Canoe Financial wins five 2023 FundGrade A+ Awards for outstanding performance

February 02 2024 - 8:00AM

Canoe Financial LP (“Canoe Financial”) is recognized with five 2023

FundGrade A+® Awards for outstanding performance.

Canoe Financial 2023 FundGrade A+ Award

winning funds:

|

Fund |

CIFSC category |

# funds in category |

FundGrade A+ start date |

|

Canoe Equity Portfolio Class |

Canadian Focused Equity |

335 |

1/31/2014 |

|

Canoe Asset Allocation Portfolio Class |

Tactical Balanced |

194 |

1/31/2014 |

|

Canoe North American Monthly Income Portfolio Class |

Global Neutral Balanced |

888 |

1/31/2014 |

|

Canoe Defensive U.S. Equity Portfolio Class |

U.S. Equity |

794 |

1/31/2014 |

|

Canoe Global Equity Fund |

Global Equity |

1,095 |

1/31/2014 |

FundGrade calculation date 12/31/2023.

The FundGrade A+® rating was designed to

recognize best performing funds that deliver the most consistent

risk-adjusted returns. It is a yearly award that honours the “best

of the best” among Canadian investment funds that have maintained a

high FundGrade rating throughout a calendar year.

“I’m extremely proud of our investment team and

their success delivering category-leading performance in some of

the most important asset classes for Canadian investors,” said

Darcy Hulston, President and Chief Executive Officer, Canoe

Financial.

About Canoe FinancialCanoe

Financial is one of Canada’s fastest growing independent mutual

fund companies managing $14.7 billion in assets across a

diversified range of award-winning investment solutions. Founded in

2008, Canoe Financial is an employee-owned investment management

firm focused on building financial wealth for Canadians. Canoe

Financial has a significant presence across Canada, including

offices in Calgary, Toronto and Montreal.

About FundGrade A+

AwardsFundGrade A+® is used with permission from Fundata

Canada Inc., all rights reserved. The annual FundGrade A+® Awards

are presented by Fundata Canada Inc. to recognize the “best of the

best” among Canadian investment funds. The FundGrade A+®

calculation is supplemental to the monthly FundGrade ratings and is

calculated at the end of each calendar year. The FundGrade rating

system evaluates funds based on their risk-adjusted performance,

measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The

score for each ratio is calculated individually, covering all time

periods from 2 to 10 years. The scores are then weighted equally in

calculating a monthly FundGrade. The top 10% of funds earn an A

Grade; the next 20% of funds earn a B Grade; the next 40% of funds

earn a C Grade; the next 20% of funds receive a D Grade; and the

lowest 10% of funds receive an E Grade. To be eligible, a fund must

have received a FundGrade rating every month in the previous year.

The FundGrade A+® uses a GPA-style calculation, where each monthly

FundGrade from “A” to “E” receives a score from 4 to 0,

respectively. A fund’s average score for the year determines its

GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade

A+® Award. For more information, see www.FundGradeAwards.com.

Although Fundata makes every effort to ensure the accuracy and

reliability of the data contained herein, the accuracy is not

guaranteed by Fundata.

Canoe Equity Portfolio Class Series A

performance for the period ended 12/31/2023 is as follows: 4.13% (1

year), 15.22% (3 years), 13.70% (5 years), 9.70% (10 years) and

7.12% (since inception-February 2011). Canoe Asset Allocation

Portfolio Class Series A performance for the period ended

12/31/2023 is as follows: 4.34% (1 year), 10.47% (3 years),9.79% (5

years), 7.21% (10 years) and 5.20% (since inception-February 2011).

Canoe North American Monthly Income Portfolio Class Series A

performance for the period ended 12/31/2023 is as follows: 4.71% (1

year), 7.76% (3 years), 7.45% (5 years), 6.21% (10 years) and 6.71%

(since inception- December 2012). Canoe Defensive U.S. Equity

Portfolio Class Series A performance for the period ended

12/31/2023 is as follows: 13.34% (1 year), 9.74% (3 years),11.93%

(5 years), 11.00% (10 years) and 11.02% (since inception-November

2013). Canoe Global Equity Fund Series A performance for the period

ended 12/31/2023 is as follows: -14.57% (1 year), 6.13% (3 years),

10.60% (5 years), 10.60% (10 years) and 12.24% (since

inception-August 2011).

Further informationInvestor RelationsCanoe

Financial LP1–877–434–2796info@canoefinancial.com

Commissions, trailing commissions, management

fees and expenses all may be associated with mutual fund

investments. Please read the prospectus before investing. The

indicated rates of return are the historical annual compounded

total returns including changes in unit value and reinvestment of

all distributions and do not take into account sales, redemption,

distribution or optional charges or income taxes payable by any

unitholder that would have reduced returns. Mutual funds are not

guaranteed, their values change frequently, and past performance

may not be repeated.

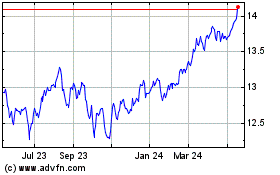

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

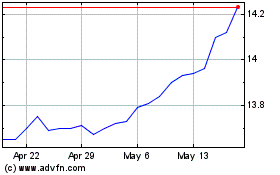

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024