The Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the

"Company"), a leading manufacturer of all-electric medium and

heavy-duty urban vehicles, today announced the pricing of its

previously announced marketed public offering of units (the

"Units") in the United States and Canada (the "Offering"). The

Company will issue 19,685,040 Units at a price of US$2.54 per Unit

for aggregate gross proceeds to the Company of approximately

US$50 million.

Each Unit will consist of one common share in

the capital of the Company (each a "Unit Share") and one common

share purchase warrant (each a "Warrant"). Each whole Warrant will

entitle the holder thereof to acquire one common share in the

capital of the Company (each a "Warrant Share") at an exercise

price of US$2.80 per Warrant Share for a period of five (5) years

following the closing of the Offering.

B. Riley Securities, Inc. and National Bank

Financial Inc. are acting as joint bookrunners for the Offering

(the "Underwriters"). The Offering is expected to close on or about

December 16, 2022, subject to customary closing

conditions.

Under the terms of the underwriting agreement,

the Company has granted the Underwriters an over-allotment option,

exercisable for a period of 30 days from the date of the closing of

the Offering, to purchase up to 2,952,755 additional Units at a

price of US$2.54 per Unit, representing in the aggregate 15% of the

total number of Units to be sold pursuant to the Offering.

Power Sustainable Capital Inc. ("Power

Sustainable"), through its wholly-owned subsidiary Power Energy

Corporation ("PEC") will purchase Units at the offering price

representing an aggregate purchase price of approximately US$25

million.

The Company intends to use the net proceeds of

the Offering to strengthen its financial position, and allow it to

continue to pursue its growth strategy, including the Company's

capacity expansion projects in Joliet, Illinois and Mirabel,

Québec.

Closing of the Offering is subject to a number

of customary conditions, including the listing of the Unit Shares

on the New York Stock Exchange ("NYSE") and the Toronto Stock

Exchange ("TSX"), and any required approvals of the NYSE and the

TSX. The Company has applied to list the Unit Shares, the Warrant

Shares and the Warrants on the NYSE and the TSX. Listing will be

subject to the Company fulfilling all of the listing requirements

of the NYSE and the TSX, including, in respect of the Warrants,

distribution of the Warrants to a minimum number of public

securityholders.

In connection with the Offering, the Company has

filed a preliminary prospectus supplement, and will file a final

prospectus supplement, to its short form base shelf prospectus

dated June 17, 2022 (the "base shelf prospectus"). The preliminary

prospectus supplement was filed, and the final prospectus

supplement will be filed, with the securities regulatory

authorities in each of the provinces and territories of Canada as

well as with the U.S. Securities and Exchange Commission (the

"SEC") as part of a registration statement on Form F-10 under the

U.S.-Canada multijurisdictional disclosure system (MJDS). A

registration statement on Form F-10 relating to this Offering has

been filed with the SEC and is effective.

The Offering is being made in Canada only by

means of the base shelf prospectus and applicable prospectus

supplement and in the United States only by means of the

registration statement, including the base shelf prospectus and

applicable prospectus supplement. Such documents contain important

information about the Offering. Copies of the base shelf prospectus

and the applicable prospectus supplement can be found on SEDAR at

www.sedar.com and a copy of the registration statement, including

the base shelf prospectus and the preliminary prospectus

supplement, can be found on EDGAR at www.sec.gov. Copies of such

documents may also be obtained from any of the following sources:

B. Riley Securities, Inc., Attn: Prospectus Department, 1300 17th

Street North, Suite 1300, Arlington, VA 22209, telephone: (703)

312-9580 or by emailing prospectuses@brileyfin.com; or National

Bank Financial Inc., 130 King Street West, 4th Floor Podium,

Toronto, ON M5X 1J9, telephone (416) 869-6534 or by emailing

ecm-origination@nbc.ca.

Prospective investors should read the base shelf

prospectus and the prospectus supplement as well as the

registration statement before making an investment decision.

No securities regulatory authority has

either approved or disapproved the contents of this press release.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

Units in any province, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province, state

or jurisdiction.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of

zero-emission vehicles. The company creates, designs and

manufactures all-electric class 5 to class 8 commercial urban

trucks and all-electric buses and minibuses for the school,

paratransit and mass transit segments. Lion is a North American

leader in electric transportation and designs, builds and assembles

many of its vehicles' components, including chassis, battery packs,

truck cabins and bus bodies.

Always actively seeking new and reliable

technologies, Lion vehicles have unique features that are

specifically adapted to its users and their everyday needs. Lion

believes that transitioning to all-electric vehicles will lead to

major improvements in our society, environment and overall quality

of life. Lion shares are traded on the New York Stock Exchange and

the Toronto Stock Exchange under the symbol LEV.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS This press release contains "forward-looking

information" and "forward-looking statements" within the meaning of

applicable securities laws and within the meaning of the United

States Private Securities Litigation Reform Act of 1995

(collectively, "forward-looking statements"). Any statements

contained in this press release that are not statements of

historical fact, including statements regarding the proposed

Offering and the terms thereof, listing of the Unit Shares, the

Warrant Shares and the Warrants on the NYSE and the TSX, the

closing of the Offering and the intended use of proceeds thereof,

are forward-looking statements and should be evaluated as such.

Forward-looking statements may be identified by

the use of words such as "believe," "may," "will," "continue,"

"anticipate," "intend," "expect," "should," "would," "could,"

"plan," "project," "potential," "seem," "seek," "future," "target"

or other similar expressions and any other statements that predict

or indicate future events or trends or that are not statements of

historical matters, although not all forward-looking statements may

contain such identifying words. Such forward-looking statements are

based on a number of estimates and assumptions that the Company

believes are reasonable when made and inherently involve numerous

risks and uncertainties, known and unknown, including economic

factors. Such estimates and assumptions are made by the Company in

light of the experience of management and their perception of

historical trends, current conditions and expected future

developments, as well as other factors believed to be appropriate

and reasonable in the circumstances. However, there can be no

assurance that such estimates and assumptions will prove to be

correct. A number of risks, uncertainties and other factors may

cause actual results to differ materially from the forward-looking

statements contained in this press release, including, among other

factors, those risk factors identified in the offering documents

relating to the Offering and the documents incorporated by

reference therein. Readers are cautioned to consider these and

other factors carefully when making decisions with respect to the

Units and not to place undue reliance on forward-looking

statements. Forward-looking statements contained in this press

release are not guarantees of future performance and, while

forward-looking statements are based on certain assumptions that

the Company considers reasonable, actual events and results could

differ materially from those expressed or implied by

forward-looking statements made by the Company. Readers cannot be

assured that the Offering discussed above will be completed on the

terms described above, or at all. Except as may be expressly

required by applicable law, the Company does not undertake any

obligation to update publicly or revise any such forward-looking

statements, whether as a result of new information, future events

or otherwise. All of the forward-looking statements contained in

this press release are expressly qualified by the foregoing

cautionary statements.

For further information:

Nicolas Brunet, Executive Vice-President and Chief Financial

Officer, 450-432-5466.

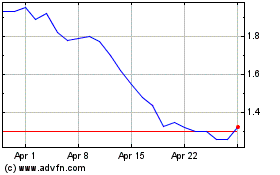

Lion Electric (TSX:LEV)

Historical Stock Chart

From Jun 2024 to Jul 2024

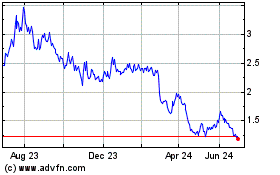

Lion Electric (TSX:LEV)

Historical Stock Chart

From Jul 2023 to Jul 2024