First quarter revenue increases 62 per cent and

Adjusted EBITDA increases by 234 per cent

2021 revenue guidance maintained at €47M

Accelerating rollout of proprietary in-house

developed slot content

B2B gaming technology and content provider Bragg Gaming Group

(TSX:BRAG, OTC:BRGGD) ("Bragg" or the "Company")

today released its financial results for the three months ended

March 31, 2021.

“We’ve continued to build on the strong momentum of 2020 with an

excellent first quarter,” said Richard Carter, CEO of Bragg Gaming.

“Revenue is up by 62 per cent year-over-year and Adjusted EBITDA

increased by 234 per cent. We’ve also seen a 54 per cent increase

in the number of unique players using Bragg content, have launched

nine new operators and our customer pipeline for the remainder of

2021 is expected to continue to grow and expand globally,

underpinning future company growth in 2021.

“We continue to invest in our employees, our technology and our

product offering, and this has allowed us to commercialize our

in-house casino content studio, with our first game recently

launched across our network,” continued Mr. Carter. “With further

in-house casino games and player engagement tools scheduled for

upcoming release, and our acquisition of Spin Games LLC laying the

foundation for our strategy of building a tier one vertically

integrated iGaming business in the U.S., Bragg Gaming has never

been better positioned for long-term success.”

Q1 2021 financial highlights

- Revenue increased by 62 per cent to €14.2M (C$20.9M1) in

the first quarter of 2021, compared to €8.8M (C$12.9M) for

the first quarter of 2020, maintaining quarterly growth momentum

since Q1 2019

- Quarter-over-quarter revenue increase of 3 per cent, from

€13.8M (C$20.3M) in the fourth quarter of 2020 to €14.2M

(C$20.9M) in the first quarter of 2021

- Wagering revenue generated by customers2 up by 52 per cent to

€3.5B (C$5.1B) compared to €2.3B (C$3.4B) in Q1

2020

- The number of unique players3 using Bragg games and content

increased by 54 per cent up to 2.4M, from 1.6M during the

comparable period in Q1 2020

- Gross profit increased by 68 per cent to €6.6M (C$9.8M),

compared to €4.0M (C$5.8M) with an increase in margins from

45 per cent to 47 per cent, mainly attributed to the shift in

proportion of revenues from games and content to iGaming and

turn-key services, the latter of which have lower associated cost

of sales

- Net loss for the period was €1.1M (C$1.6M), a decrease

of €4.6M (C$6.8M) from Q1 2020, mainly due to the full

settlement of the ORYX earn-out on January 18, 2020, resulting in

nil expenditure from re-measurement of deferred and contingent

consideration and accretion on liabilities in the current quarter

(Q1 2020: €5.0m)

- Adjusted EBITDA4 was €2.3M (C$3.4M) in Q1 2021, up 234

per cent compared to €0.7M (C$1.0M) in Q1 2020, with an

increase in margins from 8 per cent to 16 per cent, primarily as a

result of higher scale

- Cash and cash equivalents as of March 31, 2021 increased to

€30.1M (C$44.3M) compared to €26.1M as of December 31, 2020

(C$38.4M)

Selected first quarter 2021 performance indicators

Euros (Thousands)

Q1-21

Q1-20

%

Revenue

14,196

8,784

62%

Adjusted EBITDA

2,342

702

234%

Adjusted EBITDA margin

16%

8%

106%

Operational

Q1-21

Q1-20

%

Wagering revenue (Euros)

3.5B

2.3B

52%

Unique players

2.4M

1.6M

54%

Revenue/ top 10 customers

62%

65%

-3%

Business highlights

- Successful launch of nine new B2C operators5 during the period

across a number of jurisdictions, including PAF (Finland), iGaming

platform Senator (Croatia), Swiss market leader Casino Luzern and

Maxbet (Romania)

- Improved customers revenue diversification, with 62 per cent of

revenue for Q1 2021 derived from the top 10 customers, as compared

to 65 per cent in Q1 2020

- Launched 11 new casino games fully certified and distributed

successfully throughout the entire network

- Signed agreement to be the exclusive distributor of slots

studio Sakuragate outside of Japan

- Completed a private placement for €1.9M (C$3.0M) - Board of

Directors and management participated

Ongoing strategy

- On May 12, 2021, Bragg announced that it had entered into an

agreement to acquire Spin Games LLC (“Spin”) in a cash and stock

transaction for a purchase price of approximately US$30 million.

Under the deal the sellers of Spin will receive US$10 million in

cash and US$20 million in Common Shares of the Company, of which

US$5 million in Common Shares will be issued on closing and the

balance over the next three years. The transaction will close

following final approval from state gaming regulators and

satisfaction of other customary closing conditions

- Recently announced the appointment of Richard Carter to the

role of CEO, effective May 1, 2021

- Announced intent to trade on the Nasdaq Stock Market and

completed share consolidation to support the listing

- First in-house developed proprietary casino game launched

across the Bragg network with encouraging early signs, with five

more planned in the remainder of 2021

- Continuing to invest in technical infrastructure, an in-house

content studio, increasing operational efficiencies, and deepening

data analytics, gamification and bonusing features

- Continuing to explore strategic M&A opportunities in the

U.S. and globally

Guidance

Bragg’s revenue guidance for 2021 remains unchanged at €47m

(C$69M) with adjusted EBITDA of €4m (C$6M) pre-M&A.

First Quarter 2021 conference call information

Call will take place on Thursday May 13, 2021 at 8:30am ET.

Richard Carter, CEO of Bragg, along with Chief Financial Officer

Ronen Kannor and Chief Strategy Officer Yaniv Spielberg, will host

the call.

To join the call, please use the below dial-in

information:

Participant Toll Free Dial-In Number: +1 844.965.3274

Participant International Dial-In Number: +1 639.491.2382

Conference ID: 8473511

A replay of the call will be available for seven days following

the conclusion of the live call.

Replay Dial-In Number: 1.800.585.8367 or 1.416.621.4642

Conference ID: 8473511

About Bragg Gaming Group

Bragg Gaming Group (TSX:BRAG, OTC: BRGGD) is a global B2B gaming

technology and content provider. Since its inception in 2012, Bragg

has grown to include operations across Europe and Latin America and

is expanding into an international force within the growing global

online gaming market.

Through its wholly owned subsidiary ORYX, Bragg delivers an

innovative business-to-business iGaming platform, casino content

aggregator, managed sportsbook and managed services provider,

offering cutting-edge content from leading studios.

Bragg’s ORYX Gaming is licensed by the Malta Gaming Authority

(MGA) and the Romanian National Gambling Office (ONJN) and its

content is certified or approved in 18 other major jurisdictions.

Underpinning Bragg Gaming Group’s commitment to information

security, ORYX Gaming was recently awarded an ISO/IEC 27001

certificate.

Cautionary Statement Regarding Forward-Looking

Information

This news release may contain forward-looking statements or

"forward-looking information" within the meaning of applicable

Canadian securities laws ("forward-looking statements"). Often, but

not always, forward-looking statements can be identified by the use

of words such as "plans," "expects" or "does not expect," "is

expected," "budget," "scheduled," "estimates," "forecasts,"

"intends," "anticipates" or "does not anticipate," or "believes,"

or describes a "goal," or variation of such words and phrases or

state that certain actions, events or results "may," "could,"

"would," "might" or "will" be taken, occur or be achieved.

All forward-looking statements reflect the Company's beliefs and

assumptions based on information available at the time the

statements were made. Actual results or events may differ from

those predicted in these forward-looking statements. All of the

Company's forward-looking statements are qualified by the

assumptions that are stated or inherent in such forward-looking

statements, including the assumptions listed below. Although the

Company believes that these assumptions are reasonable, this list

is not exhaustive of factors that may affect any of the

forward-looking statements. The key assumptions that have been made

in connection with the forward-looking statements include the

following: the impact of COVID-19 on the business of the Company;

the countercyclical growth of the business of the Company; the

regulatory regime governing the business of the Company; the

operations of the Company; the products and services of the

Company; the Company's customers; acquisition opportunities; the

growth of the Company's business, which may not be achieved or

realized within the time frames stated or at all; and the

anticipated size and/or revenue associated with the gaming market

globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks associated with general economic conditions;

adverse industry events; future legislative and regulatory

developments; the inability to access sufficient capital from

internal and external sources; the inability to access sufficient

capital on favourable terms; realization of growth estimates,

income tax and regulatory matters; the ability of the Company to

implement its business strategies; competition; economic and

financial conditions, including volatility in interest and exchange

rates, commodity and equity prices; the estimated size of the

gaming market globally; changes in customer demand; disruptions to

our technology network including computer systems and software;

natural events such as severe weather, fires, floods and

earthquakes; and risks related to health pandemics and the outbreak

of communicable diseases, such as the current outbreak of

COVID-19.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Any forward-looking statement made by the Company in this news

release or the earnings call is based only on information currently

available to the Company and speaks only as of the date on which it

is made. Except as required by applicable securities laws, the

Company nor any of its management or directors undertake no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

Non-IFRS Financial Measures

Statements in this news release make reference to "Adjusted

EBITDA," which is a non-IFRS (as defined herein) financial measure

that the Company believes is appropriate to provide meaningful

comparison with, and to enhance an overall understanding of, the

Company's past financial performance and prospects for the future.

The Company believes that "Adjusted EBITDA" provides useful

information to both management and investors by excluding specific

expenses and items that management believe are not indicative of

the Company's core operating results. "Adjusted EBITDA" is a

financial measure that does not have a standardized meaning under

International Financial Reporting Standards ("IFRS"). As there is

no standardized method of calculating "Adjusted EBITDA," it may not

be directly comparable with similarly titled measures used by other

companies. The Company considers "Adjusted EBITDA" to be a relevant

indicator for measuring trends in performance and its ability to

generate funds to service its debt and to meet its future working

capital and capital expenditure requirements. "Adjusted EBITDA" is

not a generally accepted earnings measure and should not be

considered in isolation or as an alternative to net income (loss),

cash flows or other measures of performance prepared in accordance

with IFRS.

Neither TSX nor its Regulation Services Provider (as that

term is defined in the policies of the TSX) accepts responsibility

for the adequacy or accuracy of this news release.

________________________ 1 Bragg Gaming’s reporting

currency is Euros. The exchange rate provided for Canadian dollars

is 1.47. Due to fluctuating currency exchange, this rate is

provided for convenience only and may differ from the rate used to

calculate 2020 numbers 2 “customer " is a licensed entity that

contracts directly with the group for B2B gaming services 3 “unique

players" are defined as individuals who made a real money wager at

least once during the period. 4 Adjusted EBITDA is a non-IFRS

measure. For important information on the Company’s non-IFRS

measures, see “Non-IFRS Financial Measures” below. 5 “operator " is

a licensed entity that contracts directly or indirectly with the

group for B2B gaming services

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210513005545/en/

For Bragg Gaming Group: Yaniv Spielberg, CSO, Bragg

Gaming Group info@bragg.games

For media enquiries or interviews: Hayley Suchanek,

Kaiser & Partners Communications keera.hart@kaiserpartners.com

1.289.681.2477

For investor enquiries: David Gentry dgentry@bragg.games

1.800.733.2447 1.407.491.4498

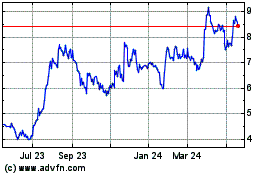

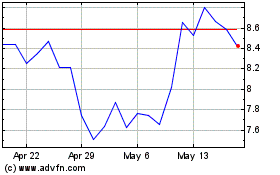

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Dec 2023 to Dec 2024