(all numbers in this release are in Canadian dollars (CDN$) unless

otherwise noted) Alaris Equity Partners Income Trust (the

“Trust”) (TSX: AD.UN) is pleased to announce that

its wholly-owned subsidiary, Alaris Equity Partners USA, Inc.

(collectively with the Trust and its other subsidiaries,

“Alaris”) has made an investment of US$36.5

million (the

“FMP Investment”) into Federal

Management Partners, LLC. (

“FMP”). There is a

further US$3.5 million (

“Tranche 2”) available to

FMP in a second tranche if FMP achieves certain financial hurdles.

“We’re very pleased to be welcoming FMP to the

Alaris family. FMP has shown an outstanding ability to

deliver both steady cash flow and growth over their long history.

Recurring revenue from long-term relationships in numerous

government agencies makes this a low volatility business in any

economic environment. We look forward to a long and

prosperous relationship with our newest partner,” said Steve King,

President and Chief Executive Officer, Alaris.

FMP Investment

The FMP Investment consists of: (i) US$30.5

million (the “FMP Preferred Contribution”) of

preferred equity, entitling Alaris to an initial annualized

distribution of US$4.3 million (the “FMP

Distribution”); and (ii) US$6.0 million (the “FMP

Common Equity”) for a minority common equity ownership in

FMP. The FMP Distribution is equivalent to a pre-tax yield of 14%

in the first full year after the FMP Contribution. FMP can elect to

defer a portion of the FMP Distribution for up to 3% ($0.92 million

in the first full year) of the FMP Preferred Contribution with any

such deferred distributions compounding at the current yield of the

FMP Distribution. If FMP achieves the financial hurdles, Tranche 2

will consist entirely of additional preferred equity and will have

the same yield and rights as the initial FMP Preferred

Contribution. Following the FMP Investment, Alaris expects its run

rate payout ratio to be between 65% and 70%. This does not take

into account Alaris receiving dividends on the FMP Common Equity,

which it is entitled to as cash flow permits.

Commencing on January 1, 2024, the FMP

Distribution will be adjusted annually based on the percentage

change in gross revenue over the most recently completed 12-month

period versus the prior 12-month period (January 1, 2024 adjustment

will be based on fiscal 2023 vs fiscal 2022), subject to a collar

of 7%.

Alaris Management believe that FMP will have an

earnings coverage ratio between 1.2x and 1.5x, based on: (i)

Alaris' review of FMP’s internal pro forma financial results for

the most recent trailing twelve-month period in 2023, (ii) certain

other changes to FMP’s capital structure and (iii) the FMP

Distribution payable to Alaris. Proceeds of the FMP

Contribution were used to provide a partial liquidity event to

equity holders.

FMP is a leading-edge professional services firm

that provides evidence-based workforce and organizational

management solutions to transform the public sector. The Company

leverages its strategic human capital experience to develop

practical, customized solutions focused on engaging employees and

empowering organizations. The Company is a collection of 100+

expert consultants whose mission is to be at the forefront of

virtually every government-wide human capital initiative over the

last two decades.

ABOUT ALARIS:

The Trust, through its subsidiaries, indirectly

provides alternative financing to private companies

("Partners") in exchange for distributions with

the principal objective of generating stable and predictable cash

flows for payment of distributions to unitholders of the Trust.

Distributions from the Partners are adjusted each year based on the

percentage change of a "top line" financial performance measure

such as gross margin and same-store sales and rank in priority to

the owners' common equity position.

NON-IFRS MEASURES:

Earnings Coverage Ratio refers

to the Normalized EBITDA of a Partner divided by such Partner’s sum

of debt servicing (interest and principal), unfunded capital

expenditures and distributions to Alaris. Management believes the

earnings coverage ratio is a useful metric in assessing our

partners continued ability to make their contracted

distributions.

Normalized EBITDA refers to

EBITDA excluding items that are non-recurring in nature and is

calculated by adjusting for non-recurring expenses and gains to

EBITDA. Management deems non-recurring charges to be unusual and/or

infrequent charges that our Partners incur outside of its common

day-to-day operations.

EBITDA refers to earnings

determined in accordance with IFRS, before depreciation and

amortization, net of gain or loss on disposal of capital assets,

interest expense and income tax expense. EBITDA is used by

management and many investors to determine the ability of an issuer

to generate cash from operations.

Run Rate Payout Ratio refers to

Alaris’ total distribution per unit expected to be paid over the

next twelve months divided by the estimated net cash from operating

activities per unit that Alaris expects to generate over the same

twelve month period (after giving effect to the impact of all

information disclosed as of the date of this report).

The terms Run Rate Payout Ratio, Earnings

Coverage Ratio, Normalized EBITDA and EBITDA (the "Non-IFRS

Measure") are not standard measures under IFRS. Alaris' calculation

of the Non-IFRS Measure may differ from those of other issuers and,

therefore, should only be used in conjunction with the Trust’s

annual audited and unaudited interim financial statements, which

are available under the Trust's (and its predecessor's) profile on

SEDAR at www.sedar.com.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements, including forward-looking statements within the meaning

of "safe harbor" provisions under applicable securities laws

(“forward-looking statements”). Statements other than statements of

historical fact contained in this news release may be

forward-looking statements, including, without limitation,

management's expectations, intentions and beliefs concerning: the

financial impact of the FMP Contribution, including the FMP

Distribution and adjustments thereto and the impact on Alaris’

revenue and net cash from operating activities; FMP’s Earnings

Coverage Ratio; Alaris’ Run Rate Payout Ratio and the impact of the

FMP Contribution thereon. Many of these statements can be

identified by words such as "believe", "expects", "will",

"intends", "projects", "anticipates", "estimates", "continues" or

similar words or the negative thereof. Any forward-looking

statements herein which constitute a financial outlook or

future-oriented financial information (including the impact on

revenues, net cash from operating activities and Run Rate Payout

Ratio) were approved by management as of the date hereof and have

been included to provide an understanding of Alaris' financial

performance and are subject to the same risks and assumptions

disclosed herein. There can be no assurance that the plans,

intentions or expectations upon which these forward-looking

statements are based will occur.

By their nature, forward-looking statements

require Alaris to make assumptions and are subject to inherent

risks and uncertainties. Assumptions about the performance of the

Canadian and U.S. economies over the next 24 months and how that

will affect Alaris’ business and that of its Partners (including,

without limitation, any ongoing impact of COVID-19) are material

factors considered by Alaris management when setting the outlook

for Alaris. Key assumptions include, but are not limited to,

assumptions that: interest rates will not rise in a matter

materially different from the prevailing market expectations over

the next 12 to 24 months; that COVID-19 or any variants therefore

will not impact the economy or any Partners’ operations in a

material way in the next 12 months; the businesses of the majority

of our Partners will continue to grow; the businesses of new

Partners and those of existing partners will perform in line with

Alaris’ expectations and diligence; more private companies will

require access to alternative sources of capital and that Alaris

will have the ability to raise required equity and/or debt

financing on acceptable terms. Management of Alaris has also

assumed that the Canadian and U.S. dollar trading pair will remain

in a range of approximately plus or minus 15% of the current rate

over the next 6 months. In determining expectations for economic

growth, management of Alaris primarily considers historical

economic data provided by the Canadian and U.S. governments and

their agencies as well as prevailing economic conditions at the

time of such determinations.

Forward-looking statements are subject to risks,

uncertainties and assumptions and should not be read as guarantees

or assurances of future performance. The actual results of the

Trust and the Partners could materially differ from those

anticipated in the forward-looking statements contained herein as a

result of certain risk factors, including, but not limited to: an

increase in COVID-19 or similar heath crises restrictions; the

ability of our Partners and, correspondingly, Alaris to meet

performance expectations for 2023; any change in the senior lenders

under the Facility’s outlook for Alaris’ business; management's

ability to assess and mitigate the impacts of any local, regional,

national or international health crises like COVID-19; the

dependence of Alaris on the Partners; reliance on key personnel;

general economic conditions in Canada, North America and globally;

failure to complete or realize the anticipated benefit of Alaris’

financing arrangements with the Partners; a failure of the Trust or

any Partners to obtain required regulatory approvals on a timely

basis or at all; changes in legislation and regulations and the

interpretations thereof; risks relating to the Partners and their

businesses, including, without limitation, a material change in the

operations of a Partner or the industries they operate in;

inability to close additional Partner contributions in a timely

fashion, or at all; a change in the ability of the Partners to

continue to pay Alaris’ distributions; a change in the unaudited

information provided to the Trust; a failure of a Partner (or

Partners) to realize on their anticipated growth strategies; a

failure to achieve the expected benefits of the third-party asset

management strategy or similar new investment structures and

strategies; a failure to achieve resolutions for outstanding issues

with Partners on terms materially in line with management’s

expectations or at all; and a failure to realize the benefits of

any concessions or relief measures provided by Alaris to any

Partner or to successfully execute an exit strategy for a Partner

where desired. Additional risks that may cause actual results to

vary from those indicated are discussed under the heading "Risk

Factors" and "Forward Looking Statements" in the Trust’s Management

Discussion and Analysis for the year ended December 31, 2021, which

is filed under the Trust’s profile at www.sedar.com and on its

website at www.alarisequitypartners.com.

This news release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about increases to the Trust's net operating

cash per flow per unit and liquidity, each of which are subject to

the same assumptions, risk factors, limitations, and qualifications

as set forth above. Readers are cautioned that the assumptions used

in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on FOFI and

forward-looking statements. Alaris' actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and FOFI, or if any of

them do so, what benefits the Trust will derive therefrom. The

Trust has included the forward-looking statements and FOFI in order

to provide readers with a more complete perspective on Alaris’

future operations and such information may not be appropriate for

other purposes. Alaris disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Readers are cautioned not to place undue

reliance on any forward-looking information contained in this news

release as a number of factors could cause actual future results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed in the

forward-looking statements. Statements containing forward-looking

information reflect management’s current beliefs and assumptions

based on information in its possession on the date of this news

release. Although management believes that the assumptions

reflected in the forward-looking statements contained herein are

reasonable, there can be no assurance that such expectations will

prove to be correct.

The forward-looking statements contained herein

are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this news

release are made as of the date of this news release and Alaris

does not undertake or assume any obligation to update or revise

such statements to reflect new events or circumstances except as

expressly required by applicable securities legislation.

Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

For further information please

contact:

ir@alarisequity.comP: (403) 260-1457Alaris Equity

Partners Income TrustSuite 250, 333 24th Avenue S.W.Calgary,

Alberta T2S 3E6www.alarisequitypartners.com

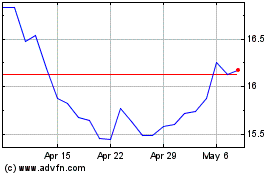

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025