0001851003false00018510032024-09-042024-09-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 04, 2024 |

ZETA GLOBAL HOLDINGS CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40464 |

80-0814458 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3 Park Ave, 33rd Floor |

|

New York, New York |

|

10016 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 967-5055 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.001 per share |

|

ZETA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 4, 2024, Zeta Global Holdings Corp. (the “Company”) issued a press release setting forth updated revenue, adjusted EBITDA and adjusted EBITDA margin guidance for the quarter ending September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Zeta Global Holdings Corp. |

|

|

|

|

Date: |

September 4, 2024 |

By: |

/s/ Christopher Greiner |

|

|

|

Christopher Greiner

Chief Financial Officer |

September 4, 2024

Zeta Increases 3Q’24 Guidance

NEW YORK – Zeta Global (NYSE: ZETA), the AI-Powered Marketing Cloud, today announced increased third quarter 2024 guidance.

“The Zeta Marketing Platform with data and Artificial Intelligence at our core is fueling our growth,” said David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta. “Through our strong competitive positioning, we see an acceleration in the marketing cloud replacement cycle. Coupled with increasing adoption of generative AI, we believe this gives us continued momentum.”

“The combination of accelerating growth through the first two months of the quarter along with high visibility across our customer base gives us confidence to increase our guidance,” said Chris Greiner, Zeta’s CFO. “We believe the uplift we are seeing reflects new growth that is not the result of pull forward activity from the fourth quarter and we are pleased with the momentum we are experiencing.”

Guidance*

Third Quarter 2024

•Increasing revenue guidance to at least $255 million, up $15.8 million from the midpoint of the prior guidance of $239.2 million. The revised guidance represents year-over-year growth of at least 35%.

•Increasing revenue guidance from political candidates to at least $10 million, up $5 million from the prior guidance of $5 million. Excluding political candidate revenue, the revised revenue guidance represents year-over-year growth of at least 30%.

•Increasing Adjusted EBITDA guidance to at least $50.2 million, up $3.1 million from the midpoint of the prior guidance of $47.1 million. The revised guidance represents year-over-year growth of at least 49% and at these values implies an Adjusted EBITDA margin of 19.7%.

|

|

|

|

Prior 3Q’24 Guidance (midpoint) As of 7/31/24 |

Updated 3Q’24 Guidance As of 9/4/24 |

Revenue |

$239.2M |

at least $255M |

% Growth Y/Y |

27% |

35% |

Political Candidate Revenue |

$5M |

$10M |

Revenue ex-Political Candidate Revenue |

$234.2M |

at least $245M |

% Growth Y/Y ex-Political Candidate Rev. |

24% |

30% |

Adjusted EBITDA |

$47.1M |

at least $50.2M |

% Growth Y/Y |

39% |

49% |

Adjusted EBITDA Margin |

19.7% |

19.7%** |

**Based on values in the table

We are not updating our full year 2024 guidance at this time. We do not believe that the uplift we are experiencing in our business in the third quarter was driven by projected revenues from the fourth quarter being pulled forward. We expect to discuss our fourth quarter and full year guidance with our third quarter earnings release, once our actual results for the third quarter are finalized.

* This press release does not include a reconciliation of forward-looking Adjusted EBITDA and Adjusted EBITDA margin to forward-looking GAAP net income (loss) and net income (loss) margin, respectively, because the Company is unable, without making unreasonable efforts, to provide a meaningful or reasonably accurate calculation or estimation of certain reconciling items which could be significant to the Company’s results.

About Zeta

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that leverages advanced artificial intelligence (AI) and trillions of consumer signals to make it easier for marketers to acquire, grow, and retain customers more efficiently. Through the Zeta Marketing Platform (ZMP), our vision is to make sophisticated marketing simple by unifying identity, intelligence, and omnichannel activation into a single platform – powered by one of the industry’s largest proprietary databases and AI. Our enterprise customers across multiple verticals are empowered to personalize experiences with consumers at an individual level across every channel, delivering better results for marketing programs. Zeta was founded in 2007 by David A. Steinberg and John Sculley and is headquartered in New York City with offices around the world.

Forward-Looking Statements

This press release, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this press release that are not statements of historical fact, including statements about our third quarter 2024 guidance, our expected growth, the acceleration of the marketing cloud replacement cycle, rebound in automotive and insurance verticals, and generative AI adoption, and our strong competitive position are forward-looking

statements and should be evaluated as such. Forward-looking statements include information concerning our anticipated future financial performance, our market opportunities and our expectations regarding our business plan and strategies. These statements often include words such as “anticipate,” “believe,” “could,” “estimates,” “expect,” “forecast,” “guidance,” “intend,” “may,” “outlook,” “plan,” “projects,” “should,” “suggests,” “targets,” “will,” “would” and other similar expressions. We base these forward-looking statements on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances at such time. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our business, results of operations and financial condition and could cause actual results to differ materially from those expressed in the forward-looking statements. These statements are not guarantees of future performance or results.

The forward-looking statements are subject to and involve risks, uncertainties and assumptions, and you should not place undue reliance on these forward-looking statements. Factors that may materially affect such forward-looking statements include, but are not limited to: global supply chain disruptions; macroeconomic and industry trends and adverse developments in the debt, consumer credit and financial services markets and other macroeconomic factors beyond Zeta’s control; increases in our borrowing costs as a result of changes in interest rates and other factors; the impact of inflation on us and on our customers; potential fluctuations in our operating results, which could make our future operating results difficult to predict; underlying circumstances, including cash flows, cash position, financial performance, market conditions and potential acquisitions; prevailing stock prices, general economic and market condition; the impact of future pandemics, epidemics and other health crises on the global economy, our customers, employees and business; the war in Ukraine and escalating geopolitical tensions as a result of Russia’s invasion of Ukraine; the escalating conflict in Israel, Gaza and in the surrounding areas; our ability to innovate and make the right investment decisions in our product offerings and platform; the impact of new generative AI capabilities and the proliferation of AI on our business; our ability to attract and retain customers, including our scaled and super-scaled customers; our ability to manage our growth effectively; our ability to collect and use data online; the standards that private entities and inbox service providers adopt in the future to regulate the use and delivery of email may interfere with the effectiveness of our platform and our ability to conduct business; a significant inadvertent disclosure or breach of confidential and/or personal information we process, or a security breach of our or our customers’, suppliers’ or other partners’ computer systems; and any disruption to our third-party data centers, systems and technologies. These cautionary statements should not be construed by you to be exhaustive and the forward-looking statements are made only as of the date of this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

The third quarter 2024 guidance provided herein is based on Zeta’s current estimates and assumptions and is not a guarantee of future performance. The guidance provided is subject to significant risks and uncertainties, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission (“SEC”), that could cause actual results to differ materially. There can be no assurance that the Company will achieve the results expressed by this guidance or the targets.

Non-GAAP Measures

In order to assist readers of our consolidated financial statements in understanding the core operating results that our management uses to evaluate the business and for financial planning purposes, we describe our non-GAAP measures below. We believe these non-GAAP measures are useful to investors in evaluating our performance by providing an additional tool for investors to use in comparing our financial performance over multiple periods.

•Adjusted EBITDA is a non-GAAP financial measure defined as net loss adjusted for interest expense, depreciation and amortization, stock-based compensation, income tax (benefit) / provision, acquisition related expenses, restructuring expenses, change in fair value of warrants and derivative liabilities, certain dispute settlement expenses, gain on extinguishment of debt, certain non-recurring IPO related expenses, including the payroll taxes related to vesting of restricted stock and restricted stock units upon the completion of the IPO, and other expenses. Acquisition related expenses and restructuring expenses primarily consist of severance and other employee-related costs which we do not expect to incur in the future as acquisitions of businesses may distort the comparability of the results of operations. Change in fair value of warrants and derivative liabilities is a non-cash expense related to periodically recording “mark-to-market” changes in the valuation of derivatives and warrants. Other expenses consist of non-cash expenses such as changes in fair value of acquisition related liabilities, gains and losses on extinguishment of acquisition related liabilities, gains and losses on sales of assets and foreign exchange gains and losses. In particular, we believe that the exclusion of stock-based compensation, certain dispute settlement expenses and non-recurring IPO related expenses that are not related to our core operations provides measures for period-to-period comparisons of our business and provides additional insight into our core controllable costs. We exclude these charges because these expenses are not reflective of ongoing business and operating results.

•Adjusted EBITDA margin is a non-GAAP financial measure defined as Adjusted EBITDA divided by the total revenues for the same period.

Adjusted EBITDA and Adjusted EBITDA margin provide us with useful measures for period-to-period comparisons of our business as well as comparison to our peers. We believe that these non-GAAP financial measures are useful to investors in analyzing our financial and operational performance. Nevertheless our use of Adjusted EBITDA and Adjusted EBITDA margin has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our financial results as reported under GAAP. Other companies may calculate similarly-titled non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other GAAP-based financial performance measures, including revenues and net loss.

We calculate forward-looking Adjusted EBITDA and Adjusted EBITDA margin based on internal forecasts that omit certain amounts that would be included in forward-looking GAAP net income (loss). We do not attempt to provide a reconciliation of forward-looking Adjusted EBITDA and Adjusted EBITDA margin guidance to forward looking GAAP net income (loss) and GAAP net income (loss) margin, respectively, because forecasting the timing or amount of items that have not yet occurred and are out of our control is inherently uncertain and unavailable without unreasonable efforts. Further, we believe that such

reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of financial performance.

Contacts:

Investor Relations

Scott Schmitz

ir@zetaglobal.com

Press

James A. Pearson

press@zetaglobal.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

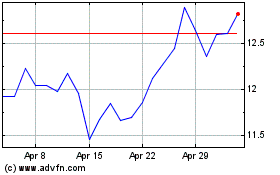

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

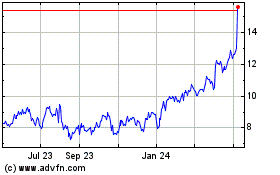

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024