MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG”

or the

“Company”) announces the Company’s

unaudited financial results for the three and nine months ended

September 30, 2019. For details of the unaudited condensed

interim consolidated financial statements and Management's

Discussion and Analysis for the three and nine months ended

September 30, 2019, please see the Company’s filings on SEDAR

(www.sedar.com) or on EDGAR (www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

HIGHLIGHTS – SEPTEMBER 30,

2019

- Joint formal Juanicipio Project mine development approval by

Fresnillo and MAG was announced in the second quarter of 2019 (see

Press Release dated April 11, 2019), and an Engineering,

Procurement and Construction Management (“EPCM”) contract finalized

to oversee the mine development.

- During the quarter ended September 30, 2019 further progress

was made in detailed engineering, and subsequent to the quarter end

in October, earthmoving and foundation preparation commenced for

the construction of the 4,000 tonnes per day (“tpd”) beneficiation

plant.

- Mill fabrication is progressing on schedule, and both the SAG

and ball mills are expected to be shipped to site early 2020.

Flotation cells, processing tanks and minor process equipment

pieces are starting to arrive on site. Thickener tanks and drive

and rakes fabrication are well advanced.

- Underground development is ongoing at Juanicipio and has now

reached approximately 23 kilometres of development (or 14.3 miles).

The focus areas for underground development are the three

sub-vertical ramps that descend alongside the mineralization and

the conveyor ramp to surface.

- Construction is on track for late 2020 commissioning according

to the operator Fresnillo.

- Estimated pre-operative initial capital is $395,000 (100%

basis) as of January 1, 2018, less development expenditures

incurred since then to September 30, 2019 of approximately $107,600

(Company therefore estimates approximately $287,400 of remaining

initial capital on a 100% basis as at September 30,

2019).

- MAG is well funded with cash and cash equivalents as at

September 30, 2019 of $94,599 while Minera Juanicipio had working

capital on a 100% basis of $24,486 as at September 30, 2019.

- A 25,000 metre 2019 Juanicipio exploration program was

completed in late October, with all assays pending.

“This year we've launched the final stages of

development of the Juanicipio mine.” said George Paspalas,

President and CEO. “We're opening up more areas underground,

including production cross-cuts through the vein, surface

construction has commenced in earnest and every day sees more mill

components arriving to site.”

JUANICIPIO PROJECT UPDATES

MINE DEVELOPMENT APPROVAL

On April 11, 2019, Fresnillo and MAG as

shareholders of Minera Juanicipio, jointly announced formal

approval of the Juanicipio mine development plan. The partners also

finalized an EPCM agreement as part of the approval process which

defines the specific terms by which Fresnillo will oversee the

continued project development and the construction of the process

plant and associated surface infrastructure. Pre-operative

initial capital is estimated on a 100% basis as $395,000 as of

January 1, 2018, of which over the past 21 months approximately

$107,600 has been expended to September 30, 2019, leaving an

estimated $287,400 of remaining initial capital (MAG’s 44%

remaining share estimated $126,456 as at September 30, 2019).

The Operator Services agreement was also

finalized by the partners in the project approval process which

will become effective on commencement of commercial production. As

well, both lead and zinc off-take agreements have been agreed to by

the partners whereby both concentrates will be treated at market

terms by Met-Mex Peñoles, S.A. De C.V., in Torreón, Mexico.

SURFACE CONSTRUCTION AND SITE

PREPARATION

Upon project approval, construction plans for

the 4,000 tpd processing plant commenced immediately. Basic

engineering is substantially complete and detailed engineering is

well advanced. Development of surface infrastructure facilities

(power lines, access roads, auxiliary buildings, etc.) had already

previously begun and continues. During the quarter ended

September 30, 2019, further progress was made in detailed

engineering, and subsequent to the quarter end in October,

earthmoving and foundation preparation commenced for the

construction of the beneficiation plant.

Orders had already been placed and the

manufacturing of the long lead items for the process plant is well

advanced. Mill fabrication is progressing on schedule, and both the

SAG and ball mills are expected to be shipped to site early 2020.

Flotation cells, processing tanks and minor process equipment

pieces are starting to arrive on site. Thickener tanks and drive

and rakes fabrication are well advanced.

According to the operator, Fresnillo, permitting

for the tailings impoundments should be completed in the fourth

quarter of this year and mill construction is on track for

commissioning by late 2020.

UNDERGROUND DEVELOPMENT

Access to the mine will be via the completed

twin underground declines that now have reached the top of

mineralization in the Valdecañas Vein. From there, the upper

footwall haulage/access drift has been driven the length of the

vein from which three internal spiral footwall production ramps

will extend to depth. Twinning of the original access decline was

required to provide expanded capacity for hauling additional

mineralized rock and waste stemming from the planned increase in

processing capacity to 4,000 tpd. The twin ramps and second

entry portal allow for streamlined underground traffic flow and

increased safety through the mine having a second egress. The three

spiral ramps into the mineralized envelope are designed to provide

access to stopes within the mineralized material and were also

required to facilitate the increase in planned mining rate to 4,000

tpd. The first cross-cuts through the vein have been made

from the easternmost footwall ramp, exposing well-mineralized

vein.

Mineralized material from throughout the vein

will be crushed underground and the crushed material conveyed

directly from the underground crushing station (already excavated)

to the process plant area via a third ramp which is being driven

both from the surface and from the crushing chamber. This

ramp will also provide access to the entire Valdecañas underground

mining infrastructure and serve as a fresh air entry for the

ventilation system.

With total underground development having now

reached approximately 23 kilometres to date, an additional

contractor has been appointed to further accelerate development

rates. Concurrent with the ongoing underground development,

detailed engineering continues for the internal shaft, other mine

infrastructure, and the final process plant configuration.

A photo gallery of current progress on the

Juanicipio development is available at

http://www.magsilver.com/s/PhotoGallery.asp

The Juanicipio development is expected to create

approximately 2,750 jobs during construction and 1,720 jobs once at

full production, with potential to scale-up operations in the

future beyond 4,000 tpd.

EXPLORATION

Exploration drilling continued in the quarter

ended September 30, 2019. To date in 2019, 29 drill holes

have been completed, 21 being infill holes and 8 exploration holes

as part of a 25,000 metre 2019 exploration program which was

completed subsequent to the September 30, 2019 quarter end (all

assays pending). The 2019 drilling has primarily been

directed at infilling the few remaining gaps in the Indicated

Resources in the Bonanza Zone, converting Inferred Resources

included in the Deep Zone into Indicated Resources, and further

tracing the Deep Zone laterally and to depth. Five holes were

also directed at the recently discovered Venadas Vein, and

additional prospective targets are expected to be drilled in

2020.

Assays from 48 previously completed holes

(46,060 metres) were reported in the first quarter of 2019 (see

Press Release dated March 4, 2019).

FINANCIAL RESULTS – THREE AND NINE

MONTHS ENDED SEPTEMBER 30, 2019

As at September 30, 2019, the Company had

working capital of $94,895 (September 30, 2018: $141,865) including

cash and cash equivalents of $94,599 (September 30, 2018:

$141,776). Other than an office lease obligation under IFRS

16, the Company currently has no debt and believes it has

sufficient working capital to maintain all of its properties and

currently planned programs well into next year (2020). The

Company makes capital contributions through cash advances to Minera

Juanicipio as ‘cash called’ by operator Fresnillo, based on

approved joint venture budgets. In the three and nine months ended

September 30, 2019, the Company funded advances to Minera

Juanicipio, which combined with MAG’s Juanicipio expenditures on

its own account, totaled $17,915 and $33,371 respectively

(September 30, 2018: $8,542 and $14,387 respectively).

The Company’s net loss for the three and nine

months ended September 30, 2019 amounted to $2,005 and $3,408

respectively (September 30, 2018: $597 net income and $1,973 net

loss respectively) or $(0.02)/share and $(0.04)/share respectively

(September 30, 2018: $0.01/share and $(0.02)/share

respectively).

Share based payment expense, a non-cash item,

recorded in the three and nine months ended September 30, 2019

amounted to $507 and $2,015 respectively (September 30, 2018: $406

and $1,217 respectively), and is determined based on the fair value

of equity incentives granted and vesting in the period. In the

three and nine months ended September 30, 2019, the Company earned

interest income on its cash and cash equivalents of $589 and $2,215

respectively (September 30, 2018: $812 and $2,277 respectively).

The Company also recorded its 44% equity loss pick up of $266 and

equity income pick up of $496 respectively for the three and nine

months ended September 30, 2019 (September 30, 2018: $665 equity

income pick up and $75 equity loss pick up respectively) from

Minera Juanicipio related primarily to exchange rate changes and

deferred taxes.

About MAG Silver Corp.

(www.magsilver.com)

MAG Silver Corp. (MAG: TSX / NYSE A) is a

Canadian exploration and development company focused on becoming a

top-tier primary silver mining company, by exploring and advancing

high-grade, district scale, silver-dominant projects in the

Americas. Our principal focus and asset is the Juanicipio Property

(44%), being developed in Joint Venture partnership with Fresnillo

Plc (56%). Juanicipio is located in the Fresnillo Silver Trend in

Mexico, the world's premier silver mining camp and we are currently

developing the surface and underground infrastructure on the

property to support a 4,000 tonnes per day mining operation, with

the operational expertise of our JV partner, Fresnillo plc. As

well, we have an aggressive exploration program in place targeting

multiple highly prospective targets across the property.

On behalf of the Board ofMAG SILVER

CORP.

"Larry Taddei"

Chief Financial Officer

|

For further information on behalf of MAG Silver Corp. Contact

Michael J. Curlook, VP Investor Relations

and Communications |

|

Website: Phone: Toll free: |

www.magsilver.com(604) 630-1399(866) 630-1399 |

Email: Fax: |

info@magsilver.com(604) 681-0894 |

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements that

address future mineral production, reserve potential,

exploration drilling, exploitation activities and events or

developments. Forward-looking statements are often, but not always,

identified by the use of words such as "seek", "anticipate",

"plan", "continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements.

Although MAG believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results or developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include, but are not limited to, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the Company’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward looking statement will come to pass and investors

should not place undue reliance upon forward-looking

statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov

LEI: 254900LGL904N7F3EL14

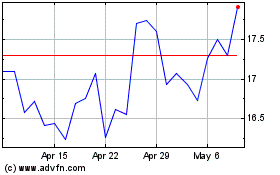

MAG Silver (TSX:MAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

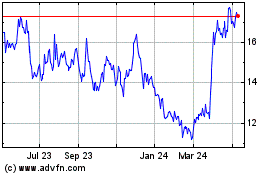

MAG Silver (TSX:MAG)

Historical Stock Chart

From Jul 2023 to Jul 2024