Gran Tierra Energy Inc. (“Gran Tierra”) (NYSE

American: GTE)(TSX: GTE)(LSE: GTE), today announces that

the Toronto Stock Exchange (“

TSX”) has approved

its notice of intention to make a normal course issuer bid (the

“

Bid”) for its shares of common stock (the

“

Shares”). As of October 20, 2023, there were

33,288,305 Shares issued and outstanding and the public float was

32,349,140 Shares. Pursuant to the Bid, Gran Tierra will be able to

purchase for cancellation up to 3,234,914 Shares, representing 10%

of the public float, at prevailing market prices at the time of

purchase, through the facilities of the TSX, the NYSE American (the

“

NYSE”) or alternative trading platforms in Canada

or the United States, if eligible, or by such other means as may be

permitted by the TSX, the NYSE and applicable securities laws for a

one year period commencing on November 3, 2023 and ending on

November 2, 2024. Gran Tierra has also entered into an Automatic

Share Purchase Plan (the “

ASPP”) in connection

with the Bid. The brokerage firm conducting the Bid on behalf of

Gran Tierra and administering the ASPP is Eight Capital. The ASPP

is intended to allow for the purchase of Shares under the Bid when

Gran Tierra would ordinarily not be permitted to purchase Shares

due to regulatory restrictions and customary self-imposed blackout

periods.

Gran Tierra may purchase up to 14,306 Shares

during any trading day, which represents approximately 25% of

57,225, which represents the average daily trading volume on the

TSX for the most recently completed six calendar months prior to

the TSX’s acceptance of the notice of the Bid. Gran Tierra may

effect repurchases from time to time in the open market.

Management of Gran Tierra believes that the

Shares, at times, have been trading in a price range which does not

adequately reflect their value in relation to Gran Tierra’s current

operations, growth prospects and financial position. At such times,

the purchase of Shares for cancellation or to satisfy awards

granted under Gran Tierra’s Long Term Equity Incentive Plan may be

advantageous to stockholders by increasing the value of the

Shares.

Within the past twelve months, Gran Tierra

purchased 2,530,026 Shares at a volume weighted average price of

CDN$9.40 under a previously approved normal course issuer bid

through the facilities of the TSX and eligible alternative trading

platforms in Canada permitting the purchase of up to 3,603,397

Shares (calculated on a post-10-for-1 reverse stock split basis),

which expired on August 30, 2023.

Pursuant to the ASPP, outside of a trading

blackout period, Gran Tierra may, but is not required to, instruct

the designated broker to make purchases under the Bid in accordance

with the terms of the ASPP. Such purchases will be determined by

the designated broker at its sole discretion based on purchasing

parameters set by Gran Tierra in accordance with the rules of the

TSX, the NYSE, applicable securities laws, including Rule 10b-18

under the U.S. Securities Exchange Act of 1934, as amended, and the

terms of the ASPP. The ASPP has been pre-cleared by the TSX and

will be implemented on November 3, 2023.

Outside of blackout periods, Shares may be

purchased under the Bid based on management’s discretion, in

compliance with the rules of the TSX, the NYSE and applicable

securities laws. Purchases made under the ASPP will be included in

computing the number of Shares purchased under the Bid.

About Gran Tierra Energy

Inc.

Gran Tierra Energy Inc. together with its

subsidiaries is an independent international energy company

currently focused on oil and natural gas exploration and production

in Colombia and Ecuador. Gran Tierra is currently developing its

existing portfolio of assets in Colombia and Ecuador and will

continue to pursue additional growth opportunities that would

further strengthen Gran Tierra’s portfolio. Gran Tierra’s common

stock trades on the NYSE American, the Toronto Stock Exchange and

the London Stock Exchange under the ticker symbol GTE. Additional

information concerning Gran Tierra is available at

www.grantierra.com. Information on Gran Tierra does not constitute

a part of this press release. Investor inquiries may be directed to

info@grantierra.com or (403) 265-3221.

Gran Tierra’s U.S. Securities and Exchange

Commission (“SEC”) filings are available on the

SEC website at www.sec.gov. Gran Tierra’s Canadian securities

regulatory filings are available on SEDAR at www.sedar.com and UK

regulatory filings are available on the National Storage Mechanism

(the “NSM”) website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Gran

Tierra’s filings on the SEC, SEDAR and NSM websites are not

incorporated by reference into this press release.

Forward-Looking Statements and

Advisories

This press release contains statements about

future events that constitute forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

and forward looking information within the meaning of applicable

Canadian securities laws (collectively, “forward-looking

statements”). Such forward-looking statements include, but

are not limited to, the belief of Gran Tierra’s management that the

Bid will be advantageous to stockholders, potential purchases of

the Shares for cancellation or redeployment under Gran Tierra’s

Long Term Equity Incentive Plan, the potential value of the Bid for

Gran Tierra’s stockholders and other benefits to be derived from

the Bid. There can be no assurance as to how many Shares, if any,

will ultimately be acquired by Gran Tierra.

The forward-looking statements contained in this

news release are subject to risks, uncertainties and other factors

that could cause actual results or outcomes to differ materially

from those contemplated by the forward-looking statements,

including, among others, unexpected changes in general market and

economic conditions. Accordingly, readers should not place undue

reliance on the forward-looking statements contained herein.

Further information on potential factors that could affect Gran

Tierra are included in risks detailed from time to time in Gran

Tierra’s reports filed with the Securities and Exchange Commission,

including, without limitation, under the caption “Risk Factors” in

Gran Tierra’s Annual Report on Form 10-K filed February 21, 2023

and its subsequent quarterly reports on Form 10-Q. These filings

are available on a Website maintained by the SEC at

http://www.sec.gov and on SEDAR at www.sedar.com.

All forward-looking statements are made as of

the date of this press release and the fact that this press release

remains available does not constitute a representation by Gran

Tierra that Gran Tierra believes these forward-looking statements

continue to be true as of any subsequent date. Actual results may

vary materially from the expected results expressed in

forward-looking statements. Gran Tierra disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities laws. Gran

Tierra’s forward-looking statements are expressly qualified in

their entirety by this cautionary statement.

No Offer or Solicitation

The information in this press release is for

informational purposes only and is neither an offer to purchase,

nor a solicitation of an offer to sell, subscribe for or buy any

securities or otherwise, nor shall there be any purchase in any

jurisdiction in contravention of applicable law.

Contact Information:

For investor and media inquiries please contact:

Gary GuidryPresident & Chief Executive Officer

Ryan EllsonExecutive Vice President & Chief Financial

Officer

Rodger TrimbleVice President, Investor Relations

+1-403-265-3221

info@grantierra.com

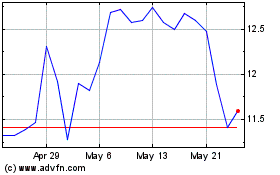

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

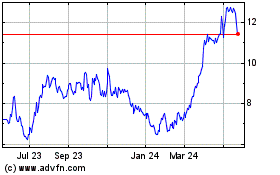

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2023 to Nov 2024