Today Emera Inc. (“Emera”) (TSX: EMA) reported financial results

for the third quarter and year-to-date 2024.

Highlights

- Increase in Adjusted Earnings Per Share1 (“Adjusted

EPS”): Adjusted EPS increased by 8% or $0.06 to $0.81 compared

to adjusted EPS of $0.75 in Q3 2023.

- Customer growth at both Florida utilities, and new base rates

at Peoples Gas (“PGS”) resulted in higher contributions;

- Corporate costs were lower, primarily due to the timing

difference in the valuation of long-term incentive expense and

related hedges;

- These increases were partially offset by lower contributions

from Canadian Electric Utilities driven by the sale of the Labrador

Island Link (“LIL”) in June 2024 and lower contributions from Nova

Scotia Power (“NSPI”) driven by an increase in reliability and

customer experience-related operating costs.

- Decrease in Reported Earnings Per Share (“EPS”):

Reported EPS decreased by $0.36 to $0.01 in Q3 2024, compared to

$0.37 in Q3 2023. This decrease was primarily driven by charges

related to the pending sale of New Mexico Gas Company

(“NMGC”).

- Strengthened Financial Position: In late September, NSPI

finalized a $500 million federal loan guarantee with the Government

of Canada and the Government of Nova Scotia. This guarantee

provides important cost relief to electricity customers in Nova

Scotia and protects the overall financial health of the utility by

way of a $500 million debt reduction. This builds on the Q3

announcement of the US$1.252 billion pending sale of NMGC.

- Investing for the Future: Emera remains on track to

fully deploy its $2.9 billion capital plan in 2024, with two-thirds

of new rate base investments committed to date. The investment plan

remains focused on reliability and resiliency, grid modernization,

renewable energy integration, technology innovations focused on

cost efficiency and customer experience, and customer growth driven

infrastructure expansion.

“Emera’s third quarter results were strong, with an 8 per cent

increase in adjusted earnings per share over Q3 2023, principally

driven by solid operational performance across the portfolio and

particularly strong financial performance from our Florida

utilities,” said Scott Balfour, President and CEO of Emera Inc.

“The successful storm response following the recent back-to-back

hurricanes in Florida is a testament to our local teams’ expertise,

and the resilience of our electric and gas infrastructure. The PGS

gas system experienced minimal impacts from both Helene and Milton,

while grid restoration efforts for Tampa Electric were completed in

record time given the severity of the events.”

Q3 2024 Financial Results

Q3 2024 reported net income was $4 million, or $0.01 per common

share, compared with reported net income of $101 million, or $0.37

per common share, in Q3 2023. Reported net income for the quarter

included $225 million in charges related to the pending sale of

NMGC, after tax and a $7 million MTM loss, after-tax, primarily at

Emera Energy Services (“EES”) compared to a $103 million loss,

after-tax, in Q3 2023.

Q3 2024 adjusted net income(1) was $236 million, or $0.81 per

common share, compared with $204 million, or $0.75 per common

share, in Q3 2023. The increase in adjusted net income was

primarily due to increased earnings at TEC, PGS, NSPI and NMGC; and

lower Corporate operating, maintenance and general expenses

(“OM&G”) largely due to the timing difference in the valuation

of long-term incentive expense and related hedges. These were

partially offset by decreased earnings at Emera Energy; lower

equity earnings as a result of the sale of Emera’s LIL equity

interest; lower Corporate income tax recovery due to decreased

losses before provision for income taxes; increased Corporate

interest expense due to increased interest rates and increased

total debt; and increased Corporate preferred share dividends.

Year-to-date Financial Results

Year-to-date reported net income was $340 million or $1.18 per

common share, compared with reported net income of $689 million or

$2.53 per common share year-to-date in 2023. Year-to-date reported

net income included a $107 million gain, after tax and transaction

costs, on the sale of Emera’s LIL equity interest and was

unfavourably impacted by the $225 million charges, after-tax,

related to the pending sale of NMGC, and the $145 million MTM

losses, after-tax, primarily at EES, compared to a $55 million

gain, after-tax, in 2023.

Year-to-date adjusted net income(1) was $603 million or $2.10

per common share, compared with $634 million or $2.33 per common

share year-to-date in 2023.

The year-to-date decrease in adjusted net income was primarily

due to decreased earnings at NMGC, Emera Energy, and NSPI; lower

equity earnings as a result of the sale of Emera’s LIL equity

interest; increased Corporate interest expense due to increased

interest rates and increased total debt; and increased Corporate

preferred share dividends. These were partially offset by increased

earnings at PGS and TEC; decreased Corporate OM&G due to the

timing difference in the valuation of long-term incentive expense

and related hedges; and higher income tax recovery due to increased

loss before provision for income taxes.

The translation impact of a weaker CAD on US denominated

earnings increased net income by $7 million in Q3 2024 compared to

the same period in 2023. Year-to-date 2024, the impact of a weaker

CAD on US denominated earnings was more than offset by the realized

and unrealized losses on FX hedges used to mitigate the translation

risk of USD earnings, resulting in a $6 million decrease to net

income compared to the same period in 2023. Weakening of the CAD

increased adjusted net income by $2 million in Q3 2024 and $3

million year-to-date compared to the same periods in 2023. Impacts

of the changes in the translation of the CAD include the impacts of

Corporate FX hedges used to mitigate translation risk of USD

earnings in the Other segment.

(1) See “Non-GAAP Financial Measures and

Ratios” noted below and “Segment Results and Non-GAAP

Reconciliation” below for reconciliation to nearest USGAAP

measure.

Segment Results and Non-GAAP Reconciliation

For the

Three months ended

September 30

Nine months ended

September 30

millions of Canadian dollars (except per

share amounts)

2024

2023

2024

2023

Adjusted net income1,2

Florida Electric Utility

$

252

$

228

524

512

Canadian Electric Utilities

26

38

155

179

Gas Utilities and Infrastructure

38

23

180

155

Other Electric Utilities

10

17

27

31

Other3

(90)

(102)

(283)

(243)

Adjusted net income1,2

$

236

$

204

603

634

Charges related to the pending sale of

NMGC, after-tax4,5

(225)

-

(225)

-

Gain on sale of LIL, after tax and

transaction costs6

-

-

107

-

MTM (loss) gain, after-tax7

(7)

(103)

(145)

55

Net income attributable to common

shareholders

$

4

$

101

340

689

EPS (basic)

$

0.01

$

0.37

1.18

2.53

Adjusted EPS (basic)1,2

$

0.81

$

0.75

2.10

2.33

1 See “Non-GAAP Financial Measures and

Ratios” noted below.

2 Excludes the charges related to the

pending sale of NMGC, after-tax, the gain on sale, after tax and

transaction costs of Emera’s LIL equity interest and the effect of

MTM adjustments.

3 Higher earnings quarter-over-quarter,

primarily due to lower OM&G, partially offset by decreased

income tax recovery, increased interest expense and lower

contributions from Emera Energy. Year-over-year change primarily

due to increased interest expense and lower contributions from

Emera Energy, partially offset by lower operating expenses and

increased income tax recovery.

4 Represents (i) $206 million in non-cash

goodwill and other impairment charges, after-tax and (ii) $19

million in estimated transaction costs, after-tax for the three and

nine months ended September 30, 2024 (2023 – nil).

5 Net of income tax recovery of $20

million for the three and nine months ended September 30, 2024

(2023 – nil).

6 Net of income tax expense of $75 million

for the nine months ended September 30, 2024 (2023 – nil).

7 Net of income tax recovery of $4 million

for the three months ended September 30, 2024 (2023 – $40 million

recovery) and $60 million income tax recovery for the nine months

ended September 30, 2024 (2023 – $24 million expense).

Consolidated Financial Review

The following table highlights significant year-over-year

changes in adjusted net income attributable to common shareholders

from 2023 to 2024.

For the

Three months ended

Nine months ended

millions of Canadian dollars

September 30

September 30

Adjusted net income – 20231,2

$

204

$

634

Operating Unit Performance

Increased earnings at TEC due to higher

revenues as a result of customer growth and new base rates, lower

income tax expense and the impact of a weaker CAD, partially offset

by unfavourable weather and higher depreciation. Year-over-year

earnings was also partially offset by higher OM&G due to higher

generation and transmission and distribution ("T&D") costs

24

12

Increased earnings at PGS due to higher

revenue from new base rates and customer growth, partially offset

by increased depreciation, OM&G, interest expense and income

tax expense

15

47

Increased earnings quarter-over-quarter at

NSPI due to lower OM&G. Decreased earnings year-over-year due

to higher OM&G due to increased reliability initiatives,

partially offset by higher revenue from increased residential sales

volumes

4

(12)

Decreased earnings year-over-year at NMGC

due to lower asset optimization revenues and increased OM&G,

partially offset by lower income tax expense

1

(18)

Decreased income from equity investments

due to the sale of LIL equity interest

(15)

(16)

Decreased earnings at Emera Energy due to

the recognition of investment tax credits in 2023 related to Bear

Swamp

(5)

(8)

Decreased earnings at EES due to less

favourable market conditions. Year-over-year decrease also reflects

favourable hedging opportunities in Q1 2023 as a result of higher

natural gas pricing

(3)

(13)

Corporate

Decreased OM&G, pre-tax, primarily due

to the timing difference in the valuation of long-term incentive

expense and related hedges

32

15

Increased preferred share dividends due to

higher dividend rate for series B, C, and H preferred shares

(2)

(6)

Increased interest expense, pre-tax, due

to increased interest rates and increased total debt

(6)

(29)

Decreased income tax recovery

quarter-over-quarter due to decreased loss before provision for

income taxes. Increased income tax recovery year-over-year due to

increased loss before provision for income taxes

(7)

8

Other Variances

(6)

(11)

Adjusted net income – 20241,2

$

236

$

603

1 See “Non-GAAP Financial Measures and

Ratios” noted below and “Segment Results and Non-GAAP

Reconciliation" for reconciliation to nearest USGAAP measure.

2 Excludes the charges related to the

pending sale of NMGC, after-tax, the gain on sale, after tax and

transaction costs of Emera’s LIL equity interest and the effect of

MTM adjustments.

1 Non-GAAP Financial Measures and Ratios

Emera uses financial measures that do not have standardized

meaning under USGAAP and may not be comparable to similar measures

presented by other entities. Emera calculates the non-GAAP measures

and ratios by adjusting certain GAAP measures for specific items.

Management believes excluding these items better distinguishes the

ongoing operations of the business. For further information on the

non-GAAP financial measure, adjusted net income, and the non-GAAP

ratio, adjusted EPS – basic, refer to the "Non-GAAP Financial

Measures and Ratios" section of the Emera’s Q3 2024 MD&A which

is incorporated herein by reference and can be found on SEDAR+ at

www.sedarplus.ca. Reconciliation to the nearest GAAP measure is

included in “Segment Results and Non-GAAP Reconciliation”

above.

Forward-Looking Information

This news release contains forward-looking information within

the meaning of applicable securities laws. By its nature,

forward-looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. These statements

reflect Emera management’s current beliefs and are based on

information currently available to Emera management. There is a

risk that predictions, forecasts, conclusions and projections that

constitute forward-looking information will not prove to be

accurate, that Emera’s assumptions may not be correct and that

actual results may differ materially from such forward-looking

information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s

securities regulatory filings, including under the heading

“Business Risks and Risk Management” in Emera’s annual Management’s

Discussion and Analysis, and under the heading “Principal Risks and

Uncertainties” in the notes to Emera’s annual and interim financial

statements, which can be found on SEDAR+ at www.sedarplus.ca.

Teleconference Call

The company will be hosting a teleconference today, Friday,

November 8, at 6:00 p.m. Atlantic (5:00 p.m. Eastern) to discuss

the Q3 2024 financial results.

Analysts and other interested parties in North America are

invited to participate by dialing 1-800-717-1738. International

parties are invited to participate by dialing 1-289-514-5100.

Participants should dial in at least 10 minutes prior to the start

of the call. No pass code is required.

A live and archived audio webcast of the teleconference will be

available on the Company's website, www.emera.com. A replay of the

teleconference will be available on the Company’s website two hours

after the conclusion of the call.

About Emera

Emera (TSX: EMA) is a leading North American provider of energy

services headquartered in Halifax, Nova Scotia, with investments in

regulated electric and natural gas utilities, and related

businesses and assets. The Emera family of companies delivers safe,

reliable energy to approximately 2.5 million customers in Canada,

the United States and the Caribbean. Our team of 7,300 employees is

committed to our purpose of energizing modern life and delivering a

cleaner energy future for all. Emera’s common and preferred shares

are listed and trade on the Toronto Stock Exchange. Additional

information can be accessed at www.emera.com or

www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108261374/en/

Emera Inc. Investor Relations Dave Bezanson, VP,

Investor Relations & Pensions 902-474-2126

dave.bezanson@emera.com

Media 902-222-2683 media@emera.com

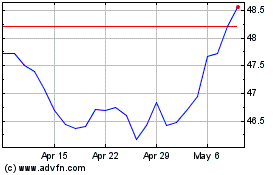

Emera (TSX:EMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Emera (TSX:EMA)

Historical Stock Chart

From Jan 2024 to Jan 2025