Bonterra Energy Corp. Announces Receipt of CRA Proposal to Reassess

November 27 2013 - 6:03PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES OF AMERICA

Bonterra Energy Corp. (Bonterra) (www.bonterraenergy.com) (TSX:BNE) has been

notified by the Canada Revenue Agency (CRA) that Bonterra's taxation years,

since the November 18, 2008 conversion of Bonterra Energy Income Trust to a

corporation, may be reassessed to eliminate certain tax pools. If such

reassessments are issued and maintained on appeal, Bonterra will owe total cash

taxes of approximately $25 million for the five taxation years since the

conversion.

In Management's view, the reassessment of companies with respect to the use of

tax pools is part of an overall initiative by the CRA. Management remains of the

opinion, that after careful consideration and consultation at the time of the

conversion, Bonterra's subsequent tax returns were correct as filed. If the

proposed reassessments are issued, management will vigorously defend Bonterra's

tax filing position. Any amounts paid to the CRA in connection with such

reassessments would be refunded on a successful appeal of the reassessments.

Management confirms that the proposed reassessment will not affect the

Corporation's strategy going forward, nor the amount of the monthly dividend

distributions.

Bonterra Energy Corp. is a conventional oil and gas corporation with operations

in Alberta, Saskatchewan and British Columbia. The Common Shares are listed on

The Toronto Stock Exchange under the symbol "BNE".

Forward Looking Information

This press release contains certain statements or disclosures relating to

Bonterra that are based on the expectations of Bonterra as well as assumptions

made by and information currently available to Bonterra which may constitute

forward-looking information under applicable securities laws. In particular,

this press release contains forward-looking information related to the

reassessment and future taxes payable. Such forward looking information involves

material assumptions and known and unknown risks and uncertainties, certain of

which are beyond Bonterra's control. Many factors could cause the reassessment

and future taxes payable to be materially different from those expressed or

implied herein. Bonterra's Annual Information Form and other documents filed

with securities regulatory authorities (accessible through the SEDAR website at

www.sedar.com) describe the risks, material assumptions and other factors that

could influence actual results of Bonterra and accordingly the tax consequences

of its operations, which are incorporated herein by reference. Bonterra

disclaims any intention or obligation to publicly update or revise any forward

looking information, whether as a result of new information, future events or

otherwise, except as may be expressly required by applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb D. Thompson

CFO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

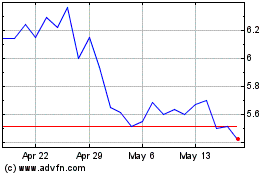

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

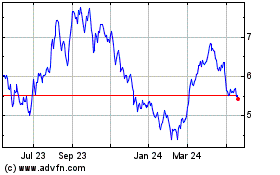

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024