Canoe Financial wins four 2023 LSEG Lipper Fund Awards for outstanding performance

November 10 2023 - 4:35PM

Canoe Financial LP (“Canoe Financial”) was recognized at the 2023

LSEG Lipper Fund Awards with four awards for outstanding

performance.

Canoe Financial 2023 LSEG Lipper

Awards:

|

Best Canadian Focused Equity Fund over 3

years |

Canoe Equity Portfolio Class (Series F) |

|

Best Tactical Balanced Fund over 3 years |

Canoe Asset Allocation Portfolio Class (Series F) |

|

Best Tactical Balanced Fund over 5 years |

Canoe Asset Allocation Portfolio Class (Series F) |

|

Best Tactical Balanced Fund over 10 years |

Canoe Asset Allocation Portfolio Class (Series F) |

LSEG Lipper Fund Awards recognize funds that

have excelled in delivering consistently strong risk-adjusted

outperformance relative to their peers.

“I’m extremely proud of the work our investment

team is doing. I’m especially proud that these awards recognize

long-term performance over an extended period of three years or

more, and that they are in some of the most important categories

for Canadian investors,” said Darcy Hulston, President and Chief

Executive Officer, Canoe Financial.

About Canoe FinancialCanoe

Financial is one of Canada’s fastest growing independent mutual

fund companies managing $13.8 billion in assets across a

diversified range of award-winning investment solutions. Founded in

2008, Canoe Financial is an employee-owned investment management

firm focused on building financial wealth for Canadians. Canoe

Financial has a significant presence across Canada, including

offices in Calgary, Toronto and Montreal.

About LSEG Lipper AwardsThe

LSEG Lipper Fund Awards, granted annually, highlight funds and fund

companies that have excelled in delivering consistently strong

risk-adjusted performance relative to their peers. The LSEG Lipper

Fund Awards are based on the Lipper Leader for Consistent Return

rating, which is an objective, quantitative, risk-adjusted

performance measure calculated over 36, 60 and 120 months. The fund

with the highest Lipper Leader for Consistent Return (Effective

Return) value in each eligible classification wins the LSEG Lipper

Fund Award. For more information, see lipperfundawards.com.

Although LSEG Lipper makes reasonable efforts to ensure the

accuracy and reliability of the data used to calculate the awards,

their accuracy is not guaranteed.

Canoe Asset Allocation Portfolio Class Series F

was awarded the 2023 LSEG Lipper Fund Award in the Canadian focused

equity category for: three years ending 7/31/2023, out of a

classification total of 52 funds, five years ending 7/31/2023, out

of a classification total of 49 funds, 10 years ending 7/31/2023,

out of a classification total of 22 funds. Performance for the Fund

for the period ending 7/31/2023 is as follows: 7.50% (one year),

15.37% (three years), 9.09% (five years), 9.48% (ten years) and

6.48% (since inception 02/14/2011). The corresponding LSEG Lipper

Leader ratings of the Fund for the same period are as follows: N/A

(one year), 5 (three years), 5 (five years), 5 (ten years).

Canoe Equity Portfolio Class Series F was

awarded the 2023 LSEG Lipper Fund Award in the Canadian focused

equity category for three years ending 7/31/2023, out of a

classification total of 63 funds. Performance for the Fund for the

period ending 7/31/2023 is as follows: 11.74% (one year), 23.61%

(three years), 12.21% (five years), 12.56% (ten years) and 8.61%

(since inception 02/14/2011). The corresponding LSEG Lipper Leader

ratings of the Fund for the same period are as follows: N/A (one

year), 5 (three years), 5 (five years), 5 (ten years).

Further informationInvestor RelationsCanoe

Financial LP1–877–434–2796info@canoefinancial.com

Commissions, trailing commissions, management

fees and expenses all may be associated with mutual fund

investments. Please read the prospectus before investing. The

indicated rates of return are the historical annual compounded

total returns including changes in unit value and reinvestment of

all distributions and do not take into account sales, redemption,

distribution or optional charges or income taxes payable by any

unitholder that would have reduced returns. Mutual funds are not

guaranteed, their values change frequently, and past performance

may not be repeated.

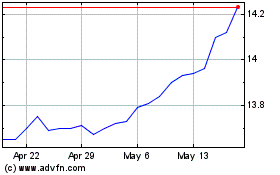

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

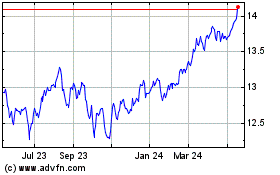

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024