will have

an option to purchase up to an additional 769,350 Subscription

Receipts under the Subscription Receipt Offering to cover

over-allotments.

The Bought Deal Financing will also include the

issuance of 3,261,000 Common Shares on a “flow-through” basis under

the Income Tax Act (Canada) (the “CEE Flow-Through Shares” and,

together with the Subscription Receipts, the "Securities") at a

price per CEE Flow-Through Share of $0.46 for aggregate gross

proceeds of approximately $1.5 million (the “Flow-Through

Offering”). The Underwriters will have an option to offer for sale

up to an additional 489,150 CEE Flow-Through Shares under the

Flow-Through Offering to cover over-allotments.

The gross proceeds from the Subscription Receipt

Offering will be placed in escrow (the “Escrowed Proceeds”) and

will be released to the Company (together with the interest

thereon) and each holder of Subscription Receipts shall receive one

unit of the Company (a "Unit") for no additional consideration upon

Mackie receiving a certificate from the Company to the effect that:

(i) all conditions precedent to the completion the Acquisition have

been satisfied or waived in accordance with the terms of the

definitive agreement in respect of the Arrangement (the

"Arrangement Agreement") (any such waiver to be consented to by

Mackie, on behalf of the Underwriters, in writing, acting

reasonably); and (ii) receipt by the Company of all necessary

regulatory and other approvals regarding the Subscription Receipt

Offering and the Acquisition.

If: (i) the Acquisition has not been completed

by 5:00 p.m. (Calgary time) on December 6, 2018 (or such later date

as MRCC may consent on behalf of the Underwriters in writing); (ii)

the Arrangement Agreement is terminated in accordance with its

terms; or (iii) the Company advises the Underwriters or the public

that it does not intend to proceed with the Acquisition, the gross

proceeds from the Subscription Receipt Offering will be reimbursed

pro rata to the holders of Subscription Receipts together with each

such holder's pro rata portion of interest earned thereon, if any.

To ensure that each holder of the Subscription Receipt receives an

amount equal to the aggregate purchase price of such Subscription

Receipts, the Company shall contribute such amounts as are

necessary to satisfy any shortfall.

Each Unit shall consist of one common share of

the Company (a “Common Share”) and one-half of one Common Share

purchase warrant (each whole Common Share purchase warrant, a

“Warrant”). Each Warrant shall entitle the holder to acquire one

Common Share (a “Warrant Share”) at the exercise price of $0.50 for

a period of 24 months from the Closing of the Offering.

The Securities will be offered by way of a

short-form prospectus to be filed in those provinces of Canada

(other than Quebec) as the Underwriters may designate, pursuant to

National Instrument 44-101 - Short Form Prospectus Distributions

and, other than the CEE Flow-Through Shares, may be offered in , in

the United Kingdom and Europe and in the United States on a private

placement basis pursuant to Rule 144A of the U.S. Securities Act of

1933, or such other exemptions as agreed to by the Company and

Mackie Research Capital Corp. The completion of the Offering shall

be subject to the receipt of all necessary regulatory approvals and

other customary conditions, including TSX acceptance.

The Company will use commercial reasonable

efforts to obtain the necessary approvals to list the CEE

Flow-Through Shares, the Subscription Receipts, the Common Shares

and Warrants issuable in exchange of the Subscription Receipts

issued pursuant to this Offering, and the Warrant Shares issuable

on the exercise of Warrants on the TSX on the Closing Date and the

date of the issuance of the underlying Common Shares, Warrants and

Warrant Shares, respectively. Listing is subject to the approval of

the TSX in accordance with its original listing requirements. The

TSX has not conditionally approved the Company's listing

application and there is no assurance that the TSX will approve the

listing application.

The Bought Deal Financing is expected to close

the week of October 8, 2018.

New Credit Facilities

Prairie Provident has received a commitment

letter from Prudential Capital Group in respect to an

expansion of its current credit agreements, to be effected

concurrently with the closing of the Arrangement (and subject to

the closing of the Arrangement). The highly confident letter

contemplates that the expanded debt structure will provide Prairie

Provident with senior secured revolving credit facilities up to

US$65 million (or C$84 million equivalent) and up to US$28.5

million (or $37 million equivalent) of senior secured revolving

notes due October 31, 2021 (“Secured Notes”). The credit facilities

are expected to be available following the closing of the

Arrangement to finance Prairie Provident's ongoing capital

expenditures and for general corporate purposes. Concurrently with

the closing of the Arrangement, it is anticipated that Marquee’s

existing credit facilities will be repaid in full and terminated.

In addition, Prairie Provident will issue $1.5 million equivalent

of shares to Marquee’s term loan lender for early repayment of the

term loan.

Governance

Prairie Provident’s Board of Directors will

include one additional member from Marquee and will be led by

Prairie Provident’s current chairman, Patrick McDonald, with the

balance of the board to be detailed in the information circular

being sent to the shareholders of Marquee.

Shareholder Approvals and Closing Matters

Implementation of the Arrangement will be

subject to the approval of Marquee shareholders at special meetings

to be held on, or about, November 26, 2018, by majorities of not

less than two-thirds of the votes cast by Marquee shareholders at

the Marquee meeting, and not less than two-thirds of the votes cast

at the Prairie Provident meeting by the common shareholders of

Prairie Provident.

All of the directors and officers of both

Marquee and Prairie Provident have entered into support agreements

under which they have agreed, among other things, to vote in favour

of the Arrangement. In addition, shareholders of Prairie Provident

related to Goldman Sachs Asset Management, holding approximately

42.67% of the outstanding Prairie Provident shares have agreed to

vote in favour of the Arrangement. Such shareholders will hold

approximate 30% of pro forma Prairie Provident Shares (after the

Acquisition, Financing and shares issued for redemption of Marquee

term loan). Shareholders of Marquee holding approximately 23% of

the outstanding Marque Shares have agreed to vote in favour of the

Arrangement.

The Arrangement provides for non-solicitation

covenants on the part of Marquee with respect to alternative

transactions, subject to its ability to consider, pursuant to the

fiduciary obligations of the Marquee Board of Directors, a proposal

for an alternative transaction that meets specified criteria and

the right of Prairie Provident to match any such proposal, and for

the payment of certain fees if the Arrangement is terminated.

Fairness Opinions

The Prairie Provident Board has unanimously

approved the Arrangement, determined that the Arrangement is in the

best interests of Prairie Provident and the holders of Prairie

Provident shares, and has recommended that the holders of Prairie

Provident shares vote in favor of the issuance of Prairie Provident

Shares pursuant to the Arrangement. Cormark has provided the

Prairie Provident Board with its verbal opinion that, subject to

its review of the final form of documents effecting the

Arrangement, the exchange ratio pursuant to the Arrangement

Agreement is fair, from a financial point of view, to Prairie

Provident.

GMP FirstEnergy has provided the Marquee Board

with its verbal opinion that, subject to its review of the final

form of documents effecting the Arrangement, the consideration to

be received by holders of Marquee Shares pursuant to the terms of

the Arrangement Agreement is fair, from a financial point of view,

to Marquee shareholders.

Advisors

Cormark Securities Inc. is acting as the

exclusive financial advisor to Prairie Provident with respect to

the Transaction. Bennett Jones LLP is acting as Prairie Provident’s

legal advisor.

GMP FirstEnergy is acting as exclusive financial

advisor to Marquee. DLA Piper (Canada) LLP is acting as Marquee’s

legal advisor.

Mackie Research Capital Corporation has been

engaged by the Company to act as a strategic advisor.

About Prairie Provident

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company’s strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident’s operations are primarily focused at Wheatland

and Princess in Southern Alberta targeting the Ellerslie and the

Lithic Glauc formations, along with an early stage waterflood

project at Evi in the Peace River Arch. Prairie Provident protects

its balance sheet through an active hedging program and manages

risk by allocating capital to opportunities offering maximum

shareholder returns.

About Marquee Energy Ltd.

Marquee is a Calgary-based, junior energy company focused on

light oil development and production in the Michichi area of

eastern Alberta. Additional information about Marquee may be

found on its website www.marquee-energy.com and in its continuous

disclosure documents filed with Canadian securities regulators on

SEDAR at www.sedar.com.

For further information, please contact:

| Prairie

Provident Resources Inc. Tim Granger President and Chief Executive

Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca website:

www.ppr.ca |

Marquee

Energy Ltd.Howard BolingerExecutive VP & Chief Financial

OfficerTel: (403) 817-5568Email: Hbolinger@marquee-energy.com |

| |

|

FORWARD-LOOKING INFORMATION

This news release contains certain

forward-looking information and statements within the meaning of

applicable Canadian securities laws. Statements involving

forward-looking information relate to future performance, events or

circumstances, and are based upon internal assumptions, plans,

intentions, expectations and beliefs. All statements other than

statements of current or historical fact constitute forward-looking

information. Forward-looking information is typically, but not

always, identified by words such as “anticipate”, “believe”,

“expect”, “intend”, “plan”, “budget”, “forecast”, “target”,

“estimate”, “propose”, “potential”, “project”, “continue”, “may”,

“will”, “should” or similar words suggesting future outcomes or

events or statements regarding an outlook.

The forward-looking information and statements

contained in this news release reflect material factors and

expectations and assumptions of Prairie Provident including,

without limitation: commodity prices and foreign exchange rates for

2018 and beyond; the timing and success of future drilling,

development and completion activities (and the extent to which the

results thereof meet Management's expectations); the continued

availability of financing (including borrowings under the Company's

credit agreements) and cash flow to fund current and future

expenditures, with external financing on acceptable terms; future

capital expenditure requirements and the sufficiency thereof to

achieve the Company's objectives; the performance of both new and

existing wells; the successful application of drilling, completion

and seismic technology; the Company's ability to economically

produce oil and gas from its properties and the timing and cost to

do so; the predictability of future results based on past and

current experience; prevailing weather conditions; prevailing

legislation and regulatory requirements affecting the oil and gas

industry (including royalty regimes); the timely receipt of

required regulatory approvals; the availability of capital, labour

and services on timely and cost-effective basis; and the general

economic, regulatory and political environment in which the Company

operates. Prairie Provident believes the material factors,

expectations and assumptions reflected in the forward-looking

information and statements are reasonable but no assurance can be

given that these factors, expectations and assumptions will prove

to be correct.

In respect of the forward-looking information

and statements concerning anticipated benefits and completion of

the proposed Arrangement and the anticipated timing for completion

of the Arrangement, Prairie Provident and Marquee have provided

such information and statements in reliance on certain assumptions

that they believe are reasonable at this time, including

assumptions as to the time required to prepare and mail shareholder

meeting materials, including the required information circular; the

ability of Prairie Provident and Marquee to each receive, in a

timely manner, the necessary regulatory, court, shareholder, stock

exchange and other third party approvals, including but not limited

to the receipt of applicable competition approvals; the ability of

each of Prairie Provident and Marquee to satisfy, in a timely

manner, the other conditions to the closing of the Arrangement; and

expectations and assumptions concerning, among other things:

commodity prices and interest and foreign exchange rates; planned

synergies, capital efficiencies and cost-savings; applicable tax

laws; future production rates; the sufficiency of budgeted capital

expenditures in carrying out planned activities; and the

availability and cost of labour and services. Other specific

forward-looking statements contained in this news release such as,

outstanding debt at closing, estimated production levels, estimated

combined tax pools and borrowing base available to Prairie

Provident on closing, are provided based on, among other

assumptions described herein. To the extent that the proposed sales

are not complete, such forward-looking statements may be materially

inaccurate.

Although Prairie Provident believes that the

expectations and assumptions upon which the forward-looking

information in this news release is based are reasonable based on

currently available information, undue reliance should not be

placed on such information, which is inherently uncertain, relies

on assumptions and expectations, and is subject to known and

unknown risks, uncertainties and other factors, both general and

specific, many of which are beyond the Company's control, that may

cause actual results or events to differ materially from those

indicated or suggested in the forward-looking information. Prairie

Provident can give no assurance that the forward-looking

information contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. These include, but are not limited to: risks

inherent to oil and gas exploration, development, exploitation and

production operations and the oil and gas industry in general,;

adverse changes in commodity prices, foreign exchange rates or

interest rates; the ability to access capital when required and on

acceptable terms; the ability to secure required services on a

timely basis and on acceptable terms; increases in operating costs;

environmental risks; changes in laws and governmental regulation

(including with respect to royalties, taxes and environmental

matters); adverse weather or break-up conditions; competition for

labour, services, equipment and materials necessary to further the

Company's oil and gas activities; and changes in plans with respect

to exploration or development projects or capital expenditures in

respect thereof. These and other risks are discussed in more detail

in the Company's current annual information form and other

documents filed by it from time to time with securities regulatory

authorities in Canada, copies of which are available electronically

under Prairie Provident's issuer profile on the SEDAR website at

www.sedar.com and on the Company's website at

www.ppr.ca. This list is not exhaustive.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Prairie Provident assumes no obligation to

publicly update or revise them to reflect new events or

circumstances, or otherwise, except as may be required pursuant to

applicable laws. All forward-looking information and statements

contained in this news release are expressly qualified by this

cautionary statement.

OTHER ADVISORIES

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

Non-IFRS Measures

The Company uses certain terms in this news

release and within the MD&A that do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS), and, accordingly these measures may not be

comparable with the calculation of similar measures used by other

companies. For a reconciliation of each non-IFRS measure to its

nearest IFRS measure, please refer to the “Non-IFRS Measures”

section in the MD&A. Non-IFRS measures are provided as

supplementary information by which readers may wish to consider the

Company's performance but should not be relied upon for comparative

or investment purposes. The non-IFRS measures used in this news

release are summarized as follows:

Working Capital – Working capital (deficit) is

calculated as current assets less current liabilities excluding the

current portion of derivative instruments, the current portion of

decommissioning liabilities and flow-through share premium. This

measure is used to assist management and investors in understanding

liquidity at a specific point in time. The current portion of

derivatives instruments is excluded as management intends to hold

derivative contracts through to maturity rather than realizing the

value at a point in time through liquidation; the current portion

of decommissioning expenditures is excluded as these costs are

discretionary; and the current portion of flow-through share

premium liabilities are excluded as it is a non-monetary

liability.

Net Debt – Net debt is defined as long-term debt plus working

capital surplus or deficit. Net debt is commonly used in the oil

and gas industry for assessing the liquidity of a company.

Operating Netback – Operating netback is a

non-IFRS measure commonly used in the oil and gas industry. This

measure assists management and investors to evaluate operating

performance at the oil and gas lease level. Operating netbacks

included in this news release were determined by calculating oil

and gas revenues less royalties less operating costs and dividing

that number by gross working interest production. Operating

netback, including realized commodity (loss) and gain, adjusts the

operating netback for only realized gains and losses on derivative

instruments.

Adjusted EBITDAX and Adjusted EBITDAX (before

pro forma adjustments) – These measures are indicative of the

Company’s ability to manage its debt levels under current operating

conditions. “Adjusted EBITDAX” corresponds to defined terms in the

Company’s debt agreements and means net earnings before financing

charges, foreign exchange gain (loss), E&E expense, income

taxes, depreciation, depletion, amortization, other non-cash items

of expense and non-recurring items, adjusted for major acquisitions

and material dispositions assuming that such transactions had

occurred on the first day of the applicable calculation period

(“pro forma adjustments”). As transaction costs related to merger

and acquisition transactions are non-recurring costs, Adjusted

EBITDAX has been calculated, excluding transaction costs, as a

meaningful measure of continuing operating cash flows. For purposes

of calculating covenants under long-term debt, Adjusted EBITDAX is

determined using financial information from the most recent four

consecutive fiscal quarters. Adjusted EBITDAX (before pro forma

adjustments) is determined by subtracting pro forma adjustments

from Adjusted EBITDAX.

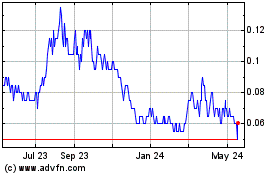

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

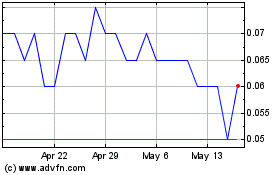

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025