NOVAGOLD RESOURCES INC. (“NOVAGOLD” or “the

Company”) (NYSE American, TSX: NG) today released its 2022 fiscal

year financial results and an update on Donlin Gold, among the

largest — and envisioned to be in the lower quartile in terms of

operating cost — of the next generation of gold operating mines,

and more importantly in a jurisdiction that welcomes responsible

development. Donlin Gold LLC is owned equally by NOVAGOLD and

Barrick Gold Corporation (“Barrick”).

Details of the financial results for the fiscal year ended

November 30, 2022 are presented in the consolidated financial

statements and annual report on Form 10-K filed on January 25, 2023

that is available on the Company’s website at www.novagold.com, on

SEDAR at www.sedar.com, and on EDGAR at www.sec.gov. All amounts

are in U.S. dollars unless otherwise stated.

In 2022, the following milestones were achieved at

Donlin Gold:

- The comprehensive

141-hole, 42,331-meter drill program was successfully completed

ahead of schedule, with multiple high-grade gold intercepts

reported from the last set of assays and the advancement of key

project efforts.

- The success of our

2022 drill program is due to the exceptional dedication of the

Donlin Gold team in Anchorage and at site, the majority of which

are local hires from 24 different communities in the

Yukon-Kuskokwim (“Y-K”) region, who all share the goal of

protecting the health and safety of their colleagues.

- In partnership with

Calista Corporation (“Calista”) and The Kuskokwim Corporation

(“TKC”), the Company pursued its stakeholder and government

engagement efforts in the Y-K region, Alaska and Washington, D.C.:

- Crooked Creek, the

closest community to the project site in the Y-K region formally

expressed its support of Donlin Gold;

- Four additional

Shared Value Statements were signed with Y-K villages, for a total

of 12;

- Five local hires

from the 2022 drill program signed on as Donlin Gold Community

Liaison representatives in their villages (Marshall, Tuluksak,

Nikolai, Napaskiak, and Pilot Station); and

- Calista and Donlin

Gold continued their proactive, bipartisan outreach in Alaska as

well as with the Administration and Congress in Washington,

D.C.

- Environmental and

social investment focused on the Y-K region spanned from supporting

important health and safety initiatives in remote communities to

cultural preservation efforts and educational programming in

collaboration with school districts and other organizations. Key

achievements included:

- Conducted multiple

fishery studies, reclamation work and other environmental

activities.

- Supported various

search and rescue teams in the region, funded the Healthy Alaska

Natives Foundation and Bethel Community Services Foundation, as

well as sponsored and participated in the Alaska Safe Riders

initiative, which promotes safety for year-round outdoor

sports.

- Fostered education,

community wellness and cultural preservation through a variety of

interventions including several river studies, supported the local

school district and educational organizations, funded and

participated in youth sporting activities, and backed initiatives

led by Traditional Councils and Native communities.

- As a federally

permitted project on private Alaska Native Corporation land

designated by law for mining activities and with key State permits

in hand, activities continued to keep our permits in good standing.

Major milestones included:

- Applied for a new

air quality permit from the Alaska Department of Environmental

Conservation (ADEC). A draft permit was issued for public comment

in December 2022.

- Submitted

application to ADEC for the regularly scheduled re-issuance of its

Alaska Pollutant Discharge Elimination System permit, which is now

complete and will remain in effect until the State completes the

re-issuance.

- On November 1, 2022,

the Alaska Department of Natural Resources (ADNR) finalized the

re-location plan for public easements in the mine site and

transportation facility areas — decisions which were not

appealed.

President’s Message

Excellent Results from the 2022 Drill Program Support

Next Steps for Donlin Gold

NOVAGOLD’s management team has been together for a decade now

and is committed to the advancement of the 50%-owned Donlin Gold

project to be perfectly situated for the next leg in the gold bull

market. Many activities have taken place over the years to support

Donlin Gold and de-risk the project to enable it to benefit from a

rising gold price environment. These include, among many others,

the receipt of key Federal and State permits, geological and

exploration drilling, technical and trade-off studies,

environmental initiatives, successful implementation of employee

health and safety procedures, and extensive community engagement

and government affairs efforts. This last year was no exception as

activities substantially ramped-up at the start of the year with

the project camp reopening to begin the largest drill program in

over 15 years at Donlin Gold. This campaign was executed while

remaining attentive to the health and safety of our employees,

project contractors and stakeholders, and concurrently with the

extensive community relations and government affairs efforts

conducted in collaboration with our Alaska Native Corporation

partners, Calista and TKC. The success of this program is due to

the exceptional dedication of the Donlin Gold team in Anchorage and

at site, the majority of which were local hires from 24 different

communities in the Y-K region, who all share the goal of protecting

the health and safety of their colleagues.

Donlin Gold’s 2022 drill program was completed in September with

141 holes drilled for a total of 42,331 m. The final set of results

released jointly with Barrick on January 19, 2023, include assays

for 37 complete and 7 partial holes, encompassing the remaining

12,762 m of length drilled. Drilling in 2022 returned some of the

best assay results seen to date at Donlin Gold, delivering

outstanding gold intercepts which include, among others from the

most recent set of assay results, drill hole DC22-2130 that

intersected 17.20 m grading 11.11 g/t gold, with a sub-interval of

4.25 m grading 36.91 g/t gold.

As part of the key focus areas for the drill program,

tight-spaced 20m x 20m grid drilling in representative areas within

the main structural domains of the deposit (Lewis –further infilled

to 10m x 10m, West ACMA and Divide areas) confirmed recent

geological modelling at wider drill-spacing in the immediate area

surrounding the grids. It also identified additional short-scale

controls that will be incorporated into an update to refine the

geological domains used for global resource estimation, which will

be utilized for strategic mine planning work. The 14 additional

geotechnical drill holes provided information needed to advance the

application for the Alaska Dam Safety Certifications. In truth, we

could not be happier with the outcome of the 2022 drill program;

the assay labs returned some of the best intercepts since the

project’s inception and indeed among open-pit gold projects

industry-wide. Just to highlight how encouraging the results were,

what follows are the top 20 intercepts from the 2022 Donlin Gold

drill program:

|

Hole ID |

Location |

Date Reported |

From (m) |

To (m) |

Length (m) |

Grade(g/t Au) |

|

DC22-2068 |

Divide |

11/01/2022 |

117.52 |

159.80 |

42.28 |

30.68 |

|

DC22-2077 |

Divide |

11/01/2022 |

150.11 |

199.07 |

48.96 |

20.61 |

|

DC22-2040 |

ACMA |

07/28/2022 |

232.95 |

285.22 |

52.57 |

14.63 |

|

DC22-2063 |

Divide |

11/01/2022 |

236.22 |

297.18 |

60.96 |

12.35 |

|

DC22-2063 |

Divide |

11/01/2022 |

162.18 |

181.92 |

19.74 |

34.17 |

|

DC22-2056 |

ACMA |

07/28/2022 |

99.82 |

173.80 |

73.98 |

4.21 |

|

DC22-2092 |

Divide |

11/01/2022 |

116.12 |

157.31 |

41.19 |

6.64 |

|

DC22-2063 |

Divide |

07/28/2022 |

130.04 |

142.14 |

12.10 |

22.15 |

|

DC22-2086 |

Divide |

11/01/2022 |

160.87 |

170.78 |

9.91 |

22.24 |

|

DC22-2120 |

Lewis |

11/01/2022 |

41.86 |

71.73 |

29.87 |

6.96 |

|

DC22-2040 |

ACMA |

07/28/2022 |

197.60 |

216.25 |

18.65 |

10.78 |

|

DC22-2067 |

ACMA |

07/28/2022 |

464.06 |

508.64 |

44.58 |

4.50 |

|

DC22-2072 |

Divide |

11/01/2022 |

140.67 |

148.61 |

7.94 |

24.65 |

|

DC22-2056 |

ACMA |

07/28/2022 |

2.44 |

13.33 |

10.89 |

17.55 |

|

DC22-2130 |

Lewis |

01/19/2023 |

902.45 |

919.65 |

17.20 |

11.11 |

|

DC22-2110 |

Lewis |

11/01/2022 |

157.98 |

164.53 |

6.55 |

28.96 |

|

DC22-2081 |

Divide |

11/01/2022 |

179.90 |

201.10 |

21.20 |

8.73 |

|

DC22-2183 |

Lewis |

01/19/2023 |

62.53 |

86.80 |

24.27 |

7.56 |

|

DC22-2177 |

Lewis |

01/19/2023 |

168.51 |

197.82 |

29.31 |

6.01 |

|

DC22-2109 |

Lewis |

11/01/2022 |

94.22 |

120.70 |

26.48 |

6.65 |

|

|

|

|

|

|

|

|

With this highly successful drill program behind us, to be

followed by the completion of an updated resource model and

trade-off studies, the owners look forward to supporting the Donlin

Gold team and its partners Calista and TKC in positioning the

project for the next steps in taking Donlin Gold up the value chain

with an updated feasibility study decision for the benefit of all

stakeholders.

Developing one of the world’s largest gold mines represents a

substantial undertaking that takes the necessary time and energy to

ensure a diligent, thorough, transparent, and inclusive process for

all involved, including stakeholders from the Y-K region. But I can

also tell you from my own experience with multiple Tier-1 assets —

including as President of Barrick North America for eight years,

which is when I realized just how spectacular the Donlin project

really is — I believe that the more intensive work that is done on

the front end, the better the long-term outcome. Richard Williams,

our Vice President of Engineering & Development, shares that

philosophy. As the man who built and brought the famed Pueblo Viejo

mine into production for Barrick, he too felt that in joining

NOVAGOLD he was aligning himself with the best-in-class for the

gold industry’s future.

This shared philosophy is particularly meaningful for a project

that is by any definition not just Tier-1 but generational. As

committed partners to the second largest gold-producing state in

one of the world’s premier jurisdictions, we welcome a process that

enhances our social and environmental license for a mine that we

fully expect to operate for decades to come.

A Healthy Workforce to Safely Advance Site Activities

and Support Local Communities

Keeping our workforce healthy and safe has always

been a top priority for NOVAGOLD and at Donlin Gold. This also

extends to health and safety initiatives in the surrounding

communities where we operate. The safety protocols and meetings at

the project site played a central role in ensuring the continued

success of Donlin Gold and its drill program in 2022. We are

immensely proud that Donlin Gold achieved zero Lost-Time-Incidents

once again in 2022 — a remarkable achievement that we do not take

for granted as we continue to work and improve practices to ensure

the health and safety of our people.

One of the key areas in which we spend a

considerable amount of time and resources at the Donlin Gold

project is participating, funding, and supporting local communities

in initiatives associated with health and safety, environmental

management, training and education, and cultural programming

throughout the Y-K region. This has represented a fundamental

undertaking by Donlin Gold over the years — for the benefit of all

stakeholders. Local recruitment is also an important part of our

ongoing efforts. During the 2022 field season, 150 employees worked

at the Donlin Gold site representing 24 Y-K villages. Local hires

from the 2022 drill program will continue to support Donlin Gold’s

engagement efforts through the Community Liaison program in five

Y-K villages.

We immensely appreciate the meaningful input from

Calista and TKC regarding their land and the significant economic

needs required to sustain healthy living for their communities. Our

partners’ continued and time-tested collaboration, project support,

and full engagement are extremely valuable in ensuring responsible

and sustainable economic development throughout all phases of the

Donlin Gold project. Crooked Creek, the closest community to the

project site in the Y-K region, formally expressed their support of

Donlin Gold in December 2022. Four additional Shared Value

Statements were also signed with villages in the Y-K region in the

last three months, for a total of 12. These documents formalize

current engagement with key local communities, expand upon the

long-term relationships already established with them, and address

specific community needs including water, sewer, and solid waste

projects; the ice road that connects remote villages in the Y-K

region; salmon and other aquatic life studies; and suicide

prevention and public safety programs.

Environmental stewardship, education, community

wellness, and cultural preservation constitute key focus

investments for Donlin Gold in the Y-K region. The project supports

these initiatives through fisheries studies and other environmental

activities, subsistence and cultural preservation efforts, and

educational grants. A wide range of activities and projects were

carried out in collaboration with Calista and TKC in the fourth

quarter. Donlin Gold supported various search and rescue teams in

the region, provided funding to the Healthy Alaska Natives

Foundation and Bethel Community Services Foundation, as well as

sponsored and participated in the Alaska Safe Riders initiative,

which promotes safety for year-round outdoor sports. Donlin Gold

fostered education, community wellness and cultural preservation

through a variety of interventions including several river studies,

supporting the local school district and educational organizations,

funding and participating in youth sporting activities, and backing

initiatives led by Traditional Councils and Native communities.

In 2022, several community engagements and critical

support initiatives took place across the region. Donlin Gold

funded the 270-mile-long Kuskokwim ice road developed to improve

safety to nearby communities — a significant undertaking during the

winter months to connect many communities along the Kuskokwim River

and provide road access to residents living in remote locations.

With support from TKC, Donlin Gold supplied safe drinking water to

the village of Red Devil following a flood that was caused by ice

break-up and which temporarily contaminated the local water wells.

We funded and participated in the fifth annual “In It for the Long

Haul” Backhaul Project to collect, remove, and safely dispose of

household hazardous and electronic waste from some 30 remote

villages throughout the Y-K region that would otherwise have ended

up in landfills and waterways. As advocates of training and youth

educational initiatives, Donlin Gold supported EXCEL Alaska, a

non-profit organization providing life-changing educational and

professional opportunities for rural Alaska students and young

adults, and the Lower Kuskokwim School District annual College and

Career fair. We also collaborated with six Y-K school districts as

part of the national Yup’ik Dictionary Project. Additionally,

Donlin Gold funded community investments through the Bethel

Community Services Foundation for the development, growth, and

enhancement of community-based programs.

Calista and Donlin Gold continued their proactive, bipartisan

outreach in Alaska and with the Administration and Congress in

Washington, D.C. to highlight the thoroughness of the project’s

environmental review and permitting processes, in addition to the

considerable benefits that the project would deliver to all Native

Alaskans. Alaska U.S. Senators Lisa Murkowski and Dan Sullivan, as

well as Governor Michael Dunleavy, have been long-term supporters

of the Donlin Gold project. We also recognize the historic

re-election of U.S. Representative Mary Peltola for a full term as

the first Alaska Native to join Congress and look forward to our

continued outreach to her regarding Donlin Gold in the coming

year.

A Diligent, Thorough, and Transparent Permitting Process

to Maintain Permits in Good Standing and Complete the Required

State Permitting

Donlin Gold is a federally permitted project on

private Alaska Native Corporation land designated, by law, for

mining activities as part of the 1971 Alaska Native Claims

Settlement Act (ANCSA) — a considerable differentiating factor from

most other mining assets in Alaska. As private landowners, both

Calista and TKC are dedicated to developing Donlin Gold in a way

that remains consistent with the Elders’ vision of responsible

development, while creating jobs and economic benefits for the

surrounding communities as well as protecting the local culture. As

someone who has visited many of the world’s greatest mining

districts, I feel extremely lucky to be operating in the great

State of Alaska.

In 2022, Donlin Gold applied for a new air quality permit from

the ADEC and a draft permit was issued for public comment in

December 2022. Donlin Gold also submitted its application to ADEC

for the regularly scheduled re-issuance of its Alaska Pollutant

Discharge Elimination System permit. In December 2022, ADEC sent a

letter indicating that the application was complete, and that the

permit would remain in effect until ADEC completes the reissuances

process. On November 1, 2022, the ADNR finalized the re-location

plan for public easements in the mine site and transportation

facility areas — decisions which were not appealed.

We have always prepared and organized Donlin Gold for potential

challenges to the Federal and State permits as this is the norm in

the United States. The Donlin Gold project leadership and

litigation teams are intimately familiar with the permits and the

associated procedures that need to be followed. Donlin Gold and its

owners, alongside the steadfast advocacy of Calista and TKC,

continue to support the State and Federal government agencies in

the defense of what has constituted an exceptionally thorough and

diligent permitting process.

Excellent Treasury to Execute on Activities in

2023

NOVAGOLD’s well-executed strategy to take Donlin Gold up the

value chain has allowed the Company to remain in a strong financial

position. The Company has not issued equity to raise capital since

January 2012, and we believe that we have sufficient funds to cover

anticipated costs to fund our share of the Donlin Gold project

through an updated feasibility study. We have approximately $126

million in cash and term deposits as of November 30, 2022 and

expect an additional $25 million due from Newmont in July 2023 from

the sale of our 50%-owned Galore Creek project in British Columbia.

A further payment of $75 million is contingent upon a construction

decision on Galore Creek.

Looking ahead to 2023, NOVAGOLD anticipates spending

approximately $31 million, with approximately $17 million allocated

to fund our share of expenditures at the Donlin Gold project. This

includes $8 million for external affairs, permitting,

environmental, land, and legal activities and $9 million for

project planning and fieldwork. A total of $13 million is allocated

for NOVAGOLD general corporate and administrative costs and $1

million for working capital and other items.

The focus areas at Donlin Gold will be to update the geologic

and resource models with 2022 data; review key project assumptions,

inputs, and design components for optimization (mine engineering,

metallurgy, hydrology, and infrastructure); complete trade-off

studies; continue fieldwork to collect geotechnical and

hydrological information for completing design documentation

required for the Alaska Dam Safety certificates, as well as advance

permits through the regulatory process and support the State in

maintaining the existing permits under appeal; and through

continued engagement, sustain and expand project support in the

region. As a direct consequence of the success that characterized

last year’s large-scale drill program in achieving its objectives,

our focus this year will be on advancing trade-off studies and

advancing the Donlin Gold project toward a decision to commence an

updated feasibility study.

Donlin Gold — An Absolute Gem to Advance Up

the Value Chain in a Jurisdiction that Welcomes Responsible Mining

Development

As the premier gold deposit located in Alaska,

Donlin Gold represents a potential source of responsible economic

development for the benefit of all stakeholders in the second

largest gold-producing state in the United States, with its

well-established tradition of responsible mining, and an

opportunity to provide long-term, sustainable economic growth for

many decades to come.

Moreover, Donlin Gold truly stands in a league of

its own within the gold industry itself. With approximately 39

million ounces of gold grading 2.24 grams per tonne1 in

the Measured and Indicated Mineral Resource categories (100 percent

basis), Donlin Gold hosts one of the largest and highest-grade

undeveloped open-pit gold endowments in the world. And we believe

it has an extraordinary capacity to grow. The most recent 2022

drill program results clearly demonstrate remarkable additional

upside potential. The ACMA and Lewis pits, where the existing

resources sit, occupy only three kilometers of an eight-kilometer

mineralized belt, which itself is located on less than 5% of Donlin

Gold’s land position. As currently envisioned, the project would

produce an average of 1.1 million ounces per year over its 27-year

mine life.

The gold industry in general, and unique high-quality assets

such as Donlin Gold in particular, require patience — an attribute

that we have demonstrated extensively over the last decade, and

which has proven beneficial in allowing us to substantially de-risk

the project and the Company. Donlin Gold is indeed brilliantly

positioned for this next leg in the gold market. As stated by our

Chairman, our largest shareholder and a well-seasoned investor with

extensive experience in gold, platinum, silver and hydrocarbons,

Dr. Thomas S. Kaplan: “As an investor, I find that the ability to

make money is very much a function of developing a thesis,

scrubbing that thesis to the point where one enjoys massive

conviction, finding the right assets that will allow one to benefit

from the underlying theme, increasingly so in a jurisdiction that

secures the fruits of that benefit, and then having patience and

riding it for as long as it takes. And I came to that conviction

with NOVAGOLD.” With such remarkable attributes of scale, quality,

longevity, additional growth potential, excellent partnerships and

jurisdictional appeal, Donlin Gold is in the right place at the

right time to meet an industry need for new responsible gold mining

development.

In closing, I wish to extend my sincere gratitude

to our Board members for their steadfast commitment and loyalty to

NOVAGOLD — and particularly Igor Levental, a long-tenured director

who unexpectedly passed away last June. We would like to thank his

family for sharing him with us and for his extensive knowledge of

the mining industry that brought such a unique and valuable

perspective to NOVAGOLD’s Board. I am also grateful for the highly

experienced team of professionals at NOVAGOLD, Donlin Gold, and

Barrick, along with our contractors and drill crew at site, and for

the various State agencies and representatives for their

determination and commitment to the permitting process. Their

passion and expertise, as well as the long-term support from

Calista and TKC, constitute the foundation of Donlin Gold’s vision

and the source of the Company’s present and future accomplishments.

To Calista and TKC: your knowledge and guidance have been critical

over the years through permitting, sustainability, and community

engagement initiatives — we thank you for your constant support. It

is a distinct pleasure and a real honor to be a part of this

Company and to work alongside each of you.

Last but certainly not least, to our shareholders: I wish to

thank each and every one of you for your strong backing and for

choosing to invest in NOVAGOLD, as well as for your engagement,

patience, and insight over the years. I look forward to continuing

to deliver on our promises and to keeping an open line of

communication between us while we reach even more milestones and

achievements together in 2023.

Sincerely,

Gregory A. LangPresident & CEO

Financial Results

in thousands of U.S. dollars, except for per share

amounts

|

|

Year endedNovember 30,

2022$ |

|

Year endedNovember 30,

2021$ |

|

|

General and administrative expense (1) |

20,109 |

|

20,210 |

|

|

Share of losses – Donlin Gold |

28,163 |

|

16,625 |

|

|

Total operating expenses |

48,272 |

|

36,835 |

|

|

|

|

|

|

Loss from operations |

(48,272) |

|

(36,835) |

|

|

Interest expense on promissory note |

(7,962) |

|

(5,922) |

|

|

Accretion of notes receivable |

849 |

|

2,556 |

|

|

Other income, net |

2,009 |

|

(198) |

|

|

Income tax recovery (expense) |

33 |

|

(137) |

|

|

Net loss |

(53,343) |

|

(40,536) |

|

|

|

|

|

|

Loss per share, basic and diluted |

(0.16) |

|

(0.12) |

|

|

|

|

|

At November 30,

2022$ |

|

At November 30, 2021

$ |

|

|

Cash and term deposits |

|

|

125,882 |

|

169,124 |

|

|

Total assets |

|

|

159,189 |

|

198,852 |

|

|

Total liabilities |

|

|

129,286 |

|

120,570 |

|

|

|

|

|

|

|

|

|

Net loss increased by $12.8 million in 2022

compared to 2021, primarily due to the expanded Donlin Gold

drilling and work program, and lower accretion income in 2022

resulting from the receipt of the $75 million note from Newmont in

July 2021. Increasing interest rates resulted in higher Barrick

promissory note interest expense and was offset by income earned on

cash and term deposits and favorable foreign exchange

movements.

During the fourth quarter of 2022 we incurred a net

loss of $12.3 million compared to a net loss of $10.3 million in

2021. The increase in net loss primarily resulted from the expanded

activity at Donlin Gold and increased interest on the promissory

note, partially offset by higher interest income and lower

remediation expense for the former New Gold House mineral

property.

Liquidity and Capital ResourcesIn

2022, the net decrease in cash and cash equivalents of $27.2

million primarily resulted from Donlin Gold funding of $28.4

million, corporate operating activities of $12.4 million and

withholding tax on share-based compensation of $2.1 million,

partially offset by cash received from term deposits of $16

million.

Net spending on operating activities increased in

2022 from 2021 primarily due to the timing of corporate liability

insurance payments; partially offset by higher interest received on

cash and term deposits due to higher interest rates. Donlin Gold

funding increased due to the expanded drilling and work program. In

2021, a $75,000 payment was received from Newmont related to the

2018 sale of Galore Creek.

2023 Outlook

We anticipate spending approximately $31 million in

2023, which includes $13 million for corporate general and

administrative costs; $1 million for working capital and other

items; and $17 million to fund our share of expenditures at

the Donlin Gold project, including:

- $8 million for external affairs,

permitting, environmental, land, and legal activities

- $9 million for project planning and

fieldwork

NOVAGOLD’s primary goals in 2023 will be to continue to advance

the Donlin Gold project toward a construction decision; maintain or

increase support for Donlin Gold among the project’s stakeholders;

promote a strong safety, sustainability, and environmental culture;

maintain a peer-leading reputation for NOVAGOLD, its governance

practices and its project among shareholders; and manage the

Company’s treasury effectively and efficiently. Our operations

primarily relate to the delivery of project milestones, including

the achievement of various technical, environmental, sustainable

development, economic and legal objectives, obtaining necessary

permits, commencement of feasibility studies, preparation of

engineering designs and the financing to fund these objectives.

Conference Call & Webcast Details

NOVAGOLD’s conference call and webcast to discuss these results

will take place on January 26, 2023, at 8:00 am PT (11:00

am ET). The webcast and conference call-in details are provided

below.

| |

Video

Webcast: |

www.novagold.com/investors/events |

|

| |

North American

callers: |

1-800-319-4610 |

|

| |

International callers: |

1-604-638-5340 |

|

| |

|

|

|

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on

the development of its 50%-owned Donlin Gold project in Alaska, one

of the safest mining jurisdictions in the world. With approximately

39 million ounces of gold in the Measured and Indicated

Mineral Resource categories, inclusive of Proven and Probable

Mineral Reserves (541 million tonnes at an average grade of

approximately 2.24 grams per tonne in the Measured and Indicated

Resource categories on a 100% basis),2 Donlin Gold is regarded to

be one of the largest, highest-grade, and most prospective known

open-pit gold deposits in the world.

According to the 2021 Technical Report and the S-K 1300 Report,

once in production, Donlin Gold is expected to produce an average

of more than one million ounces per year over a 27-year mine life

on a 100% basis. The Donlin Gold project has substantial

exploration potential beyond the designed footprint which currently

covers three kilometers of an approximately eight-kilometer-long

gold-bearing trend. Current activities at Donlin Gold are focused

on State permitting, engineering studies, community outreach, and

workforce development in preparation for the eventual construction

and operation of this project. With a strong balance sheet,

NOVAGOLD is well-positioned to fund its share of permitting and

advancement efforts at the Donlin Gold project.

Scientific and Technical Information

Certain scientific and technical information contained herein

with respect to the Donlin Gold project is derived from the 2021

Technical Report and the S-K 1300 Report3. Henry Kim, P.Geo.,

Senior Resource Geologist, Wood Canada Limited; Mike Woloschuk,

P.Eng., VP Global Business Development & Consulting, Wood Group

USA, Inc.; and Kirk Hanson, MBA, P.E., Technical Director, Open Pit

Mining, Wood Group USA, Inc. are the Qualified Persons responsible

for the preparation of the 2021 Technical Report, and each is an

independent Qualified Person as defined by National Instrument

43-101 (“NI 43-101”). Wood prepared the S-K 1300 Report.

Paul Chilson, P.E., who is the Manager, Mine Engineering for

NOVAGOLD and a Qualified Person under NI 43-101 and under S-K

1300, has approved and verified the scientific and technical

information related to the 2022 Donlin Gold project drill program,

the 2021 Technical Report and the S-K 1300 Report contained in this

media release.

NOVAGOLD Contacts:Mélanie HennesseyVice

President, Corporate Communications

604-669-6227 or 1-866-669-6227

Cautionary Note Regarding Forward-Looking

Statements

This media release includes certain “forward-looking

information” and “forward-looking statements” (collectively

“forward-looking statements”) within the meaning of applicable

securities legislation, including the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as “expects”, “anticipates”, “believes”, “intends”, “estimates”,

“potential”, “possible”, and similar expressions, or statements

that events, conditions, or results “will”, “may”, “could”, “would”

or “should” occur or be achieved. Forward-looking statements are

necessarily based on several opinions, estimates and assumptions

that management of NOVAGOLD considered appropriate and reasonable

as of the date such statements are made, are subject to known and

unknown risks, uncertainties, assumptions, and other factors that

may cause the actual results, activity, performance, or

achievements to be materially different from those expressed or

implied by such forward-looking statements. All statements, other

than statements of historical fact, included herein are

forward-looking statements. These forward-looking statements

include statements regarding the anticipated timing of certain

judicial and/or administrative decisions; the 2023 Outlook; the

timing and potential for an updated feasibility study on the

project; our goals and planned expenditures for the remainder of

2023; ongoing support provided to key stakeholders including Native

Corporation partners; Donlin Gold’s continued support to the

State’s thorough permitting process; the potential development and

construction of Donlin Gold; the sufficiency of funds to continue

to advance development of Donlin Gold, including to a construction

decision; perceived merit of properties; mineral reserve and

mineral resource estimates; Donlin Gold’s ability to secure the

permits needed to construct and operate the Donlin Gold project in

a timely manner, if at all; legal challenges to Donlin Gold’s

existing permits and the timing of decisions in those challenges;

the Donlin Gold LLC Board approval to advance Donlin Gold up the

value chain; the success of the strategic mine plan for Donlin

Gold; the outcome of exploration drilling at Donlin Gold and the

timing thereof; and the conversion of Galore Creek into a mine and

the receipt of $25 million due in July 2023 from Newmont

Corporation and the $75 million contingent payment from Newmont. In

addition, any statements that refer to expectations, intentions,

projections or other characterizations of future events or

circumstances are forward-looking statements. Forward-looking

statements are not historical facts but instead represent the

expectations of NOVAGOLD management’s estimates and projections

regarding future events or circumstances on the date the statements

are made.

Important factors that could cause actual results to differ

materially from expectations include the need to obtain additional

permits and governmental approvals; the timing and likelihood of

obtaining and maintaining permits necessary to construct and

operate; the need for additional financing to explore and develop

properties and availability of financing in the debt and capital

markets; the coronavirus global pandemic (COVID-19); uncertainties

involved in the interpretation of drill results and geological

tests and the estimation of reserves and resources; changes in

mineral production performance, exploitation and exploration

successes; changes in national and local government legislation,

taxation, controls or regulations and/or changes in the

administration of laws, policies and practices, expropriation or

nationalization of property and political or economic developments

in the United States or Canada; the need for continued cooperation

between Barrick and NOVAGOLD for the continued exploration,

development and eventual construction of the Donlin Gold property;

the need for cooperation of government agencies and Native groups

in the development and operation of properties; risks of

construction and mining projects such as accidents, equipment

breakdowns, bad weather, disease pandemics, non-compliance with

environmental and permit requirements, unanticipated variation in

geological structures, ore grades or recovery rates; unexpected

cost increases, which could include significant increases in

estimated capital and operating costs; fluctuations in metal prices

and currency exchange rates; whether a positive construction

decision will be made regarding Donlin Gold; and other risks and

uncertainties disclosed in NOVAGOLD’s most recent reports on Forms

10-K and 10-Q, particularly the “Risk Factors” sections of those

reports and other documents filed by NOVAGOLD with applicable

securities regulatory authorities from time to time. Copies of

these filings may be obtained by visiting NOVAGOLD’s website at

www.novagold.com, or the SEC’s website at www.sec.gov, or at

www.sedar.com. The forward-looking statements contained herein

reflect the beliefs, opinions and projections of NOVAGOLD on the

date the statements are made. NOVAGOLD assumes no obligation to

update the forward-looking statements of beliefs, opinions,

projections, or other factors, should they change, except as

required by law.

1 Donlin Gold data as per the 2021 Technical Report and S-K 1300

Report (both as defined herein). Donlin Gold possesses Measured

Resources of approximately 8 Mt grading 2.52 g/t and Indicated

Resources of approximately 534 Mt grading 2.24 g/t, each on a 100%

basis and inclusive of Mineral Reserves, of which approximately 4

Mt of Measured Resources and approximately 267 Mt of Indicated

Resources inclusive of Reserves is attributable to NOVAGOLD through

its 50% ownership interest in Donlin Gold LLC. Exclusive of Mineral

Reserves, Donlin Gold possesses Measured Resources of approximately

1 Mt grading 2.23 g/t and Indicated Resources of approximately 69

Mt grading 2.44 g/t, of which approximately 0.5 Mt of Measured

Resources and approximately 35 Mt of Indicated Resources exclusive

of Mineral Reserves is attributable to NOVAGOLD. Donlin Gold

possesses Proven Reserves of approximately 8 Mt grading 2.32 g/t

and Probable Reserves of approximately 497 Mt grading 2.08 g/t,

each on a 100% basis, of which approximately 4 Mt of Proven

Reserves and approximately 249 Mt of Probable Reserves is

attributable to NOVAGOLD. Mineral Reserves and Resources have been

estimated in accordance with NI 43-101 and S-K 1300.

2 Donlin Gold data as per the 2021 Technical

Report and the S-K 1300 Report, refer to footnote 3 for the

description.

3 The Company retained Wood Canada Limited

(“Wood”) in 2020 to update content in its previously filed “Donlin

Creek Gold Project, Alaska, USA, NI 43-101 Technical Report on the

Second Updated Feasibility Study,” effective November 18, 2011, and

amended January 20, 2012. This update resulted in a report titled

“NI 43-101 Technical Report on the Donlin Gold Project, Alaska,

USA” with an effective date of June 1, 2021 (the “2021 Technical

Report”) and was filed on August 31, 2021. The Company is a

registrant with the SEC and is reporting its exploration results,

Mineral Resources, and Mineral Reserves in accordance with Subpart

229.1300 of Regulation S-K – Disclosure by Registrants Engaged in

Mining Operations (“S-K 1300”) as of November 30, 2021. While the

S-K 1300 rules are similar to National Instrument 43-101 Standards

of Disclosure for Mineral Projects rules in Canada, they are not

identical and therefore two reports have been produced for the

Donlin Gold project. The Company requested that Wood prepare a

Technical Report Summary of the Donlin Gold project, Alaska, USA

using the standards of S-K 1300 and it is titled “S-K 1300

Technical Report Summary on the Donlin Gold Project, Alaska,

USA” (“S-K 1300 Report”), current as of November 30, 2021.

Wood incorporated 2020 costs and new gold price guidance to meet

the Company’s reporting requirements. The resultant 2021 Technical

Report and S-K 1300 Report showed no material change to the

previously reported mineral resources or mineral reserves.

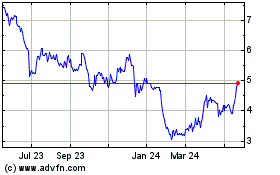

NovaGold Resources (TSX:NG)

Historical Stock Chart

From Nov 2024 to Dec 2024

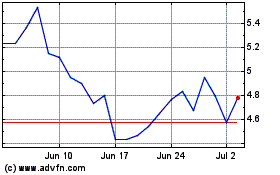

NovaGold Resources (TSX:NG)

Historical Stock Chart

From Dec 2023 to Dec 2024