Black Diamond Group Limited ("Black Diamond", the "Company" or

"we"), (TSX:BDI), a leading provider of space rental and workforce

accommodation solutions, today announced its operating and

financial results for the three months ended March 31, 2024

(the "Quarter") compared with the three months ended March 31,

2023 (the "Comparative Quarter"). All financial figures are

expressed in Canadian dollars.

Key Highlights from the First Quarter of

2024

- Consolidated rental revenue of

$35.1 million was up 2% from the Comparative Quarter, while

Adjusted EBITDA1 of $19.4 million was down 9% from the

Comparative Quarter, driven primarily by lower sales revenue for

several custom sales projects were deferred into subsequent

periods.

- The Company’s consolidated

contracted future rental revenue at the end of the Quarter grew 5%

from the Comparative Quarter to $137.1 million.

- MSS rental revenue was

$21.5 million, an increase of 5% from the Comparative Quarter,

and was achieved with an 81% utilization rate.

- MSS average monthly rental rate per

unit increased 8% from the Comparative Quarter (or 9% on a constant

currency basis).

- Despite utilization falling to 64%

due to the completion of camp rentals related to two larger

pipeline projects, WFS rental revenue of $13.6 million, was

relatively consistent compared to the Comparative Quarter, driven

by meaningfully higher average rates.

- LodgeLink net revenue of

$2.6 million grew 18% from the Comparative Quarter on higher

booking volumes than the Comparative Quarter.

- Total capital expenditures were

$17.3 million for the Quarter, including maintenance capital of

$2.7 million. Total capital commitments at the end of the

Quarter of $39 million is 11% greater than the Comparative Quarter,

with the majority of growth capital being allocated to contracted

project specific fleet units.

- Long term debt and Net Debt1 at the

end of the Quarter increased 5% and 2% since December 31, 2023,

respectively, to $199.8 million and $187.9 million,

respectively. Net Debt to trailing twelve month ("TTM") Adjusted

Leverage EBITDA1 of 1.8x remains below the Company's target range

of 2.0x to 3.0x while available liquidity was $148.3 million

at the end of the Quarter.

- Subsequent to the end of the

Quarter, the Company declared a second quarter dividend of $0.03

payable on or about July 15, 2024 to shareholders of record on June

30, 2024.

OutlookResults for the Quarter

were impacted by lower sales revenues due to project-specific

deferrals which has shifted some sales revenue into subsequent

quarters which provides reasonable visibility for sales revenue to

recover to typical volumes in first half and full year. The

Company’s outlook for the remainder of 2024 remains optimistic

driven by the strong uptake of organic growth capital to start the

year, along with $137.1 million of future contracted rental

revenue at the end of the Quarter. Capital expenditures in the

Quarter are up modestly compared to the Comparative Quarter, and

capital commitments of $39 million at the end of the Quarter are

more than 11% higher year-over-year. Subsequent to Quarter end,

capital deployment opportunities for organic growth have continued

to accelerate based on a robust opportunities pipeline in both MSS

and WFS. This is expected to drive continued forward growth in the

Company’s high-margin, recurring rental revenue stream.

MSS generated $21.5 million in rental

revenue in the Quarter, up 5% from the Comparative Quarter, driven

primarily by increased average rental rates and ongoing organic

fleet investment, slightly offset by moderating utilization.

Utilization of 81% is down 320 basis points from the Comparative

Quarter, but on average, remains at healthy consolidated levels

across the MSS business. MSS contracted future rental revenue

continues to grow and ended the Quarter at $102.5 million,

with an average rental duration of 53 months. Demand for modular

rental buildings remains strong and management anticipates healthy

activity levels in key infrastructure and education verticals which

are continuing to drive ongoing deployment of organic fleet growth

in 2024. Sales revenue and non-rental revenue in the Quarter

declined 55% and 19%, respectively from the Comparative Quarter,

while Adjusted EBITDA1 declined 10% from the Comparative Quarter.

While sales revenues and the ancillary non-rental revenues

associated with these projects can be variable on a quarterly

basis, the Company expects relative growth to prior trends in these

revenue line items on an annual basis as sales opportunities remain

robust. Specific to the Quarter, several sales projects were

deferred into subsequent periods.

Despite the conclusion of camp rental contracts

for two sizable pipeline projects in the fourth quarter of 2023,

WFS rental revenue and Adjusted EBITDA1 were relatively flat for

the Quarter as the Company's geographical and industry

diversification efforts have continued to drive improved rental

revenue stability. Rental revenue of $13.6 million and Adjusted

EBITDA1 of $10.9 million compared to $14.0 million and $11.0

million, respectively, in the Comparative Quarter. WFS contracted

future rental revenue of $34.6 million for the Quarter was up

5% from the Comparative Quarter and management continues to see a

robust opportunity set for redeployment of assets in a generally

higher rental rate environment across North America. Also, organic

growth opportunities in Australia continue to be attractive. The

Company continues to expect improving WFS rental revenue and

Adjusted EBITDA1 performance in the back half of 2024 and into 2025

driven by redeployment of rental assets, organic fleet growth and

further customer and geographic diversification.

LodgeLink continues to scale, with Gross

Bookings1 up 16% and net revenue climbing 18% from the Comparative

Quarter. Total room nights sold in the Quarter were 115,063. Net

Revenue Margins1 for the Quarter were up 20 basis points versus the

Comparative Quarter, reaching 12.1%, driven by additional higher

margin ancillary revenue. The Company continues to believe that

LodgeLink is well-positioned for continued, ongoing growth within a

large, addressable North American workforce travel market with an

expanding base of corporate customers, and the ongoing support of

our supply partners that represent over 1.5 million rooms of

capacity in over 15,000 North American properties.

Black Diamond continues to focus on driving

growth and compounding the Company’s high-margin, recurring rental

revenue streams by pursuing numerous opportunities for organic and

inorganic investment in both North America and Australia. The

Company is well positioned to fund this continued growth with ample

liquidity of $148 million, and Net Debt to TTM Adjusted Leverage

EBITDA1 of 1.8x, which remains below the Company's target range of

2.0x to 3.0x. The outlook for the balance of 2024 remains positive,

and is further supported by growing contracted rental revenues, a

robust sales pipeline, and continued scaling and value creation

within LodgeLink.

1 Adjusted EBITDA and Gross Bookings are

non-GAAP financial measures. Net Revenue Margin and Net Debt to TTM

Adjusted Leverage EBITDA are non-GAAP ratios. Refer to the Non-GAAP

Financial Measures section of this news release for more

information on each non-GAAP financial measure and ratio.

First Quarter 2024

Financial Highlights

| |

Three months

ended March 31, |

| ($ millions,

except as noted) |

2024 |

2023 |

Change |

| Financial

Highlights |

$ |

$ |

% |

| Total revenue |

73.6 |

81.5 |

(10)% |

| Gross profit |

35.8 |

37.3 |

(4)% |

| Administrative expenses |

16.9 |

16.0 |

6% |

| Adjusted EBITDA(1) |

19.4 |

21.4 |

(9)% |

| Adjusted EBIT(1) |

8.7 |

11.6 |

(25)% |

| Funds from Operations(1) |

19.4 |

21.4 |

(9)% |

| Per share ($) |

0.32 |

0.36 |

(11)% |

| Profit before income taxes |

2.3 |

6.5 |

(65)% |

| Profit |

1.5 |

4.4 |

(66)% |

|

Earnings per share - Basic and Diluted ($) |

0.02 |

0.07 |

(71)% |

| Capital expenditures |

17.3 |

15.8 |

9% |

|

Property & equipment |

517.8 |

497.5 |

4% |

| Total assets |

661.9 |

644.4 |

3% |

| Long-term debt |

199.8 |

214.8 |

(7)% |

| Cash and cash

equivalents |

12.2 |

6.5 |

88% |

| Return on Assets

(%)(1) |

14.3% |

16.3% |

(200) bps |

| Free Cashflow(1) |

9.4 |

13.0 |

(28)% |

| (1) Adjusted

EBITDA, Adjusted EBIT, Funds from Operations and Free Cashflow are

non-GAAP financial measures. Return on Assets is a non-GAAP ratio.

Refer to the Non-GAAP Financial Measures section of this news

release for more information on each non-GAAP financial measure and

ratio. |

Additional Information

A copy of the Company's unaudited interim

condensed consolidated financial statements for the three months

ended March 31, 2024 and 2023 and related management's

discussion and analysis have been filed with the Canadian

securities regulatory authorities and may be accessed through the

SEDAR+ website (www.sedarplus.ca) and

www.blackdiamondgroup.com.

About Black Diamond Group

Black Diamond is a specialty rentals and

industrial services company with two operating business units - MSS

and WFS. We operate in Canada, the United States, and

Australia.

MSS through its principal brands, BOXX Modular,

Britco, CLM, MPA Systems, and Schiavi, owns a large rental fleet of

modular buildings of various types and sizes. Its network of local

branches rent, sell, service, and provide ancillary products and

services to a diverse customer base in the construction,

industrial, education, financial, and government sectors.

WFS owns a large rental fleet of modular

accommodation assets of various types. Its regional operating

terminals rent, sell, service, and provide ancillary products and

services including turnkey operated camps to a wide array of

customers in the resource, infrastructure, construction, disaster

recovery, and education sectors.

In addition, WFS includes LodgeLink which

operates a digital marketplace for business-to-business crew

accommodation, travel, and logistics services across North America.

The LodgeLink proprietary digital platform enables customers to

efficiently find, book, and manage their crew travel and

accommodation needs through a rapidly growing network of hotel,

remote lodge, and travel partners. LodgeLink exists to solve the

unique challenges associated with crew travel and applies

technology to eliminate inefficiencies at every step of the crew

travel process from booking, to management, to payments, to cost

reporting.

Learn more at www.blackdiamondgroup.com.

For investor inquiries please contact Jason Zhang at

403-206-4739 or investor@blackdiamondgroup.com.

Conference CallBlack Diamond

will hold a conference call and webcast at 9:00 a.m. MT (11:00 a.m.

ET) on Friday, May 3, 2024. CEO Trevor Haynes and CFO Toby LaBrie

will discuss Black Diamond’s financial results for the quarter and

then take questions from investors and analysts.

To access the conference call by telephone dial toll free

1-844-763-8274. International callers should use 1-647-484-8814.

Please connect approximately 10 minutes prior to the beginning of

the call.

To access the call via webcast, please log into

the webcast link 10 minutes before the start time at:

https://www.gowebcasting.com/13221

Following the conference call, a replay will be available on the

Investor Centre section of the Company’s website at

www.blackdiamondgroup.com, under Presentations & Events.

Reader

AdvisoryForward-Looking StatementsCertain

information set forth in this news release contains forward-looking

statements including, but not limited to, expectations for and

opportunities in different geographic areas, opportunities for

organic investment, the sales and opportunity pipeline,

expectations for asset sales, timing and payment of a second

quarter dividend, management's assessment of Black Diamond's future

operations and what may have an impact on them, opportunities and

effect of deploying investment capital, financial performance,

business prospects and opportunities, changing operating

environment including changing activity levels, effects on demand

and performance based on the changing operating environment,

expectations for demand and growth in the Company's operating and

customer segments, timing of deferred projects, the expected rate

environment, expectations for revenue run rate for 2024, future

deployment of assets, amount of revenue anticipated to be derived

from current contracts, sources and use of funds, expected length

of existing contracts and future growth and profitability of the

Company. With respect to the forward-looking statements in this

news release, Black Diamond has made assumptions regarding, among

other things: future commodity prices, the future rate environment,

that Black Diamond will continue to raise sufficient capital to

fund its business plans in a manner consistent with past

operations, timing and cost estimates of the ERP, that

counterparties to contracts will perform the contracts as written

and that there will be no unforeseen material delays in contracted

projects. Although Black Diamond believes that the expectations

reflected in the forward-looking statements contained in this news

release, and the assumptions on which such forward-looking

statements are made, are reasonable, there can be no assurances

that such expectations or assumptions will prove to be correct.

Readers are cautioned that assumptions used in the preparation of

such statements may prove to be incorrect. Events or circumstances

may cause actual results to differ materially from those predicted,

as a result of numerous known and unknown risks, uncertainties and

other factors, many of which are beyond the control of Black

Diamond. These risks include, but are not limited to: volatility of

industry conditions, the Company's ability to attract new

customers, political conditions, dependence on agreements and

contracts, competition, credit risk, information technology systems

and cyber security, vulnerability to market changes, operating

risks and insurance, weakness in industrial construction and

infrastructure developments, weakness in natural resource

industries, access to additional financing, dependence on suppliers

and manufacturers, reliance on key personnel, and workforce

availability. The risks outlined above should not be construed as

exhaustive. Additional information on these and other factors that

could affect Black Diamond's operations and financial results are

included in Black Diamond's annual information form for the year

ended December 31, 2023 and other reports on file with the

Canadian securities regulatory authorities which can be accessed on

Black Diamond's profile on SEDAR+. Readers are cautioned not to

place undue reliance on these forward-looking statements.

Furthermore, the forward-looking statements contained in this news

release are made as at the date of this news release and Black

Diamond does not undertake any obligation to update or revise any

of the forward-looking statements, except as may be required by

applicable securities laws.

Non-GAAP MeasuresIn this news

release, the following specified financial measures and ratios have

been disclosed: Adjusted EBITDA, Adjusted EBIT, Adjusted EBITDA as

% of Revenue, Net Debt, Net Debt to TTM Adjusted Leverage EBITDA,

Funds from Operations, Return on Assets, Gross Bookings, Net

Revenue Margin and Free Cashflow. These non-GAAP and other

financial measures do not have any standardized meaning prescribed

under International Financial Reporting Standards ("IFRS") and

therefore may not be comparable to similar measures presented by

other entities. Readers are cautioned that these non-GAAP measures

are not alternatives to measures under IFRS and should not, on

their own, be construed as an indicator of the Company's

performance or cash flows, a measure of liquidity or as a measure

of actual return on the common shares of the Company. These

non-GAAP measures should only be used in conjunction with the

consolidated financial statements of the Company.

Adjusted EBITDA is not a measure recognized

under IFRS and does not have standardized meanings prescribed by

IFRS. Adjusted EBITDA refers to consolidated earnings before

finance costs, tax expense, depreciation, amortization, accretion,

foreign exchange, share-based compensation, acquisition costs,

non-controlling interests, share of gains or losses of an

associate, write-down of property and equipment, impairment,

non-recurring costs, and gains or losses on the sale of non-fleet

assets in the normal course of business.

Black Diamond uses Adjusted EBITDA primarily as

a measure of operating performance. Management believes that

operating performance, as determined by Adjusted EBITDA, is

meaningful because it presents the performance of the Company's

operations on a basis which excludes the impact of certain non-cash

items as well as how the operations have been financed. In

addition, management presents Adjusted EBITDA because it considers

it to be an important supplemental measure of the Company's

performance and believes this measure is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in industries with similar capital

structures.

Adjusted EBITDA has limitations as an analytical

tool, and readers should not consider this item in isolation, or as

a substitute for an analysis of the Company's results as reported

under IFRS. Some of the limitations of Adjusted EBITDA are:

- Adjusted EBITDA excludes certain

income tax payments and recoveries that may represent a reduction

or increase in cash available to the Company;

- Adjusted EBITDA does not reflect

the Company's cash expenditures, or future requirements, for

capital expenditures or contractual commitments;

- Adjusted EBITDA does not reflect

changes in, or cash requirements for, the Company's working capital

needs;

- Adjusted EBITDA does not reflect

the significant interest expense, or the cash requirements

necessary to service interest payments on the Company's debt;

- depreciation and amortization are

non-cash charges, thus the assets being depreciated and amortized

will often have to be replaced in the future and Adjusted EBITDA

does not reflect any cash requirements for such replacements;

and

- other companies in the industry may

calculate Adjusted EBITDA differently than the Company does,

limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA

should not be considered as a measure of discretionary cash

available to invest in the growth of the Company's business. The

Company compensates for these limitations by relying primarily on

the Company's IFRS results and using Adjusted EBITDA only on a

supplementary basis. A reconciliation to profit, the most

comparable GAAP measure, is provided below.

Adjusted EBIT is Adjusted

EBITDA less depreciation and amortization. Black Diamond uses

Adjusted EBIT primarily as a measure of operating performance.

Management believes that Adjusted EBIT is a useful measure for

investors when analyzing ongoing operating trends. There can be no

assurances that additional special items will not occur in future

periods, nor that the Company's definition of Adjusted EBIT is

consistent with that of other companies. As such, management

believes that it is appropriate to consider both profit determined

on a GAAP basis as well as Adjusted EBIT. A reconciliation to

profit, the most comparable GAAP measure, is provided below.

Adjusted EBITDA as a % of

Revenue is calculated by dividing Adjusted EBITDA by total

revenue for the period. Black Diamond uses Adjusted EBITDA as a %

of Revenue primarily as a measure of operating performance.

Management believes this ratio is an important supplemental measure

of the Company's performance and believes this measure is

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in industries

with similar capital structures.

Return on Assets is calculated

as annualized Adjusted EBITDA divided by average net book value of

property and equipment. Annualized Adjusted EBITDA is calculated by

multiplying Adjusted EBITDA for the Quarter and Comparative Quarter

by an annualized multiplier. Management believes that Return on

Assets is a useful financial measure for investors in evaluating

operating performance for the periods presented. When read in

conjunction with our profit and property and equipment, two GAAP

measures, this non-GAAP ratio provides investors with a useful tool

to evaluate Black Diamond's ongoing operations and management of

assets from period-to-period.

Reconciliation of Consolidated Profit to Adjusted

EBITDA, Adjusted EBIT, Adjusted EBITDA as a % of Revenue and Return

on Assets:

| |

Three months

ended March 31, |

|

($ millions, except as noted) |

2024 |

2023 |

Change % |

| Profit |

1.5 |

4.4 |

(66)% |

| Add: |

|

|

|

|

Depreciation and amortization(1) |

10.7 |

9.8 |

9% |

|

Finance costs(1) |

3.8 |

2.9 |

31% |

|

Share-based compensation(1) |

1.5 |

2.2 |

(32)% |

|

Non-controlling interest(1) |

0.3 |

0.3 |

—% |

|

Current income taxes(1) |

0.2 |

— |

100% |

|

Deferred income taxes(1) |

0.3 |

1.8 |

(83)% |

| Non-recurring

items: |

|

|

|

|

ERP implementation

and related costs(2) |

0.5 |

— |

100% |

|

Acquisition

costs |

0.6 |

— |

100% |

|

Adjusted EBITDA |

19.4 |

21.4 |

(9)% |

| Less: |

|

|

|

|

Depreciation and amortization(1) |

10.7 |

9.8 |

9% |

|

Adjusted EBIT |

8.7 |

11.6 |

(25)% |

| |

|

|

|

| Total

revenue(1) |

73.6 |

81.5 |

(10)% |

|

Adjusted EBITDA as a % of Revenue |

26.4% |

26.3% |

10 bps |

| |

|

|

|

|

Annualized multiplier |

4 |

4 |

|

| Annualized adjusted

EBITDA |

77.6 |

85.6 |

(9)% |

| Average

net book value of property and equipment |

542.2 |

524.7 |

3% |

| Return

on Assets |

14.3% |

16.3% |

(200) bps |

|

(1) Sourced from the Company's unaudited interim condensed

consolidated financial statements for the three months ended

March 31, 2024 and 2023.(2) This relates to the corporate

structure reorganization costs that have been incurred in

preparation of a new ERP system. |

Net Debt to TTM

Adjusted Leverage EBITDA is a non-GAAP financial ratio

which is calculated as Net Debt divided by trailing twelve months

Adjusted Leverage EBITDA. Net Debt, a non-GAAP

financial measure, is calculated as long-term debt minus cash and

cash equivalents. A reconciliation to long-term debt, the most

comparable GAAP measure, is provided below. Net Debt and Net Debt

to TTM Adjusted Leverage EBITDA removes cash and cash equivalents

from the Company's debt balance. Black Diamond uses this ratio

primarily as a measure of operating performance. Management

believes this ratio is an important supplemental measure of the

Company's performance and believes this measure is frequently used

by securities analysts, investors and other interested parties in

the evaluation of companies in industries with similar capital

structures. In the quarter ended June 30, 2022, Net Debt to TTM

Adjusted EBITDA was renamed Net Debt to TTM Adjusted Leverage

EBITDA, to provide further clarity on the composition of the

denominator to include pre-acquisition estimates of EBITDA from

business combinations. Management believes including the additional

information in this calculation helps provide information on the

impact of trailing operations from business combinations on the

Company's leverage position.

Reconciliation of Consolidated Profit to

Adjusted EBITDA, Net Debt and Net Debt to TTM Adjusted Leverage

EBITDA:

|

($ millions, except as noted) |

2024 |

2023 |

2023 |

2023 |

2023 |

2022 |

2022 |

2022 |

Change |

| |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

|

| Profit |

1.5 |

7.8 |

13.6 |

4.6 |

4.4 |

9.4 |

9.0 |

4.0 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

10.7 |

11.2 |

12.6 |

10.6 |

9.8 |

8.6 |

9.2 |

8.8 |

|

|

Finance costs |

3.8 |

3.7 |

3.7 |

3.7 |

2.9 |

3.6 |

2.1 |

1.7 |

|

|

Share-based compensation |

1.5 |

1.1 |

1.6 |

1.3 |

2.2 |

1.3 |

1.3 |

1.1 |

|

|

Non-controlling interest |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.4 |

0.5 |

0.5 |

|

|

Current income taxes |

0.2 |

0.1 |

— |

0.1 |

— |

0.1 |

— |

0.4 |

|

|

Deferred income taxes |

0.3 |

0.4 |

4.8 |

1.9 |

1.8 |

3.7 |

3.9 |

1.7 |

|

|

Impairment reversal |

— |

— |

— |

— |

— |

(6.3) |

— |

— |

|

|

Non-recurring items |

|

|

|

|

|

|

|

|

|

|

Acquisition costs |

0.6 |

— |

— |

— |

— |

1.2 |

— |

— |

|

|

ERP implementation and related costs (1) |

0.5 |

1.5 |

— |

— |

— |

— |

— |

— |

|

|

Adjusted EBITDA |

19.4 |

26.1 |

36.6 |

22.5 |

21.4 |

22.0 |

26.0 |

18.2 |

|

|

Acquisition pro-forma adjustments(2) |

— |

— |

— |

— |

— |

0.5 |

2.3 |

2.2 |

|

|

Adjusted Leverage EBITDA |

19.4 |

26.1 |

36.6 |

22.5 |

21.4 |

22.5 |

28.3 |

20.4 |

|

| |

|

|

|

|

|

|

|

|

|

| TTM Adjusted Leverage

EBITDA |

104.6 |

|

|

|

92.6 |

|

|

|

13% |

| |

|

|

|

|

|

|

|

|

|

| Long-term debt |

199.8 |

|

|

|

214.8 |

|

|

|

(7)% |

| Cash and cash equivalents |

12.2 |

|

|

|

6.5 |

|

|

|

88% |

| Current

portion of long term debt (3) |

0.3 |

|

|

|

0.3 |

|

|

|

—% |

| Net

Debt |

187.9 |

|

|

|

208.6 |

|

|

|

(10)% |

| Net

Debt to TTM Adjusted Leverage EBITDA |

1.8 |

|

|

|

2.3 |

|

|

|

(22)% |

|

(1) This relates to the corporate structure reorganization costs

that have been incurred in preparation of a new ERP system. (2)

Includes pro-forma pre-acquisition EBITDA estimates as if the

acquisition that occurred in the fourth quarter 2022, occurred on

January 1, 2022.(3) Current portion of long-term debt relating to

the payments due within one year on the bank term loans assumed as

part of the acquisition in the fourth quarter of

2022. |

Funds from Operations is

calculated as the cash flow from operating activities, the most

comparable GAAP measure, excluding the changes in non-cash working

capital. Management believes that Funds from Operations is a useful

measure as it provides an indication of the funds generated by the

operations before working capital adjustments. Changes in long-term

accounts receivables and non-cash working capital items have been

excluded as such changes are financed using the operating line of

Black Diamond's credit facilities. A reconciliation to cash flow

from operating activities, the most comparable GAAP measure, is

provided below.

Free Cashflow is calculated as

Funds from Operations minus maintenance capital, net interest paid

(including lease interest), payment of lease liabilities, net

current income tax expense (recovery), distributions declared to

non-controlling interest, dividends paid on common shares and

dividends paid on preferred shares plus net current income taxes

received (paid). Management believes that Free Cashflow is a useful

measure as it provides an indication of the funds generated by the

operations before working capital adjustments and other items noted

above. Management believes this metric is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in industries with similar capital

structures. A reconciliation to cash flow from operating

activities, the most comparable GAAP measure, is provided

below.

Reconciliation of Cash Flow From

Operating Activities to Funds from Operations and Free

Cashflow:

| |

Three months ended March 31, |

|

($ millions, except as noted) |

2024 |

2023 |

Change |

| |

|

|

|

| Cash Flow from Operating

Activities(1) |

22.5 |

31.6 |

(29)% |

| Add/(Deduct): |

|

|

|

| Change in other long

term assets(1) |

(0.5) |

(0.2) |

(150)% |

|

Changes in non-cash operating working capital(1) |

(2.6) |

(10.0) |

74% |

| Funds

from Operations |

19.4 |

21.4 |

(9)% |

| Add/(deduct): |

|

|

|

|

Maintenance capital |

(2.7) |

(2.3) |

(17)% |

|

Payment for lease liabilities |

(2.1) |

(1.8) |

(17)% |

|

Interest paid (including lease interest) |

(3.6) |

(2.8) |

(29)% |

|

Net current income tax expense |

0.2 |

— |

100% |

|

Dividends paid on common shares |

(1.8) |

(1.2) |

(50)% |

|

Distributions paid to non-controlling interest |

— |

(0.3) |

100% |

|

Free Cashflow |

9.4 |

13.0 |

(28)% |

|

(1) Sourced from the Company's unaudited interim condensed

consolidated financial statements for the three months ended

March 31, 2024 and 2023. |

Gross Bookings, a non-GAAP

measure, is total revenue billed to the customer which includes all

fees and charges. Net revenue, a GAAP measure, is Gross Bookings

less costs paid to suppliers. Revenue from bookings at third party

lodges and hotels through LodgeLink are recognized on a net revenue

basis. LodgeLink is an agent in the transaction as it is not

responsible for providing the service to the customer and does not

control the service provided by a supplier. Management believes

this ratio is an important supplemental measure of LodgeLink's

performance and cash generation and believes this ratio is

frequently used by interested parties in the evaluation of

companies in industries with similar forms of revenue

generation.

Net Revenue Margin is

calculated by dividing net revenue by Gross Bookings for the

period. Management believes this ratio is an important supplemental

measure of LodgeLink's performance and profitability and believes

this ratio is frequently used by interested parties in the

evaluation of companies in industries with similar forms revenue

generation where companies act as agents in transactions.

Reconciliation of Net Revenue to Gross Bookings and Net

Revenue Margin:

| |

Three months ended March 31, |

|

($ millions, except as noted) |

2024 |

2023 |

Change |

| Net revenue(1) |

2.6 |

2.2 |

18% |

| Costs

paid to suppliers(1) |

18.9 |

16.3 |

16% |

| Gross

Bookings(1) |

21.5 |

18.5 |

16% |

| Net

Revenue Margin |

12.1% |

11.9% |

20 bps |

| (1) Includes intercompany

transactions. |

|

|

|

Readers are cautioned that the non-GAAP measures

are not alternatives to measures under IFRS and should not, on

their own, be construed as an indicator of Black Diamond's

performance or cash flows, a measure of liquidity or as a measure

of actual return on the shares of Black Diamond. These non-GAAP

measures should only be used in conjunction with the consolidated

financial statements of Black Diamond.

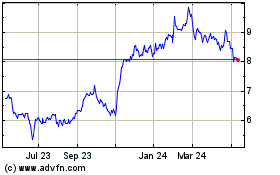

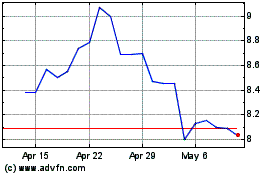

Black Diamond (TSX:BDI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Black Diamond (TSX:BDI)

Historical Stock Chart

From Nov 2023 to Nov 2024