Marimaca Hosts Mejillones Open House; Achieves “A” Rating in 2023 Digbee Sustainability Assessment and Provides Corporate Update

May 22 2024 - 4:30PM

Marimaca Copper Corp. (“Marimaca Copper” or the

“Company”) (TSX: MARI) is pleased to

provide project and corporate updates regarding it’s ongoing

development strategy to accelerate the Marimaca Oxide Deposit (the

“MOD”) toward first production.

Mejillones Community Day

- Successful

initial Open House in the community of Mejillones to present the

Marimaca Copper Project

- Open-forum

format with interactive Q&A with Marimaca management and core

team members

- Close to 80

attendees from across the Community

- Opportunity

for Marimaca to present the project development plan and key

milestones ahead for 2024 including the planned project permitting

submission in Q3 and ongoing Definitive Feasibility Study

(“DFS”)

- Positive

initial response from the Community to the Marimaca Copper

Project

- Marimaca

will continue it’s participatory approach to project development

and permitting and looks forward to the next Open House planned for

July 2024

2023 Digbee Assessment

- Completion

of Marimaca’s third independent ESG performance assessment

continues to highlight it’s unique ESG position via the Digbee ESG

reporting framework

- The Digbee

framework is designed specifically for the mining sector and

endorsed by leading sector and financial stakeholders

- Overall

score of “A” awarded for the Company and Marimaca Project, an

improvement from the “BBB” score assessed in 2022

- Assessment

continues to highlight the significant ESG credential of the

Marimaca Project development plan

- Water –

ability to utilize recycled seawater for life-of-mine operations,

mitigating any potential groundwater use

- Leaching

operation – no wet tailings discharge required from expected SX-EW

processing operation

- Carbon

intensity - No ‘Scope 3’ emissions generated given expected

production of copper cathode which does not require smelting and

refining of concentrates

- Simple and

transparent land and ownership structure

- Very

favourable access to existing regional infrastructure given the

Project’s unique location

ATM Program

The Company also announces that it has entered

into an equity distribution agreement (the “Distribution

Agreement”) with Canaccord Genuity Corp. (“Canaccord Genuity”) and

filed a Prospectus Supplement (as defined below) in respect of an

at-the-market equity program (the “ATM Program”).

The ATM Program allows the Company to issue and

sell up to C$20,000,000 of common shares (the “Marimaca Copper

Shares”) from treasury to the public, from time to time, at the

Company’s sole discretion and in accordance with the terms and

conditions of the Distribution Agreement entered into with

Canaccord Genuity. Any Marimaca Copper Shares issued under the ATM

Program will be sold in transactions that are deemed to be

“at-the-market distributions” as defined in National Instrument

44-102 – Shelf Distributions, including sales made directly on the

Toronto Stock Exchange or on any other “marketplace” (as defined in

National Instrument 21-101 – Marketplace Operation) in Canada,

and/or any other method permitted by applicable law, at the

prevailing market price at the time of sale and, as such, prices

may vary among purchasers during the period of the ATM Program.

The ATM Program is intended to provide the

Company with additional financing flexibility should it be required

in the future. The volume and timing of distributions under the ATM

Program, if any, will be determined in the Company’s sole

discretion. Distributions of the Marimaca Copper Shares under the

ATM Program will be made pursuant to the terms and conditions of

the Distribution Agreement.

The ATM Program will be effective until the

earlier of the date on which (i) the issuance and sale of all of

the Marimaca Copper Shares issuable pursuant to the ATM Program

have been completed, and (ii) the receipt issued for the Shelf

Prospectus (as defined below) ceases to be effective, unless

earlier terminated prior to such date by the Company or Canaccord

Genuity in accordance with the terms of the Distribution

Agreement.

The Company intends to use the net proceeds from

the ATM Program, if any, to finance exploration activities,

including exploration at the Company’s Mercedes and Sierra de

Medina property block targets, and fund any shortfall in funds

required to achieve certain business objections and milestones for

the remainder of 2024, as further described in the Prospectus

Supplement.

The offering of Marimaca Copper Shares under the

ATM Program is qualified by a prospectus supplement dated May 22nd,

2024 (the “Prospectus Supplement”) to the short form base shelf

prospectus dated September 12, 2023 (the “Shelf Prospectus”), which

were each filed with the applicable securities regulatory

authorities in each of the provinces and territories in Canada.

Before making an investment in the Marimaca Shares, potential

investors should read the Prospectus Supplement and the Shelf

Prospectus, including the documents incorporated by reference

therein, which contains detailed information about the Company and

the securities offered. The Distribution Agreement, the Prospectus

Supplement and the Shelf Prospectus are available on SEDAR+ at

www.sedarplus.ca. Alternatively, Canaccord Genuity will send copies

of the Distribution Agreement, the Prospectus Supplement and the

Shelf Prospectus upon request by contacting Canaccord Genuity at:

Canaccord Genuity Corp., Suite 2100, 40 Temperance Street, Toronto,

Ontario M5H 0B4 or by email at ecm@cgf.com.

The securities offered in the ATM Program have

not been and will not be registered under the United States

Securities Act of 1933, as amended or the securities laws of any

state of the United States and may not be offered or sold absent

such registration or an applicable exemption from such registration

requirements. This news release does not constitute an offer to

sell or the solicitation of an offer to buy the Marimaca Copper

Shares, nor shall there be any sale of the Marimaca Copper Shares

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

Hayden Locke, President and CEO of

Marimaca Copper, commented:

“We are extremely pleased to continue our

commitment to community and sustainability in our approach to

developing the Marimaca Project. Our initial Open House was a

positive milestone in our journey to develop the Marimaca Project,

and we thoroughly enjoyed engaging with the Mejillones community on

our development strategy and key milestones targeted for 2024 and

2025. Our third independent Digbee Assessment underlines our

progress in developing a sustainable mine in partnership with key

stakeholders.”

Contact InformationFor further

information please visit www.marimaca.com or contact:

Tavistock +44 (0) 207 920

3150Jos Simpson / Adam Baynesmarimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation, including, without limitation, statements with respect

to the distribution of Marimaca Copper Shares under the ATM

Program, the benefits associated therewith and the proposed use of

proceeds, if any, from sales thereunder, the development activities

at the MOD, the anticipated timing of the DFS and the anticipated

timing of the MOD project permitting submissions. There can be no

assurance that such statements will prove to be accurate, and

actual results and future events could differ materially from those

anticipated in such statements. Forward-looking statements reflect

the beliefs, opinions and projections on the date the statements

are made and are based upon a number of assumptions and estimates

that, while considered reasonable by Marimaca Copper, are

inherently subject to significant business, economic, competitive,

political and social uncertainties and contingencies. Many factors,

both known and unknown, could cause actual results, performance or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward-looking statements and the parties have made

assumptions and estimates based on or related to many of these

factors. Such factors include, without limitation: risks that the

development activities at the MOD will not progress as anticipated,

or at all, risks that the DFS may not be completed as anticipated,

or at all, risks that the MOD project permitting submission may not

be submitted as anticipated, or at all, risks related to share

price and market conditions, the inherent risks involved in the

mining, exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological data, fluctuating metal prices, the possibility of

project delays or cost overruns or unanticipated excessive

operating costs and expenses, uncertainties related to the

necessity of financing, uncertainties relating to regulatory

procedure and timing for permitting submissions and reviews, the

availability of and costs of financing needed in the future as well

as those factors disclosed in the annual information form of the

Company dated March 28, 2024 and other filings made by the Company

with the Canadian securities regulatory authorities (which may be

viewed at www.sedar.com).. Readers should not place undue reliance

on forward-looking statements. Marimaca Copper undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be

required by law.

Neither the TSX nor the Canadian Investment

Regulatory Organization accepts responsibility for the adequacy or

accuracy of this release.

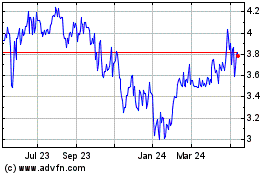

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Nov 2024 to Dec 2024

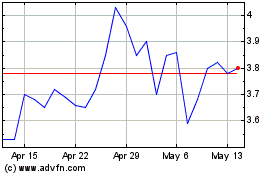

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Dec 2023 to Dec 2024