NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Bonterra Energy Corp. (Bonterra or the Company) (TSX:BNE) is pleased to announce

its operating and financial results for the three months and six months ended

June 30, 2013. The related unaudited condensed consolidated financial statements

and notes, as well as management's discussion and analysis, are available on the

System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com

and on Bonterra's website at www.bonterraenergy.com

The second quarter of 2013 has been an exceptional quarter. The Company had

record production, revenue, funds flow, net earnings and a debt level that is

favourable amongst its peers. On a six month basis, funds flow is $3.25 per

share if the Spartan assets contribution is for 181 days or $3.12 for 157 days

using the January 25, 2013 closing date. Kindly review the following disclosure

for additional positive highlights.

As at and for the periods

ended Three months ended Six Months ended

($ 000s except for $ per June 30, June 30, June 30, June 30,

share) 2013 2012 2013 2012

------------------------------------------------------------------------

FINANCIAL

Revenue - realized oil and

gas sales 79,344 31,049 145,812 67,942

Funds flow (1)(5) 50,566 16,621 91,341 38,928

Per share - basic 1.65 0.84 3.13 1.97

Per share - diluted 1.65 0.84 3.12 1.97

Payout ratio 51% 93% 52% 79%

Funds flow (2)(5) 50,566 16,621 95,160 38,928

Per share - basic 1.65 0.84 3.26 1.97

Per share - diluted 1.65 0.84 3.25 1.97

Payout ratio 51% 93% 50% 79%

Cash flow from operations 41,445 14,727 82,171 36,425

Per share - basic 1.35 0.74 2.81 1.85

Per share - diluted 1.35 0.74 2.81 1.84

Payout ratio 62% 105% 58% 84%

Cash dividends per share 0.84 0.78 1.64 1.56

Net earnings 15,119 9,201 27,814 19,383

Per share - basic 0.49 0.47 0.95 0.98

Per share - diluted 0.49 0.46 0.95 0.98

Capital expenditures and

acquisitions, net of

dispositions 9,731 25,288 (3) 59,237 (4) 46,701(3)

Total assets 987,067 393,772

Working capital deficiency 26,824 42,082

Long-term debt 179,379 114,747

Shareholders' equity 648,574 176,292

------------------------------------------------------------------------

OPERATIONS

Oil (barrels per day)(1) 8,414 3,650 7,939 3,813

NGLs (barrels per day)(1) 782 428 757 424

Natural gas (MCF per day)(1) 20,554 11,753 21,361 12,006

Total barrels of oil

equivalent per day (BOE)(1) 12,621 6,037 12,256 6,237

Total barrels of oil

equivalent per day (BOE)(2) 12,621 6,037 12,870 6,237

------------------------------------------------------------------------

(1) Six month figures for 2013 include the results of Spartan Oil Corp.

(Spartan) for the period of January 25, 2013 to June 30, 2013. Production

includes 157 days for Spartan and 181 days for Bonterra.

(2) Six month figures for 2013 include the results of Spartan for the period

of January 1, 2013 to June 30, 2013. Production includes 181 days for

Spartan and Bonterra.

(3) Includes an acquisition that closed on June 7, 2012 for $17,108,000.

(4) Includes the Spartan acquisition that closed on January 25, 2013 that

included $10,000,000 of acquired cash that reduced capital expenditures from

$61,643,000 excluding dispositions.

(5) Funds flow is not a recognized measure under IFRS. For these purposes,

the Company defines funds flow as funds provided by operations including

proceeds from sale of investments and investment income received excluding

the effects of changes in non-cash working capital items and decommissioning

expenditures settled.

Highlights

-- Generated record fund flows from operations of $50.6 million ($1.65 per

share) in the second quarter of 2013, as compared to $40.8 million

($1.47 per share; note 1) in the first quarter of 2013, an increase of

24.0 percent and $16.6 million ($0.84 per share) in the second quarter

of 2012, an increase of 204.8 percent;

-- Achieved a new average daily production record of 12,621 boe per day

during the second quarter of 2013, compared to 11,887 boe per day in the

first quarter of 2013 and 6,037 boe per day in the second quarter of

2012. Average daily production for the six month period was 12,256 (note

2; results would have been 12,870 boe per day), an increase of 96.5

percent over the same period in 2012. The increased production year over

year is mainly due to the Spartan acquisition while quarter over quarter

growth resulted primarily from strong production additions from the

Pembina and Willesden Green Cardium drilling program;

-- Substantially decreased operating costs to $11.44 per boe in the second

quarter of 2013, a reduction of 11.4 percent over the first quarter of

2013 and 28.3 percent over the second quarter of 2012;

-- Recorded cash netbacks of $43.52 per boe in the second quarter of 2013,

an increase of 15.3 percent quarter over quarter and an increase of 43.9

percent over the same period in 2012 due mainly to higher realized

commodity prices and decreased operating costs;

-- Paid out $0.84 per share in cash dividends to shareholders in Q2 2013.

This represents a payout ratio of 51 percent of funds flow which is on

the very low end of the Company's payout ratio guidance of 50 to 65

percent of funds flow;

-- Completed a bought deal financing of 553,725 common shares at a price of

$49.85 per common share for gross proceeds of $27.6 million. The

financing closed subsequent to quarter end on July 2, 2013 and the funds

will be used to increase the 2013 capital development budget from $90

million to $105 million and commence with studies to attempt to increase

recovery of commodities;

-- Maintained its strong balance sheet and reduced its net debt to cash

flow ratio at June 30, 2013 to 1.25 to 1 times. This ratio has been

further reduced as of July 2, 2013 with the proceeds of the bought deal

financing of $27.6 million;

-- Announced the promotion of Adrian Neumann, Vice President, Engineering

and Operations to the position of Chief Operating Officer.

Note 1: Quarterly figures for Q1 2013 include the results of Spartan Oil Corp.

(Spartan) for the period of January 25, 2013 to March 31, 2013; 65 days for

Spartan and 90 days for Bonterra.

Note 2: Quarterly figures for Q1 2013 include the results of Bonterra and

Spartan for 90 days.

Operations

Bonterra's operational focus in the first half 2013 was to integrate the Spartan

assets into its operations, accelerate its winter drilling program in the first

quarter to minimize the impact of spring break-up and to actively manage its

corporate decline. As a result, the Company has maintained its full year 2013

average daily production guidance at 12,000 boe per day, preserved its balance

sheet strength, continued to pay out a large percentage of funds flow in the

form of a monthly dividend and is in a position to continue to provide steady

annual production and reserves growth of approximately five to 10 percent on

both a total and per share basis.

Bonterra spent approximately $59.2 million on its capital development program

during the first six months of the year and drilled 15 gross (14.8 net) operated

Cardium horizontal wells and two (0.3 net) non-operated wells. In addition,

Bonterra placed on production six (5.8 net) operated horizontal wells and four

(1.0 net) non-operated horizontal wells that Spartan had drilled prior to

Bonterra's acquisition in January, 2013. The increased operating activities led

to record production levels in the second quarter of 12,621 boe per day. Due to

spring break-up, the Company typically spends little capital in the second

quarter each year and now looks to focus its operations on an active second half

of 2013.

As referenced above, Bonterra's management and Board have elected to increase

the capital development budget to $105 million for the year. The Company

currently plans to drill an additional 16 (15.9 net) operated wells and 21 (4.25

net) non-operated wells in the third and fourth quarters. The capital

development program will continue to delineate the main Pembina pool and in the

fourth quarter of the year the focus will shift to pad drilling in the Company's

Carnwood area.

Bonterra's land position in the Carnwood area includes 38 gross (35 net)

sections representing approximately 152 gross (140 net) locations at four wells

per section. As the Company continues to explore increased well density within

its land base to increase its ultimate oil recovery factor, it estimates that

six to eight wells per section will likely become the standard for development

of its Cardium assets. This would increase the Carnwood drilling inventory

substantially to approximately 305 gross (280 net) locations at eight wells per

section for this one area of its Cardium land base.

Bonterra's drilling in the Carnwood area has included the 1-10-048-07 well on

the western edge which was completed with a nitrogen foam frac with 80 meter

spacing and the 03-34-047-05 well which was completed with a nitrified

slickwater frac with 80 meter spacing on the eastern edge of the area. These

wells have recorded some of Bonterra's best production results to date and have

produced 29,139 barrels of oil and 32,636 barrels of oil, respectively, over a

five month cumulative period. With the outer edges of the Carnwood area

delineated, the Company now intends to target increased well density throughout

the area with a targeted pad drilling program. Pad drilling involves drilling

multiple horizontal wells from a single surface location and should result in

fewer drilling days, reduced costs, onstream efficiencies and a smaller

environmental footprint. Based on the results of the Carnwood program, the

Company anticipates that increased well density and pad drilling will be used

across its Cardium asset base to lower costs, drive higher recovery rates and

ultimately produce higher rates of return.

Bonterra has had great success thus far in applying new drilling and completion

technologies, improving well performance and reducing costs. In addition,

Bonterra is also investigating the potential for secondary recovery methods on

its Cardium lands and will look to further calibrate its development of the

Cardium assets to optimize overall recoveries.

Financial

Oil and natural gas prices continued to increase during the second quarter of

2013 and the Company's average realized price for crude oil was $89.38 per

barrel in Q2 2013, an increase of 6.2 percent over the first quarter of the year

and an increase of 10.4 percent over the second quarter of 2012. As a result of

this improved price environment and the significant production volume increases,

revenue and cash flow from operations for the first six months of 2013 increased

114.6 percent and 134.6 percent, respectively, over the same period in 2012.

The Company's netback of $40.74 per BOE for the first six months of 2013

represents an increase of 22.7 percent year over year but remains below the

Company's 2013 annual guidance of approximately $43.00 per BOE as natural gas

accounted for 29 percent of production within this timeframe. However, the cash

netback for the second quarter of 2013 was $43.52 per boe and the Company

continues to anticipate that the cash netback will be within guidance for the

full year 2013 as the remaining wells in the 2013 drilling program are expected

to have an increased liquids/gas ratio.

Bonterra has maintained its focus on balance sheet strength and conservative

financial management. Subsequent to quarter end, the Company closed a bought

deal financing of 553,725 common shares at a price of $49.85 per common share

for gross proceeds of $27.6 million. The funds will be used to temporarily

reduce outstanding bank debt which will result in a reduction of the debt to

cash flow ratio. The Company believes it is vital to maintain its net debt to

cash flow ratio in the 1 to 1 to 1.5 to 1 times range. At June 30, 2013, the

Company was well within its guidance at 1.25 to 1 times and the Company will

continue to closely monitor this ratio by managing its cash flow, capital

expenditure ranges and dividend payment over the year to ensure that it remains

within its targeted guidance for the full year 2013.

Outlook

Bonterra is very well-positioned for continued improvements in operational

performance and results across the second half of the year and well into the

future. It has one of the largest inventory of drilling locations in the

industry. The Company looks forward to maintaining its focus on the long-term

development of its extensive and high-quality Cardium assets and in the

near-term, will execute on the Company's highest economic return opportunities

to maximize returns and enhance shareholder value.

Cautionary Statement

This summarized news release should not be considered a suitable source of

information for readers who are unfamiliar with Bonterra Energy Corp. and should

not be considered in any way as a substitute for reading the full report. For

the full report, please go to www.bonterraenergy.com.

Use of Non-IFRS Financial Measures

Throughout this release the Company uses the terms "payout ratio" and "cash

netback" to analyze operating performance, which are not standardized measures

recognized under IFRS and do not have a standardized meaning prescribed by IFRS.

These measures are commonly utilized in the oil and gas industry and are

considered informative by management, shareholders and analysts. These measures

may differ from those made by other companies and accordingly may not be

comparable to such measures as reported by other companies.

The Company calculates payout ratio by dividing cash dividends paid to

shareholders by cash flow from operating activities, both of which are measures

prescribed by IFRS which appear on our statements of cash flows. We calculate

cash netback by dividing various financial statement items as determined by IFRS

by total production for the period on a barrel of oil equivalent basis.

Forward-Looking Information

Certain statements contained in this release include statements which contain

words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "will", "believe" and similar expressions, relating to

matters that are not historical facts, and such statements of our beliefs,

intentions and expectations about development, results and events which will or

may occur in the future, constitute "forward-looking information" within the

meaning of applicable Canadian securities legislation and are based on certain

assumptions and analysis made by us derived from our experience and perceptions.

Forward-looking information in this RELEASE includes, but is not limited to:

expected cash provided by continuing operations; cash dividends; future capital

expenditures, including the amount and nature thereof; oil and natural gas

prices and demand; expansion and other development trends of the oil and gas

industry; business strategy and outlook; expansion and growth of our business

and operations; and maintenance of existing customer, supplier and partner

relationships; supply channels; accounting policies; credit risks; and other

such matters.

All such forward-looking information is based on certain assumptions and

analyses made by us in light of our experience and perception of historical

trends, current conditions and expected future developments, as well as other

factors we believe are appropriate in the circumstances. The risks,

uncertainties, and assumptions are difficult to predict and may affect

operations, and may include, without limitation: foreign exchange fluctuations;

equipment and labour shortages and inflationary costs; general economic

conditions; industry conditions; changes in applicable environmental, taxation

and other laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas companies to raise

capital; the effect of weather conditions on operations and facilities; the

existence of operating risks; volatility of oil and natural gas prices; oil and

gas product supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future obligations;

increased competition; stock market volatility; opportunities available to or

pursued by us; and other factors, many of which are beyond our control.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, this forward-looking information and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by law, Bonterra

disclaims any intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events or otherwise.

The forward-looking information contained herein is expressly qualified by this

cautionary statement.

The TSX does not accept responsibility for the accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

CEO and Chairman of the Board

(403) 262-5307

Bonterra Energy Corp.

Robb D. Thompson

CFO and Secretary

(403) 262-5307

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

www.bonterraenergy.com

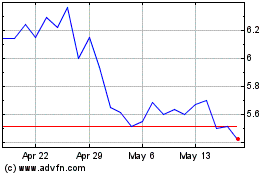

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

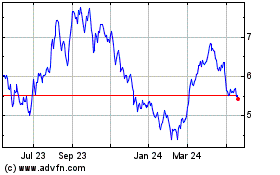

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024