Prairie Provident Resources Inc. ("Prairie Provident", "PPR" or the

"Company") is pleased to provide an operational update on

successful drilling and completion results from its core Princess

area. Corporate average daily production based on field estimates

is approximately 5,750 boe/d (75% liquids), with approximately 150

boe/d of additional production shut-in due to infrastructure

capacity constraints at the Princess area.

Based on current and projected production rates,

Prairie Provident anticipates full-year production to be within its

2018 guidance range of 5,200 to 5,600 boe/d. Prairie Provident’s

full-year 2018 capital budget remains consistent with the original

guidance of $26 million. After bringing the Princess-5 well

(defined hereunder) on-stream, the Company has approximately 17% of

its 2018 capital budget available for further development at its

Evi core area, where it intends to drill three new exploratory

wells beginning in November 2018.

Princess Area Update

Prairie Provident’s latest exploratory Lithic

Glauconite well, targeting a new Glauc channel (100% WI) and

drilled in a southern block of prospective lands at

103/14-12-019-11W4 (“Princess-5”), commenced production on

September 4, 2018 and averaged 550 boe/d (60% liquids) over its

first 3 producing days. The early success of Princess-5 further

improves PPR’s internal type curve expectations for the area, and

based on the results to date management anticipates improved

reserves and economics in the Princess area.

As previously announced, during May and July

2018 Prairie Provident brought the 102/13-24-020-11W4*well

(“Princess-1”) (100% WI) and the 102/13-26-020-11W4 well

(“Princess-4”) (100% WI) on production. During August, both wells

continued to perform favourably, with Princess-1 currently

producing at a rate of approximately 750 boe/d (65% liquids) and

Princess-4 currently producing at a rate of approximately 650 boe/d

(87% liquids), in each case based on field estimates.

Prairie Provident’s 2018 Princess capital

program has demonstrated the Company’s ability to target

higher-value oil and liquids-weighted drilling locations, supported

by its sizeable asset base. PPR currently has 33,000 acres of

undeveloped lands in the Princess area and plans to resume drilling

operations there in 2019.

The Company cautions that the short-term

production rates disclosed in this news release are preliminary in

nature and may not be indicative of stabilized on-stream production

rates or of future ratios between product types. Initial results

are not necessarily indicative of long-term well or reservoir

performance or of ultimate recovery.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company’s strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident’s operations are primarily focused at Wheatland

and Princess in Southern Alberta targeting the Ellerslie and the

Lithic Glauconite formations, along with an early stage waterflood

project at Evi in the Peace River Arch. Prairie Provident protects

its balance sheet through an active hedging program and manages

risk by allocating capital to opportunities offering maximum

shareholder returns.

For further information, please contact:

Prairie Provident Resources Inc. Tim Granger President and Chief

Executive Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca

website: www.ppr.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, and are based upon internal assumptions,

plans, intentions, expectations and beliefs. All statements other

than statements of current or historical fact constitute

forward-looking statements. Forward-looking statements are

typically, but not always, identified by words such as

"anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "continue", "may", "will", "should" or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to:

anticipated full-year production for 2018; budgeted capital

expenditures for 2018; intended drilling plans at Evi and timing

thereof; future development plans generally; and anticipated

reserves and economics improvements in the Princess area.

The forward-looking statements contained in this

news release reflect material factors and expectations and

assumptions of Prairie Provident including, without limitation:

commodity prices and foreign exchange rates for 2018 and beyond;

the timing and success of future drilling, development and

completion activities (and the extent to which the results thereof

meet Management's expectations); the continued availability of

financing (including borrowings under the Company's credit

facility) and cash flow to fund current and future expenditures,

with external financing on acceptable terms; future capital

expenditure requirements and the sufficiency thereof to achieve the

Company's objectives; the performance of both new and existing

wells; the successful application of drilling, completion and

seismic technology; the Company's ability to economically produce

oil and gas from its properties and the timing and cost to do so;

the predictability of future results based on past and current

experience; prevailing weather conditions; prevailing legislation

and regulatory requirements affecting the oil and gas industry

(including royalty regimes); the timely receipt of required

regulatory approvals; the availability of capital, labour and

services on timely and cost-effective basis; and the general

economic, regulatory and political environment in which the Company

operates. Prairie Provident believes the material factors,

expectations and assumptions reflected in the forward-looking

statements are reasonable but no assurance can be given that these

factors, expectations and assumptions will prove to be correct.

Although Prairie Provident believes that the

expectations and assumptions upon which the forward-looking

statements in this news release is based are reasonable based on

currently available information, undue reliance should not be

placed on such information, which is inherently uncertain, relies

on assumptions and expectations, and is subject to known and

unknown risks, uncertainties and other factors, both general and

specific, many of which are beyond the Company's control, that may

cause actual results or events to differ materially from those

indicated or suggested in the forward-looking statements. Prairie

Provident can give no assurance that the forward-looking statements

contained herein will prove to be correct or that the expectations

and assumptions upon which they are based will occur or be

realized. These include, but are not limited to: risks inherent to

oil and gas exploration, development, exploitation and production

operations and the oil and gas industry in general,; adverse

changes in commodity prices, foreign exchange rates or interest

rates; the ability to access capital when required and on

acceptable terms; the ability to secure required services on a

timely basis and on acceptable terms; increases in operating costs;

environmental risks; changes in laws and governmental regulation

(including with respect to royalties, taxes and environmental

matters); adverse weather or break-up conditions; competition for

labour, services, equipment and materials necessary to further the

Company's oil and gas activities; and changes in plans with respect

to exploration or development projects or capital expenditures in

respect thereof. These and other risks are discussed in more detail

in the Company's current annual information form and other

documents filed by it from time to time with securities regulatory

authorities in Canada, copies of which are available electronically

under Prairie Provident's issuer profile on the SEDAR website at

www.sedar.com and on the Company's website at

www.ppr.ca. This list is not exhaustive.

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

OTHER ADVISORIES

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

* The 102/13-24-020-11W4 (Princess-1) well was previously

disclosed as 102/1-26-020-11W4 in the Company's news release dated

May 9, 2018 entitled “ Prairie Provident Announces First Quarter

2018 Financial and Operating Results”.

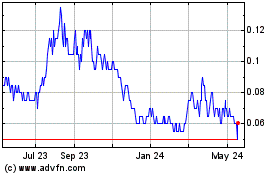

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

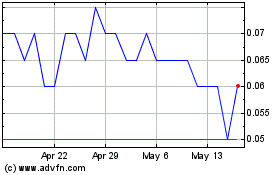

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025