Marimaca Copper Corp. (“Marimaca Copper”, “Marimaca” or the

“Company”) (TSX: MARI) and Assore International Holdings Limited

(“AIH”) are pleased to announce a C$68 million equity investment

(the “Strategic Investment”) by AIH in Marimaca.

The Strategic Investment consists of the

acquisition of 9,417,210 common shares of Marimaca (“Common

Shares”) by AIH from an affiliate of Tembo Capital Mining

GP Limited, Ndovu Capital XIV B.V. (collectively, “Tembo

Capital”) (the “Tembo Acquisition”), at a

price of C$4.50 per Common Share for gross proceeds to Tembo

Capital of C$42,377,445 pursuant to a share purchase agreement

dated July 15, 2024 and the issuance of 5,725,000 units

(“Units”) of the Company to AIH by way of a

non-brokered private placement for gross proceeds of C$25,762,500

pursuant to a subscription agreement dated July 15, 2024 (the

“AIH Private Placement”).

Each Unit consists of one Common Share and one

half of one Common Share purchase warrant (each whole Common Share

purchase warrant a “Warrant”) at a price of C$4.50

per Unit. Each Warrant will entitle AIH to purchase one additional

Common Share at an exercise price of C$5.85 for a period of 18

months following the closing of the AIH Private Placement.

Following completion of the Strategic Investment and the Additional

Private Placement (as defined below), AIH will own approximately

14.99% of the issued and outstanding Common Shares on a non-diluted

basis and 18.07% of the Common Shares on a partially diluted basis

(assuming the exercise in full of the Warrants held by AIH and the

exercise of the Option described and defined below). Prior to the

Tembo Acquisition and the AIH Private Placement, AIH did not own

any securities of Marimaca.

The Unit subscription price represents a 15%

premium to the 20-day volume weighted average price of the Common

Shares on the Toronto Stock Exchange (the “TSX”)

as of July 12, 2024.

In addition, another investor will subscribe for

1,000,000 Units by way of private placement on the same pricing

terms as the AIH Private Placement for gross proceeds of

C$4,500,000 (the “Additional Private Placement”)

(together with the AIH Private Placement the “Private

Placements”).

Proceeds from the Private Placements will be

used to advance the development of the Company’s flagship Marimaca

Copper Project (the “Project”) located in the

Antofagasta region, Chile and for exploration work programs at key

targets within the Company’s regional land package, as further

detailed below.

Hayden Locke, President & CEO of

Marimaca Copper, commented:“Firstly, I would like to take

this opportunity to thank Tembo for its strong support of the

Company. When conflicting investment and project development

timelines meet, especially with one of a Company’s key investors,

it can create challenges for management. With this transaction,

Tembo has introduced a new investor that is perfectly aligned with

the Company’s longer-term objective, to be a copper producer. I am

also very pleased that Tembo’s former nominee Director, Tim

Petterson, has agreed to stay on the Board as an independent

director.

Secondly, on behalf of the Board of Directors, I

would like to welcome our new partner, Assore International

Holdings Limited (AIH), to the Marimaca team. AIH has completed

extensive due diligence and is aligned with our objective of

becoming a copper producer, while continuing to invest in

exploration and other opportunities for value creation. AIH and its

parent company Assore Holdings bring a valuable combination of deep

mining heritage, business acumen and financial strength, which

further derisks us on our development journey.

Lastly, we welcome Kieran Daly (Managing

Director of Assore International Holdings Limited) to the Board as

the Nominee of AIH and look forward to working closely with him,

and the broader Assore group, as we push ahead with our development

plans.”

Kieran Daly, Managing Director of Assore

International Holdings Limited, commented:“We look forward

to working alongside the Marimaca team as another step in our

journey to diversify and grow our exposure to commodities and

projects that are key to meeting the future needs of the global

consumer, in a safe and sustainable manner. The well-defined

Marimaca resource along with its considerable upside and

medium-term copper production potential, is very interesting to us,

and we are excited to partner with Marimaca by leveraging our

mining heritage, experience and expertise to realise Marimaca's

potential.”

About Assore

Assore International Holdings Limited (AIH) is a

UK-based subsidiary of Assore Holdings (Pty) Limited, the apex

company of the Assore Group. The South Africa-headquartered Assore

Group is privately held and has been engaged in the mining,

processing and marketing of a range of ores, minerals and metals

for almost 100 years, mainly in South Africa. AIH, which was formed

in 2020, houses the Group’s emerging international mining and

marketing operations and investments which up to now has comprised

strategic shareholdings in Gemfields Group Limited, Atlantic

Lithium Limited and Vision Blue Resources. Visit www.assore.com for

more information.

Marimaca intends to use the proceeds of the

Private Placements to fund the technical and related costs in

respect of the Definitive Feasibility Study

(“DFS”), technical and related costs in respect of

the detailed design and engineering programs at the Project

following completion of the DFS, the preparation, implementation

and execution of the environmental permitting process at the

Project, costs related to the continued exploration at the

Company’s regional targets (including the Sierra de Medina property

block) and any such further costs relating to the Company’s

properties, including but not limited to, the Project, including

for the avoidance of doubt, general and administrative expenses.

The Strategic Investment and the Additional Private Placement are

expected to close on or about July 22, 2024 and are subject to the

approval of the TSX and customary closing conditions of

transactions of this nature.

In connection with the AIH Private Placement,

certain rights and restrictions shall apply:

- For a period of

9 months from closing, AIH has agreed to not sell or transfer any

Common Shares

- For a period of

12 months from closing, AIH has agreed that it will not transfer or

sell any Common Shares to any third party whereby said party would

hold, in aggregate, greater than 9.99% of the Common Shares after

completion of the sale or transfer without prior written consent of

the Company, at its sole discretion

- AIH has agreed

that, for a period of 12 months following completion of the AIH

Private Placement, it shall not increase its ownership of Common

Shares, on a fully diluted basis, above 15.0% subject to certain

exceptions

- AIH has agreed

that it will not, at any time, increase its ownership of Common

Shares (on a fully-diluted basis) above 19.99% unless otherwise

agreed to in writing with the Company and subject to applicable

Canadian securities laws and the rules and regulations of the

TSX

- For so long as

AIH maintains an ownership interest of at least 12.5%, AIH will be

granted participation rights that enable it to maintain its pro

rata ownership interest in the Company

- For so long as

AIH maintains an ownership interest of at least 12.5%, AIH will

have the right to nominate one member for election to the Company’s

Board of Directors

- AIH will have

the right to appoint one additional nominee to the Company’s Board

of Directors if the ratio of (a) AIH's ownership percentage in the

Company on a non-diluted basis to (b) the percentage of AIH's

representatives on the Board of Directors of the Company following

exercise of the additional appointment, equals to or exceeds

0.99

- AIH will have

the right to appoint one member to the Project’s Technical and

Environmental Committee

In connection with the Strategic Investment,

Greenstone Resources L.P. and certain of its affiliates have agreed

to waive their respective pre-existing rights to participate on a

pro rata basis in equity financings by the Company. Pursuant to

Mitsubishi Corporation’s (“Mitsubishi”)

pre-existing rights to participate on a pro rata basis in equity

financings by the Company (see announcement dated June 21, 2023),

Mitsubishi will have the right to elect to maintain its pro rata

ownership in the Company within 30 business days of the closing of

the Private Placements. Mitsubishi’s current ownership, prior to

giving effect to the Private Placements, is approximately 4.92%

based on public filings. Assuming Mitsubishi exercises its right in

full, AIH will own approximately 14.94% of the Common Shares on a

non-diluted basis.

Upon closing of the Private Placements, a cash

introduction fee is expected to be paid to Lionhead Capital

Advisors in connection with the AIH Private Placement and 56,000

Common Shares will be issued as a finder’s fee to an individual in

connection with the Additional Private Placement.

Additional Early Warning

Disclosure

The Common Shares and Warrants will be acquired

by AIH for investment purposes. In addition to the Tembo

Acquisition and the AIH Private Placement, AIH has the option to

purchase up to an additional 756,695 Common Shares from Tembo (the

“Option”) at a price equal to the greater of (i)

C$4.50 per Common Share; and (ii) the 30-day volume-weighted

average price of the Common Shares on the TSX as of the date on

which the Option is exercised. The Option is exercisable at AIH’s

discretion at any time within 30 business days of the first

anniversary of the closing of the Tembo Acquisition.

Other than the potential exercise of the

Warrants and/or the Option, AIH has no current plan or intentions

which relate to, or would result in, acquiring additional

securities of Marimaca, disposing of securities of Marimaca, or any

of the other actions requiring disclosure under the early warning

reporting provisions of applicable securities laws. Depending on

market conditions, AIH’s view of Marimaca’s prospects and other

factors AIH considers relevant, AIH may acquire additional

securities of Marimaca from time to time in the future, in the open

market or pursuant to privately negotiated transactions, or may

sell all or a portion of its securities of Marimaca.

An early warning report with additional

information in respect of the Tembo Acquisition and the AIH Private

Placement will be filed and made available under the SEDAR+ profile

of Marimaca at www.sedarplus.ca. To obtain a copy of the early

warning report, you may also contact Janine Govender at

janinegovender@assore.com. AIH’s address is 5 Charlecote Mews,

Staple Gardens, Winchester, United Kingdom, SO23 8SR. Marimaca’s

head office is located at Suite 2400, 75 Thurlow Street, Vancouver,

BC V6E 0C5.

About MarimacaMarimaca Copper is a

Canadian exploration and development company focused on developing

the Marimaca Project, an oxide, open-pit, heap leach copper project

located in the Antofagasta region of northern Chile. The Company’s

shares trade on the TSX under the symbol “MARI” and on the OTCQX

under the symbol “MARIF”.

Contact InformationFor further

information please visit www.marimaca.com or contact:

Tavistock +44 (0) 207 920

3150Jos Simpson / Adam Baynesmarimaca@tavistock.co.uk

Forward-Looking Statements

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation, including statements related to the Strategic

Investment and the Additional Private Placement and the respective

terms thereof, the anticipated fees payable, the anticipated

closing date, the intended use of proceeds of the Private

Placements, the receipt of regulatory approvals including the

approval of the TSX and AIH’s future intentions regarding the

securities of Marimaca. There can be no assurance that such

statements will prove to be accurate and actual results and future

events could differ materially from those anticipated in such

statements. Forward-looking statements reflect the beliefs,

opinions and projections on the date the statements are made and

are based upon a number of assumptions and estimates that, while

considered reasonable by Marimaca Copper, are inherently subject to

significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors, both known and

unknown, could cause actual results, performance or achievements to

be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements and the parties have made assumptions

and estimates based on or related to many of these factors. Such

factors include, without limitation: risks related to fulfilling

the conditions to closing of the Strategic Investment and the

Additional Private Placement including receipt of required

regulatory approvals, risks related to share price and market

conditions, the inherent risks involved in the mining, exploration

and development of mineral properties, the uncertainties involved

in interpreting drilling results and other geological data,

fluctuating metal prices, the possibility of project delays or cost

overruns or unanticipated excessive operating costs and expenses,

uncertainties related to the necessity of financing, uncertainties

relating to regulatory procedure and timing for permitting reviews,

the availability of and costs of financing needed in the future as

well as those factors disclosed in the annual information form of

the Company dated March 26, 2024 and other filings made by the

Company with the Canadian securities regulatory authorities (which

may be viewed at www.sedarplus.ca). Statements regarding the

Company’s planned DFS on the Project are forward-looking statements

and may not be realized. Accordingly, readers should not place

undue reliance on forward-looking statements. Marimaca Copper

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be

required by law.

Certain information contained in this news

release has been prepared by AIH, which information has not been

independently audited or verified by the Company. No representation

or warranty, express or implied, is made by the Company as to the

accuracy or completeness of such information contained in this news

release.

Neither the TSX nor the Canadian Investment

Regulatory Organization accepts responsibility for the adequacy or

accuracy of this news release.

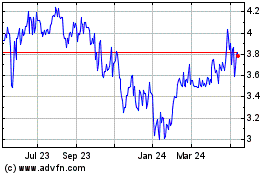

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Nov 2024 to Dec 2024

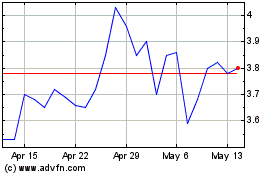

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Dec 2023 to Dec 2024