November 5, 2024 – Information Services Corporation (TSX:ISV)

(“ISC” or the “Company”) today reported on the Company’s financial

results for the third quarter ended September 30, 2024.

Capitalized terms that are used but not defined

in this news release have the meaning ascribed to those terms in

Management's Discussion & Analysis for the three and nine

months ended September 30, 2024.

2024 Third Quarter

Highlights

-

Revenue was $60.9 million for the quarter, an

increase of 12 per cent compared to the third quarter of 2023. This

increase was driven by increased volumes across the Saskatchewan

Registries division, combined with a full quarter of fee

adjustments compared to two months in the prior period, new revenue

related to the Bank Act Security Registry (“the BASR”) and the

advancement of project work on existing and new solution definition

and implementation contracts in Technology Solutions.

- Net

income was $4.2 million or $0.23 per basic and diluted

share compared to $4.2 million or $0.24 per basic share and $0.23

per diluted share in the third quarter of 2023. Strong operating

results were offset by increased share-based compensation expense,

increased investment in information technology services primarily

related to project delivery work in Technology Solutions as well as

increased amortization associated with the Extension.

- Net cash

flow provided by operating activities was $14.2 million

for the quarter, a decrease of $0.4 million from $14.6 million in

the third quarter of 2023. The change was driven by changes in

non-cash working capital, partially offset by strength in the

operating segments.

- Adjusted

net income was $11.0 million or $0.61 per basic share and

$0.60 per diluted share compared to $8.4 million or $0.47 per basic

share and $0.46 per diluted share in the third quarter of 2023. The

growth in adjusted net income for the three and nine months ended

September 30, 2024, reflects the strong results from all operating

segments.

- Adjusted

EBITDA was $22.7 million for the quarter compared to $19.2

million in the third quarter of 2023. The increase was driven by

volume increases across the Saskatchewan Registries division and

fee adjustments, which resulted in higher revenues. Additionally,

progress continues to be made on existing and new solution

definition and implementation contracts in Technology Solutions.

Adjusted EBITDA margin was 37.3 per cent compared

to 35.2 per cent in the third quarter of 2023, driven mainly by the

volume increases and fee adjustments in Registry Operations’

Saskatchewan Registries division discussed above.

- Adjusted

free cash flow for the quarter was $15.9 million, up 10

per cent compared to $14.4 million in the third quarter of 2023.

This growth was driven by strong performance across the

Saskatchewan Registries division and progress on existing and new

solutions definition and implementation contracts in Technology

Solutions.

- Voluntary

prepayments of $16.0 million were made towards the Company’s Credit

Facility during the quarter. This is part of the Company’s plan to

deleverage towards a long-term net leverage target of 2.0x –

2.5x.

Financial Position as at September 30,

2024

-

Cash of $12.0 million compared to $24.2 million as of December 31,

2023.

- Total debt of

$177.5 million compared to $177.3 million as of December 31,

2023.

Events

-

On July 2, 2024, the Company launched the online, self-service

Customer Portal for the Bank Act Security Registry (“the

BASR”).

- On July 31, 2024,

the first of five annual cash payments of $30.0 million was made

pursuant to the Extension Agreement, using funds drawn from the

Credit Facility.

Commenting on ISC’s results, Shawn Peters,

President and CEO stated, “Similar to the first and second quarters

for the year, the third quarter of 2024 delivered excellent results

with revenue up 12 per cent and adjusted EBITDA up 18 per cent,

compared to the third quarter of 2023. The diversified nature of

our business is clearly a major strength for us based on these

results.” Peters continued, “Given our performance for the year to

date, we have re-iterated our guidance for 2024, which means that

we expect to post our highest annual revenue and adjusted EBITDA

upon completion of the year and since going public in 2013.”

Summary of 2024 Third Quarter

Consolidated Financial Results

|

|

|

|

|

(thousands of CAD; except earnings per

share, adjusted earnings per shareand where

noted) |

Three MonthsEnded September 30,

2024 |

|

Three Months Ended September 30,

2023 |

|

|

Revenue |

|

|

|

Registry Operations |

$31,860 |

|

$27,419 |

|

|

Services |

|

25,562 |

|

|

25,551 |

|

|

Technology SolutionsCorporate and other |

|

3,5082 |

|

|

1,6355 |

|

|

Total Revenue |

$60,932 |

|

$54,610 |

|

|

Expenses |

$49,707 |

|

$43,334 |

|

|

Adjusted EBITDA1 |

$22,706 |

|

$19,209 |

|

|

Adjusted EBITDA margin1 |

|

37.3% |

|

|

35.2% |

|

|

Net income |

$4,203 |

|

$4,234 |

|

|

Adjusted net income1 |

$11,035 |

|

$8,357 |

|

|

Earnings per share (basic) |

$ 0.23 |

|

$0.24 |

|

|

Earnings per share (diluted) |

$ 0.23 |

|

$0.23 |

|

|

Adjusted earnings per share (basic)1 |

$ 0.61 |

|

$0.47 |

|

|

Adjusted earnings per share (diluted)1 |

$ 0.60 |

|

$0.46 |

|

|

Adjusted free cash flow1 |

$15,941 |

|

$14,444 |

|

|

1 Adjusted net income, adjusted earnings per share, basic, adjusted

earnings per share, diluted, adjusted EBITDA, adjusted EBITDA

margin and adjusted free cash flow are not recognized as measures

under IFRS and do not have a standardized meaning prescribed by

IFRS and therefore, they may not be comparable to similar measures

reported by other companies; refer to Section 8.8 “Non-IFRS

financial measures” in the MD&A. Refer to section 2

“Consolidated Financial Analysis” in the MD&A for a

reconciliation of adjusted net income and adjusted EBITDA to net

income. Refer to section 6.1 “Cash flow” in the MD&A for a

reconciliation of adjusted free cash flow to net cash flow provided

by operating activities. See also a description of these non-IFRS

measures and reconciliations of adjusted net income and adjusted

EBITDA to net income and adjusted free cash flow to net cash flow

provided by operating activities presented in the section of this

news release titled “Non-IFRS Performance Measures”. |

|

|

|

|

|

|

2024 Third Quarter Results of

Operations

- Total revenue

was $60.9 million, up 12 per cent compared to Q3 2023.

- Registry

Operations segment revenue was $31.9 million, up compared to $27.4

million in Q3 2023:

- Land Registry

revenue was $20.7 million, up compared to $17.8 million in Q3

2023.

- Personal

Property Registry revenue was $3.3 million, up compared to the same

prior year period.

- Corporate

Registry revenue was $3.1 million, up compared to $2.8 million in

Q3 2023.

- Property Tax

Assessment Services revenue was $3.9 million, up compared to the

same prior year period.

- Other revenue

was $0.8 million, up compared to the same prior year period.

- Services segment

revenue was $25.6 million, consistent when compared to $25.6

million in Q3 2023:

- Regulatory

Solutions revenue was $18.9 million, down compared to $19.4 million

in Q3 2023.

- Recovery

Solutions revenue was $3.7 million, up compared to $2.9 million in

Q3 2023.

- Corporate

Solutions revenue was $2.9 million, down compared to $3.3 million

in Q3 2023.

- Technology

Solutions revenue from third parties was $3.5 million, up from $1.6

million in Q3 2023.

- Consolidated

expenses (all segments) were $49.7 million, up $6.4 million

compared to $43.3 million in Q3 2023.

- Net income was

$4.2 million or $0.23 per basic share and $0.23 per diluted share,

compared to $4.2 million or $0.24 per basic and $0.23 per diluted

share for Q3 2023.

OutlookThe following section

includes forward-looking information, including statements related

to our strategy, future results, including revenue and adjusted

EBITDA, segment performance, expenses, operating costs and capital

expenditures, the industries in which we operate, economic

activity, growth opportunities, investments and business

development opportunities. Refer to “Caution Regarding

Forward-Looking Information” in Management’s Discussion &

Analysis for the three and nine months ended September 30,

2024.

The Bank of Canada has now lowered its key

interest rate three times in 2024 with market expectations of

further cuts into next year. Strong activity in the Saskatchewan

real estate market is expected to continue in the near term,

despite inventory challenges in lower-value homes. We continue to

monitor interest rates and other economic conditions which can

impact real estate activity. Factors such as strong population

growth and improved market confidence create an environment for

heightened real estate activity, most notably benefitting the

Saskatchewan Land Registry. In addition, the realization of a full

year of fee adjustments will continue to support strong revenue in

the Saskatchewan Registries division of the Registry Operations

segment.

Services will continue to be a significant part

of our organic growth. The current trend of enhanced due diligence

in an environment of increased regulatory oversight is expected to

continue and positively impact the Regulatory Solutions division.

Furthermore, the decline in used car values, which worsens the

loan-to-value of the vehicle and reduces any equity debtors may

have in their existing vehicle(s), coupled with current mortgage,

rental and inflationary pressures is expected to negatively impact

consumers’ disposable income as well as lead to increased

assignment levels in our Recovery Solutions division for the next

two years.

The key drivers of expenses in adjusted EBITDA

in 2024 are expected to be wages and salaries and cost of goods

sold. Furthermore, as a result of the Extension Agreement, the

Company has additional operating costs associated with the

enhancement of the Saskatchewan Registries and increased interest

expense arising from additional borrowings, which are excluded from

adjusted EBITDA. Our capital expenditures are expected to increase

because of the enhancement of the Saskatchewan Registries but will

remain immaterial overall.

In February, we provided our annual guidance

that forecasted meaningful organic growth in 2024 for revenue and

adjusted EBITDA. In light of the strong performance to date in 2024

and the view that market trends will continue to be in our favour,

we are re-iterating our annual guidance for 2024 with revenue

expected to be within a range of $240.0 million to $250.0 million

and adjusted EBITDA to be within a range of $83.0 million to $91.0

million.

Note to ReadersThe Board of

Directors (“Board”) carries out its responsibility for review of

this disclosure primarily through the Audit Committee, which is

comprised exclusively of independent directors. The Audit Committee

reviews and approves the fiscal year-end Management’s Discussion

and Analysis (“MD&A”) and financial statements and recommends

both to the Board for approval. The interim financial statements

and MD&A are reviewed and approved by the Audit Committee.

This news release provides a general summary of

ISC’s results for the quarters ended September 30, 2024, and 2023.

Readers are encouraged to download the Company’s complete financial

disclosures. Links to ISC’s financial statements and related notes

and MD&A for the period are available on our website in the

Investor Relations section at ww.isc.ca.

Copies can also be obtained SEDAR+ at www.sedarplus.ca by

searching Information Services Corporation’s profile or by

contacting Information Services Corporation at

investor.relations@isc.ca.

All figures are in Canadian dollars unless

otherwise noted.

Conference Call and WebcastWe

will hold an investor conference call on Wednesday, November 6,

2024 at 11:00 a.m. ET to discuss the results. Those joining the

call on a listen-only basis are encouraged to join the live audio

webcast which will be available on our website at

company.isc.ca/investor-relations/events. Participants who wish to

ask a question on the live call may do so through the ISC website

or by registering through the following live call URL:

https://register.vevent.com/register/BI0ab31dca78164eebb5d1a27f40af3107

Once registered, participants will receive the

dial-in numbers and their unique PIN number. When dialing in,

participants will input their PIN and be placed into the call. The

audio file with a replay of the webcast will be available about 24

hours after the event on our website at the link above. We invite

media to attend on a listen-only basis.

About ISCHeadquartered in

Canada, ISC is a leading provider of registry and information

management services for public data and records. Throughout our

history, we have delivered value to our clients by providing

solutions to manage, secure and administer information through our

Registry Operations, Services and Technology Solutions segments.

ISC is focused on sustaining its core business while pursuing new

growth opportunities. The Class A Shares of ISC trade on the

Toronto Stock Exchange under the symbol ISV.

Cautionary Note Regarding

Forward-Looking InformationThis news release contains

forward-looking information within the meaning of applicable

Canadian securities laws including, without limitation, those

contained in the “Outlook” section hereof and statements related to

the industries in which we operate, growth opportunities and our

future financial position and results of operations.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those expressed or implied by such

forward-looking information. Important factors that could cause

actual results to differ materially from the Company's plans or

expectations include risks relating to changes in the condition of

the economy, including those arising from public health concerns,

reliance on key customers and licences, dependence on key projects

and clients, securing new business and fixed-price contracts,

identification of viable growth opportunities, implementation of

our growth strategy, competition and other risks detailed from time

to time in the filings made by the Company including those detailed

in ISC’s Annual Information Form for the year ended December 31,

2023 and ISC’s Unaudited Condensed Consolidated Interim Financial

Statements and Notes and Management’s Discussion and Analysis for

the third quarter ended September 30, 2024, copies of which are

filed on SEDAR+ at www.sedarplus.ca.

The forward-looking information in this release

is made as of the date hereof and, except as required under

applicable securities laws, ISC assumes no obligation to update or

revise such information to reflect new events or circumstances.

Non-IFRS Performance

MeasuresIncluded within this news release are certain

measures that have not been prepared in accordance with IFRS, such

as adjusted net income, adjusted earnings per share, basic,

adjusted earnings per share, diluted, EBITDA, EBITDA margin,

adjusted EBITDA, adjusted EBITDA margin, free cash flow and

adjusted free cash flow. These measures are provided as additional

information to complement those IFRS measures by providing further

understanding of our financial performance from management’s

perspective, to provide investors with supplemental measures of our

operating performance and, thus, highlight trends in our core

business that may not otherwise be apparent when relying solely on

IFRS financial measures.

Management also uses non-IFRS measures to

facilitate operating performance comparisons from period to period,

prepare annual operating budgets and assess our ability to meet

future capital expenditure and working capital requirements.

Accordingly, these non-IFRS measures should not

be considered in isolation or as a substitute for analysis of our

financial information reported under IFRS. Such measures do not

have any standardized meaning prescribed by IFRS and therefore may

not be comparable to similar measures presented by other

companies.

|

Non-IFRS performance measure |

Why we use it |

How we calculate it |

Most comparable IFRS financial measure |

|

Adjusted net incomeAdjusted earnings per share, basicAdjusted

earnings per share, diluted |

- To evaluate performance and profitability while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts will use

adjusted net income and adjusted earnings per share to evaluate

performance while excluding items that management believes do not

contribute to our ongoing operations.

|

Adjusted net income:Net income addShare-based compensation expense,

acquisitions, integration and other costs, effective interest

component of interest expense, debt finance costs expensed to

professional and consulting, amortization of the intangible asset

associated with the right to manage and operate the Saskatchewan

Registries, amortization of registry enhancements, interest on the

vendor concession liability and the tax effect of these adjustments

at ISC’s statutory tax rate.Adjusted earnings per share,

basic:Adjusted net income divided by weighted average number of

common shares outstandingAdjusted earnings per share,

diluted:Adjusted net income divided by diluted weighted average

number of common shares outstanding |

Net incomeEarnings per share, basicEarnings per share, diluted |

|

EBITDAEBITDA margin |

- To evaluate performance and profitability of segments and

subsidiaries as well as the conversion of revenue.

- We believe that certain investors and analysts use EBITDA to

measure our ability to service debt and meet other performance

obligations.

|

EBITDA: Net income add (remove)Depreciation and amortization,

net finance expense, income tax expenseEBITDA margin:EBITDA

divided byTotal revenue |

Net income |

|

Adjusted EBITDAAdjusted EBITDA margin |

- To evaluate performance and profitability of segments and

subsidiaries as well as the conversion of revenue while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts use adjusted

EBITDA to measure our ability to service debt and meet other

performance obligations.

- Adjusted EBITDA is also used as a component of determining

short-term incentive compensation for employees.

|

Adjusted EBITDA:EBITDA add (remove)share-based compensation

expense, acquisition, integration and other costs, gain/loss on

disposal of assets and asset impairment charges if

significantAdjusted EBITDA margin:Adjusted EBITDA divided

byTotal revenue |

Net income |

|

Free cash flow |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets.

- Free cash flow is also used as a component of determining

short-term incentive compensation for employees.

|

Net cash flow provided by operating activities deduct

(add)Net change in non-cash working capital, cash additions to

property, plant and equipment, cash additions to intangible assets,

interest received and paid as well as interest paid on lease

obligations and principal repayments on lease obligations |

Net cash flow provided by operating activities |

|

Adjusted free cash flow |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis from continuing operations while

excluding non-operational and share-based volatility.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets based on continuing

operations while excluding short term non-operational items.

|

Free cash flow deduct (add)Share-based compensation expense,

acquisition, integration and other costs and registry enhancement

capital expenditures |

Net cash flow provided by operating activities |

The following presents a reconciliation of

adjusted net income to net income, a reconciliation of adjusted

EBITDA to EBITDA to net income and a reconciliation of adjusted

free cash flow to free cash flow to net cash flow from operating

activities:

Reconciliation of Adjusted Net Income to Net

Income

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

| |

|

Pre-tax |

Tax1 |

After-tax |

|

(thousands of CAD) |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Adjusted net income |

$ |

15,222 |

|

$ |

11,754 |

|

$ |

(4,187 |

) |

$ |

(3,397 |

) |

$ |

11,035 |

|

$ |

8,357 |

|

|

Add (subtract): |

|

|

|

|

|

|

|

Share-based compensation expense |

|

(3,192 |

) |

|

(1,513 |

) |

|

862 |

|

|

409 |

|

|

(2,330 |

) |

|

(1,104 |

) |

|

Acquisition, integration and other costs |

|

(1,472 |

) |

|

(796 |

) |

|

397 |

|

|

215 |

|

|

(1,075 |

) |

|

(581 |

) |

|

Effective interest component of interest expense |

|

(66 |

) |

|

(64 |

) |

|

18 |

|

|

17 |

|

|

(48 |

) |

|

(47 |

) |

|

Interest on vendor concession liability |

|

(2,315 |

) |

|

(1,733 |

) |

|

625 |

|

|

468 |

|

|

(1,690 |

) |

|

(1,265 |

) |

|

Amortization of right to manage and operate the Saskatchewan

Registries |

|

(2,314 |

) |

|

(1,543 |

) |

|

625 |

|

|

417 |

|

|

(1,689 |

) |

|

(1,126 |

) |

|

Net income |

|

$ |

5,863 |

|

$ |

6,105 |

|

$ |

(1,660 |

) |

$ |

(1,871 |

) |

$ |

4,203 |

|

$ |

4,234 |

|

|

1 Calculated at ISC's statutory tax rate of 27.0 per cent. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA to EBITDA to Net

Income

| |

Three Months Ended September 30, |

|

(thousands of CAD) |

|

2024 |

|

|

2023 |

|

|

Adjusted EBITDA |

$ |

22,706 |

|

$ |

19,209 |

|

| Add (subtract): |

|

|

|

Share-based compensation expense |

|

(3,192 |

) |

|

(1,513 |

) |

|

Acquisition, integration and other costs |

|

(1,472 |

) |

|

(796 |

) |

|

EBITDA1 |

$ |

18,042 |

|

$ |

16,900 |

|

|

Add (subtract): |

|

|

|

Depreciation and amortization |

|

(6,817 |

) |

|

(5,624 |

) |

|

Net finance expense |

|

(5,362 |

) |

|

(5,171 |

) |

|

Income tax expense |

|

(1,660 |

) |

|

(1,871 |

) |

|

Net income |

$ |

4,203 |

|

$ |

4,234 |

|

|

EBITDA margin (% of revenue)1 |

|

29.6% |

|

|

30.9% |

|

|

Adjusted EBITDA margin (% of revenue) |

|

37.3% |

|

|

35.2% |

|

| 1 EBITDA and

EBITDA margin are not recognized as measures under IFRS and do not

have a standardized meaning prescribed by IFRS and therefore, they

may not be comparable to similar measures reported by other

companies; refer to Section 8.8 “Non-IFRS financial measures” for a

discussion on why we use these measures, the calculation of them

and their most directly comparable IFRS financial measure. |

|

| |

|

|

|

|

|

|

Reconciliation of Adjusted Free Cash Flow to Free Cash

Flow to Net Cash Flow Provided by Operating Activities

| |

|

|

|

|

Three Months Ended September 30, |

|

(thousands of CAD) |

|

2024 |

|

|

2023 |

|

|

Adjusted free cash flow |

$ |

15,941 |

|

$ |

14,444 |

|

|

Add (subtract): |

|

|

|

Share-based compensation expense |

|

(3,192 |

) |

|

(1,513 |

) |

|

Acquisition, integration and other costs |

|

(1,472 |

) |

|

(796 |

) |

|

Registry enhancement capital expenditures |

|

(1,241 |

) |

|

(157 |

) |

|

Free cash flow,1 |

$ |

10,036 |

|

$ |

11,978 |

|

|

Add (subtract): |

|

|

|

Cash additions to property, plant and equipment |

|

119 |

|

|

71 |

|

|

Cash additions to intangible assets |

|

1,786 |

|

|

382 |

|

|

Interest received |

|

(229 |

) |

|

(347 |

) |

|

Interest paid |

|

3,123 |

|

|

2,498 |

|

|

Interest paid on lease obligations |

|

117 |

|

|

88 |

|

|

Principal repayment on lease obligations |

|

706 |

|

|

579 |

|

|

Net change in non-cash working capital2 |

|

(1,447 |

) |

|

(676 |

) |

|

Net cash flow provided by operating activities |

$ |

14,211 |

|

$ |

14,573 |

|

| 1 Free cash flow

is not recognized as a measure under IFRS and does not have a

standardized meaning prescribed by IFRS and therefore, may not be

comparable to similar measures reported by other companies; refer

to Section 8.8 “Non-IFRS financial measures” for a discussion on

why we use these measures, the calculation of them and their most

directly comparable IFRS financial measure.2 Refer to Note 17 to

the Financial Statements for

reconciliation. |

| |

|

|

|

|

|

|

Investor ContactJonathan HackshawSenior

Director, Investor Relations & Capital MarketsToll Free:

1-855-341-8363 in North America or

1-306-798-1137investor.relations@isc.ca

Media ContactJodi BosnjakExternal

Communications SpecialistToll Free: 1-855-341-8363 in North America

or 1-306-798-1137corp.communications@isc.ca

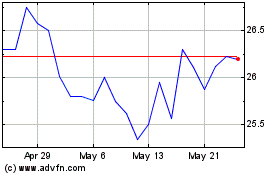

Information Services (TSX:ISV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Information Services (TSX:ISV)

Historical Stock Chart

From Nov 2023 to Nov 2024