UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-37922

ZTO Express (Cayman) Inc.

Building One, No. 1685

Huazhi Road

Qingpu District

Shanghai, 201708

People's Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

Exhibit 99.1 – Announcement – Connected Transactions – Non-exercise of Rights of First Refusal

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ZTO Express (Cayman) Inc. |

| |

|

| |

|

|

|

| |

By |

: |

/s/ Huiping Yan |

| |

Name |

: |

Huiping Yan |

| |

Title |

: |

Chief Financial Officer |

Date: December 22, 2023

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Under

our weighted voting rights structure, our share capital comprises Class A ordinary shares and Class B ordinary shares. Each Class A ordinary

share entitles the holder to exercise one vote, and each Class B ordinary share entitles the holder to exercise 10 votes, respectively,

on all matters that require a shareholder’s vote. Shareholders and prospective investors should be aware of the potential risks

of investing in a company with a weighted voting rights structure. Our American depositary shares, each representing one of our Class

A ordinary shares, are listed on the New York Stock Exchange in the United States under the symbol ZTO.

ZTO

Express (Cayman) Inc.

中通快遞(開曼)有限公司

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock

Code: 2057)

CONNECTED

TRANSACTIONS

NON-EXERCISE

OF RIGHTS OF FIRST REFUSAL

NON-EXERCISE

OF RIGHTS OF FIRST REFUSAL

As

at the date of this announcement, the Company indirectly holds approximately 16.36% of the interest in ZTO Cloud Warehouse through Shanghai

Zhongtongji (an indirect wholly- owned subsidiary of the Company). Pursuant to the proposed restructuring plan of ZTO Cloud Warehouse,

among other things, (i) Zhejiang Zhongjun, an existing shareholder of ZTO Cloud Warehouse, proposes to conduct the Proposed Equity Transfers,

and (ii) ZTO Cloud Warehouse proposes to conduct the Proposed Capital Increase.

Pursuant

to the Company Law of the PRC and the articles of association of ZTO Cloud Warehouse, Shanghai Zhongtongji, being an existing equity

holder of ZTO Cloud Warehouse, is entitled to rights of first refusal in respect of each of the Proposed Equity Transfers and the Proposed

Capital Increase.

On

December 22, 2023, the Board resolved that the Group (through Shanghai Zhongtongji) will not exercise its rights of first refusal in

respect of the Proposed Equity Transfers and the Proposed Capital Increase.

HONG

KONG LISTING RULES IMPLICATIONS

ZTO

Cloud Warehouse is held (i) as to approximately 16.36% by Shanghai Zhongtongji, (ii) as to approximately 24.55% by Zhejiang Zhongjun

and (iii) as to approximately 14.38% and 8.35%, respectively, by Tonglu Kaixiang and Tonglu Zhongqi, and all of these entities are ultimately

controlled by Mr. Meisong LAI (an executive Director and a controlling shareholder of the Company) and his associates as of the date

of this announcement. Therefore, each of Zhejiang Zhongjun and ZTO Cloud Warehouse is an associate of Mr. Meisong LAI and thus a connected

person of the Company. The non-exercise of rights of first refusal by the Group in respect of each of the Proposed Equity Transfers by

Zhejiang Zhongjun and the Proposed Capital Increase by ZTO Cloud Warehouse constitutes a connected transaction of the Company under Chapter

14A of the Hong Kong Listing Rules.

As the highest

applicable percentage ratio calculated pursuant to the Hong Kong Listing Rules in respect of the Non-exercise of Rights of First Refusal

(on an aggregate basis in respect of the Proposed Equity Transfers and the Proposed Capital Increase) is more than 0.1% but less than

5%, the Non-exercise of Rights of First Refusal is subject to the reporting and announcement requirements but exempt from the independent

Shareholders’ approval requirement under Chapter 14A of the Hong Kong Listing Rules.

BACKGROUND

As at the date

of this announcement, ZTO Cloud Warehouse is held (based on subscribed capital contribution):

| (i) | as

to approximately 24.55% by Zhejiang Zhongjun; |

| (ii) | as

to approximately 16.36% by Shanghai Zhongtongji, an indirect wholly-owned subsidiary of the

Company; |

| (iii) | as

to approximately 14.38% and 8.35%, respectively, by Tonglu Kaixiang and Tonglu Zhongqi, limited

partnerships established in the PRC ultimately controlled by Mr. Meisong LAI and his associates; |

| (iv) | as

to approximately 12.91% and 11.64%, respectively, by Tonglu Yunfu Enterprise Management Partnership

(Limited Partnership) (桐廬雲福企業管理合夥企業(有限合夥))

and Tonglu Yunzhong Enterprise Management Partnership (Limited Partnership) (桐廬雲眾企業管理合夥企業(有限合夥)),

limited partnerships established in the PRC as share incentive platforms of ZTO Cloud Warehouse

with Mr. Xiangliang HU as general partner and Independent Third Parties; |

| (v) | as

to approximately 9.09% by Mr. Xiangliang HU, an Independent Third Party; and |

| (vi) | as

to approximately 2.73% by Mr. Huili YAO, an Independent Third Party. |

Pursuant to the Company Law of the PRC

and the articles of association of ZTO Cloud Warehouse, same as the other equity holders of ZTO Cloud Warehouse, Shanghai Zhongtongji

is entitled to:

| (i) | the

right of first refusal with respect to any transfer of equity interests in ZTO Cloud Warehouse

by its existing equity holder to any third party who is not an existing equity holder of

ZTO Cloud Warehouse; and |

| (ii) | the

right of first refusal with respect to any increase in the capital contributions in ZTO Cloud

Warehouse in proportion to its paid-in capital contribution (unless otherwise agreed by all

equity holders). |

NON-EXERCISE

OF RIGHTS OF FIRST REFUSAL

Pursuant

to the proposed restructuring plan of ZTO Cloud Warehouse, among other things:

| (i) | Zhejiang

Zhongjun proposes to transfer its approximately 24.55% interest in ZTO Cloud Warehouse to

the equity holders of Zhejiang Zhongjun in proportion to their respective interest in Zhejiang

Zhongjun based on the value of the registered capital of the equity interest in ZTO Cloud

Warehouse held by Zhejiang Zhongjun for an aggregate consideration of RMB135 million (the

“Proposed Equity Transfers”); and |

| (ii) | ZTO

Cloud Warehouse proposes to increase its registered capital from RMB550 million to RMB700

million through capital contribution in the amount of RMB150 million by Mr. Xiangliang HU

(the “Proposed Capital Increase”), which represents approximately 21.43%

of the enlarged registered capital of ZTO Cloud Warehouse immediately after the completion

of the Proposed Capital Increase. |

Therefore,

same as the other equity holders of ZTO Cloud Warehouse, Shanghai Zhongtongji is entitled to:

| (i) | the

right of first refusal to purchase the equity interest in ZTO Cloud Warehouse to be transferred

by Zhejiang Zhongjun to its equity holders (other than the equity interest to be transferred

to Mr. Xiangliang HU who is an existing equity holder of ZTO Cloud Warehouse); and |

| (ii) | the

right of first refusal to acquire additional equity interest in the Proposed Capital Increase

in proportion to its paid-in capital contribution to ZTO Cloud Warehouse (which represents

approximately 16.89% of the paid-in capital of ZTO Cloud Warehouse as at the date of this

announcement). |

On

December 22, 2023, the Board resolved that the Group (through Shanghai Zhongtongji) will not exercise its rights of first refusal in

respect of the Proposed Equity Transfers and the Proposed Capital Increase.

Upon

completion of the Proposed Equity Transfer and the Proposed Capital Increase, ZTO Cloud Warehouse will be held as to approximately 12.86%

by Shanghai Zhongtongji.

INFORMATION

ON RELEVANT PARTIES

The

Group

The

Company was incorporated under the laws of the Cayman Islands on April 8, 2015. The securities of the Company are dual-primary listed

on the NYSE and the Hong Kong Stock Exchange. The Group is principally engaged in express delivery services in the PRC through a nationwide

network partner model.

Shanghai

Zhongtongji is an indirect wholly-owned subsidiary of the Company established under the laws of the PRC and principally engaged in the

business of providing technical support and consulting services.

ZTO

Cloud Warehouse

ZTO

Cloud Warehouse and its subsidiaries are primarily engaged in the provision of one-stop warehouse solutions including warehouse storage,

warehouse management and delivery services in the PRC. The Group has been an investor of ZTO Cloud Warehouse since its inception in 2018

and ZTO Cloud Warehouse has been accounted for as an equity investee in the financial statements of the Company.

Set

out below is a summary of the financial information of ZTO Cloud Warehouse for the year ended December 31, 2021 and 2022, respectively,

based on the consolidated management accounts of ZTO Cloud Warehouse prepared in accordance with the General Accepted Accounting Principles

of the PRC (中國企業會計準則):

| | |

For the

year ended

December 31,

2022 | | |

For the

year ended

December 31,

2021 | |

| | |

| RMB’000 | | |

| RMB’000 | |

| | |

| (unaudited) | | |

| (unaudited) | |

| Profit/(loss) before taxation | |

| (63,399 | ) | |

| (97,842 | ) |

| Profit/(loss) after taxation | |

| (63,607 | ) | |

| (98,747 | ) |

As

at June 30, 2023, the total assets and the net assets of ZTO Cloud Warehouse were approximately RMB1,121.81 million and approximately

RMB359.45 million, respectively.

Zhejiang

Zhongjun

Zhejiang

Zhongjun is a company established under the laws of the PRC and is principally engaged in investment holding. As at the date of this

announcement, Zhejiang Zhongjun is held as to (i) approximately 57.50% by Mr. Meisong LAI, an executive Director and controlling shareholder

of the Company, (ii) approximately 18.00% by Mr. Jianfa LAI, a substantial shareholder of ZTO Express, (iii) approximately 15.20% by

Mr. Jilei WANG, an executive Director, and (iv) approximately 9.30% by Mr. Xiangliang HU, holder of approximately 7.05% shares in ZTO

Express and an Independent Third Party.

REASONS

FOR AND BENEFITS OF THE NON-EXERCISE OF RIGHTS OF FIRST REFUSAL

Taking

into account the difference in the principal business of ZTO Cloud Warehouse and its subsidiaries on the one hand, and that of the Group

on the other hand mentioned in the section headed “Information on Relevant Parties” above, the Board has decided to approve

the Non-exercise of Rights of First Refusal to focus on the principal business of the Group.

Upon

completion of the Proposed Equity Transfer and the Proposed Capital Increase, ZTO Cloud Warehouse will be held as to approximately 12.86%

by Shanghai Zhongtongji. As ZTO Cloud Warehouse has been accounted for as an equity investee of the Company in the financial statements

of the Company and there will be no change to the accounting treatment after the completion of the proposed restructuring of ZTO Cloud

Warehouse (including but not limited to the Proposed Equity Transfers and the Proposed Capital Increase), the Non-exercise of Rights

of First Refusal will neither have any adverse impact on the Group’s daily business operations and financial position, nor any

impact on the scope of the consolidated financial statements of the Company.

In

view of the above, the Directors (including the independent non-executive Directors) consider that although the Non-exercise of Rights

of First Refusal is not conducted in the ordinary and usual course of business of the Group, the Non-exercise of Rights of First Refusal

will be made on normal commercial terms, fair and reasonable and in the interests of the Company and its Shareholders as a whole.

The

Group will assist ZTO Cloud Warehouse and relevant parties to complete necessary procedures (including signing of relevant documents)

in respect of the Proposed Equity Transfers and the Proposed Capital Increase.

HONG

KONG LISTING RULES IMPLICATIONS

ZTO

Cloud Warehouse is held (i) as to approximately 16.36% by Shanghai Zhongtongji, (ii) as to approximately 24.55% by Zhejiang Zhongjun,

and (iii) as to approximately 14.38% and 8.35%, respectively, by Tonglu Kaixiang and Tonglu Zhongqi, and all of these entities are ultimately

controlled by Mr. Meisong LAI (an executive Director and a controlling shareholder of the Company) and his associates as of the date

of this announcement. Therefore, each of Zhejiang Zhongjun and ZTO Cloud Warehouse is an associate of Mr. Meisong LAI and thus a connected

person of the Company. The non-exercise of rights of first refusal by the Group in respect of each of the Proposed Equity Transfers by

Zhejiang Zhongjun and the Proposed Capital Increase by ZTO Cloud Warehouse constitutes a connected transaction of the Company under Chapter

14A of the Hong Kong Listing Rules.

As

the highest applicable percentage ratio calculated pursuant to the Hong Kong Listing Rules in respect of the Non-exercise of Rights of

First Refusal (on an aggregate basis in respect of the Proposed Equity Transfers and the Proposed Capital Increase) is more than 0.1%

but less than 5%, the Non-exercise of Rights of First Refusal is subject to the reporting and announcement requirements but exempt from

the independent Shareholders’ approval requirement under Chapter 14A of the Hong Kong Listing Rules.

Each

of Mr. Meisong LAI and Mr. Jilei WANG (as equity holders of Zhejiang Zhongjun and one of the transferees in the Proposed Equity Transfers),

is or may be perceived to have a material interest in the Non-exercise of Rights of First Refusal, and as a result has abstained from

voting on the resolutions of the Board approving the Non-exercise of Rights of First Refusal. Other than the aforesaid Directors, no

Directors have a material interest in the Proposed Equity Transfers, the Proposed Capital Increase or the Non-exercise of Right of First

Refusal in respect of the same or are required to abstain from voting on the resolutions of the Board approving the Non-exercise of Rights

of First Refusal.

DEFINITIONS

In

this announcement, unless the context otherwise requires, the following terms shall have the following meanings:

| “associate(s)” |

has

the meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “Board” |

the board

of Directors |

| |

|

| “Class

A ordinary shares” |

Class A

ordinary shares of the share capital of the Company with a par value of US$0.0001 each, giving a holder of a Class A ordinary share

one vote per share on any resolution tabled at the Company’s general meeting |

| |

| “Class

B ordinary shares” |

Class B

ordinary shares of the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the

Company such that a holder of a Class B ordinary share is entitled to 10 votes per share on any resolution tabled at the Company’s

general meeting |

| |

| “Company” |

ZTO Express

(Cayman) Inc., a company incorporated in the Cayman Islands on April 8, 2015 as an exempted company and, where the context requires,

its subsidiaries and consolidated affiliated entities from time to time |

| |

| “connected

person(s)” |

has the

meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “controlling

shareholder” |

has the

meaning ascribed to it under the Hong Kong Listing Rules |

| |

|

| “Director(s)” |

the director(s)

of the Company |

| |

|

| “Group” |

the Company,

subsidiaries and consolidated affiliated entities from time to time |

| |

| “Hong

Kong Listing Rules” |

the Rules

Governing the Listing of Securities on the Hong Kong Stock Exchange, as amended or supplemented from time to time |

| |

| “Hong

Kong Stock Exchange” |

The Stock

Exchange of Hong Kong Limited |

| “Independent

Third Party” |

any entity

or person who is not a connected person of the Company |

| |

| “Non-exercise

of Rights of First Refusals” |

the non-exercise

by the Group (through Shanghai Zhongtongji) of its rights of first refusal in respect of the Proposed Equity Transfers and the Proposed

Capital Increase |

| |

| “NYSE” |

New York

Stock Exchange |

| |

| “PRC” |

the People’s

Republic of China |

| |

| “Proposed

Capital Increase” |

has the

meaning as ascribed to it under the section headed “Background” in this announcement |

| |

| “Proposed

Equity Transfers” |

has the

meaning as ascribed to it under the section headed “Background” in this announcement |

| |

| “RMB” |

Renminbi,

the lawful currency of the PRC |

| |

| “Shanghai

Zhongtongji” |

Shanghai

Zhongtongji Network Technology Co., Ltd. (上海中通吉網絡技術有限公司),

an indirect wholly-owned subsidiary of the Company |

| |

|

| “Share(s)” |

the Class A ordinary shares and Class B ordinary

shares in the share capital of the Company, as the context so requires |

| |

| “Shareholder(s)” |

the holder(s)

of the Share(s), where the context requires, ADSs |

| |

| “subsidiary(ies)” |

has the

meaning ascribed to it under the Hong Kong Listing Rules |

| |

| “substantial

shareholder” |

has the

meaning ascribed to it under the Hong Kong Listing Rules |

| |

| “Tonglu

Kaixiang” |

Tonglu

Kaixiang Investment Partnership (Limited Partnership) (桐廬凱祥投資合夥企業(有限合夥)),

a limited partnership established in the PRC |

| |

| “Tonglu

Zhongqi” |

Tonglu

Zhongqi Enterprise Management Partnership (Limited Partnership) ( 桐廬仲騏企業管理合夥企業(

有限合夥)), a limited partnership established in the PRC |

| |

| “US$” |

United

States dollars, the lawful currency of the United States of America |

| |

| “Zhejiang

Zhongjun” |

Zhejiang

Zhongjun Investment Management Co., Ltd. (浙江仲君投資管理有限公司),

a company established under the laws of the PRC |

| |

|

| “ZTO

Cloud Warehouse” |

ZTO Cloud

Warehouse Technology Co., Ltd. (中通雲倉科技有限公司), a company established

under the laws of the PRC |

| |

|

| “ZTO Express” |

ZTO Express Co. Ltd., a company established under the laws of the PRC and a consolidated affiliated entity

of the Company |

The

English names of the PRC entities referred to in this announcement are translations from their Chinese names and are for identification

purposes only.

| |

By order of the

Board |

| |

ZTO Express (Cayman)

Inc. |

| |

Meisong LAI |

| |

Chairman |

Hong

Kong, December 22, 2023

As

at the date of this announcement, the board of directors of the Company comprises Mr. Meisong LAI as the chairman and executive director,

Mr. Jilei WANG and Mr. Hongqun HU as executive directors, Mr. Xing LIU and Mr. Xudong CHEN as non-executive directors, Mr. Frank Zhen

WEI, Mr. Qin Charles HUANG, Mr. Herman YU, Mr. Tsun-Ming (Daniel) KAO and Ms. Fang XIE as independent non-executive directors.

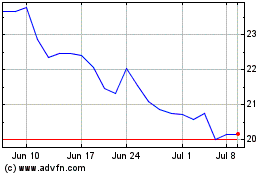

ZTO Express Cayman (NYSE:ZTO)

Historical Stock Chart

From Apr 2024 to May 2024

ZTO Express Cayman (NYSE:ZTO)

Historical Stock Chart

From May 2023 to May 2024