Zeta Global Holdings Corp. (“Zeta”) (NYSE: ZETA), the AI-Powered

Marketing Cloud, announced today the commencement of an

underwritten public offering of an aggregate of 11,000,000 shares

of its Class A common stock. Zeta is offering 8,800,000 shares and

GPI Capital Gemini HoldCo LP (the “Selling Stockholder”) is

offering 2,200,000 shares. Zeta and the Selling Stockholder intend

to grant the underwriters a 30-day option to purchase up to an

additional 1,320,000 and 330,000 shares, respectively, at the

public offering price, less underwriting discounts and

commissions.

Zeta intends to use the net proceeds from the offering for

general corporate purposes which may include future acquisitions.

Zeta will not receive any of the proceeds from the sale of shares

by the Selling Stockholder in the offering.

Morgan Stanley, Goldman Sachs & Co. LLC, BofA Securities,

Citigroup and KKR Capital Markets LLC are acting as joint

book-running managers for the Offering.

The public offering is being made pursuant to an automatic shelf

registration statement on Form S-3 that was filed by Zeta with the

U.S. Securities and Exchange Commission (the “SEC”) and

automatically became effective upon filing. A preliminary

prospectus supplement and accompanying prospectus relating to and

describing the terms of the offering have been filed with the SEC

and are available on the SEC’s website at www.sec.gov. When

available, copies of the preliminary prospectus supplement and

accompanying prospectus, as well as copies of the final prospectus

supplement once available, may be obtained by contacting: Morgan

Stanley & Co. LLC, Attn: Prospectus Department, 180 Varick

Street, 2nd Floor, New York, NY 10014; Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, New

York 10282, by phone at 1-866-471-2526, by facsimile at

1-212-902-9316, or by email at: prospectus-ny@ny.email.gs.com; BofA

Securities, Attention: Prospectus Department, NC1-022-02-25, 201

North Tryon Street, Charlotte, North Carolina 28255-0001, by phone

at 1-800-294-1322, or by email: dg.prospectus_requests@bofa.com;

Citigroup Global Markets Inc. at 388 Greenwich Street, New York,

New York 10013, Attention: General Counsel, facsimile number: +1

(646) 291-1469; or KKR Capital Markets LLC, Attention: Prospectus

Delivery, 30 Hudson Yards, 75th Floor, New York, NY 10001.

This release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release that are not

statements of historical fact, including those relating to the

timing, size and other terms of the offering and the anticipated

use of proceeds from the offering are forward-looking statements

and should be evaluated as such. Forward-looking statements include

information concerning our anticipated future financial

performance, our market opportunities and our expectations

regarding our business plan and strategies. These statements often

include words such as “anticipate,” “believe,” “could,”

“estimates,” “expect,” “forecast,” “intend,” “may,” “plan,”

“projects,” “should,” “suggests,” “targets,” “will,” “would” or the

negative of these terms or other similar expressions. We base these

forward-looking statements on our current expectations, plans and

assumptions that we have made in light of our experience in the

industry, as well as our perceptions of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate under the circumstances at such time.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future

performance or results.

The forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. Factors that may

materially affect such forward-looking statements include, but are

not limited to: the important factors discussed in Item 1A of

Zeta’s Annual Report on Form 10-K for the year ended December 31,

2023, and Forms 10-Q and 8-K subsequently filed with the SEC. Such

statements in this release are based upon information available to

Zeta as of the date of this release, and while Zeta believes such

information forms a reasonable basis for such statements, such

information may be limited or incomplete, and such statements

should not be read to indicate that Zeta has conducted an

exhaustive inquiry into, or review of, all potentially available

relevant information. These statements are inherently uncertain and

investors are cautioned not to unduly rely upon these statements.

Zeta qualifies all of its forward-looking statements by these

cautionary statements. Except as required by applicable law, Zeta

does not plan to publicly to update or revise any forward-looking

statements contained in this release, whether as a result of any

new information, future events.

About Zeta

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow,

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence, and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904669356/en/

Investor Relations Scott Schmitz ir@zetaglobal.com

Press James A. Pearson press@zetaglobal.com

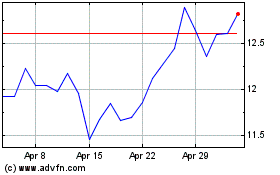

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

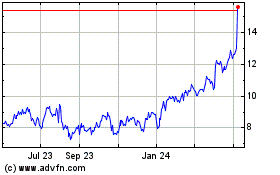

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024