Sartorius, a leading international laboratory and pharmaceutical

equipment provider, successfully closed the first nine months of

2012, with substantial gains in order intake, sales revenue and

earnings. The Bioprocess Solutions Division that primarily

specializes in single-use products for pharmaceutical drug

manufacture performed especially well. In addition, initial

consolidation of the Biohit Liquid Handling business substantially

boosted growth for the Laboratory Products & Services Division.

Based on the company’s strong business development in the first

nine months, management slightly lifted its full-year guidance for

its earnings yet again. Assuming that the currency exchange rates

essentially remain favorable as in the first nine months of 2012,

Sartorius expects adjusted earnings (operating EBITA) to increase

by about 18% (former guidance: about 15%). Full-year guidance for

sales remains unchanged: sales revenue is projected to grow by

about 11% in constant currencies.

Dynamic Growth of Sales Revenue and Order Intake

In the first nine months of 2012, Sartorius increased its sales

revenue year over year by 18.1%, or 13.8% in constant currencies,

to 639.4 million euros. The Biohit Liquid Handling business

acquired at the end of 2011 added approximately six percentage

points to this gain. In the same period, order intake rose 15.8%,

or 11.6% in constant currencies, to 636.6 million euros.

The Bioprocess Solutions Division, which accounts for more than

half of consolidated revenue, continued on the growth track of the

past quarters: it posted strong organic sales growth of 360.3

million euros, up 19.0%, or 14.4% in constant currencies. Order

intake for the division also rose significantly by 13.6%, or 9.2%

in constant currencies, to 356.6 million euros. Demand was high,

especially for single-use products for the manufacture of

biopharmaceuticals, such as specialty filters and aseptic bags and

tanks.

The Lab Products & Services Division, which provides premium

lab instruments and consumables, saw its nine-month sales revenue

soar 22.5%, or 17.9% in constant currencies, to 202.5 million

euros, and reported a jump in order intake of 27.4%, or 22.4% in

constant currencies, to 203.9 million euros. Initial consolidation

of the Biohit Liquid Handling business acquired at the end of 2011

contributed around 19 percentage points, based on constant

currencies, to growth for this division.

The smallest Group division, Industrial Weighing, showed stable

development, as projected. Its sales revenue improved against the

moderate year-earlier revenue base by 4.5%, or 2.2% in constant

currencies, to 76.7 million euros, while its order intake edged up

0.6% from 75.6 million euros a year ago to 76.1 million euros and

thus remained approximately at the previous year's level

(currency-adjusted -1.7%).

Regional analysis shows that North America posted the strongest

growth in sales revenue, which was considerably up 25.3%. In Asia,

business expanded by 11.7%; Europe saw a gain of 10.2% (all

regional figures in constant currencies).

Significant Increase in Earnings

Based on its dynamic sales performance, Sartorius further

increased its earnings year over year. The Group's operating

earnings1) surged 22.7% from 81.5 million euros to 100.0 million

euros; the respective margin for the Group climbed from 15.0% to

15.6%.

In the same period, the Bioprocess Solutions Division boosted

its earnings 26.1% to 66.8 million euros; its margin rose from

17.5% to 18.5%. The Lab Products & Services Division

considerably lifted its operating earnings by 16.2% to 26.4 million

euros from 22.8 million euros in the previous period, with a margin

of 13.1%, relative to 13.8% a year earlier. The Industrial Weighing

Division achieved operating earnings of 6.8 million euros; its

margin was 8.9% relative to 7.9% a year ago.

Including extraordinary items of -9.7 million euros (9-mo. 2011

period: -7.7 million euros), Group EBITA soared year on year by

22.5% from 73.7 million euros to 90.3 million euros. These

extraordinary expenses primarily were related to integration of the

Biohit Liquid Handling business, transfer of single-use bag

manufacture from California, USA, to Puerto Rico, and to various

Group projects. The corresponding EBITA margin was 14.1% (9-mo.

2011 period: 13.6%). The Group’s relevant net profit2) surged 22.1%

from 38.3 million euros a year ago to 46.8 million euros. The

Group’s respective earnings per share are at 2.75 euros, up from

2.25 euros in the previous period.

Full-year Earnings Guidance Raised

Based on the company’s strong business performance in the first

nine months of the current fiscal year, management slightly raised

its earnings guidance for the full year of 2012 yet again. Assuming

that currency exchange rates remain favorable as in the first nine

months of 2012, Sartorius now anticipates that operating EBITA will

increase by about 18% (former guidance: about 15%), with its

guidance for sales growth remaining unchanged at a projected rate

of about 11% in constant currencies.

In view of the three divisions, Sartorius anticipates that

currency-adjusted sales revenue for Bioprocess Solutions will grow

approximately 11% (former guidance: about 10%). The division’s

operating EBITA is projected to increase by about 20% (former

guidance: approximately 15%).

The company confirms its sales and earnings forecasts for the

Lab Products & Services Division and the Industrial Weighing

Division. According to the outlook for Lab Products & Services,

the company continues to project that sales revenue will expand by

approximately 16% to 20%, primarily due to initial consolidation of

the Biohit Liquid Handling business. The division’s operating EBITA

is expected to increase by approximately 20% to 24%.

For the Industrial Weighing Division, the company expects both

the currency-adjusted sales revenue and the operating EBITA of this

division to show stable development relative to the year-earlier

period.

1) Sartorius uses earnings before interest, taxes and

amortization, EBITA, as the key profitability measure. To enable a

more informative comparison of the figures given for the previous

years, the company additionally reports operating earnings adjusted

for extraordinary items (= operating EBITA) besides EBITA.

2) Underlying net profit after non-controlling interest,

excluding non-cash amortization and effects from valuation

adjustments of derivative financial instruments.

Key Figures for the First Nine Months of 2012

www.sartorius.de/fileadmin/media/global/company/pr_20121029_9M_2012_figures_sag-en.pdf

Current Image Files

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius AG:

www.sartorius.com/fileadmin/media/global/company/joachim_kreuzburg_1.jpg

Sartorius products used in the manufacture of medications:

www.sartorius.com/fileadmin/media/global/company/pr_20120419_bioprocess_solutions.jpg

Sartorius products used in laboratory research:

www.sartorius.com/fileadmin/media/global/company/pr_20120419_lab_products_services.jpg

Conference Call and Webcast

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius, will discuss the figures for the first nine months of

2012 with analysts and investors on October 29, 2012, at 3:30 p.m.

Central European Time in a webcast teleconference. You may dial

into the teleconference starting at 3:20 p.m. CET at the

following numbers:

Germany: +49(0)69 2999 3285France: +33(0)1 70 48 01 63UK:

+44(0)20 3450 9571USA: +1646 254 3387

The dial-in code is as follows: 4467739; the webcast and

presentation can be viewed at: www.sartorius.com

Upcoming Financial Date:

January 2013 Publication of the preliminary figures for fiscal

2012

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected.

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of Bioprocess

Solutions, Lab Products & Services and Industrial Weighing. In

2011, the technology group earned sales revenue of 733.1 million

euros. Founded in 1870, the Goettingen-based company currently

employs more than 5,000 persons. The major areas of activity of its

Bioprocess Solutions segment cover filtration, fluid management,

fermentation, cell cultivation and purification, and focus on

production processes in the biopharmaceutical industry. The Lab

Products & Services segment primarily manufactures laboratory

instruments and consumables. Industrial Weighing concentrates on

weighing, monitoring and control applications in the manufacturing

processes of the food, chemical and pharma sectors. Sartorius has

its own production facilities in Europe, Asia and America as well

as sales subsidiaries and local commercial agencies in more than

110 countries.

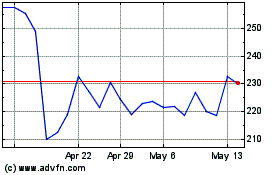

Sartorius (TG:SRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

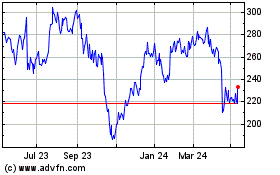

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2023 to Nov 2024