Canoe Financial broadens its fixed income and international equity fund lineups

August 01 2023 - 6:00AM

Canoe Financial LP (“Canoe Financial”) announces the expansion of

its fixed income and equity fund lineups with the launch of Canoe

Unconstrained Bond Fund and Canoe Unconstrained Bond Portfolio

Class sub-advised by Reams Asset Management (“Reams”), and Canoe

International Equity Portfolio Class sub-advised by PineStone Asset

Management Inc. (“PineStone”).

Rethink traditional fixed income investing with Canoe

Unconstrained Bond Fund and Canoe Unconstrained Portfolio

Class

Canoe Unconstrained Bond Fund and Canoe Unconstrained Bond

Portfolio Class aim to provide a flexible, unconstrained approach

to navigating across fixed income sectors while optimizing returns

in all market environments. The Reams investment team utilizes a

broader array of tools than traditional fixed income solutions to

manage duration, mitigate risk and capitalize on opportunities.

Canoe Unconstrained Bond Portfolio Class has a tax-efficient

structure that is suitable for non-registered investment

accounts.

Reams Asset Management

Reams is an Indianapolis-based boutique manager with a

successful track record of managing unconstrained fixed income

strategies dating back to 1998, and US$23.8 billion in assets under

management. Led by Mark Egan, Chief Investment Officer, the Reams

investment team’s differentiated investment approach focuses on

risk-adjusted returns and benchmark-agnostic portfolio

construction.

“Reams is excited to partner with Canoe Financial to bring our

time-tested unconstrained fixed income strategy to Canadian

investors,” said Mark Egan. “Throughout the vetting process,

Canoe’s innovative and client-centric approach to distribution

resonated strongly with our team. Our shared ethos – belief in

active management, independent thought, and serving as stewards of

our clients’ capital – also reinforces our confidence that Canoe is

an ideal partner in an important market for Reams.”

Diversify home country bias with Canoe International

Equity Portfolio Class

Canoe International Equity Portfolio Class leverages the

expertise of PineStone’s proven high conviction approach to

investing that has benefitted investors in Canoe Financial’s US,

global and defensive international equity strategies. PineStone’s

award-winning investment team focuses on what PineStone believes to

be high quality international companies that can generate increased

shareholder value.

PineStone Asset Management

Headed by veteran portfolio manager Nadim Rizk, Montreal-based

PineStone is independent, 100% private and employee-owned, and

manages CAD$60 billion in assets across international, global, and

US equity strategies. PineStone’s core values are centred around a

single investment philosophy and process that is focused on quality

and long-term investing.

“Our mission is to create extraordinary value for our clients

and their beneficiaries over many years,” said Nadim Rizk, Chief

Executive Officer and Chief Investment Officer. “Our relationship

with Canoe goes back several years now and I am thrilled to be

partnering with them once again to bring our international strategy

to Canadian investors.”

“We continue to grow and offer products to meet the evolving

needs of Canadians. These investment solutions strengthen our

lineup and provide access to highly sought-after asset classes,”

said Darcy Hulston, President and Chief Executive Officer, Canoe

Financial. “Reams brings a strong track record and proven expertise

in unconstrained bond investing, and we’re excited to be deepening

our relationship with Nadim and PineStone, a long-time valued

partner of Canoe. Partnering with both Reams and PineStone

highlights our commitment to providing investors excellence in

asset management.”

Fund codes

|

Fund |

Series F |

Series A |

|

Canoe Unconstrained Bond Fund |

GOC5063 |

GOC5061 |

|

Canoe Unconstrained Bond Portfolio Class |

GOC5163 |

GOC5161 |

|

Canoe International Equity Portfolio Class |

GOC4633 |

GOC4631 |

About Canoe Financial

Canoe Financial is one of Canada’s fastest growing independent

mutual fund companies managing $13.8 billion in assets across a

diversified range of award-winning investment solutions. Founded in

2008, Canoe Financial is an employee-owned investment management

firm focused on building financial wealth for Canadians. Canoe

Financial has a significant presence across Canada, including

offices in Calgary, Toronto and Montreal.

Further InformationInvestor RelationsCanoe

Financial LP1–877–434–2796info@canoefinancial.com

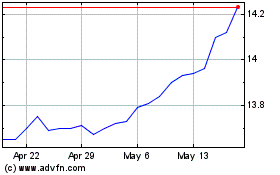

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

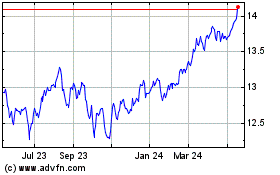

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024