Zeta Global to Acquire LiveIntent in a Highly Accretive Transaction

October 08 2024 - 4:05PM

Business Wire

- Expands Zeta’s identity graph, unveils new publisher cloud and

accelerates growth in mobile and retail media

- Acquisition meets Zeta’s four guiding M&A principles and is

expected to be immediately accretive to Zeta’s earnings

profile

- Zeta reaffirms third quarter 2024 guidance

Zeta Global (NYSE: ZETA), the AI-Powered Marketing Cloud, today

announced it has entered into an agreement to acquire LiveIntent.

Founded in 2009, LiveIntent is a pioneer in people-based marketing,

with proprietary technology powering mobile-centric experiences and

first-party identity solutions to identify, unlock, engage, and

monetize audiences across channels.

The addition of LiveIntent’s assets, publisher network, and

channel capabilities will bolster the Zeta Marketing Platform and

advance Zeta’s position in AI-powered marketing by:

- Enhancing identity resolution capabilities. The

acquisition integrates LiveIntent’s extensive identity graph—over

235 million unique hashed email addresses per month—into Zeta’s

Data Cloud, significantly complementing Zeta’s identity resolution

solutions. Authenticated and authoritative identity is the

foundation of the Zeta Marketing Platform, and the addition of

LiveIntent’s data assets expands Zeta’s scope while increasing the

precision of its people-based marketing programs.

- Expanding into publisher monetization. With the addition

of LiveIntent’s 2,000+ premium publishers, including relationships

with eight of the top 10 largest in the Comscore rankings, Zeta is

entering the publisher monetization business. This paves the way

for Zeta to launch a new product offering, the Publisher Cloud,

creating a compelling closed-loop ecosystem that rivals the reach

and targeting capabilities of walled gardens.

- Elevating Zeta’s newly released mobile and retail media

solutions. The acquisition accelerates Zeta’s recently launched

mobile and retail media products, empowering marketers to unify

identity across devices and channels, predict customer behavior,

uncover hidden opportunities, and leverage AI in real time to

activate intelligence-powered cross-channel campaigns that drive

better outcomes. LiveIntent powers millions of mobile experiences

per day and their recent entry into the retail media ecosystem

aligns with Zeta’s strategy to deliver a more innovative set of

offerings to retailers and brands.

“We are excited to welcome LiveIntent to Team Zeta as we

continue to build out our position and sharpen our differentiation

in AI-powered marketing," said David A. Steinberg, Co-Founder,

Chairman, and CEO of Zeta Global. “We have gotten to know the

LiveIntent team through our work with them over the past five years

and have seen firsthand the benefits of their core assets and

experienced the impact of their platform. As more brands view first

party data as a corporate asset, seek to make AI actionable, and

move towards a single platform that powers more efficient and

effective marketing across the customer lifecycle, this acquisition

accelerates Zeta’s flywheel and positions the combined company to

continue to grow faster than the market.”

Steinberg continued, “Consistent with our focused and

disciplined approach to M&A, LiveIntent meets all four of our

cited M&A principles. Namely, it is a complementary platform we

can seamlessly integrate into the Zeta Marketing Platform within

six months. This acquisition is immediately accretive to earnings

and priced at a highly attractive Adjusted EBITDA multiple of ~16x.

We already have interest from Zeta customers in our largest

verticals for cross selling opportunities, and we believe these

synergies can accelerate LiveIntent’s growth while continuing

Zeta’s strong organic growth rates. Bottom-line, we see our

combined businesses driving long-term shareholder value and

accruing significant benefits to our customers.”

“We’ve been extremely impressed with Zeta’s exceptional growth

and proven ability to deliver real impact to their global

customers,” said Matt Keiser, CEO of LiveIntent. “We share a

relentless focus on innovation and an aim to make AI-powered

marketing actionable. We are excited to work together to provide

marketers and publishers with added capabilities to reach their

customers through even more channels.”

Transaction Details

Pursuant to the definitive merger agreement, Zeta will purchase

LiveIntent for a total consideration of $250 million, subject to

customary adjustments, in the form of $77.5 million in cash-on-hand

and $172.5 million in common stock at closing. The stock

consideration is subject to a lockup and limitations on sale volume

following the release.

The agreement also provides for a potential earnout of 50% cash

and 50% stock tied to significant Adjusted EBITDA growth and

sustained margin expansion targets in each of fiscal years 2025,

2026, and 2027. The maximum potential earn-out consideration is $25

million per year for each of the three years. Zeta has also agreed

to issue $25 million in Performance Stock Units to the LiveIntent

management team tied to certain performance and retention targets

for fiscal years 2025, 2026, and 2027.

The transaction is expected to close in the fourth quarter of

2024 and is subject to customary closing conditions.

Advisors

Roth Capital Partners, LLC served as a transaction advisor to

Zeta. Citigroup Global Markets Inc. served as capital markets

advisor to Zeta. Latham & Watkins LLP served as legal advisors

to Zeta Global. Houlihan Lokey served as financial advisor to

LiveIntent. Lowenstein Sandler LLP served as legal advisor to

LiveIntent.

Reaffirming 3Q’24 Guidance

Zeta also today reaffirmed its third quarter 2024 guidance as

provided on September 4, 2024, including revenue of at least $255

million and Adjusted EBITDA of at least $50.2 million.

Conference Call Details

Zeta will host a conference call today, October 8 at 4:30 p.m.

Eastern Time, to discuss this acquisition. A live webcast of the

conference call and supporting materials can be accessed from the

Company’s investor relations website

https://investors.zetaglobal.com. A webcast replay will be

available on the Company's website for one year following the

call.

About Zeta Global

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release that are not

statements of historical fact, including statements about our

acquisition of LiveIntent and its anticipated integration,

synergies, accretive value, market growth and transaction closing,

and the time frame in which any of this will occur, if at all, and

our third quarter 2024 guidance are forward-looking statements and

should be evaluated as such. Forward-looking statements include

information concerning our anticipated future financial

performance, our market opportunities and our expectations

regarding our business plan and strategies. We base these

forward-looking statements on our current expectations, plans and

assumptions that we have made in light of our experience in the

industry, as well as our perceptions of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate under the circumstances at such time.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. For information regarding other related risks, see the

“Risk Factors” section of Zeta Holdings’ most recent annual report

on Form 10-K and quarterly reports on Form 10-Q. The

forward-looking statements included herein are made only as of the

date hereof, and Zeta Holdings undertakes no obligation to revise

or update any forward-looking statements, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008799629/en/

Investor Relations Madison Serras ir@zetaglobal.com

Press Candace Dean press@zetaglobal.com

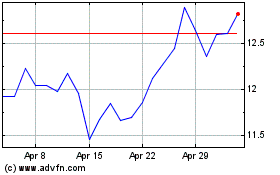

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

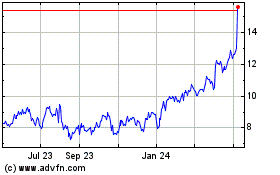

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024