Asante Gold Corporation (CSE:ASE | GSE:ASG |

FRANKFURT:1A9 | U.S.OTC:ASGOF) (“Asante” or the

“Company”) is pleased to provide an update on its operations and

corporate activities.

Operations Update – Bibiani

Mine

The Bibiani process and mine facilities are

operating on a 24 hour per day basis with throughput of

approximately 3.0M tonnes per year. Completion of critical plant

upgrades and other capital initiatives, as outlined below, are

expected to enable material increases in throughput, gold recovery

and production levels with a commensurate decrease in all-in

sustaining costs per ounce in Q4 2023. The Company continues to

advance near-term funding initiatives to provide the required

capital to achieve these initiatives.

Recent achievements and planned initiatives at

Bibiani include:

- Exploration of

near mine targets proved to be successful with the Grasshopper

satellite pit coming into production in Q2 2023. At the South

Russel deposit, a starter pit is planned to be developed during Q4

with delivery of mineralized material expected to occur by January

2024;

- The gravity

plant was upgraded prior to start of production in July 2022 and

continues operation achieving 25 – 35% gold recovery, as planned.

The installation of a scalping screen is planned to increase

gravity gold recovery by 5% with expected completion in late

October 2023;

- The oxygen

plant, installed on schedule, has been providing oxygen to the

process plant from September 2023. Installation of a Mach-reactor

to increase oxygen utilization will be completed this week;

- A pebble crusher

has been ordered and will be installed in the coming months to

increase process plant throughput capacity from 3.0 million to 3.4

million tonnes per year;

- The Sulphide

Recovery Plant long lead items are expected to ship in September

2023. Construction of the plant is planned to be five months from

the time of delivery to site. When in operation, the Sulphide

Recovery Plant is expected to improve gold recovery to over

90%;

- Construction of

the planned detour road is nearly complete allowing the highway to

be cut and providing access to higher grade mineralized material

from the main pit by early 2024; and

- Other cost saving and productivity

improvement initiatives have started with implementation planned

over the coming months.

For the fiscal year ending January 31, 2024, the

Company expects production of approximately 80,000 to 90,000 ounces

gold at Bibiani. Subject to receipt of the requisite funding and

completion of capital projects as outlined above, Asante expects

Bibiani to produce approximately 180,000 ounces of gold for the

fiscal year ending January 31, 2025 with all-in sustaining costs of

$1,325/oz. See footnote 1 below for assumptions.

Operations Update – Chirano

Mine

The Chirano process and mine facilities are

operating on a 24 hour per day basis at a current throughput of

approximately 3.6M tonnes per year.

Recent achievements and planned initiatives at

Chirano include:

- Gravity plant

design, procurement and installation is advanced, with completion

expected in October 2023 to increase gold recovery at Chirano by

5%;

- Oxygen addition

to the CIL (carbon-in-leach) plant is proceeding and the oxygen

plant is planned for installation prior to November 30, 2023;

- A pebble crusher

was procured and installed on schedule in May 2023 increasing plant

throughput from 3.4 million to 3.6 million tonnes per year;

- Further primary

grinding upgrades are planned to be operational late this year to

increase process plant throughput from 3.6 million to 4.0 million

tonnes per year;

- Relocation of

minor infrastructure and facilities planned to provide access to

and expansion of the Akoti South open pit and the second cutback at

the Sariehu open pit is progressing well;

- Mining from the

Mamnao central and south pits is expected to be completed during Q3

2024. This production is expected to be replaced by Sariehu and

Mamnao north pits. These initiatives would provide access to

incremental resources and sustained gold production;

- Studies and

associated initiatives are progressing on schedule to be finalized

late 2024, with design to improve the current material handling

systems and to deliver mineralized material to the process plant at

lower cost;

- Initiatives to

capture synergies to yield benefits related to the supply of

principal consumable materials between the Bibiani and Chirano

mines are being advanced with an overall objective of saving

approximately $10 million per year;

- Other cost

saving and productivity improvement initiatives have advanced, with

results expected to be achieved later this year;

- Development of

Obra, Suraw and the lower Tano underground mines have been

accelerated facilitating earlier than planned underground mining at

the Obra mine which supplements plant feed and has improved the

grade from 1.2 g/t to 1.6 g/t for the year to date; and

- Exploration projects such as the

Suraw mine, Obra mine and open pit mining life extension projects

at the Sariehu/Mamnao area are progressing as planned to support a

robust mining program and extend the mining life.

For the fiscal year ending January 31, 2024, the

Company expects production of between 145,000 and 155,000 ounces of

gold at Chirano. With the execution of the foregoing initiatives,

the Company is projecting production of approximately 180,000

ounces of gold for the fiscal year ending January 31, 2025 at

all-in sustaining costs of approximately $1,250/oz. See footnote 2

below for assumptions.

Corporate and Financing

Update

The Company continues to focus on the execution

of its near-term growth plans and financing initiatives, including

discussions with potentially interested parties regarding strategic

alternatives. Any proposals, if received, will be reviewed by the

Company, in consultation with its financial and legal advisors. The

Company does not undertake any obligation to provide any updates

with respect to any proposals, except as required under applicable

law.

The Company is also pleased to report that Malik

Easah has accepted the role of Executive Chairman. Mr. Easah was

previously an Executive Director of the Company. Mr. Douglas

MacQuarrie has stepped down from the Non-Executive Chairman role

while remaining a non-executive Director of the Company. The Board

thanks Mr. MacQuarrie for his service.

The Company is also pleased to report that it

has entered into an agreement (the “Agreement”) with a strategic

financial institution (the “Purchaser”) for the forward sale of

gold which will provide US$40 million of financing to the Company

on a revolving basis over a two-year period. Under the

Agreement, a subsidiary of the Company will deliver 4,000 ounces of

refined gold per month to the Purchaser for 24 months, commencing

in October 2023.

As an advance deposit (the “Deposit”) towards

future gold deliveries, the Purchaser will pay the equivalent of

US$40 million in local currency to a subsidiary of the Company

shortly after execution of the Agreement. Deliveries will be

credited against the Deposit and funds will be re-advanced, at the

Company’s election, on each fifth monthly anniversary of execution

of the Agreement.

The Company continues to pursue other near-term,

non-dilutive financing initiatives to support capital investments

and working capital requirements.

Dave Anthony, President and CEO of Asante,

stated,

“It’s an exciting and busy time at Asante with

several near-term catalysts on the horizon, most notably the

completion of high-return capital projects that are expected to

transform the production and cost profile at both of our

operations. With the receipt of funding to backstop near-term

liquidity requirements and other near-term financing initiatives

well underway, we are confident in our ability to execute on our

business plans.

On behalf of the Management Team, I would also

like to thank Douglas MacQuarrie for his service to the Company as

Non-Executive Chairman of the Board for the past 18 months. We are

pleased that he has agreed to continue to serve as a Director of

the Company and that Malik Easah has agreed to assume the role of

Executive Chairman.”

Footnotes

- The current production guidance at

Bibiani as at September 2023 is derived from the current life of

mine operating plan on the basis of mineral reserves associated

with the property. Material factors and assumptions underlying the

production figures derived from the mine plan are a realized gold

price of US$1,802, gold recoveries of 91.5%, average cash costs of

US$929 per ounce, all in sustaining costs of US$1,397 per ounce,

all in costs of US$1,494 per ounce and exchange rates of

C$1/US$0.74, C$1/8.6 Ghanaian Cedi and US$1/11.5 Ghanaian

Cedi.

- The current production guidance at

Chirano as at September 2023 is derived from the current life of

mine operating plan on the basis of mineral reserves associated

with the property. Material factors and assumptions underlying the

production figures derived from the mine plan are a realized gold

price of US$1,800, gold recoveries of 91%, average cash costs of

US$1,165 per ounce, all in sustaining costs of US$1,246 per ounce,

all in costs of US$1,368 per ounce and exchange rates of

C$1/US$0.74, C$1/8.6 Ghanaian Cedi and US$1/11.5 Ghanaian

Cedi.

Qualified Person Statement

Scientific and technical information contained

in this news release has been reviewed and approved by Kwamina

Ackun-Wood, a member of the Australasian Institute of Mining and

Metallurgy, and the Exploration Manager for Mensin Gold Bibiani

Ltd. and by Daniel Apau, a member of the Australasian Institute of

Geoscientists, and the Exploration Manager for Chirano Gold Mines

Limited, and by Dave Anthony, P.Eng., Mining and Mineral

Processing, President and CEO of Asante, all of whom are “qualified

persons” under NI 43-101.

About Asante Gold

Corporation

Asante is a gold exploration, development and

operating company with a high-quality portfolio of projects and

mines in Ghana. Asante is currently operating the Bibiani and

Chirano Gold Mines and continues with detailed technical studies at

its Kubi Gold Project. All mines and exploration projects are

located on the prolific Bibiani and Ashanti Gold Belts. Asante has

an experienced and skilled team of mine finders, builders and

operators, with extensive experience in Ghana. The Company is

listed on the Canadian Securities Exchange, the Ghana Stock

Exchange and the Frankfurt Stock Exchange. Asante is also exploring

its Keyhole, Fahiakoba and Betenase projects for new discoveries,

all adjoining or along strike of major gold mines near the centre

of Ghana’s Golden Triangle. Additional information is available on

the Company’s website at www.asantegold.com.

About the Bibiani Gold Mine

Bibiani is an operating open pit gold mine

situated in the Western North Region of Ghana, with previous gold

production of more than 4.5 million ounces. It is fully permitted

with available mining and processing infrastructure on-site

consisting of a newly refurbished 3 million tonne per annum process

plant and existing mining infrastructure. Asante commenced mining

at Bibiani in late February 2022 with the first gold pour announced

on July 7, 2022. Commercial production was announced November 10,

2022.

For additional information relating to the

mineral resource and mineral reserve estimates for the Bibiani Gold

Mine, please refer to Asante’s press releases dated July 18, 2022

and September 1, 2022 and the technical report filed on its SEDAR

profile (www.sedarplus.ca) on September 1, 2022.

About the Chirano Gold Mine

Chirano is an operating open pit and underground

mine located in the Western Region of Ghana, immediately south of

the Company’s Bibiani Gold Mine. Chirano was first explored and

developed in 1996 and began production in October 2005. The mine

comprises the Akwaaba, Suraw, Akoti South, Akoti North, Akoti

Extended, Paboase, Tano, Obra South, Obra, Sariehu and Mamnao open

pits and the Akwaaba and Paboase underground mines.

For additional information relating to the

mineral resource and mineral reserve estimates for the Chirano Gold

Mine, please refer to Asante’s press releases dated October 15,

2022 and May 15, 2023 and the technical report filed on its SEDAR

profile (www.sedarplus.ca).

For further information please

contact:

Dave Anthony, President & CEOFrederick

Attakumah, Executive Vice President and Country Director

info@asantegold.com+1 604 661 9400 or +233 303

972 147

Cautionary Statement on Forward-Looking

Statements

Certain statements in this news release

constitute forward-looking statements, including but not limited

to, production and all-in sustaining costs forecasts for the

Bibiani and Chirano Gold Mines, estimated mineral resources,

reserves, exploration results and potential, development programs

and increases in mine-life, starter pit development and potential

synergies between Chirano and Bibiani. Forward-looking statements

involve risks, uncertainties and other factors that could cause

actual results, performance, prospects, and opportunities to differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially from these forward-looking statements include, but are

not limited to, variations in the nature, quality and quantity of

any mineral deposits that may be located, the Company’s inability

to obtain any necessary permits, consents or authorizations

required for its planned activities, the Company’s inability to

raise the necessary capital or to be fully able to implement its

business strategies, and the price of gold. The reader is referred

to the Company’s public disclosure record which is available on

SEDAR (www.sedarplus.ca). Although the Company believes that the

assumptions and factors used in preparing the forward-looking

statements are reasonable, undue reliance should not be placed on

these statements, which only apply as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. Except as required by

securities laws and the policies of the securities exchanges on

which the Company is listed, the Company disclaims any intention or

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or

otherwise.

Cautionary Note Regarding Non-GAAP

Financial Measures

Alternative performance measures in this news

release such as “AISC” are furnished to provide additional

information. These non-GAAP performance measures are included in

this news release because these statistics are used as key

performance measures that management uses to monitor and assess

performance of Bibiani and Chirano, and to plan and assess the

overall effectiveness and efficiency of mining operations. These

performance measures do not have a standard meaning within

International Financial Reporting Standards (“IFRS”) and,

therefore, amounts presented may not be comparable to similar data

presented by other mining companies. These performance measures

should not be considered in isolation as a substitute for measures

of performance in accordance with IFRS.

All-In Sustaining Cost (“AISC”) - AISC

includes cash costs and sustaining capital and exploration

expenses. The Company believes that this measure is useful to

external users in assessing operating performance and the Company’s

ability to generate free cash flow from current operations.

LEI Number: 529900F9PV1G9S5YD446. Neither IIROC

nor any stock exchange or other securities regulatory authority

accepts responsibility for the adequacy or accuracy of this

release.

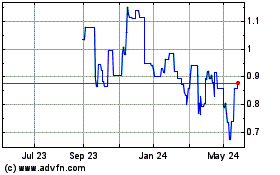

Asante Gold (TG:1A9)

Historical Stock Chart

From Nov 2024 to Dec 2024

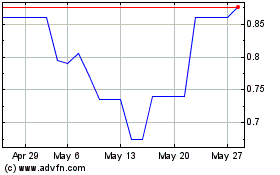

Asante Gold (TG:1A9)

Historical Stock Chart

From Dec 2023 to Dec 2024