By Richard Teitelbaum

Retirement wasn't in the cards for Paul Herendeen.

The former chief financial officer of drugmaker Warner Chilcott

figured it was time to kick back after helping engineer the sale of

the company in 2013 and a four-decade career in corporate

finance.

"I worked on my golf game," Mr. Herendeen said. "I realized I

didn't have a golf game."

So when investors emailed Mr. Herendeen, now 60 years old, about

an opening at Zoetis Inc., he was curious, despite having never

heard of the Florham Park, N.J., animal-health-care company. "I

threw my hat in the ring," he said.

Shares of Zoetis, which was spun off from Pfizer Inc. in 2013,

rose 1.9%, to $33.69 on Aug. 15, 2014, the day after the company

named Mr. Herendeen CFO. They closed Monday at $47.27.

Since joining Zoetis, Mr. Herendeen has cut costs, acquired

assets and faced off against activist investors, amid a wave of

mergers and acquisitions in the drug industry.

The Massachusetts native brought with him a reputation as a deal

maker, having helped sell his former company to Actavis--now called

Allergan PLC--for about $8.5 billion. It was his second stint at

Warner Chilcott, where he also was CFO from 1998 to 2000. In

between, he was finance chief of MedPointe, a closely held

health-care company.

Expectations for him are high in his current role. "We've seen

what Paul has done before," said Debbie Wang, a senior equity

analyst at research firm Morningstar Inc.

Mr. Herendeen is reshaping the company through a restructuring

program called "Zoetis Next," and predicts savings of $300 million

a year. For the third quarter of 2015, Zoetis had profit of $189

million on revenue of $1.2 billion.

The animal-health industry's robust growth was part of what drew

Mr. Herendeen, who owns two golden retrievers. The market is

growing by mid-single-digit percentages, and Zoetis is the largest

player, with $4.8 billion in 2014 sales. One rival, Sanofi SA is in

talks to swap its animal-health unit for Boehringer Ingelheim

GmbH's consumer unit plus $5.1 billion in cash.

Zoetis derives slightly more than a third of its sales from

drugs for domestic pets. Livestock health accounted for 65% of 2014

revenue, helped by emerging markets, where meat consumption is

increasing.

"You can look out into the next decade or two decades and see

growth drivers," said Mr. Herendeen, who plays hockey on a men's

league team called the Shamrocks. Unlike human pharma, animal

health is largely a cash business, with lower drug-approval hurdles

and less generic competition.

But there have been pressures. Barely two months after Mr.

Herendeen joined Zoetis, Chief Executive Juan Ramón Alaix summoned

him into his corner office. The CEO had just talked with William

Ackman, founder of activist firm Pershing Square Capital Management

LP, which was building a stake that recently totaled 8.4%,

according to FactSet.

"I wasn't excited one way or the other," Mr. Herendeen said of

the investment.

The goals of most activist investors--efficiency and wise

capital allocation--shouldn't faze CFOs, Mr. Herendeen said. "Those

are themes that should be embraced," he added. "There's a role for

activist investors keeping management teams on their toes."

Pershing Square struck a standstill deal under which Zoetis

named William Doyle, a member of Pershing Square's investment team,

to its board in February 2015. Another mutually acceptable director

was named to the board in April.

Pershing Square declined to comment on its Zoetis stake.

The detente with Mr. Ackman has bolstered Wall Street's regard

for the CFO.

"He doesn't get flustered," said Piper Jaffray & Co. senior

research analyst Kevin Ellich.

Mr. Herendeen has laid out his plans to Wall Street. "He was

able to explain the pathway for margin expansion," said Dan Lang,

head of the value team at RS Investments Management Co. who focuses

on health care.

As part of its restructuring, Zoetis has cut the number of

countries to which it sells directly to about 45 from 70,

jettisoning 25 that accounted for just 2% of sales. Management is

being thinned, and less-profitable lines sold. Overall, Zoetis is

projecting a 20% to 25% reduction in its head count of about 10,000

employees.

Mr. Herendeen is also squeezing efficiency out of research and

development. R&D costs fell 6% in the first nine months of 2015

to $255 million.

There seem to be results. Mr. Ellich estimates that Zoetis's

gross margins ticked up in 2015, to 65.1%, and foresees more growth

this year. He also estimates that operating expenses declined 7.8%

last year.

Zoetis spent $255 million in November 2014 to buy some

animal-health products from Abbott Laboratories Inc. Last November,

it spent $765 million to buy Norway-based Pharmaq AS, which makes

fish vaccines.

But the company isn't just cutting and buying its way to growth;

its drug pipeline remains healthy. Simparica, an oral flea and tick

treatment for dogs, was recently approved for use in Europe and

could generate sales of more than $100 million a year if cleared in

the U.S., says Mr. Ellich.

(END) Dow Jones Newswires

January 04, 2016 19:58 ET (00:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

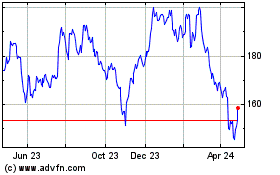

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

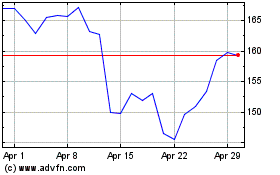

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024