GTT: Nine-month 2024 revenues stand at 465 million euros,

up 55%; good order momentum continues

Nine-month 2024 revenues stand at

465 million euros, up 55%; good order momentum

continues

- 9M 2024 revenues:

464.7 million euros, +54.9% compared to 9M

2023

- Sustained order level:

68 LNG carriers, 12 ethane carriers, 1 FSRU,

1 FLNG, 12 LNG-powered container ships and 1 LNG bunker

vessel

- 2024 objectives: revenues

and EBITDA expected to be at the top of the ranges

Paris – October 25, 2024. GTT,

the technological expert in membrane containment systems used to

transport and store liquefied gases, today announces its revenues

for the first nine months of 2024.

Commenting on the results, Jean-Baptiste

Choimet, Chief Executive Officer of GTT, said: “With a

total of 68 LNG carrier orders, 12 ethane carrier orders, one

regasification unit order and one FLNG unit order, the commercial

performance of our core business was particularly strong in the

first nine months of 2024. As demand for LNG grows, so does

the need for additional LNG carriers, which is supported by the

ongoing investments in liquefaction plants and increasing

construction capacity at shipyards.

For LNG as fuel, GTT booked 12 orders for

container ships and one order for a LNG bunker vessel in the third

quarter of 2024, in a context of increased orders for new

LNG-powered vessels, but also heightened competition from

containment technologies marketed by Chinese shipyards.

Since the start of the year, our Services

activities, which include Ascenz Marorka, have won some major

contracts with leading ship-owners, underlining the relevance of

our digital solutions. Finally, Elogen, our subsidiary specialising

in electrolysers for green hydrogen production, posted nearly

stable revenues, in a weak market volume and a very low level of

order intake.

The GTT Group is pursuing its continued

R&D and innovation efforts, as evidenced by the numerous new

approvals obtained from classification societies during the first

nine months of 2024, notably in the fields of liquid hydrogen

transport and alternative fuels.

On the financial front, revenues for the

first nine months of 2024 were up by nearly 55% compared to the

first nine months of 2023, driven by the gradual increase in

the number of LNG carriers under construction. Therefore, in the

absence of significant delays in vessel building schedules, the

Group confirms its 2024 objectives, which it now expects at the top

of the initial ranges.”

Group business activity during the first

nine months of 2024

- LNG carriers: Order momentum

continues

During the first nine months of 2024, GTT booked

68 orders for LNG carriers, including 18 very-large capacity LNG

carriers (271,000 m3). Delivery of all these vessels is

scheduled between 2026 and 2031. Over the period, GTT also received

one FSRU1 order and one FLNG2 order.

- Ethane carriers: A pioneering

position

During the first nine months of 2024, GTT

received 12 orders for large-capacity ethane carriers (including

eight ultra-large ethane carriers, i.e. 150,000 m3,

which is a world first). Deliveries are scheduled for 2026 and

2027.

- LNG as fuel: Commercial activity picks

up amid heightened competition

In July 2024, GTT received an order from the

shipyard HD KSOE to design the cryogenic tanks for 12 LNG-powered

very large container ships for CMA CGM. Delivery of these container

ships is scheduled between the second quarter of 2027 and the

second quarter of 2028.

Also in the third quarter of 2024, GTT received

a new order from the Ibaizabal Group for an LNG bunker vessel with

a capacity of 18,600 m3, to be chartered by

TotalEnergies.

These orders point to a recovery of LNG-as-fuel

activity, in a context of increased orders for new LNG-powered

vessels, but also heightened competition from containment

technologies marketed by Chinese shipyards.

In this context, GTT continued its efforts to

develop new applications to meet environmental requirements and

announced the first implementation of its “1 barg” concept in

collaboration with an Asian shipyard. This innovative concept will

be applied to the tanks of 12 recently ordered LNG-powered

container ships (see above). It will enable these vessels to comply

with future port regulations requiring cold ironing at the

quayside.

During the first nine months of 2024, GTT also

received an order to equip ten LNG-powered container ships with the

Recycool™ reliquefaction system in collaboration with Nikkiso.

Developed by GTT, this advanced passive boil-off gas management

system significantly reduces CO2 emissions from

LNG-powered vessels.

- Services and digital solutions: new

contracts, pre-engineering studies, services to vessels in

operation, “cybersecurity” certification and acquisition of

VPS

During the first nine months of 2024, revenues

of Services activities, which include Ascenz Marorka’s digital

solutions, were up +41%, thanks to new commercial successes with

tier-1 ship-owners. In particular, Ascenz Marorka’s weather routing

solution was selected by the ship-owner Latsco to equip several

vessels of its fleet, and its “Smart Shipping” solution to equip

the ship-owner Gazocean’s entire fleet of LNG carriers.

Moreover, Ascenz Marorka has been granted

“cybersecurity” certification approval for its digital solutions by

the classification society, Bureau Veritas.

Lastly, as a reminder, on February 25,

2024, GTT acquired the Danish company VPS (Vessel Performance

Solutions), which specialises in vessel performance management.

This acquisition complements the expertise of GTT and its

subsidiary Ascenz Marorka in the field of smart shipping, with its

innovative solutions based notably on the analysis of operational

data from vessels, captured without on-board sensors. The systems

designed by VPS are used by more than 1,200 vessels around the

world.

- Elogen

The structuring and industrialisation phase

continues, with a stack production rate doubling since the

beginning of the year. In a weak market volume and a very low level

of order intake, Elogen is paying a particular attention to its

costs evolution.

- Innovation: continued development of

new technologies

GTT obtained several Approvals in Principle

(AiPs) at the Gastech exhibition in Houston in September 2024:

- three AiPs paving the way for the

use of ammonia (ABS and Bureau Veritas) and methanol (Bureau

Veritas) as alternative fuels for LNG-powered vessels equipped with

the Mark III system. This allows ship-owners to prepare their

vessels for a future conversion without major structural

changes.

- two AiPs from Lloyd’s Register and

Bureau Veritas for the cutting-edge new 200,000 m³ LNG carrier

concept, which has been specially designed for optimised speed. By

incorporating three tanks (rather than the traditional four), this

design makes it possible to deliver the same amount of LNG

annually, while reducing fuel consumption thanks to a slower

cruising speed. With a reduced capital and operational cost, this

solution also enables ship-owners to decrease unit transport costs

by approximately 5% and to reduce their CO2 emissions by

around 20%.

It should also be noted that in January 2024, as

part of a joint development project between GTT, TotalEnergies, LMG

Marin and Bureau Veritas, GTT received two AiPs from Bureau

Veritas: one for the design of a cryogenic membrane containment

system for liquefied hydrogen, and the other for the preliminary

design of a large-capacity hydrogen carrier. These approvals mark

the first major achievement in the development of a liquid hydrogen

transport sector.

In June 2024, GTT also received two major

approvals from Bureau Veritas and Lloyd’s Register for

GTT NEXT1, its latest-generation LNG containment technology.

This state-of-the-art solution combines the best of GTT’s

technologies to deliver optimal performance and enhanced

reliability for LNG transport.

- GTT Strategic Ventures

During the first nine months of 2024, the GTT

investment fund acquired minority stakes in four companies: three

in the first half of the year and one in the third quarter.

In the first half of 2024:

- Energo, the French technological

expert in the production of synthetic molecules using plasma

catalysis;

- CryoCollect, a French engineering

company specialising in technologies for the treatment,

liquefaction and separation of gases such as biomethane, carbon

dioxide or hydrogen;

- Seaber.io, a Finnish software

company specialising in the digitalisation of scheduling and

chartering processes for bulk shipping.

In the third quarter of 2024, GTT announced that

it had acquired a minority stake in Bluefins, an innovative

start-up in the field of vessel propulsion systems. Bluefins is a

French company founded in 2021 that has developed a technology

inspired by whales’ tail fins. Installed at the stern of vessels,

this system uses articulated mechanisms to convert pitching motion

into forward thrust, thereby reducing fuel consumption and

CO2, SOx and NOx emissions by around 20%.

Bluefins is the seventh investment made by GTT

Strategic Ventures since its creation in 2022.

Membership to MAMII

In September 2024, GTT joined MAMII, the Methane

Abatement in Maritime Innovation Initiative. Alongside leaders such

as BP and CMA CGM, the Group is committed to developing innovative

solutions to measure and mitigate methane emissions throughout the

LNG value chain. This membership demonstrates the Group's

commitment to participate in the decarbonisation of the maritime

industry and its willingness to collaborate with top-tier partners

for a more sustainable future.

SBTi validation process

As part of its commitment to the ecological

transition, GTT has set an ambitious greenhouse gas reduction

trajectory aiming to reduce its scope 1 & 2 emissions by -55%

and its scope 3 emissions by -33% by 2033. This trajectory is part

of the Group’s CSR 2024-2026 roadmap, published in January 2024,

and was submitted to the Science Based Targets Initiative (SBTi)

earlier this year.

Following discussions with the SBTi as part of

reviewing this trajectory, the GTT Group ultimately decided to

withdraw from the validation process. The methodological approaches

currently proposed by the SBTi are not suited to the company’s

business model due to its licencing activity. These methodologies

would lead to exclude categories 1 (materials) and 11 (use of

containment systems) from its indirect emissions reduction target.

Since these two categories account for the bulk of GTT’s Scope 3

emissions, the Group decided to maintain them in its reduction

target in order to avoid limiting it to a minimum scope of

activities (e.g. business travel), which would reflect neither the

Group’s emission profile, nor its impact on the maritime sector

decarbonisation.

In line with its commitments and to ensure

transparency, GTT will continue to provide information related to

its decarbonisation trajectory in order for its stakeholders to

assess its contribution to the decarbonisation of the maritime

sector, and will take part in relative sectorial initiatives.

Order book at September 30, 2024

At January 1, 2024, GTT’s order book excluding

LNG as fuel comprised 311 units. The following changes have

occurred since January 1:

- Deliveries completed: 39 LNG

carriers, 4 onshore storage tanks;

- Orders received: 68 LNG

carriers, 12 ethane carriers, 1 FSRU and 1 FLNG.

At September 30, 2024, the order book excluding LNG as fuel

stood at 350 units, breaking down as follows:

- 325 LNG carriers;

- 16 ethane carriers;

- 2 FSRU;

- 2 FLNG;

- 5 onshore

storage tanks.

Regarding LNG as fuel, following the delivery of

28 vessels and orders for 12 container ships and one LNG

bunker vessel, the number of vessels in the order book stood at

61 units at September 30, 2024.

Change in consolidated revenues for the

first nine months of 2024

|

(in € million) |

9M 2023 |

9M 2024 |

Change |

|

Revenues |

300.0 |

464.7 |

+54.9% |

|

|

|

|

|

|

New builds |

272.6 |

429.0 |

+57.4% |

|

of which LNG carriers/ethane carriers |

246.9 |

400.4 |

+62.2% |

|

of which FSUs3 |

2.4 |

- |

-100.0% |

|

of which FSRUs4 |

- |

- |

- |

|

of which FLNGs5 |

- |

2.7 |

na |

|

Onshore storage tanks |

3.4 |

1.7 |

-50.7% |

|

of which LNG-powered vessels |

19.9 |

24.2 |

+22.0% |

|

Electrolysers |

6.7 |

6.6 |

-1.3% |

|

Services |

20.7 |

29.1 |

+40.7% |

Consolidated revenues for the first

nine months of 2024 were 464.7 million euros, up

54.9% compared to the first nine months of 2023.

- Newbuild

revenues amounted to 429.0 million euros, up 57.4%

compared to newbuild revenues for the first nine months of 2023,

benefitting from the gradual increase in the number of LNG carriers

under construction.

- Royalties

amounted to 400.4 million euros from LNG and ethane

carriers (up 62.2%), 2.7 million euros from FLNGs and

1.7 million euros from onshore storage tanks.

- Royalties

generated by the LNG-as-fuel business

(24.2 million euros, up 22.0%) are now reflecting the

large number of orders received in 2021 and 2022.

- Revenues from

the Elogen electrolyser business amounted to

6.6 million euros for the first nine months of 2024,

compared to 6.7 million euros for the first nine months

of 2023, amid a challenging market context.

- Revenues from

services, including digital solutions, were up 40.7% at

29.1 million euros for the first nine months of 2024,

mainly due to revenue growth generated by assistance services for

vessels in operation, digital services and pre-project studies.

2024 objectives expected at the top of the

ranges

In its 2023 annual results press release dated

February 26, 2024, the Group issued the following objectives

for 2024, assuming no significant order deferrals or

cancellations:

- 2024 consolidated revenues of

between 600 million euros and 640 million euros;

- 2024 consolidated EBITDA of between

345 million euros and 385 million euros;

- a 2024 dividend payout target

corresponding to a minimum payout of 80% of consolidated net

income6.

Given the absence of any significant delay in

ship construction schedules during the first nine months of

2024, the Group now expects to reach the top of the revenue and

EBITDA ranges indicated last February.

***

First nine months of 2024 activity update

presentation

Jean-Baptiste Choimet, Chief Executive Officer,

and Thierry Hochoa, Chief Financial Officer, will comment on GTT’s

business during the first nine months of 2024 and answer

questions from the financial community during a conference call to

be held, in English, on Friday, October 25, 2024, at

6.15 p.m. Paris time.

This conference will be broadcast live on GTT’s

website.

To participate in the conference call, please

dial one of the following numbers five to ten minutes before the

start of the conference:

- France: +33 1 70 91 87 04

- UK: +44 1 212 818 004

- USA: +1 718 705 87 96

Confirmation code: 140215

The presentation document will be available on

the website on October 25, 2024 from 5:45 p.m.

Financial agenda

- Publication of 2024 annual results:

February 20, 2025 (after close of trading)

- 2025 first-quarter activity update:

April 17, 2025 (after close of trading)

- Shareholders’

Meeting: June 11, 2025

- Publication of

2025 half-year results: July 29, 2025 (after close of trading)

- 2025 third-quarter activity update:

October 31, 2025 (after close of trading)

About GTT

GTT is a technology and engineering group with

expertise in the design and development of cryogenic membrane

containment systems for use in the transport and storage of

liquefied gases. Over the past 60 years, the GTT Group has designed

and developed, to the highest standards of excellence, some of the

most innovative technologies used in LNG carriers, floating

terminals, onshore storage tanks and multi-gas carriers. As part of

its commitment to building a sustainable world, GTT develops new

solutions designed to support ship-owners and energy providers in

their journey towards a decarbonised future. As such, the Group

offers systems designed to enable commercial vessels to use LNG as

fuel, develops cutting-edge digital solutions to enhance vessels’

economic and environmental performance, and actively pursues

innovation in the field of low-carbon solutions. Through its

subsidiary, Elogen, which designs and manufactures proton exchange

membrane (PEM) electrolysers, GTT is also actively involved in the

green hydrogen sector.

GTT is listed on Euronext Paris, Compartment A

(ISIN FR0011726835 Euronext Paris: GTT) and is notably included in

the CAC Next 20, SBF 120, Stoxx Europe 600 and MSCI Small Cap

indices.

Investor Relations Contact:

information-financiere@gtt.fr / +33 1 30 23 20 87

Press Contact:

press@gtt.fr / +33 1 30 23 56 37

For more information, visit www.gtt.fr.

Important notice

The figures presented here are those customarily

used and communicated to the markets by GTT. This message includes

forward- looking information and statements. Such statements

include financial projections and estimates, the assumptions on

which they are based, as well as statements about projects,

objectives and expectations regarding future operations, profits or

services, or future performance. Although GTT’s management believes

that these forward-looking statements are reasonable, investors and

GTT shareholders should be aware that such forward-looking

information and statements are subject to many risks and

uncertainties that are generally difficult to predict and beyond

the control of GTT, and may cause results and developments to

differ significantly from those expressed, implied or predicted in

the forward-looking statements or information. Such risks include

those explained or identified in the public documents filed by GTT

with the French Financial Markets Authority (AMF – Autorité des

Marchés Financiers), including those listed in the “Risk Factors”

section of the GTT Registration Document filed with the AMF on

April 29, 2024, and the half-year financial report released on

July 30, 2024. Investors and GTT shareholders should note that if

some or all of these risks are realised they may have a significant

unfavourable impact on GTT.

1 Floating Storage Regasification Unit.

2 Floating LNG Unit.

3 Floating Storage Unit.

4 Floating Storage Regasification Unit.

5 Floating Liquefied Natural Gas units.

6 Subject to approval by the Shareholders’ Meeting and the amount

of distributable net income in the GTT S.A. corporate financial

statements.

- GTT - Q3 2024 - Activity Update - Press release

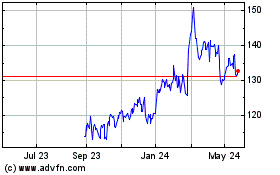

Gaztransport Et Technigaz (TG:9TG)

Historical Stock Chart

From Nov 2024 to Dec 2024

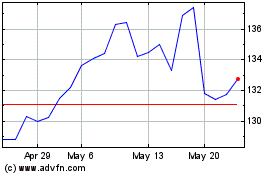

Gaztransport Et Technigaz (TG:9TG)

Historical Stock Chart

From Dec 2023 to Dec 2024