Coro Provides Projects Update

April 22 2014 - 12:04PM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to provide an

update on its projects and strategy for developing a growth oriented copper

mining business in Chile.

Berta Copper Development Project

On November 7th 2013, Coro announced that its subsidiary, SCM Berta S.A.

("SCMB") and a third party had executed a preliminary agreement which

accompanied SCMB's submission of an Environmental Impact Declaration ("EID") for

the Berta project, located approximately 20km west of the village of Inca de

Oro, in the III Region of Chile. The agreement contemplates the sale of water to

SCMB and the purchase of pregnant leach solution from SCMB at the third party's

solvent extraction/electro-winning ("SXEW") operation, for a period of 5 years.

Development of the project would include the construction by SCMB of a pipeline

between Berta and the third party's processing facilities, as well as a crusher

and heap & dump leach pads at the mine site. Subject to SCMB executing a

definitive agreement with the third party, completing a positive Preliminary

Economic Assessment ("PEA"), receiving an approved EID, and to obtaining

financing for the project, Berta is anticipated to produce 5,000-10,000 tonnes

of cathode copper per year.

SCMB is currently 87% owned by Coro and 13% by its partner, ProPipe, a Chilean

engineering company, and ProPipe may increase its interest to 50% by funding all

of the ongoing development costs, completing the PEA and arranging 100% debt

financing, non-recourse to Coro, for the project.

The EID permitting process is proceeding normally and Coro anticipates that it

should be concluded later this quarter. The definitive agreement with the owner

of the third party plant is being finalised and is currently going through their

internal approval process. The engineering studies are virtually complete and

Coro anticipates that the PEA may be released once the definitive agreement

between SCMB and the third party is executed, later this quarter. Negotiations

are in progress with the underlying property owner to defer the final US$2.5m

option payment payable by SCMB in June 2014. Finally, ProPipe is in discussions

with parties interested in financing the project.

Payen Copper-Gold Exploration Project

On October 9th 2013, Coro announced that it had entered into an agreement with

Minera Freeport-McMoRan South America Limitada (formerly Minera Aurex (Chile)

Limitada) ("Freeport SA"), an indirect subsidiary of Freeport-McMoRan Copper &

Gold Inc., whereby Freeport SA may exercise an option to acquire up to an 80%

interest in the Payen porphyry copper-gold property. Payen is located

approximately 90km NNE of La Serena, 4km W of the Panamerican Highway and

approximately 47km from the coast, in the III Region of Chile, at an elevation

of 1,100m.

The Payen property is located within the large Pajonales alteration zone which

is part of the 90-110 million year old belt of porphyry copper-gold deposits

which includes Teck's Andacollo mine, Cemin's Dos Amigos mine, PanAust's Inca de

Oro & Carmen projects and Hot Chili's Frontera project, which is located some

2.5km SE of the Payen property boundary. In a news release of 11th March 2014,

Hot Chili Ltd announced a JORC compliant Indicated resource for Frontera of

16.1mt at 0.4%Cu + 0.2g/tAu and an Inferred resource of 34.4mt at 0.4%Cu +

0.2g/tAu.

In 2011-12, reverse circulation drilling of outcropping potassically altered and

quartz stockworked diorite porphyry on the property intersected encouraging

copper-gold mineralization, results of which were summarized in the Company's

news release of October 17th 2012.

Since execution of the agreement, Freeport SA has completed surface exploration

comprising geophysics, geochemistry and geological mapping, and has advised Coro

that it intends to initiate a 4000-5000m diamond drilling program later this

quarter. Coro believes that Payen has the potential to host a major copper-gold

porphyry deposit, and we look forward to receiving the results of the Freeport

SA drill program later this year.

San Jorge Copper Development Project

On March 5th 2012, Coro announced the results of a Preliminary Feasibility Study

for its San Jorge project in Argentina, which comprises a proposed rock

quarrying operation in Mendoza province together with an SXEW plant located in

adjacent San Juan province, for the production of up to 25,000 tonnes per year

of copper in cathode.

On December 9th 2013, Coro announced the execution of a binding Heads of

Agreement with a group comprised of Aterra Investments Ltd. and Solway

Industries Ltd. giving them rights to acquire up to a 70% interest in the

project, with the provision for an early buy-out of Coro's interest, subject to

Coro's retention of a 2.5% Net Smelter Return on the production of all payable

metals from the project, except gold.

Aterra and Solway have now taken over management of the project, and the parties

are working towards the expeditious execution of a definitive agreement, which

includes a cash payment to Coro of US$300,000 within 6 months of its signature,

and two further payments of US$500,000 each on the first and second anniversary

dates of signature.

El Desesperado Copper Exploration Project

On February 27th 2014, Coro announced the results of a 5 hole, 1191m diamond

drilling program and a 7 hole, 950m reverse circulation drilling program at the

El Desesperado copper project, located 7 km NW of the city of Calama in the II

Region of Chile. A thorough review of the exploration results concluded that the

near surface mineralization intersected in drilling comprises both oxidized and

enriched structurally controlled mineralization, and transported exotic copper

oxides, but disappointingly of more limited extent than anticipated. A porphyry

copper system may be present at unknown depth beneath this mineralization, but

given the high risk nature of the target and the cost of testing it, both in

terms of drilling and property payments, Coro has elected to terminate the

option to acquire the property.

Corporate Strategy Update

Using our in-house exploration and development expertise, Coro's strategy is to

grow a mining business in Chile through the discovery, development and operation

of "Coro type" deposits. These are defined as projects at whatever stage of

development that are well located with respect to infrastructure and water, or

to third party owned plants with spare capacity, and which have the potential to

achieve a short and cost effective timeline to production. Our preference is for

open pit heap leach copper projects, where we will seek to minimise capital

investment rather than maximise NPV, where we will prioritise profitability over

production rate, and finally, where the likely capital cost is financeable

relative to our market capitalization. Partners will be sought for any

attractive projects identified that we do not have the financial capacity to

develop alone.

Cash Balance

As at March 31st 2014, Coro had a cash balance of US$1.3m. In addition, the

outstanding US$500,000 payment from the sale of the Chacay property last year is

expected to be received later this quarter or early next.

Alan Stephens, FIMMM, President and CEO, of Coro Mining Corp, a geologist with

more than 38 years of experience, and a Qualified Person for the purposes of NI

43-101, is responsible for the contents of this news release.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

base and precious metals deposits in Latin America. The Company intends to

achieve this through the exploration for, and acquisition of, projects that can

be developed and placed into production in Chile. Coro's properties include the

Berta, Payen, Celeste and Llancahue copper properties in Chile and the advanced

San Jorge copper-gold project, in Argentina.

For further information please visit the Company's website at www.coromining.com.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to future transactions involve

known and unknown risks, uncertainties, and other factors which may cause the

actual results, performance or achievements of the Company to be materially

different from any future results, performance or achievements expressed or

implied by such forward-looking statements or information. Such factors include,

among others, the actual prices of copper, the factual results of current

exploration, development and mining activities, changes in project parameters as

plans continue to be evaluated, as well as those factors disclosed in the

Company's documents filed from time to time with the securities regulators in

the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New

Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

FOR FURTHER INFORMATION PLEASE CONTACT:

Coro Mining Corp.

Michael Philpot

Executive Vice-President

(604) 682 5546

investor.info@coromining.com

www.coromining.com

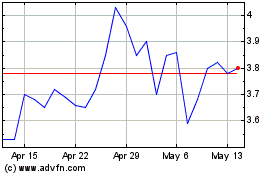

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

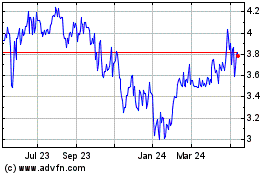

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024